We’re greater than midway by means of Yr 1 of Trump 2.0, and I stand by what I stated earlier than Inauguration Day: This administration has ushered in a inventory picker’s market.

In different phrases, buyers who make sensible strikes into, and out of, particular person dividend payers will do one of the best within the coming three-and-a-half years.

That places holders of SPY, which should maintain all the S&P 500, in a jam. The S&P 500 trades at a nosebleed 25-times earnings, and SPY has no supervisor to shift away from overbought names and towards ignored bargains. That is harmful floor.

With that in thoughts, let’s run by means of 4 tickers (all of which, sure, are SPY holdings) I urge you to avoid–or dump if you happen to’re sitting on them now.

2 Meals Shares to Fade as Trump 2.0 Rolls on

Let’s begin with Common Mills (GIS) and The Kraft-Heinz Co. (KHC), the latter of which we have lengthy criticized for being out of step with the occasions. Each have fallen arduous since Election Day–a interval when the S&P 500 has gained.

Now that may set off your “discount radar.” If that’s the case, let me rapidly banish that notion. As a result of the reality is, shopping for both of those laggards right here can be a expensive mistake.

Meals Giants Fall Flat in Trump 2.0

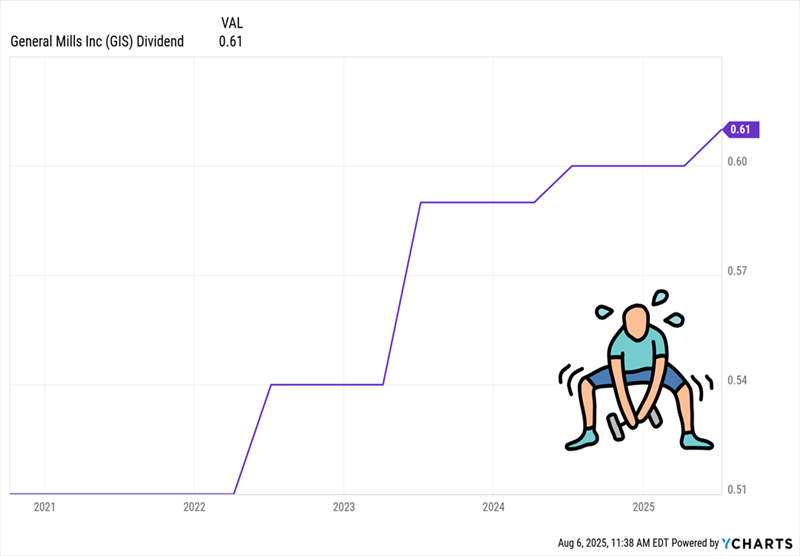

Since we primarily purchase blue chip names like these for dividend progress, this duo has naturally fallen off our purchase listing. Common Mills, for instance, has seen its payout progress sluggish sharply, rising by only a penny in every of the final two years:

Common Mills’ Decelerating Dividend

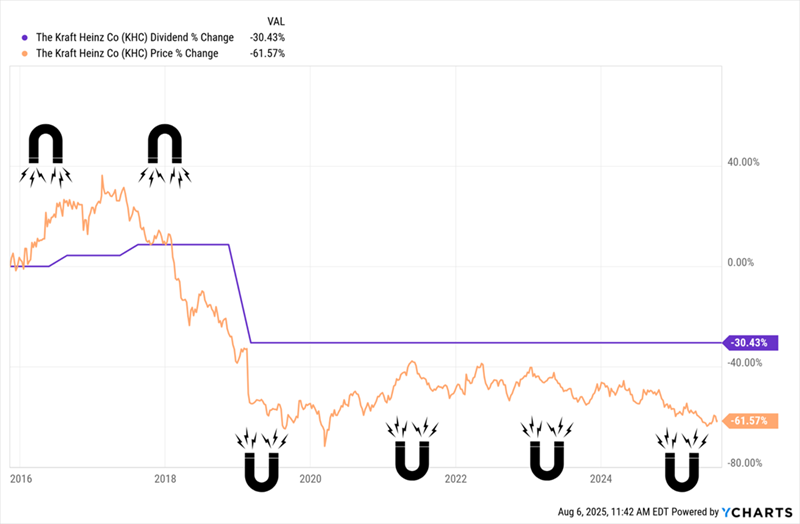

KHC? Its 5.9% dividend yield would possibly seize your consideration, however that top yield solely exists as a result of the inventory has plunged within the final decade (and share costs and dividend yields transfer in reverse instructions).

The final transfer KHC’s dividend made was truly a minimize introduced in early 2019, which took the share worth down with it. That is proof constructive that our Dividend Magnet–or the tendency for dividend progress to propel share costs higher–also works in reverse:

KHC’s “Reverse Dividend Magnet” Sinks Its Inventory

Throw in income progress that is gone nowhere for the higher a part of a decade and the truth that the corporate has a destructive payout ratio (i.e., paying dividends whereas shedding cash during the last 12 months), and the percentages of this payout getting off the mat, and giving the share worth a carry, are slim.

Now there are stories that KHC is contemplating spinning off its grocery enterprise into a brand new agency, successfully undoing the merger that created it in 2015. Usually, spinoffs are good for each the mum or dad and the brand new firm. However on this case, there’s little worth to be unlocked by changing one lagging firm with two.

2 Toymakers Dealing with Tariff (and Demographic) Ache With out Finish

One factor there is not any doubt about: Nevertheless President Trump’s workforce negotiates commerce offers from right here on out, we will assume that total tariff charges will probably be larger than they have been through the pre-Trump period.

In consequence, corporations that supply plenty of merchandise in locations like Vietnam and China will stay susceptible.

Two I am notably anxious about are toymakers Mattel (MAT) and Hasbro (HAS). The tariffs are already affecting their revenue outlooks, and there is a restrict to what number of toys they’ll make in America, given the low margins on these merchandise.

Past that, although, demographic modifications are an overhang, with folks having fewer kids, particularly in wealthier nations. In 2024, for instance, there have been simply over 3.6 million births within the US, in keeping with the Facilities for Illness Management and Prevention. That was up 1% from 2023, but it surely’s nonetheless a traditionally low determine when you think about that 2023’s complete was the bottom since 1979.

To be clear, I ought to say that each corporations deserve credit score for his or her efforts to shift manufacturing away from China, which has taken the brunt of the administration’s ire on commerce. In early Could, Mattel execs stated they acquired about 20% of their toys from China, they usually intention to chop that to 10% by 2027.

Hasbro will get round 50% of its merchandise from China, with the objective of slicing that beneath 40% in 2026. That is nonetheless a major reliance, and also you and I each know that relocating massive components of a provide chain is not one thing that occurs in a single day. Furthermore, there are few, if any, different locations within the globe these corporations can supply from to be able to keep away from tariffs outright.

Past that, Hasbro will get a big slice of its gross sales (about 45% within the second quarter of 2025) from its consumer-products section, house of its bodily toys and games–even as extra youngsters get their repair on-line.

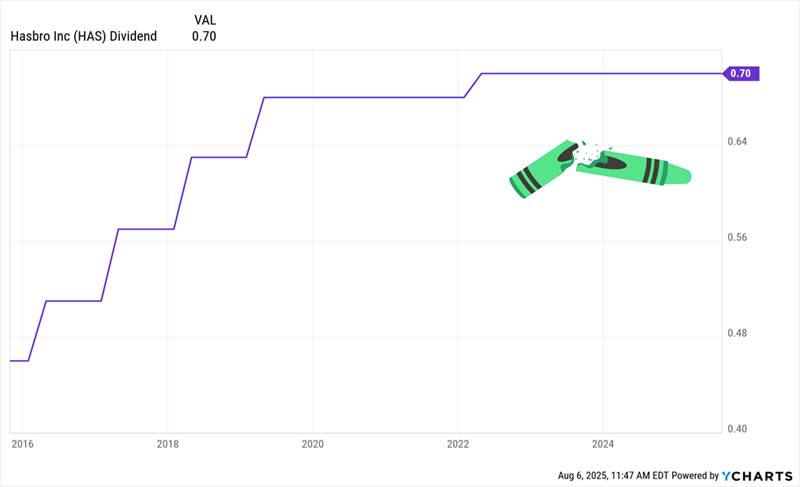

The dividend? The inventory yields a “ho-hum” 3.6% at this time, however its payout has gone nowhere since earlier than the pandemic:

Hasbro’s Damaged Payout Streak

Furthermore, like KHC, the inventory boasts a destructive payout ratio. That dangers turning slowing dividend progress into one thing a lot worse: a payout minimize. Mattel, for its half, is off our listing as a result of we’re dividend buyers before everything, and MAT would not pay a dividend, having suspended its payout in 2017.

The underside line is that the winds have shifted towards these two, and there is not any signal of that altering. That is not solely unhealthy information for MAT and HAS–but for our SPY holders, too. However for savvy inventory pickers, it units up alternatives, particularly if we search for shares with protected dividends and powerful Dividend Magnets that pull their costs larger.

The Dividend Magnet: Our Roadmap for the Remainder of Trump 2.0

There’s one “reality” we will rely on, irrespective of who holds energy in DC: A inventory’s dividend progress is the No. 1 driver of its share worth.

That makes our technique easy: Purchase shares whose payouts are growing–and accelerating–backed by rising gross sales, earnings and money move.

Even higher? Purchase when their inventory costs “lag” their payout progress. Then we journey alongside as they “snap again” to catch up.

That is simpler stated than completed, in fact: Monitoring dividend/share worth correlations requires advanced charting instruments and plenty of time studying earnings stories.

However I’ve completed the legwork for you. The outcome: my 5 prime “Dividend Magnet” picks to purchase NOW.

These 5 shares have what it takes to maintain each payouts and share costs popping. Click on right here and I will inform you extra about these 5 undervalued “Dividend Magnet” picks and offer you a free Particular Report revealing their names and tickers.

Additionally see:

Warren Buffett Dividend Shares

Dividend Development Shares: 25 Aristocrats

Future Dividend Aristocrats: Shut Contenders

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.