Picture supply: Getty Pictures

Each from time to time, an organization makes a daring transfer that places it firmly on revenue buyers’ radar. One such identify is Chesnara (LSE: CSN), the life and pensions consolidator that lately joined the FTSE 250.

Its rise has been outstanding. On 7 April, Chesnara was valued at simply £366m. Quick ahead 4 months, and it’s virtually doubled in dimension to a market-cap nearing £700m.

So what lit the fuse?

The spark got here in early July when Chesnara introduced a £260m money deal to purchase HSBC’s specialist life safety and funding bond supplier. The acquisition will add round £4bn in belongings below administration and 454,000 new insurance policies, considerably boosting its scale within the UK.

Administration expects the deal to generate £140m in money in the course of the first 5 years, with the potential to achieve £800m over the long term. That’s a sizeable kicker for any enterprise.

To fund it, Chesnara plans to lift £140m by means of share issuance — a transfer which will dilute shareholder worth and dampen enthusiasm for brand new buyers. Nonetheless, the larger story for a lot of will probably be its dividend plans. Administration expects to lift its remaining dividend for 2025 and interim dividend for 2026 by an adjusted 6%. For revenue hunters, that’s powerful to disregard.

A dividend machine?

Chesnara already gives a chunky trailing yield of seven.3%, with forecasts pointing in direction of a bumper 8.5%. That’s comfortably above the FTSE 250 common. However can it final?

One concern is the payout ratio, at present hovering round 950%. For many companies, that may be an enormous purple flag. Sometimes, a sustainable ratio sits beneath 100%. Nonetheless, insurers play by barely completely different guidelines. Unstable earnings, capital necessities and sophisticated accounting can distort the numbers.

Authorized & Normal, for example, has usually carried a excessive payout ratio however has managed to maintain shareholders candy for many years. Chesnara too has a stellar observe report — it’s elevated its dividend yearly for over 20 years. That’s not one thing an investor ought to dismiss flippantly.

One other eyebrow-raiser is valuation. Its trailing price-to-earnings (P/E) ratio stands at an eyewatering 131.5 — extra befitting of a Silicon Valley tech inventory than a UK insurer. However right here’s the twist: analysts anticipate earnings to develop quickly, bringing its ahead P/E down to simply 13.3. Out of the blue, issues don’t look fairly so stretched.

Profitability nonetheless, nonetheless nags at me. With an working margin of only one.1% and a return on fairness (ROE) of 1.16%, the enterprise isn’t precisely overflowing with surplus money.

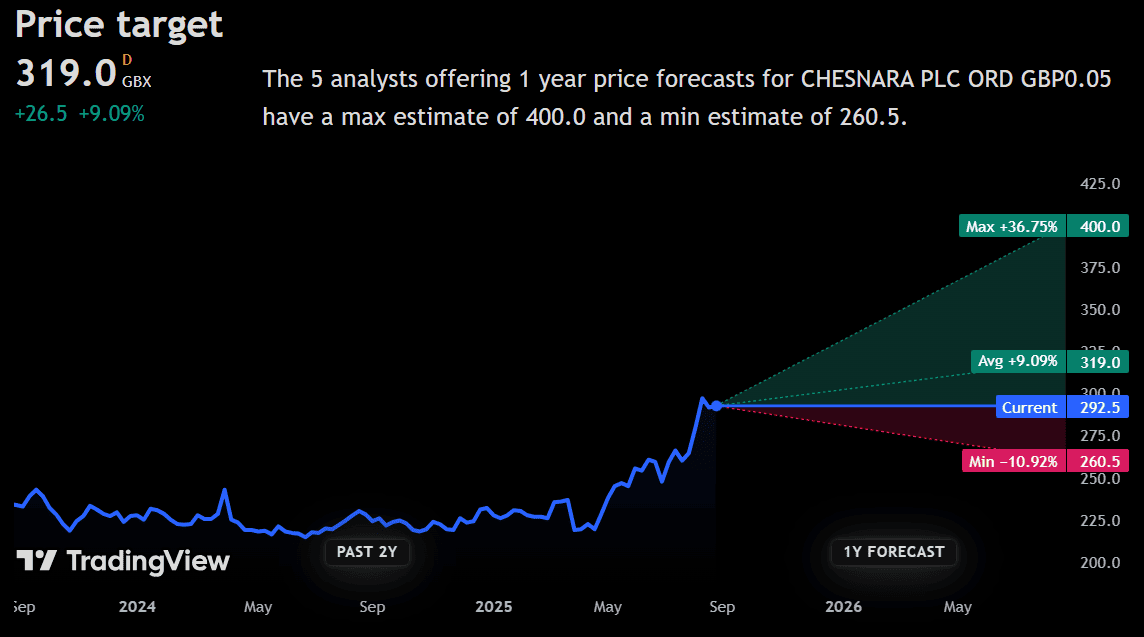

That stated, analysts stay bullish. The typical 12-month value goal sits at 319p — round 9.5% greater than at this time’s value. Out of 5 analysts masking the inventory, 4 charge it a Robust Purchase, whereas one prefers to Maintain.

My take

The FTSE 250’s filled with fascinating mid-caps that always fly below the radar, and Chesnara’s speedy ascent highlights how shortly fortunes can change. The HSBC deal may very well be a real game-changer, however it comes with dangers — from share dilution to the problem of integrating such a big ebook of enterprise.

If the acquisition pays off and dividends hold climbing, it might show a rewarding addition to a passive revenue portfolio. It’s not fairly a screaming purchase in my ebook — but — however at this yield, it’s actually value critical consideration.