Technique has simply added to its Bitcoin shopping for spree with a multi-billion greenback buy, its largest purchase since November of final yr.

Technique Has Purchased One other 21,021 Bitcoin

As introduced by Technique Chairman Michael Saylor in an X submit, the corporate has accomplished a recent Bitcoin acquisition. With this purchase, Technique has added 21,021 BTC to its holdings at a mean worth of $117,256 per token.

The $2.46 billion buy was funded utilizing proceeds from the agency’s preliminary public providing (IPO) of Variable Charge Sequence A Perpetual Stretch Most well-liked Inventory (STRC). This IPO, involving 28,011,111 shares, is the biggest within the US in 2025 up to now. Technique mentioned within the press launch:

As soon as listed on Nasdaq, STRC would be the first U.S. exchange-listed perpetual most well-liked safety issued by a Bitcoin Treasury Firm to pay month-to-month dividends and, we imagine, the primary U.S. exchange-listed perpetual most well-liked safety to include a board decided month-to-month dividend charge coverage.

Following the most recent acquisition, the corporate’s BTC reserve has grown to 628,791 BTC, with a mean price foundation of $73,277 per token or a complete funding of $46.08 billion.

CryptoQuant group analyst Maartunn has shared a chart in an X submit that places the dimensions of the brand new purchase into perspective towards previous ones.

Appears to be like just like the purchase is among the largest throughout the previous yr | Supply: @JA_Maartun on X

As is seen within the above graph, the most recent acquisition is Technique’s largest since November twenty fourth, round eight months in the past. Again then, the agency made a large buy that was greater than double the brand new one at $5.43 billion. Earlier in the identical month, Michael Saylor’s firm accomplished a purchase order that was additionally notably bigger than the present one, this time value nearly $4.59 billion.

On the present alternate charge, Technique’s Bitcoin holdings are valued at about $74.04 billion, which displays a revenue of a whopping $27.96 billion or round 60.6%. Thus, the agency’s reserve is in a snug state in the intervening time.

Whereas Technique continues to HODL, different sturdy palms seem to have taken to promoting, as identified by on-chain analytics agency Glassnode in an X submit.

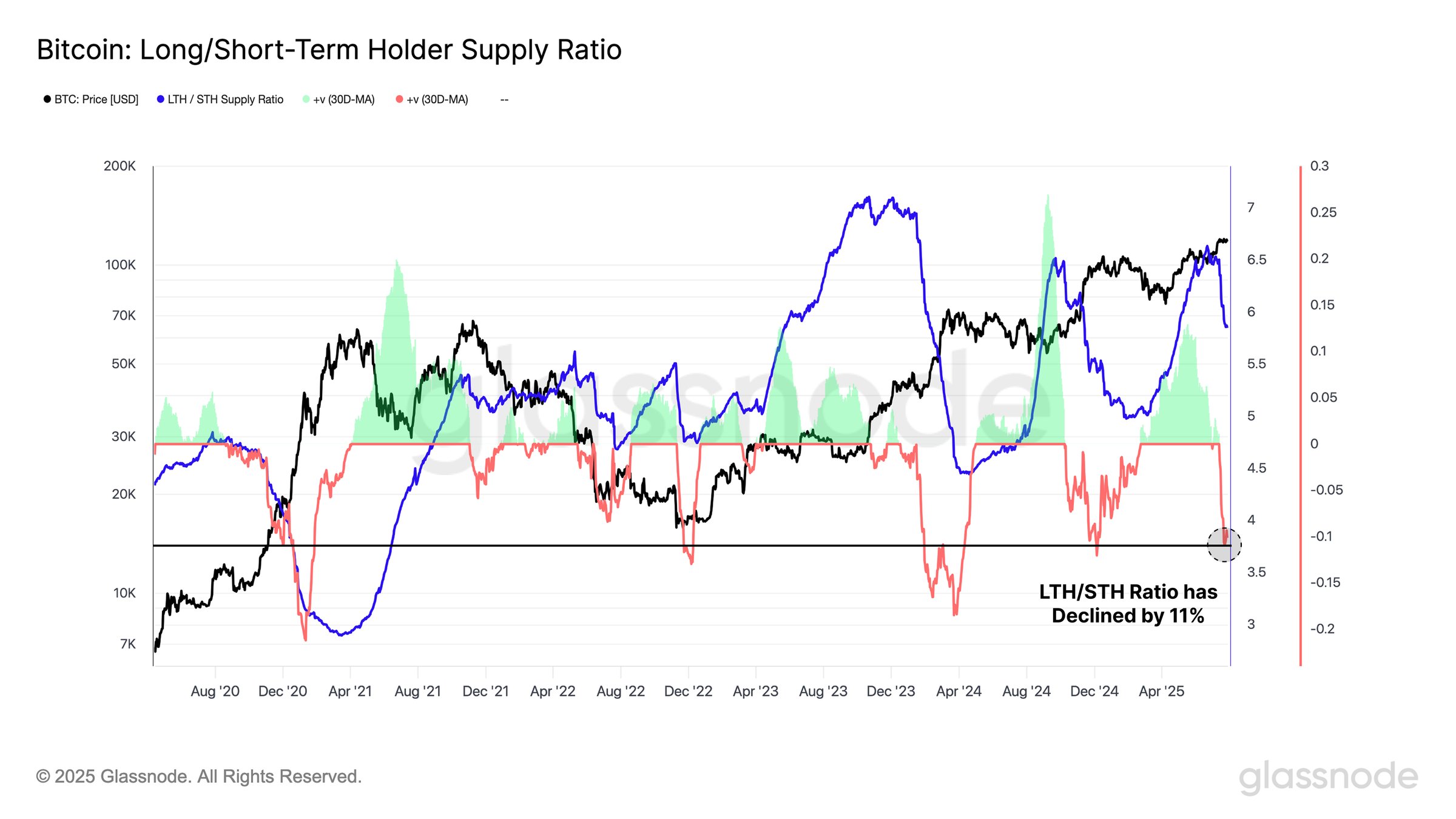

The pattern within the provide ratio of the short-term holders and long-term holders | Supply: Glassnode on X

The above chart reveals the ratio between the availability held by the 2 essential divisions of the Bitcoin market: short-term holders (STHs) and long-term holders (LTHs). Traders who bought their cash inside the previous 155 days are positioned within the STHs, whereas those that have held previous this threshold belong to the LTHs.

From the graph, it’s seen that the ratio has witnessed a big detrimental change of 11% over the previous month, implying {that a} rotation of capital has occurred from the diamond palms to the STHs. “This sample has preceded prior ATHs and highlights a structurally constant shift in investor positioning,” famous Glassnode.

BTC Worth

On the time of writing, Bitcoin is floating round $117,800, down 1% during the last 24 hours.

The value of the coin appears to have been shifting sideways over the last couple of weeks | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.