In its July 2025 crypto month-to-month recap report, world funding administration agency VanEck prompt that Ethereum (ETH) might emerge as a superior retailer of worth in comparison with Bitcoin (BTC). The report pointed to ETH’s decrease inflation fee in current months relative to BTC, alongside its rising utility inside decentralized finance (DeFi).

Ethereum A Higher Retailer Of Worth Than Bitcoin?

In recent times, a rising variety of firms have diversified their treasuries by allocating capital to digital property – most notably Bitcoin. Nevertheless, rising developments present that firms are additionally starting to build up Ethereum, recognizing its potential as each a yield-generating and deflationary asset.

VanEck’s report emphasizes that whereas Bitcoin’s finite provide and predictable issuance insurance policies make it a robust candidate for a retailer of worth, Ethereum supplies larger monetary flexibility. Particularly, ETH holders can stake their property to earn rewards, accumulate community income, and take part in DeFi protocols to generate further yield.

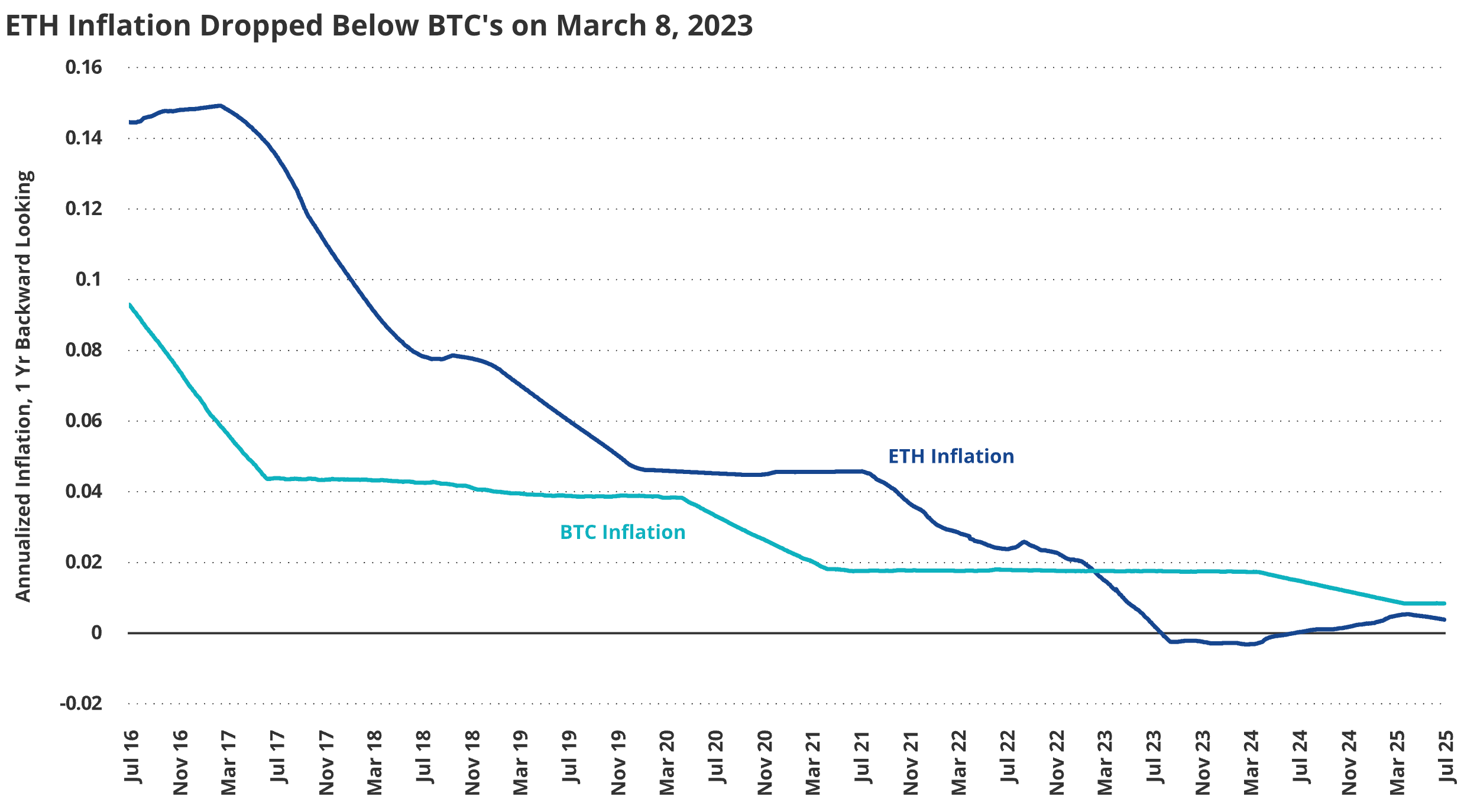

The report additionally highlights key variations within the financial insurance policies of each networks. Ethereum’s preliminary issuance fee at launch was 14.4%, in comparison with Bitcoin’s 9.3%. Nevertheless, two main coverage modifications have since dramatically lowered ETH’s inflation fee – bringing it beneath Bitcoin’s.

The primary was Ethereum Enchancment Proposal (EIP-1559), carried out in August 2021, which launched a mechanism to “burn” a portion of transaction charges. This successfully created deflationary strain during times of excessive community exercise, decreasing the whole provide of ETH.

The second transformative occasion was “The Merge” in September 2022, when Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism. This modification drastically lowered issuance – from roughly 13,000 ETH/day to round 1,700 ETH/day – by eliminating the necessity to pay miners.

Following these modifications, ETH’s inflation fee fell beneath Bitcoin’s for the primary time in March 2023. Since then, ETH’s provide has grown by solely 0.2%, in comparison with Bitcoin’s 3%. The report states:

Whole provide of ETH fell between October seventh, 2022, and April 4th, 2024, transferring from ~120.6M on to a low of ~120.1M on, reaching an annualized (-0.25%) inflation fee over the interval. Since that point, ETH burn has been lowered because of the improve in Ethereum transaction throughput, and the community has accrued (+0.5%) in further provide. Regardless, over that very same interval, BTC provide has elevated (+1.1%).

Corporations Flocking To ETH Accumulation

Over the previous month, a number of firms have unveiled Ethereum-focused treasury methods. As an example, cryptocurrency agency Bit Digital just lately crossed 120,000 ETH in whole holdings.

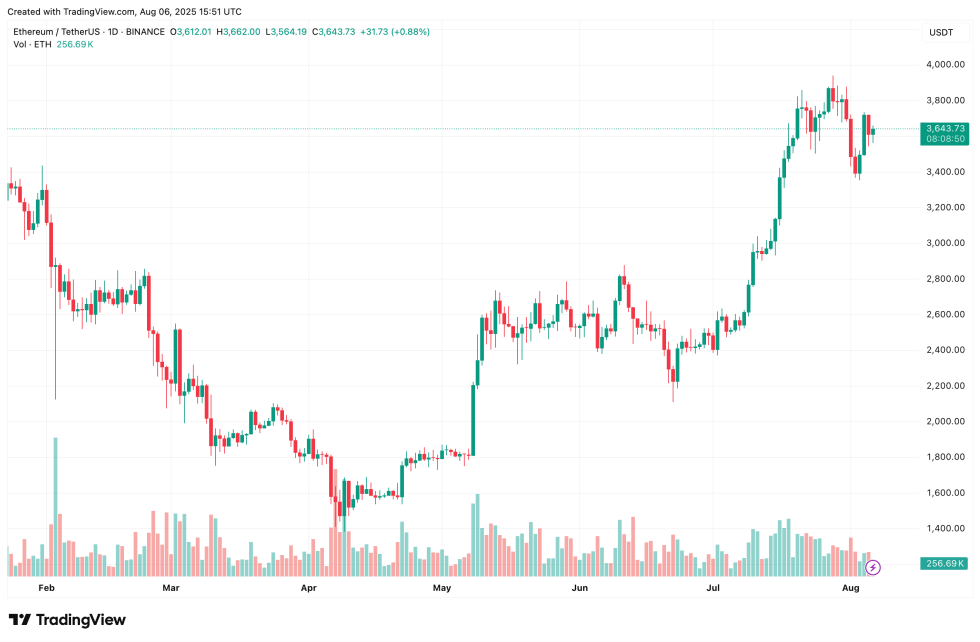

In the meantime, Bitcoin mining agency BitMine Immersion Applied sciences revealed that its ETH holdings had surged previous 833,000 tokens, making it the biggest recognized company holder of the digital asset. At press time, ETH trades at $3,643, up 2.3% prior to now 24 hours.

Featured picture from Unsplash.com, charts from VanEck and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.