Picture supply: M&S Group plc

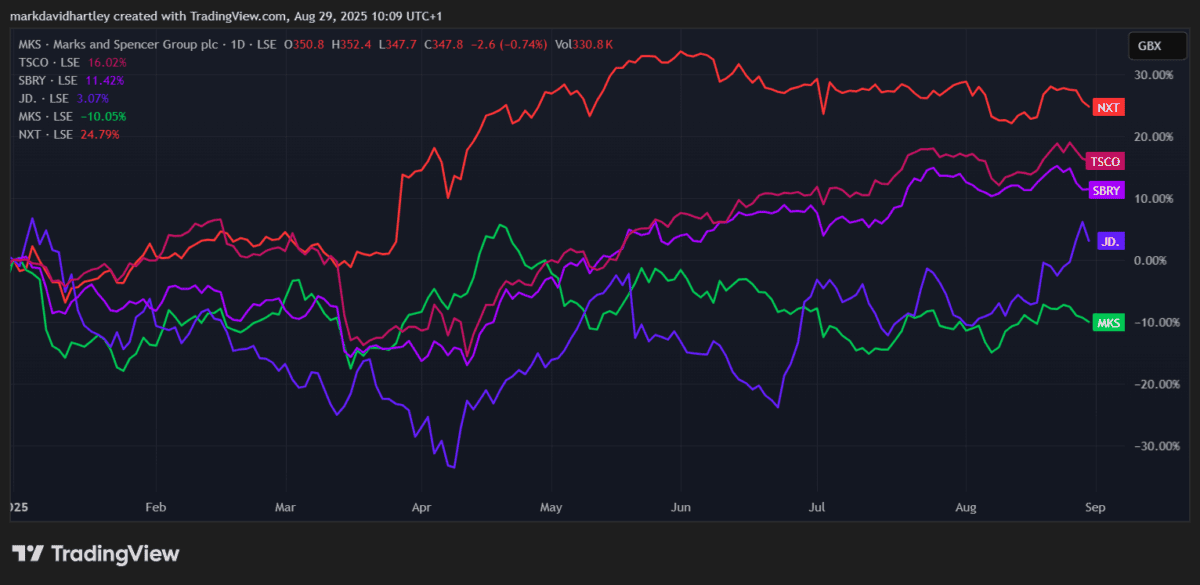

After a improbable 2024, Marks and Spencer’s (LSE: MKS) shares have taken a hammering in 2025. They’re down 8% year-to-date, making them the worst-performing retail inventory on the FTSE 100.

That’s a worse exhibiting than Subsequent, Sainsbury’s, Tesco and even JD Sports activities, which has struggled previously yr.

However earlier than I get carried away, it’s price trying on the greater image. Over 5 years, it’s nonetheless the perfect performer of the lot — up a outstanding 206%. So is that this hunch only a momentary wobble, or is it an indication of one thing deeper? I made a decision to dig deeper.

Latest developments

The obvious headwind is the fallout from the April cyber hack. In early August, M&S resumed click-and-collect orders for clothes after a painful four-month pause. That disruption was expensive — analysts estimate the whole affect may attain about £300m in misplaced working revenue.

Nonetheless, there are positives. Meals gross sales rose 6.7% year-on-year within the 12 weeks to 9 August. Analysis agency NielsenIQ reported that grocery development accelerated to 4.3% because the worst of the cyberattack’s affect pale.

In different phrases, customers nonetheless appear loyal to the model.

Margins nevertheless, stay razor-thin. Internet margin sits at simply 2.14%, whereas return on capital employed (ROCE) is 5.26%. Earnings development has slumped 32.5% yr on yr, although income climbed almost 6% over the identical interval. On the steadiness sheet, debt and fairness are finely balanced at roughly £2.93bn apiece.

One glimmer of hope lies in valuation. The inventory’s trailing price-to-earnings (P/E) ratio of 24.7 appears to be like steep, however the ahead P/E drops to 14.8, suggesting earnings are anticipated to enhance as soon as the cyber fallout is behind it.

Wanting forward

Administration clearly sees development alternatives. M&S plans to take a position £340m in a brand new automated distribution centre in Northamptonshire. Anticipated to open in 2029, the positioning ought to create greater than 2,000 jobs and streamline logistics.

In the meantime, analysts stay cautious. In a notice on 26 August, Deutsche Financial institution lowered its worth goal from 450p to 435p, citing considerations about UK client resilience. Apparently although, it nonetheless labels M&S a ‘most well-liked inventory’ relative to friends reminiscent of Subsequent, which it views much less favourably.

The dangers

Marks and Spencer’s enterprise mannequin is uncommon in that it straddles two very totally different markets. On one hand, it competes with premium meals retailers like Waitrose and the top-end own-label ranges from Tesco and Sainsbury’s.

On the opposite, it’s combating for market share in vogue towards each finances retailers reminiscent of Primark and H&M, and on-line giants like ASOS and Boohoo.

This twin positioning leaves the corporate weak on either side. Rising prices may erode already skinny meals margins, whereas altering client traits would possibly make it more durable to defend its mid-market vogue enterprise. Add in fierce competitors, and it’s clear the trail ahead gained’t be easy.

Ought to I promote?

Regardless of the rocky begin to 2025, I’m not dashing for the exit. M&S has reinvented itself earlier than, and its long-term monitor document exhibits that administration is aware of tips on how to adapt. The cyberattack was a serious setback, nevertheless it appears to be like just like the enterprise is already recovering.

For me, it’s nonetheless a inventory to think about shopping for. If something, the latest dip may very well be an opportunity for long-term buyers to choose up shares on this British retail icon at a gorgeous valuation.