Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Jake Clover, CEO of Digital Ascension Group and a long-time XRP advocate, used a brand new video revealed on September 3 to ship an unambiguous message to merchants ready for one final capitulation: he doesn’t suppose a 90% collapse is coming again. “I’d adore it too. I don’t suppose it’s going to occur,” Clover mentioned, arguing that the market already gave skeptics ample time to purchase throughout extended sub-$1 ranges. “When it was 50 cents, no one needed to purchase it… You had three years to purchase it at 50 cents or 30 cents or 40 cents or no matter it was. It ain’t coming again.”

Will XRP By no means Crash By 90% Once more?

Clover roots that conviction not in a single catalyst however in what he describes as a structural change to XRP’s market microstructure. He repeatedly cites the position of spot exchange-traded merchandise – Bloomberg’s James Seyffart places SEC approval in 2025 odds at 95% – and the execution algorithms utilized by institutional liquidity suppliers as a persistent supply of demand that alters the asset’s draw back dynamics. “It’s going to be sustained right here due to the ETFs, due to the TWAP and VWAP and them coming into the market. They’re not letting it come again down,” he mentioned, referring to time- and volume-weighted execution that systematically slices giant orders into the market over prolonged intervals.

Associated Studying

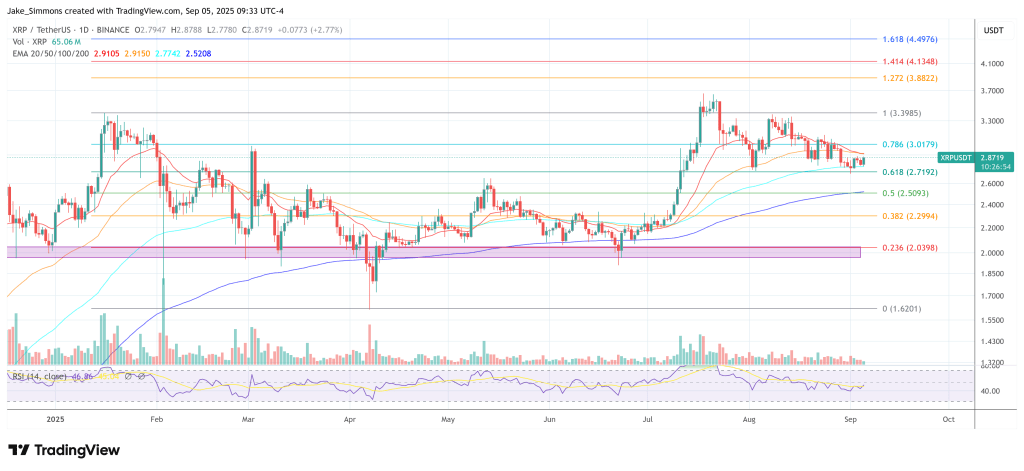

He frames the present tape as a take a look at the asset has already handed. “If it was going to [crash], there’s a bunch of stuff that rolled up after which it’s again down 90% because it went up. XRP hadn’t performed that,” Clover famous, contrasting XRP’s habits with different, sharper retracements elsewhere in crypto. In his studying, help has repeatedly asserted itself on the cross with Bitcoin as effectively. “It’s again on the road right here the place there’s been help on the Bitcoin and XRP chart. I believe it’s up from right here, particularly if Bitcoin retains going up,” he mentioned, tying XRP’s path to the broader beta of the cycle.

Clover additionally connects his outlook to a set of potential macro and market-structure tailwinds. He factors to what he calls a “reverse carry commerce,” the prospect of “adoption for the backend settlement of the inventory market,” and the affect of ETF flows as state of affairs drivers that would render near-term entry costs largely irrelevant over an extended horizon. In one of many video’s most pointed passages, he underscores that view with a blunt thought experiment on future worth ranges: “You’re not going to care for those who purchased it at $2.30 otherwise you purchased it at $2.40 otherwise you purchased it at $2 when it’s 100 {dollars} or $200 or $500.”

Associated Studying

The operational takeaway he gives to buyers is procedural slightly than tactical. Clover is express that market timing is a dropping recreation for practically everybody and that disciplined accumulation outperforms makes an attempt to catch precise bottoms. “Greenback price averaging goes to be your greatest wager 99.9% of the time,” he mentioned. “Attempting to time the market, you’re not going to do it. It’s like 1% of merchants that ever timed the market effectively. And those who greenback price common in, you’re going to win. Like you’ll be able to’t, you’ll be able to’t lose doing that. You’re going to get highs and lows, however your common goes to be fairly honest.”

Danger administration, in his account, is non-negotiable. He warns explicitly towards taking over debt or leverage that compromises fundamental obligations in an effort to chase upside. “Don’t leverage your self or over leverage your self to the purpose the place you’ll be able to’t make your payments or can’t pay different stuff,” Clover mentioned, including that small, common allocations made solely from surplus money are the suitable approach to specific conviction whereas surviving the volatility that is still endemic to the asset class.

If that thesis holds, the implication for technique—once more in Clover’s personal phrases—is to cease ready for the ghost of an outdated regime. “I do know everyone needs probably the most they will get on stuff,” he mentioned, “however greenback price averaging goes to be your greatest wager… When you could have some further liquidity, purchase just a little bit.”

At press time, XRP traded at $2.87.

Featured picture created with DALL.E, chart from TradingView.com