Knowledge exhibits the Ethereum futures quantity has flipped that of Bitcoin, an indication that robust speculative curiosity is flooding into the asset.

Ethereum Futures Quantity Has Shot Up Alongside Value Rally

In keeping with information from the analytics agency Glassnode, Ethereum has managed to surpass Bitcoin by way of futures buying and selling quantity once more. The buying and selling quantity right here naturally refers back to the quantity of buying and selling {that a} given asset noticed on the totally different centralized exchanges through the previous day. Within the context of the present matter, the quantity related to the futures market particularly is of curiosity.

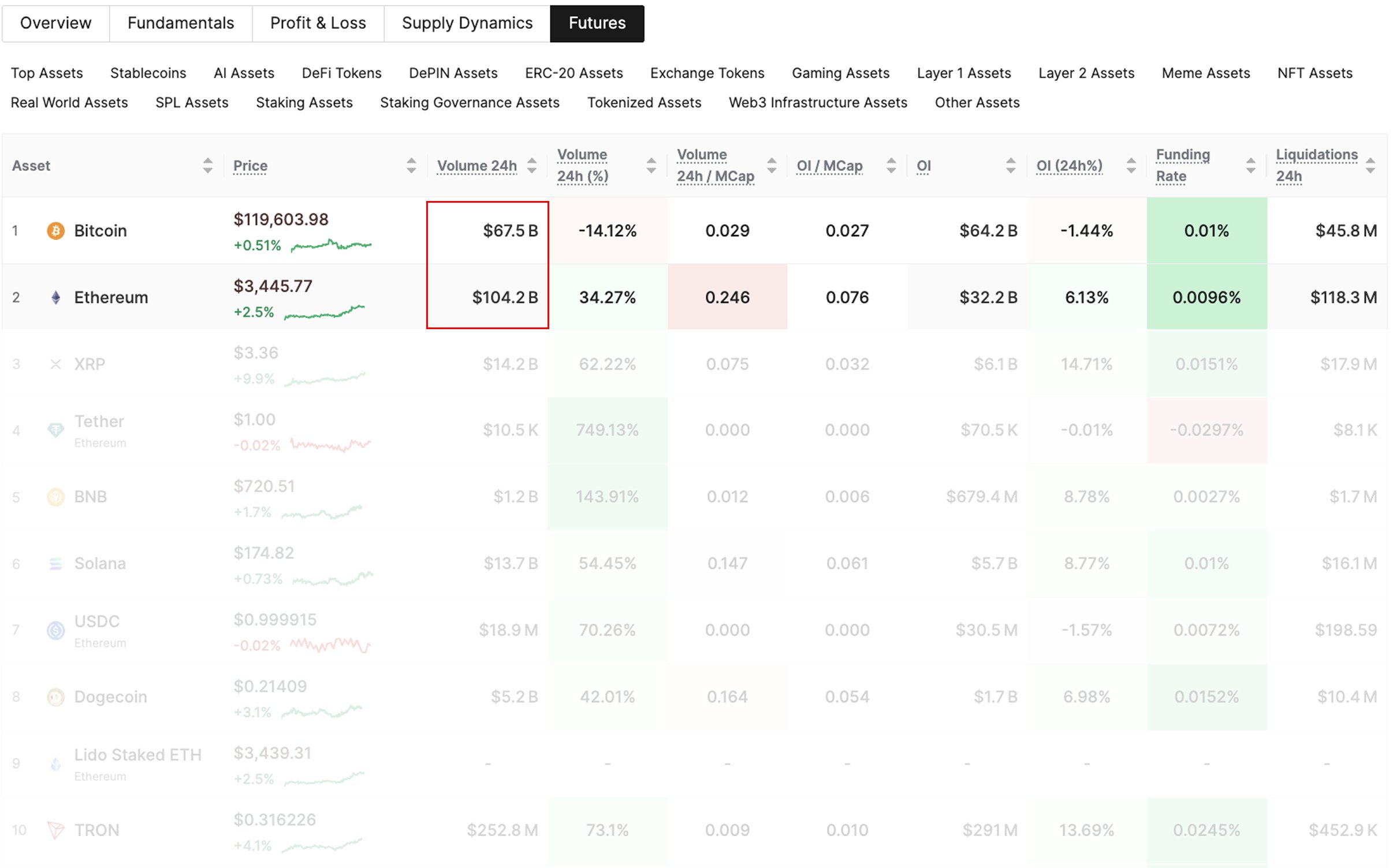

Beneath is a desk that exhibits how this metric in contrast between Bitcoin and Ethereum on the time of Glassnode’s publish.

Seems to be just like the ETH futures quantity far outweighs the BTC one | Supply: Glassnode on X

As is seen, Bitcoin registered a futures buying and selling quantity of $67.5 billion, notably decrease than the $104.2 billion determine witnessed by Ethereum. This isn’t one thing that ordinarily occurs, because the primary cryptocurrency often observes extra speculative demand than ETH or the altcoins.

In the identical desk, information of some different futures-related indicators can be proven. The BTC Open Curiosity, a metric that retains monitor of the full quantity of futures positions at the moment open on all derivatives platforms, sat at $64.2 billion on the time of the publish.

The identical indicator for ETH was at $32.2 billion, indicating that the unique digital asset was nonetheless far forward by way of complete market positioning. That stated, the 24-hour change within the metric stood at a optimistic 6.1% for Ethereum, whereas Bitcoin noticed a drop of 1.4%

The contemporary demand for ETH has come as its worth has damaged away from the market, accompanied by a robust wave of inflows into the spot exchange-traded funds (ETFs).

Curiously, whereas all this consideration got here towards the cryptocurrency, its common Funding Fee nonetheless didn’t flip too optimistic. The Funding Fee is an indicator that retains monitor of the quantity of periodic charges that merchants on the futures market are exchanging between one another.

When this metric is inexperienced, it means the lengthy buyers are paying a premium to the quick ones in an effort to maintain onto their positions. Such a development implies the presence of a bullish mentality among the many merchants.

From the desk, it’s obvious that the Funding Fee stood at 0.0096% for Ethereum even after the spike in futures buying and selling quantity. This was lower than Bitcoin’s worth of 0.01%. Thus, whereas contemporary positioning is going on for ETH, it appears the buyers are nonetheless not getting too optimistic.

“This setup leans bullish: robust speculative curiosity, rising OI, and no indicators of overheating but,” notes the analytics agency.

ETH Value

On the time of writing, Ethereum is buying and selling round $3,600, up virtually 21% within the final week.

The value of the coin has surged through the previous few days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.