PepsiCo inventory rallied on earnings, however the inventory has struggled over the previous few years. Is it lastly time for a comeback?

Earlier than we dive in, let’s be sure to’re set to obtain The Day by day Breakdown every morning. To maintain getting our day by day insights, all it’s essential to do is log in to your eToro account.

Friday’s TLDR

PEP rallied on earnings

Progress, valuation stay low

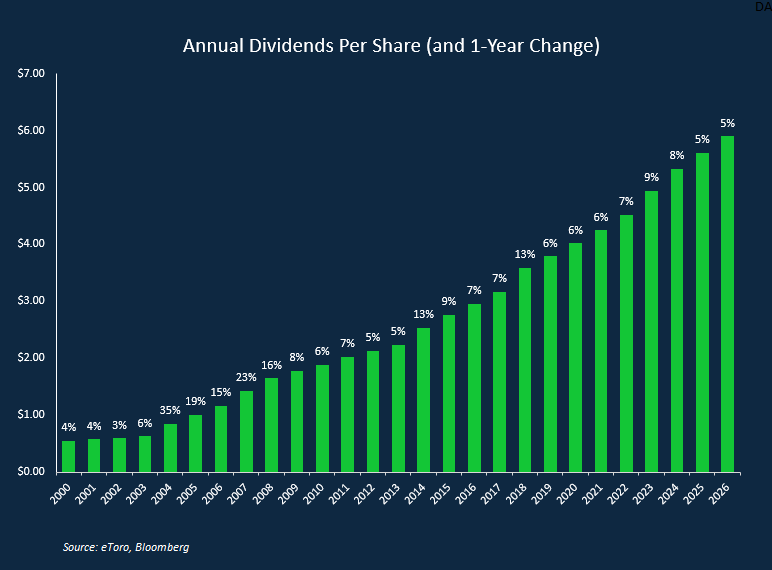

Dividend has been raised for 53 years

Deep Dive

On July seventeenth, PepsiCo inventory climbed 7.5% after the agency reported better-than-expected income and earnings outcomes.

Though there have been constructive observations about PEP inventory — like its valuation and dividend yield — there isn’t any masking its poor efficiency. Going into earnings, shares have been down 11% on the 12 months and nearly 18% over the previous 12 months. Shares are nonetheless down 26.5% from its file excessive in Might 2023.

Additional, PepsiCo has underperformed Coca-Cola over the past one, three and 5 years. So bulls need to know: Can PepsiCo maintain this momentum and switch issues round?

Unpacking the Enterprise

PepsiCo is a worldwide meals and beverage chief. Final 12 months, the corporate generated $27.4 billion in North American meals gross sales and $27.7 billion in North American beverage gross sales.

The corporate’s recognized for its extra apparent drinks — like Pepsi and Mountain Dew — however its umbrella additionally covers Gatorade, Aquafina, Bare Juice, Bubly, and Tropicana, amongst others.

On the meals aspect, some apparent soda pairings embrace Ruffles, Lays, Doritos, and Rold Gold, however different manufacturers embrace Sabra, Siete, Tostitos, SunChips, Quaker, and Smartfood.

Carbonated Comeback?

Sadly, PepsiCo’s enterprise has run into just a few roadblocks. It’s adapting to shifting client preferences — corresponding to demand for pure components and the rise of GLP-1 drugs — whereas addressing challenges in its North America meals section by means of pricing changes, portfolio modifications, and operational enhancements. It’s additionally battling by means of its personal macro- and tariff-related headwinds.

Analysts anticipate a slight earnings decline this 12 months, with adjusted earnings forecast to fall 1.8%. Estimates for subsequent 12 months (fiscal 2026) and the next 12 months name for a return to mid-single-digit progress of round 6%. Income is forecast to climb within the low-single-digit vary in fiscal 2025, 2026, and 2027.

It’s clear that progress isn’t blistering, however is that priced into the valuation? Taking a look at PepsiCo’s ahead P/E ratio since 2012, it tends to trough round 17x and peak close to 27x.

Whereas progress could also be subdued, some buyers could discover PepsiCo’s valuation engaging sufficient to justify an extended place — even after the current rally. They could achieve confidence in that call if, in future quarters, PepsiCo proves to have hit a trough in its progress outlook.

For what it’s value, analysts at present have an common worth goal of roughly $155 per share.

Wish to obtain these insights straight to your inbox?

Enroll right here

Diving Deeper — The Dividend

Even after the current rally, PEP inventory nonetheless pays a dividend yield of roughly 4%.

No dividend is ever assured, however a handful of firms have solidified themselves as reliable dividend payers — often called Dividend Kings, Champions and Aristocrats — and PepsiCo is one among them, having raised its dividend for 53 consecutive years.

Dangers of Going Flat

The highest-down dangers embrace the worldwide financial system and tariff-related hurdles. And whereas foreign money fluctuations are at present a tailwind, they might change into a headwind sooner or later.

Getting extra granular, there’s a danger that PepsiCo may face customer-specific struggles — customers that don’t need or can’t afford to maintain shopping for pricier and pricier snacks. PepsiCo has been diversifying into more healthy alternate options, however execution and client preferences could possibly be a danger transferring ahead.

The Backside Line: Progress stalled, however buyers hope they’ve seen the worst of it. Whereas execution dangers are nonetheless attainable, a near-4% dividend yield and a comparatively low valuation could also be sufficient to get buyers to think about PEP inventory.

Disclaimer:

Please observe that as a consequence of market volatility, a number of the costs could have already been reached and eventualities performed out.