Ethereum has been one of many strongest performers within the crypto market over the previous two months, surging steadily to succeed in new all-time highs simply days in the past. Its rally has bolstered Ethereum’s function because the main altcoin, attracting each institutional consideration and retail hypothesis. Nevertheless, the panorama is shifting as promoting strain begins to creep in. Some analysts warn that ETH may very well be vulnerable to additional draw back within the coming days, with volatility testing buyers’ confidence after such an aggressive run greater.

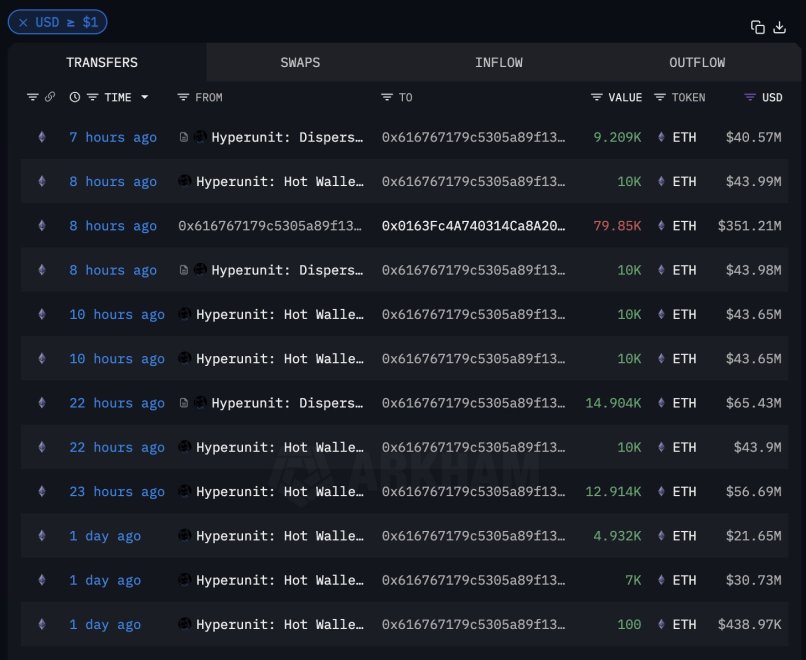

But, whereas considerations develop, on-chain information reveals that whales proceed to build up at scale. Based on Arkham, a large whale holding $5.97 billion in Bitcoin has now bought $434.7 million value of ETH. Simply yesterday, this whale moved $1.1 billion to a brand new pockets (169q) and has been actively buying ETH by means of Hyperunit. In whole, he has amassed greater than $3 billion in ETH, staking the vast majority of it, a transfer that alerts robust conviction regardless of near-term uncertainty.

This tug of warfare between promoting strain and whale accumulation units the stage for a important second in Ethereum’s trajectory. The approaching days will reveal whether or not whales are robust sufficient to maintain ETH supported or if additional retracements await.

Whale Stakes Billions In Ethereum As Capital Rotation Grows

Based on Arkham, one of many largest whales out there has now bought over $3 billion value of Ethereum (ETH), staking the vast majority of it. This exercise has drawn the eye of each analysts and buyers, because it highlights a rising capital rotation pattern away from Bitcoin and into Ethereum. The whale in query, who initially held $5.97 billion in BTC, has been step by step changing his place, deploying funds at scale by means of Hyperunit. His BTC deal with (169qYZJYkyW7HhmWTj58mVXRZDhMFHPZPd) and ETH deal with (0x616767179c5305a89f13348134C681061Cf0bA9e) are actually being intently tracked by the market as buyers speculate on his subsequent transfer.

After transferring $1.1 billion in BTC to a contemporary pockets, the whale has already bought $434.7 million in ETH, including to his large accumulation and signaling continued confidence in Ethereum’s future. The vast majority of these holdings are being staked, which reduces liquid provide and underscores a long-term outlook reasonably than short-term hypothesis.

Now, the query stays: will he purchase the subsequent $650 million right now? If that’s the case, the extra demand may present robust help for Ethereum, at the same time as short-term value motion exhibits weak point. Extra importantly, this capital rotation pattern is a transparent signal that altcoins are getting ready for his or her flip. As buyers rotate from BTC to ETH and past, the groundwork for a broader altcoin cycle seems to be forming, setting the stage for heightened volatility and alternative within the weeks forward.

Testing Key Demand Stage

Ethereum (ETH) is buying and selling round $4,369, displaying indicators of consolidation after weeks of sharp rallies and subsequent retracements. The chart highlights how ETH has cooled from its current all-time highs close to $4,900, however stays firmly above important transferring averages that proceed to information its bullish construction.

The 50-day transferring common, at present close to $4,372, is performing as rapid help and has been examined a number of occasions in current periods. Holding above this stage is vital to sustaining short-term momentum. In the meantime, the 100-day common is round $3,962, and the 200-day common is at $3,257, reinforcing the long-term bullish pattern, suggesting that even deeper pullbacks would probably be met with robust shopping for curiosity.

Nevertheless, Ethereum’s lack of ability to push again above $4,600 highlights waning momentum within the close to time period. Revenue-taking and broader market uncertainty have slowed the tempo of beneficial properties, leaving ETH susceptible to additional consolidation. A decisive break under $4,350 may open the door to $4,000 as the subsequent main demand zone.

Ethereum stays in a wholesome uptrend, however the market is clearly ready for contemporary catalysts. Whether or not it’s whale accumulation or broader institutional flows, ETH will want renewed shopping for strain to retest its highs above $4,800.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.