Markets have been below strain as buyers await phrase from Federal Chairman Jerome Powell. The Day by day Breakdown seems at expectations.

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our day by day insights, all it’s essential do is log in to your eToro account.

What’s Occurring?

Tomorrow morning isn’t a Fed assembly, however Chair Powell will give a speech at 10 a.m. ET from the Fed’s annual Jackson Gap summit.

Powell, who usually holds his playing cards shut when speaking Fed coverage, has been extra open at occasions when talking from Jackson Gap. For example, in final 12 months’s Jackson Gap speech, he informed buyers it was time for the Fed to change its rates of interest plans — in different phrases, it was time to decrease rates of interest.

The Fed reduce charges by 50 foundation factors on the subsequent assembly, then did two 25 foundation level cuts over the following few months.

Will we get related transparency tomorrow? Eh…

Whereas Powell may tip the Fed’s hand but once more, the dynamics are totally different proper now. Inflation is rising and the labor market is decelerating. Each of these metrics are transferring in the other way from the Fed’s twin mandate — that are steady costs (i.e. inflation) and most employment.

The Backside Line: No matter Powell says (or doesn’t say) might transfer markets. With the market at present pricing in about an 80% probability of a price reduce on the Fed’s September assembly, buyers could also be hoping for some affirmation tomorrow. However buyers can be listening for different clues too, making an attempt to decipher how the Fed will navigate the remainder of this 12 months. That would have an effect on markets with buyers now anticipating two price cuts by year-end.

Need to obtain these insights straight to your inbox?

Enroll right here

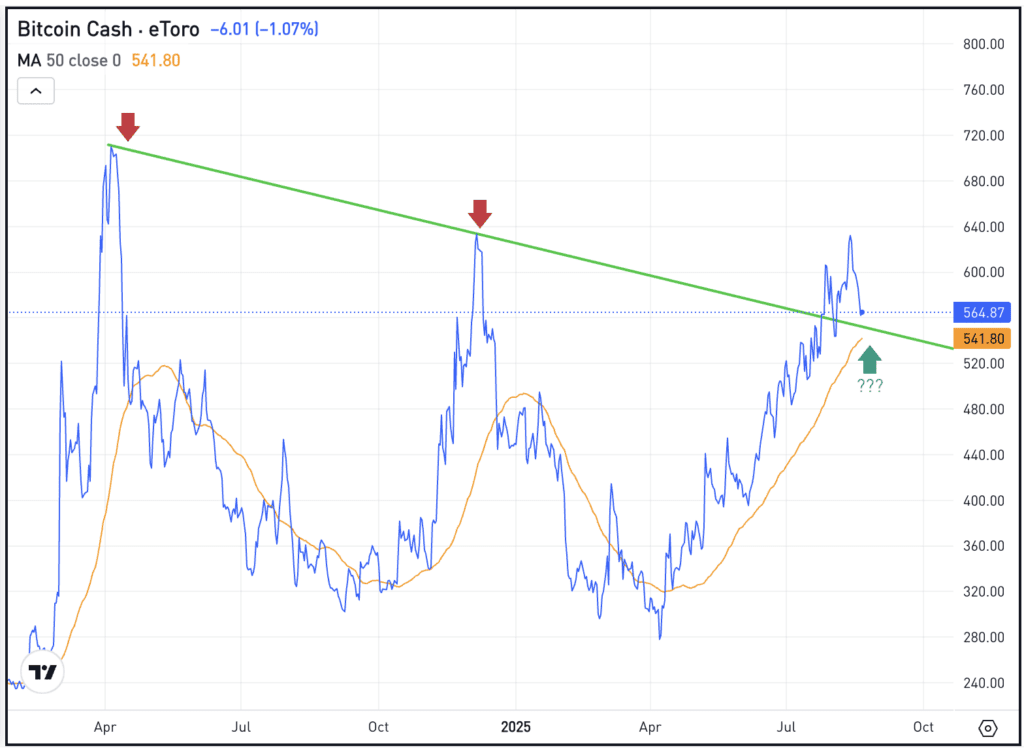

The Setup — Bitcoin Money

With the massive rallies we’ve seen in crypto over the past six weeks, Bitcoin Money looks as if it’s been misplaced within the shuffle.

Now pulling again, bulls are questioning if patrons will step in close to the $550 space. Not solely does this space deliver the rising 50-day transferring common into play, nevertheless it additionally retests the prior downtrend resistance line (marked in inexperienced). This measure saved BCH in examine by means of June, earlier than a breakout in July despatched Bitcoin Money above this mark.

Even when buyers aren’t planning to commerce BCH proper now, they’ll add it to their watchlist or set alerts proper from the asset web page.

What Wall Road’s Watching

WMT

Shares of Walmart are slipping decrease this morning after the retailer reported earnings. Whereas income and same-store gross sales expectations beat analysts’ estimates, earnings of 68 cents a share missed estimates of 74 cents a share. Coming into the report, shares have been up greater than 12% on the 12 months and up 37.5% over the previous 12 months. Dig into Walmart’s fundamentals.

INTC

Intel has been extremely risky currently. Shares tumbled 7% on Wednesday, after rising 7% on Tuesday and falling 3.7% on Monday. The truth is, final week, Intel inventory rose greater than 20%. There’s been numerous headlines driving Intel inventory currently, however with out query shares have been extra risky. Take a look at the chart for INTC.

Disclaimer:

Please notice that attributable to market volatility, among the costs might have already been reached and situations performed out.

The publish Get Prepared for the Fed appeared first on eToro.