Cardano founder Charles Hoskinson has intensified the ecosystem’s push into regulated, privacy-preserving digital {dollars}, declaring on July 31 that “Moneta’s USDM is changing into essentially the most superior stablecoin ever constructed.” The comment, posted on X, got here within the wake of a multi-day workshop in Buenos Aires that he mentioned was “making progress on the primary Personal Stablecoin.”

Hoskinson’s endorsement dovetailed with a dense technical thread from Cardano developer Andrew Westberg that sketched how a privacy-enabled greenback might fulfill enterprise and authorized necessities with out turning public ledgers into open books. “The stablecoin is a small however essential piece of the dialogue in Argentina. That being mentioned, the complexity is 10x to 20x that of USDM,” he wrote.

Why Cardano’s USDM Is A Subsequent-Gen Stablecoin

Westberg walked the group by a role-based entry mannequin that will let a payroll recipient see solely their very own cost, an accountant see quantities with out private particulars, a CFO view the entire, and a court-ordered investigator achieve full transparency throughout discovery. “Actually cool tech, however it’s a cambrian explosion of complexity to construct out one thing the place blockchain can really eclipse and change tradfi programs for the primary time,” Westberg mentioned.

These feedback observe months of public positioning by Enter Output World’s partner-chain Midnight, a zero-knowledge (“rational privateness”) community designed to let builders program selective disclosure and meet regulatory obligations whereas shielding counterparties and quantities. Midnight describes its method as “programmable information safety” for enterprise-grade purposes, with good contracts written in a TypeScript-based language known as Compact.

What Hoskinson hailed and what Westberg described are two carefully associated tracks. On Cardano’s base layer, Moneta Digital LLC points USDM as a fiat-backed, regulated stablecoin. Moneta identifies itself as a US Cash Companies Enterprise regulated on the federal stage by FinCEN and related state authorities, and says reserves are held in financial institution deposits and cash market funds managed by Constancy and Western Asset Administration.

Moneta additionally opened retail minting with a $1,000 minimal, a acknowledged $0 minting payment, and availability in 19 US states, reflecting the incremental nature of state licensing. As of press time, DeFiLlama reveals roughly $12 million USDM in circulation on Cardano.

In parallel, a privacy-preserving instrument is being constructed for Midnight. An X account branded “ShieldUSD” describes itself as a “fiat-backed privateness stablecoin on @MidnightNtwrk … issued by Moneta Digital LLC @USDMOfficial [and] constructed by @W3iSoftware,” the event studio the place Westberg serves as CTO. Whereas branding and ultimate product particulars stay in flux, the path is evident: a fiat-backed greenback with granular permissions that lives natively on a privateness chain and interoperates with public ledgers.

The core design debate—sparked by Westberg’s thread and group replies—activates whether or not such complexity is overkill relative to right this moment’s public stablecoins or the prerequisite for real-world finance emigrate on-chain. One respondent argued that USDC could be a “higher match” and that use instances for privateness cash with out “authorities stage integrations” are restricted. Westberg countered bluntly: “Usdc isn’t able to any of the above necessities. Every part it does is public.” He pointed to make use of instances past enterprise payroll—equivalent to paying a public utility the place the payer’s id stays non-public whereas the general public dataset is anonymized, or compliant remittances that confide in a verifier solely that the receiver isn’t in a sanctioned nation.

Crucially, the privateness layer seems scoped to Midnight. Westberg and subsequent protection have famous that after property transfer off Midnight to public chains, customers “lose the privateness,” even when the instrument stays interoperable with different stablecoins for liquidity or settlement. That trade-off—non-public by default the place wanted, public when bridged—tracks with Midnight’s personal “selective disclosure” mannequin and will reassure regulators that investigatory entry might be granted “with a courtroom order,” as Westberg’s payroll instance emphasised.

Hoskinson’s selection of Buenos Aires as a backdrop isn’t incidental. Argentina has been a recurring stage for Cardano’s governance and adoption rhetoric, and for Hoskinson’s advocacy of “non-public cash” that mimics the transactional privateness of money whereas remaining auditable below regulation. The Buenos Aires workshop, framed by him as a milestone on the trail to a “first Personal Stablecoin,” underscores a push to marry compliance and confidentiality in a jurisdiction the place inflation and dollarization have made stablecoins a part of on a regular basis financial life.

For Moneta and Cardano, the near-term milestones are prosaic however important: increasing licensed jurisdictions, rising USDM’s fiat reserves and on-chain provide, integrating with Cardano DeFi venues, and, if the Midnight instrument launches as envisioned, proving that programmable privateness can slot into acquainted workflows—payroll, invoice cost, remittances—with out recreating shadow banking on a blockchain. The longer-term check is market acceptance. USDM’s circulating provide—nonetheless modest relative to incumbents—might want to scale, and the privateness variant might want to show that role-based visibility and regulator-friendly entry controls can survive contact with actual compliance departments.

For now, the general public sign from Cardano’s founder is unequivocal. “Moneta’s USDM is changing into essentially the most superior stablecoin ever constructed,” he wrote. The remainder of the ecosystem—builders, enterprises, regulators, and customers—will decide whether or not the structure rising on Midnight and Cardano can earn that superlative in manufacturing reasonably than in precept.

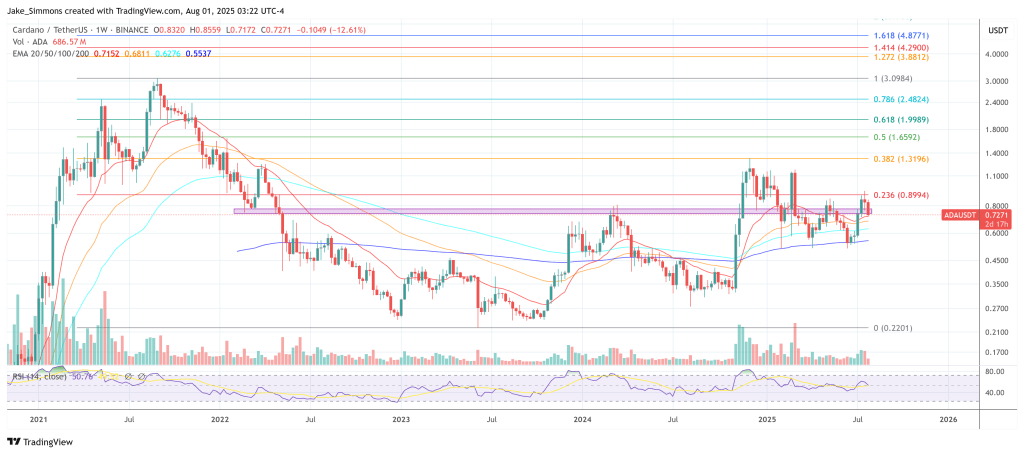

At press time, Cardano (ADA) traded at $0.72.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.