Bitcoin seems to have entered right into a consolidation part between the $115,000 and $120,000 value vary after a sudden pullback from its present all-time excessive. Regardless of Bitcoin’s current bullish momentum towards a brand new excessive, short-term BTC holders proceed to see modest earnings from their positions.

A Tight Revenue Window For Brief-Time period Bitcoin Holders

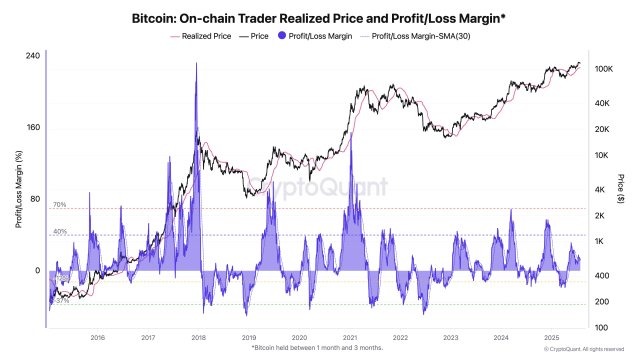

Whereas Bitcoin is hovering close to its all-time excessive, CryptoQuant, a number one on-chain information analytics agency, shared a publish displaying that short-term holders are barely in revenue. Within the quick-take publish, Darkfost, a market professional and writer, highlighted that on-chain merchants are sitting on simply 13% positive aspects.

Particularly, the on-chain merchants acknowledged by Darkfost symbolize those that are energetic on the spot market. With the 13% positive aspects conceded within the current upward pattern, it reveals a cautious undercurrent beneath the floor rally.

Darkfost famous that this group of short-term holders contains Bitcoin held for one to a few months. Inspecting the BTC held inside this vary helps to assist in capturing the overall sentiment of short-term traders, who often search to optimize earnings.

After gauging the Bitcoin On-chain Dealer Realized Value and Revenue/Loss Margin, the market professional acknowledged that the revenue for short-term holders peaked at simply 69% all through this cycle and is lowering over time. In the meantime, this determine is method beneath that of earlier bull market cycles, particularly 2012 and 2021.

Knowledge exhibits that whereas in earlier market tops, short-term holders’ common revenue reached a peak of 232% in 2012 and 150% in 2021. Because the crypto panorama slowly stabilizes, short-term holders now face a crucial juncture that would outline the subsequent main transfer for Bitcoin. BTC should be fluctuating near its peak, however the unrealized revenue of this cohort stays restricted to simply 13%.

Realized Value For Brief-Time period BTC Holders At The $104,000 Mark

Provided that their realized value is positioned across the $104,000 degree, Darkfost claims that the positioning makes it much less possible for the traders to promote their BTC. Nevertheless, if their scenario have been to worsen considerably, it’d trigger them to provide in, which can encourage a correction in BTC’s value.

Within the meantime, seasoned merchants and traders might seize the second and purchase the dip. In keeping with the professional, this growth sometimes seems to be alternative for traders who know the best way to reap the benefits of the dip.

As BTC faces bearish strain as soon as once more, many merchants who purchased the flagship digital asset throughout value swings at the moment are in a dangerous scenario. Ought to this pattern maintain, it’d most likely function a tipping level, both reiterating the upward pattern or setting off a brand new spherical of instability.

On the time of writing, BTC is buying and selling at $118,861, demonstrating a 0.55% enhance within the final 24 hours. Inside the similar interval, Bitcoin’s buying and selling quantity has seen an increase of 18.35%, indicating renewed bullish sentiment from traders.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.