As sturdy volatility persists within the cryptocurrency market, Bitcoin, the main digital asset, has witnessed a notable pullback to the $114,000 worth mark. BTC’s worth could have declined to key assist ranges, however buyers proceed to show resilience and optimism, evidenced by sustained constructive demand towards the crypto king.

Volatility Fails To Derail Bitcoin Demand

After thorough analysis of the Bitcoin market dynamics, Darkfost, a verified creator and market knowledgeable, has outlined a bullish conduct amongst buyers. Despite current worth fluctuations shaking broader market sentiment, demand for the flagship asset stays firmly intact.

As a substitute of inflicting widespread sell-offs, the volatility appears to be enhancing Bitcoin’s attract as a decentralized, scarce asset within the cryptocurrency house. Such a improvement implies that confidence in BTC’s long-term worth potential has remained fixed. Darkfost’s evaluation of BTC’s demand goals at addressing whether or not buyers, particularly short-term holders, will proceed to promote at a loss or maintain underwater positions.

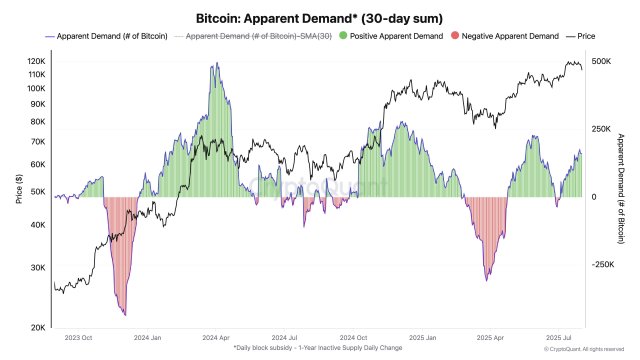

Within the publish shared on X, the knowledgeable started by pointing to Bitcoin’s Obvious Demand, a metric that contrasts newly issued BTC with provide that has been dormant for greater than 1 yr. It’s value noting that when this metric drops beneath zero, it signifies a decline in demand, whereas when it rises above zero, it implies a constructive demand.

Information reveals that the metric has now risen effectively above zero, which suggests a rising demand amongst buyers. Darkfost famous that demand continues to be clearly constructive, as evidenced by the 160,000 BTC that has been gathered over the past 30 days.

The following key metric examined by the market knowledgeable is the Bitcoin Demand from Accumulator Addresses. Particularly, this measure displays pockets addresses which have solely bought BTC with out promoting any, offering insights about demand and holding conviction.

Based on the knowledgeable, the typical BTC bought by these accumulator addresses has grown by over 50,000 BTC previously 30 days. This progress indicators a robust and sustained shopping for conduct from these buyers inside the time-frame.

A Sharp Drop In BTC OTC Desks

Darkfost has additionally drawn consideration to BTC OTC Desks. This metric covers a longer-term outlook, reflecting a definite kind of demand that’s off-chain and has a restricted short-term impact on costs, which is at the moment displaying a waning demand in the long run.

Presently, the knowledgeable highlighted that the variety of Bitcoins held by OTC desks has steadily declined considerably. Information reveals that there are 145,000 BTC accessible as we speak on OTC desks, in comparison with roughly 550,000 BTC in September 2021.

Regardless that demand in the long run has dropped sharply, Darkfost claims that the general image stays constructive. Within the meantime, demand-side indicators present no indicators of concern regardless of current worth volatility.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.