Howdy merchants,

We’re happy to announce a major replace to our Professional Advisor (EA), out there via the MQL5 Market, which introduces a brand new danger administration device designed to guard your capital and improve long-term profitability: the Forex Publicity Filter.

The Hidden Threat in Multi-Pair Buying and selling

Many foreign exchange merchants diversify throughout totally different foreign money pairs to unfold danger. Nevertheless, this strategy can result in unintended over-exposure to a single foreign money course.

Contemplate this situation:

Promote AUD/USD (promoting AUD)

Purchase EUR/AUD (promoting AUD)

Promote AUD/JPY (promoting AUD)

These seem as three distinct trades, however they lead to triple publicity to AUD weak point. If the AUD strengthens unexpectedly, all three positions may incur vital losses concurrently.

What’s the Forex Publicity Filter?

The Forex Publicity Filter is an clever danger administration device that forestalls over-concentration in any single foreign money course. It analyzes every potential commerce to find out:

Which foreign money you’re shopping for.

Which foreign money you’re promoting.

The variety of current positions in the identical foreign money course.

How It Works

Earlier than opening a brand new place, the filter performs the next checks:

Forex Course Evaluation: For a EUR/AUD purchase sign:

Shopping for EUR ✓

Promoting AUD ✓

Publicity Depend: Counting present positions promoting AUD:

Threat Choice: With a setting of Max Forex Publicity = 2:

Actual-World Demonstration: Backtest Outcomes

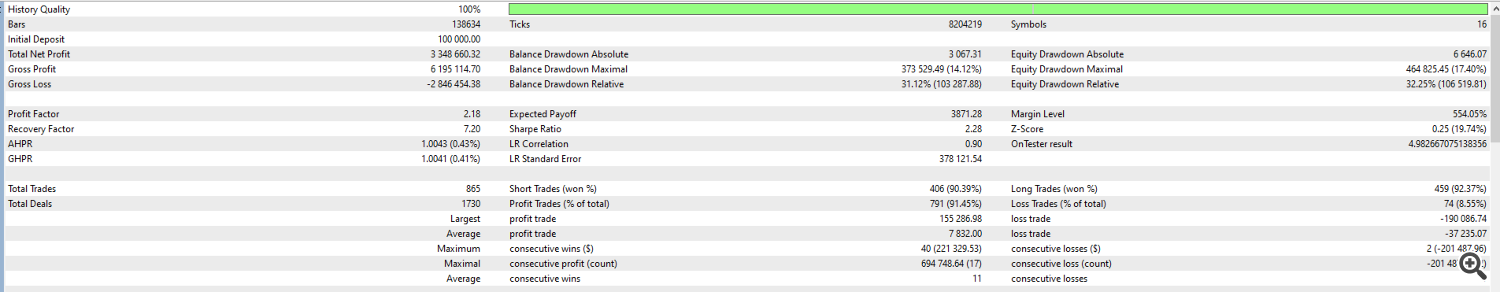

To display the effectiveness of this function, we performed backtests with numerous settings.

Backtest Interval: January 1, 2020 – July 26, 2024

Preliminary Capital: $100,000

EA Settings: Default settings, various solely the filter parameters.

State of affairs 1: Default Settings (Filter OFF)

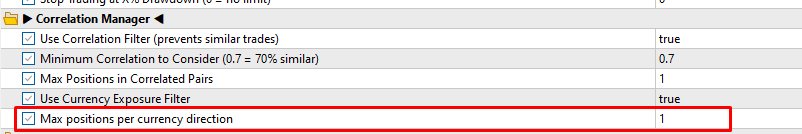

With out the filter, the EA operates as in earlier variations, with no restrict on trades in a single foreign money course.

[Image 1: Default Input Settings]

The outcomes present excessive revenue potential however vital drawdown when the market strikes towards concentrated positions.

[Image 2: Default Backtest Results]

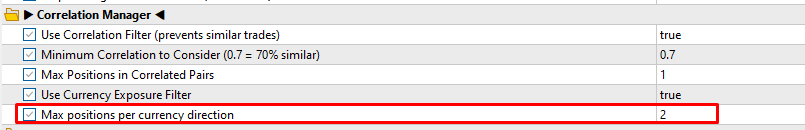

State of affairs 2: Filter ON, Max 1 Place/Course

This conservative setting ensures the EA by no means opens multiple purchase or promote place for a similar foreign money.

[Image 3: Input Settings with Max Exposure = 1]

The outcomes display a major discount in drawdown, providing enhanced account safety at the price of decrease earnings on account of skipped buying and selling alternatives.

[Image 4: Backtest Results with Max Exposure = 1]

State of affairs 3: Filter ON, Max 2 Positions/Course (Advisable)

This setting balances security and profitability, permitting the EA to capitalize on alternatives whereas controlling concentrated danger.

[Image 5: Input Settings with Max Exposure = 2]

The outcomes present managed drawdown with enticing revenue ranges, making this our advisable beginning setting.

[Image 6: Backtest Results with Max Exposure = 2]

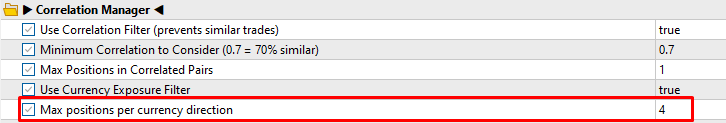

State of affairs 4: Filter ON, Max 4 Positions/Course

This setting gives extra flexibility, approaching default conduct whereas sustaining a fundamental layer of safety.

[Image 7: Input Settings with Max Exposure = 4]

The outcomes point out increased earnings than Situations 2 and three, however with elevated drawdown, appropriate for merchants with increased danger tolerance.

[Image 8: Backtest Results with Max Exposure = 4]

Necessary Observe: Threat vs. Reward Commerce-Off

Enabling the Forex Publicity Filter reduces drawdown, enhancing account safety. Nevertheless, this may occasionally decrease earnings by skipping trades that exceed the danger restrict. Disabling the filter or setting a excessive restrict will increase buying and selling alternatives and potential earnings but in addition raises the danger of upper drawdown. Select the setting that aligns along with your danger urge for food.

Integration with the Correlation Filter

The Forex Publicity Filter enhances our current Correlation Filter, creating a sturdy dual-layer safety system:

Correlation Filter: Prevents extreme trades on extremely correlated pairs (e.g., EUR/USD and GBP/USD).

Forex Publicity Filter: Limits over-exposure to a single foreign money (e.g., promoting AUD).

Get Began Right now

The Forex Publicity Filter is now out there within the newest replace of our EA, accessible by way of the MQL5 Market. We suggest beginning with the Max Publicity = 2 setting and adjusting based mostly in your danger tolerance. Obtain the replace from the MQL5 Market to combine this function into your buying and selling technique.

Efficient danger administration prioritizes long-term profitability and capital safety over short-term alternatives. Typically, the very best commerce is the one you keep away from.

Glad buying and selling!