Desk of Contents

1. Introduction

2. EA Overview

3. Set up

4. Enter Parameters

Grid Settings Commerce Settings Entry Indicator Settings Time Filters Dashboard Settings

4. Optimizing the EA

5. Troubleshooting

1. Introduction

Welcome to the Grid EA, your all-in-one resolution for grid-based buying and selling on MetaTrader 5. This information offers a step-by-step breakdown of the best way to set up, configure, and function your EA successfully.

2. EA Overview

Core Options:

4 Grid Buying and selling Modes: Impartial, Hedged, Development-Following, and Martingale 11 Entry Methods: RSI, Transferring Averages, ADX, Bollinger Bands, Ichimoku Cloud, Parabolic SAR, and extra Session-based Time Filters Constructed-in Dashboard Interface Handbook and price-level entries supported Threat Administration through Goal Revenue and Max Drawdown

3. Set up

For a detailed information of the best way to set up the EA, confer with this information set up guide.

4. Enter Parameters

Parameter Clarification:

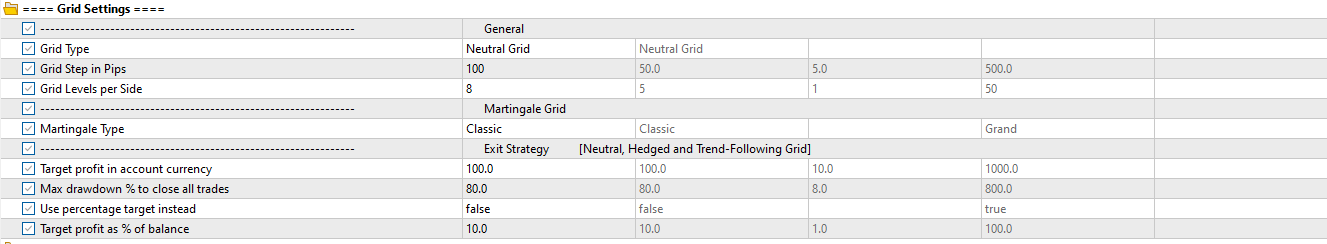

✅ Grid Sort: Choices (Traditional Grid, Hedged Grid, Development Following Grid, Martingale Grid)

Defines the construction and conduct of the restoration grid.

✅ Grid Step in Pips: Distance between grid ranges in pips.

✅ Grid Ranges per Aspect: Variety of grid positions on either side (purchase/promote).

✅ Martingale Sort: Choices (Traditional, Grand)

Controls lot sizing for Martingale Grid.

✅ Goal Revenue in account forex: Revenue purpose in account forex to shut all trades.

✅ Max Drawdown % to shut all trades: Closes all trades if drawdown exceeds this restrict.

✅ Use proportion goal as an alternative: Allow revenue closure based mostly on steadiness proportion.

✅ Goal revenue as % of steadiness: Revenue proportion (e.g. 10% of steadiness).

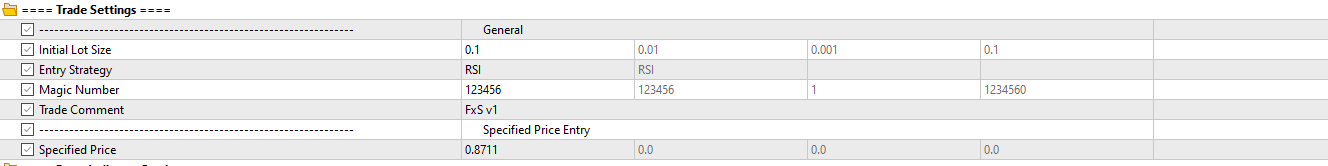

✅ Preliminary lot dimension: Base lot dimension of preliminary commerce.

✅ Entry Technique: Choices (RSI, Transferring Averages, Common Directional Index, Bollinger Bands, Ichimoku Cloud, Parabolic SAR, Specified Worth Purchase/Promote, Present Worth Purchase/Promote, Handbook)

Choose considered one of 11 entry strategies.

✅ Magic quantity: Distinctive quantity for commerce separation.

✅ Commerce remark: Label for commerce identification.

✅ Specified Worth: Utilized in ‘Specified Worth Purchase/Promote’ modes.

Parameter Clarification:

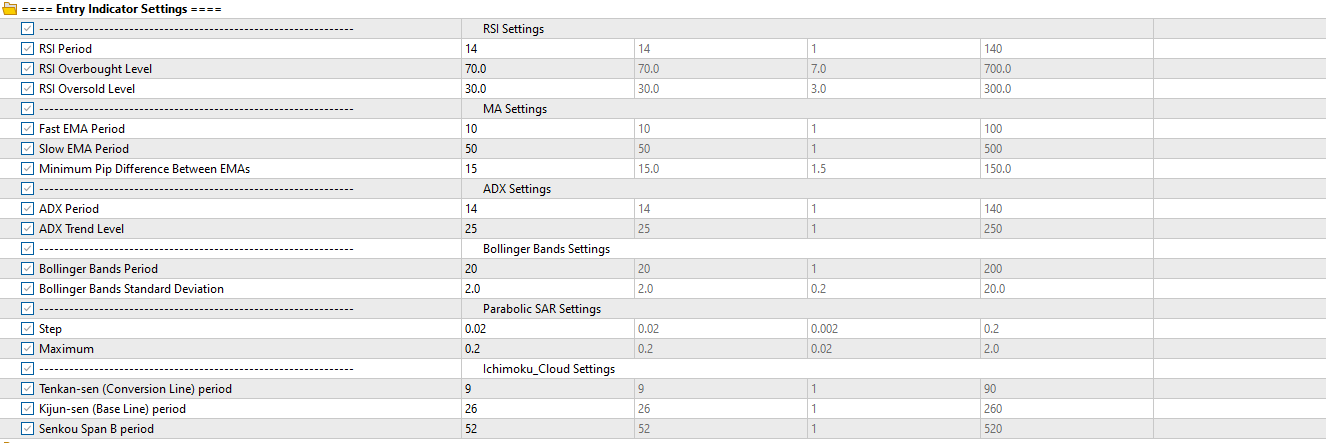

a. RSI Settings

✅ RSI Interval: Units the interval of the RSI.

✅ RSI Overbought Degree: Units overbought degree for the RSI.

✅ RSI Oversold Degree: Units oversold degree for the RSI.

b. MA Settings

✅ Quick EMA interval: Units the interval of the quick EMA. A decrease worth makes the EMA extra delicate to cost modifications (default: 50).

✅ Gradual EMA interval: Units the interval of the sluggish EMA. Used along with the quick EMA to determine pattern path (default: 200).

✅ Minimal pip distinction between EMAs: Minimal pip distinction between the quick and sluggish EMA to substantiate a sound crossover sign. Helps filter out weak or false indicators (default: 15).

c. ADX Settings

✅ ADX interval: The lookback interval for calculating the ADX indicator (default: 14).

✅ ADX Development Degree: The brink worth above which the pattern is taken into account robust. Entries are filtered based mostly on whether or not the ADX worth exceeds this degree (default: 25).

d. Bollinger Bands Settings

✅ Bollinger Bands Interval: Variety of intervals used within the Bollinger Bands calculation (default: 20).

✅ Bollinger Bands Customary Deviation: The variety of commonplace deviations from the transferring common used to type the higher and decrease bands (default: 2.0).

e. Parabolic SAR Settings

✅ Step: The step increment of the SAR. Smaller steps make the indicator extra delicate to cost modifications (default: 0.02).

✅ Most: The utmost worth that the step can attain, influencing how shortly the SAR accelerates towards worth (default: 0.2).

f. Ichimoku_Cloud Settings

✅ Tenkan-sen (Conversion Line) interval: The interval used for the conversion line (Tenkan-sen), which reacts shortly to cost motion.

✅ Kijun-sen (Base Line) interval: The interval for the bottom line (Kijun-sen), used as a pattern affirmation.

✅ Senkou Span B interval: The interval used to calculate one of many cloud boundaries (Senkou Span B), representing longer-term sentiment.

Parameter Clarification:

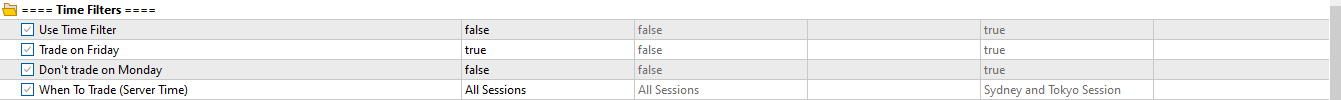

✅ Use time filters: Toggle to allow/disable utilizing time filters.

✅ Commerce on Friday: Toggle to allow/disable buying and selling on Friday.

✅ Do not commerce on Monday: Toggle to allow/disable buying and selling on Monday.

✅ When To Commerce (Server Time): Choose which session ought to buying and selling be allowed.

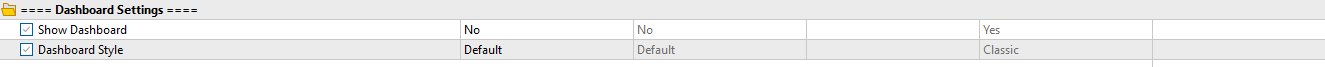

Parameters of Dashboard Setting

Parameter Clarification:

✅ Present Dashboard: Present dashboard will be both Sure or No.

✅ Dashboard Type: Dashboard Type choices are Default, Darkish or Traditional.

4. Optimizing the EA

Problem Answer / Repair EA not buying and selling Guarantee Algo Buying and selling is enabled and market is open. Dashboard Not Exhibiting Confirm that ‘Present Interface = Sure’ “No Entry” Recheck entry circumstances (RSI/MA filters, session time). Too Many Trades Cut back `Grid Ranges` or improve `Grid Interval Pips`. Slippage or Requotes Use ECN/low-spread dealer; keep away from excessive information intervals. Not Closing Trades Confirm `Goal Revenue` or `%Goal` is being reached.

Tip: Verify the Consultants and Journal tabs for detailed error logs.

Regularly Requested Questions (FAQ)

Q1: Can I run a number of situations on totally different symbols?

A: Sure. Connect one FxS Grid EA per chart/image; guarantee every makes use of a novel Magic Quantity to keep away from commerce interference.

Q2: How do I load my optimized settings?

A: Save your optimized `.set` file in `MQL5Presets`. Within the EA’s Inputs tab, click on Load and choose your file.

Q3: Does the EA help hedging accounts?

A: Sure. FxS Grid EA is suitable with each hedging and netting account sorts.

This fall: What timeframes work greatest?

A: Default methods carry out nicely on H1–H4. Use optimization to check different timeframes to your image.

Q5: My dealer makes use of 5-digit pricing—do I would like to regulate inputs?

A: The EA auto-detects digit format and adjusts pips accordingly. No guide modifications wanted.

Q6: What ought to I do if backtests look totally different from dwell outcomes?

A: Guarantee backtest unfold, slippage, and execution mannequin mirror your dealer’s dwell circumstances. Take into account tick information import for accuracy.

Q7: How usually will I obtain updates?

A: Updates are launched quarterly or as wanted for bug fixes and new options. Verify the MQL5 Market web page underneath Updates.