Gold weekly forecast turns bullish as Fed Chair hinted at a price reduce in September.

Easing tensions in Ukraine may cap the beneficial properties in gold.

Merchants eye the US Core PCE and US GDP q/q knowledge due subsequent week for extra impetus.

Gold ended the earlier week on an optimistic be aware, rising above the $3,370 stage, following the Fed Chair Powell’s statements at Jackson Gap that triggered the greenback draw back and yields. Powell indicated a change in fact towards adaptable inflation as the upper rates of interest are weighing on the labor markets. This weekend restoration will put deal with one other data-intensive week that may decide whether or not gold continues its restoration, or is as soon as once more underneath strain.

–Are you curious about studying extra about crypto robots? Test our detailed guide-

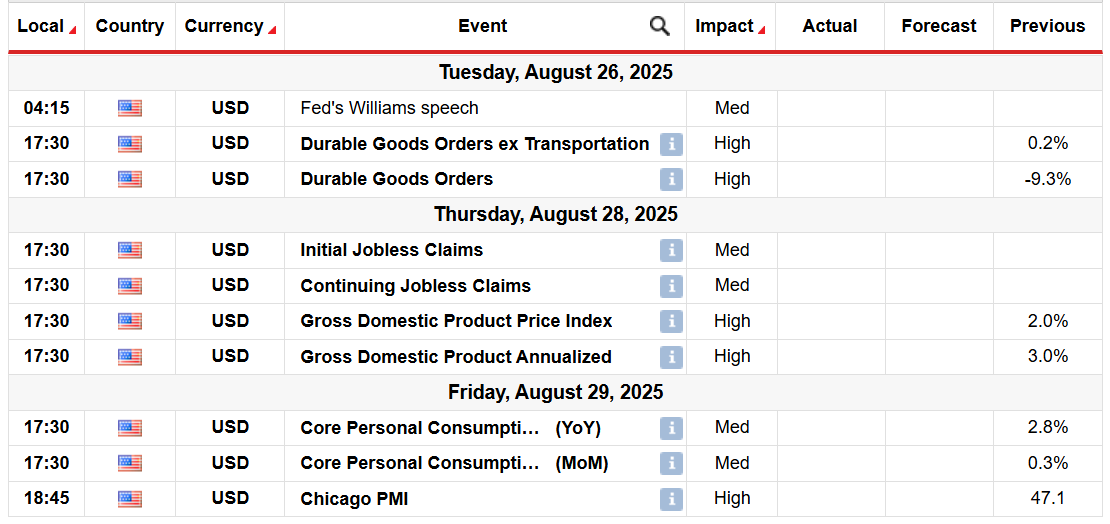

The motivation to spend money on gold will primarily be US macro-economic releases, which shall be testing the Fed coverage outlook. On Tuesday, Sturdy Items Orders knowledge is due, which is able to point out enterprise actions. Following a pointy 9.3% plunge in June, markets are anticipating an additional 4.0% lower. This may be a combined bag as a decrease print would drag on the greenback and profit gold, whereas an outperformance would push up Treasury yields and halt gold bulls.

Crucial launch of the week is the July Core Private Consumption Expenditures (PCE) Worth Index due on Friday. Inflation stays sticky, and any upside shock would immediate a reassessment of future price cuts. Stronger-than-anticipated PCE would drive Treasury yields up and gold down. A weaker quantity, however, would help bets on the dovish Fed and will see one other upside swing in XAU/USD.

On Thursday, markets will see the second estimate of Q2 GDP progress. First studying improve was wholesome with 3% annualized progress. Downward adjustment would reaffirm the concept the US financial system is slowing down. This might increase gold as merchants search a haven throughout a interval of financial downturn.

Geopolitical tensions calmed down additional following the easing of tensions in Ukraine, which capped gold demand final week. In line with the CME FedWatch Software, the chance of a 25 bps discount in September is now 90%. The merchants anticipate constant easing into the shut of the yr. Such weighted dovishness, nevertheless, additionally constrains the power of the greenback to weaken additional except future knowledge clearly warrants in opposition to the transfer.

Gold weekly technical forecast: Bulls to problem $3,400

The day by day chart reveals a detailed above the confluence of 20- and 50-day MAs close to $3,350. Nevertheless, the value remains to be enjoying inside the vary, properly beneath the higher boundary of $3,440. The 100-day MA continues to help the bulls. The following key resistance for gold lies at $3,400.

–Are you curious about studying extra about shopping for Dogecoin? Test our detailed guide-

On the flip facet, breaking the $3,300 help at 100-day MA may open the trail for losses in the direction of $3,260 help stage forward of the following help at $3,200.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to think about whether or not you may afford to take the excessive danger of shedding your cash.