The Day by day Breakdown takes a deep dive on PayPal, which simply bought off after reporting earnings. Is Wall Avenue proper or flawed on this one?

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our every day insights, all it is advisable do is log in to your eToro account.

Deep Dive

Within the earlier bull market, PayPal was considered as a high-quality development firm. However after a questionable acquisition technique and a painful bear market, the inventory has struggled to mount a significant rebound. Whereas shares are up almost 40% from their 2023 lows, PYPL inventory stays greater than 75% beneath its 2021 file excessive.

PayPal operates a worldwide funds platform that allows digital transactions for customers and retailers. Its manufacturers embrace PayPal, Venmo, and Honey, amongst others — serving a variety of use circumstances from peer-to-peer transfers to checkout, lending, and rewards.

Turnaround Takes Form

Alex Chriss took over as CEO in September 2023, and the inventory bottomed a few month later. Since then, he has steadily labored to show the corporate round. Whereas the inventory fell greater than 11% following final week’s earnings report, it was nonetheless a stable quarter.

PayPal beat each earnings and income expectations, raised its full-year EPS outlook, and reaffirmed plans for $6 billion in share buybacks this 12 months — almost 10% of its market cap at present costs. Venmo additionally stood out, with 20% income development, far outpacing the corporate’s total gross sales development of 8.2%.

Wanting on the longer-term image, analysts count on adjusted earnings to develop round 10% to 12% yearly via fiscal 2028, with income rising at a mid-single-digit tempo. As earnings development outpaces income, PayPal’s buyback can provide the underside line a lift and working margins — that are at a file excessive for the corporate — can proceed to increase.

Wish to obtain these insights straight to your inbox?

Enroll right here

Diving Deeper — PYPL Valuation

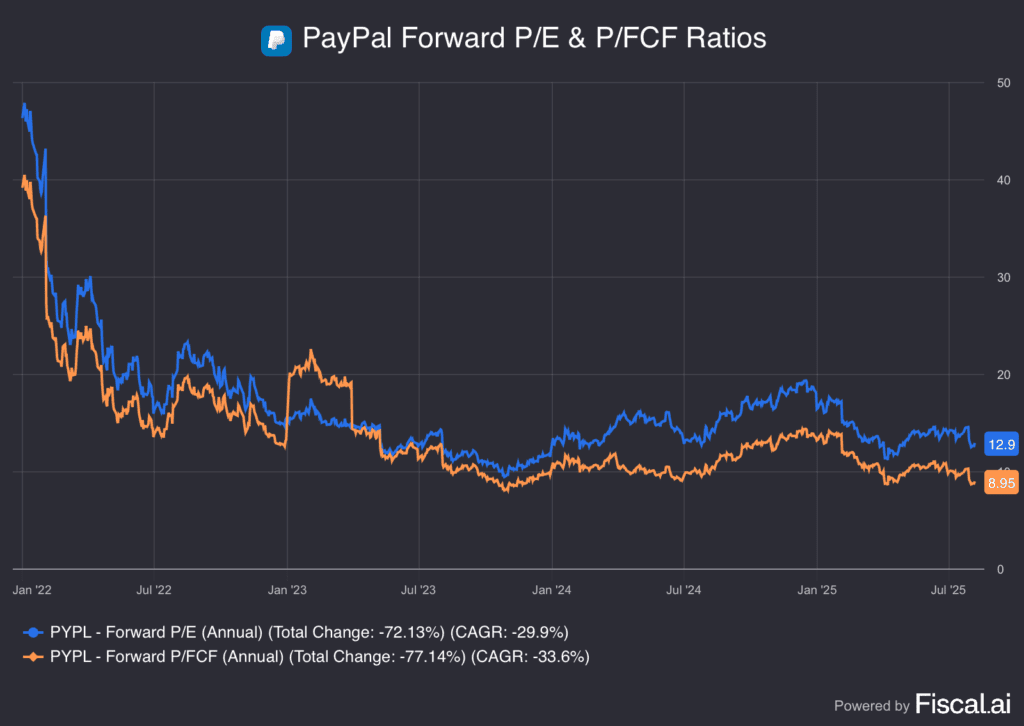

As Warren Buffett as soon as mentioned, “Worth is what you pay, worth is what you get.” Whether or not it’s a development inventory, a turnaround story, or a blue-chip stalwart, valuation performs an important function in figuring out whether or not buyers are getting an excellent deal. Based mostly on historic valuation metrics — comparable to ahead price-to-earnings and price-to-free-cash-flow — PayPal inventory seems comparatively low cost.

Dangers

It’s straightforward to see double-digit earnings development forecasts and what seems to be a sexy valuation and assume, “This inventory is a no brainer!” Nevertheless it’s necessary to keep in mind that PayPal has had a depressed valuation for a number of years now. Whereas the enterprise is in higher form than it was two years in the past, that doesn’t assure the inventory might be rewarded with a better a number of.

Additionally, look no additional than 2025 for a reminder that PYPL is just not a flight-to-safety worth inventory. Shares fell from the $90s to the $50s in just some months. Whereas that interval was marked by heightened volatility, it’s a helpful reminder: if the broader economic system weakens, buyers might as soon as once more flip away from this identify.

If you wish to improve your investing data this summer time, ensure to affix our eToro Academy Study & Earn Problem, the place you possibly can take programs, move quizzes, and earn as much as $20 in rewards. Phrases and circumstances apply.

What Wall Avenue’s Watching

AAPL

Apple unveiled a brand new $100 billion funding to increase US manufacturing and analysis — a transfer that might protect it from President Trump’s proposed tariff on chip imports. The plan consists of strengthening chip provide chain partnerships and ramping up home iPhone element manufacturing — a part of Apple’s broader push to localize operations amid mounting commerce stress from the Trump administration. Analysts have a mean worth goal of $134 for AAPL inventory.

BTC

Bitcoin, Ethereum, Ripple, and different cryptocurrencies are leaping this morning on information that President Trump will signal an govt order geared toward increasing the obtainable funding merchandise in US retirement accounts. It should reportedly embrace cryptocurrencies, actual property, and personal fairness. Take a look at the chart for Bitcoin.

Disclaimer:

Please notice that on account of market volatility, a number of the costs might have already been reached and situations performed out.