Abstract factors:

The sharp inventory worth drop after a strong earnings report is an entry or accumulation alternative;

Fortinet, regardless of a cautious steering resulting from macro uncertainty, continues to dominate nearly all of the firewall market shares;

Fortinet is doubtlessly the most effective worth play amongst massive cybersecurity shares with an affordable valuation, excessive progress charges and robust margins.

The Catalyst

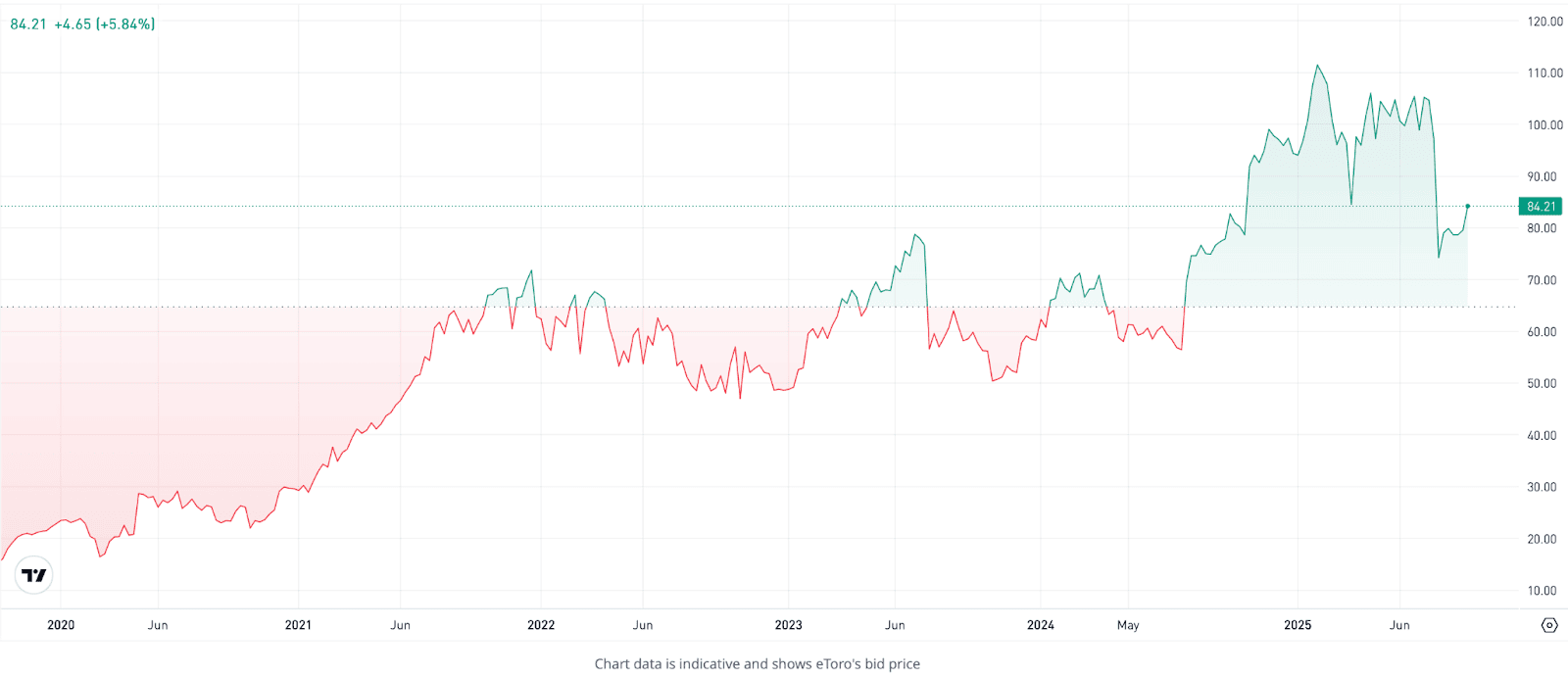

Fortinet Inc. ($FTNT) is up over 250% in 5 years and over 800% in 10 years, reflecting excessive income progress charges and a profitable enterprise mannequin within the cybersecurity sector. The inventory is presently buying and selling new 52-week lows after a pointy drop in early August publish Q2 earnings report. The report was truly convincing however the steering got here in conservative resulting from a excessive stage of macro uncertainty amidst tariffs and a slowing US financial system. The drop under $75 in August (from a $107 excessive in July) is unjustified, and though the inventory has already began the restoration, crossing the $80 price ticket a couple of days in the past, it’s nonetheless effectively under its 52-week highs of $114.

The corporate introduced a share repurchase program which can act as a serious catalyst in my view. The announcement of a $1 billion improve within the share repurchase program and its extension to February 2027 ought to act as a flooring for the inventory, subsequently limiting draw back. The share repurchases additionally considerably enhance shareholder sentiment: an organization that buys its personal shares is an organization that believes it may possibly develop additional.

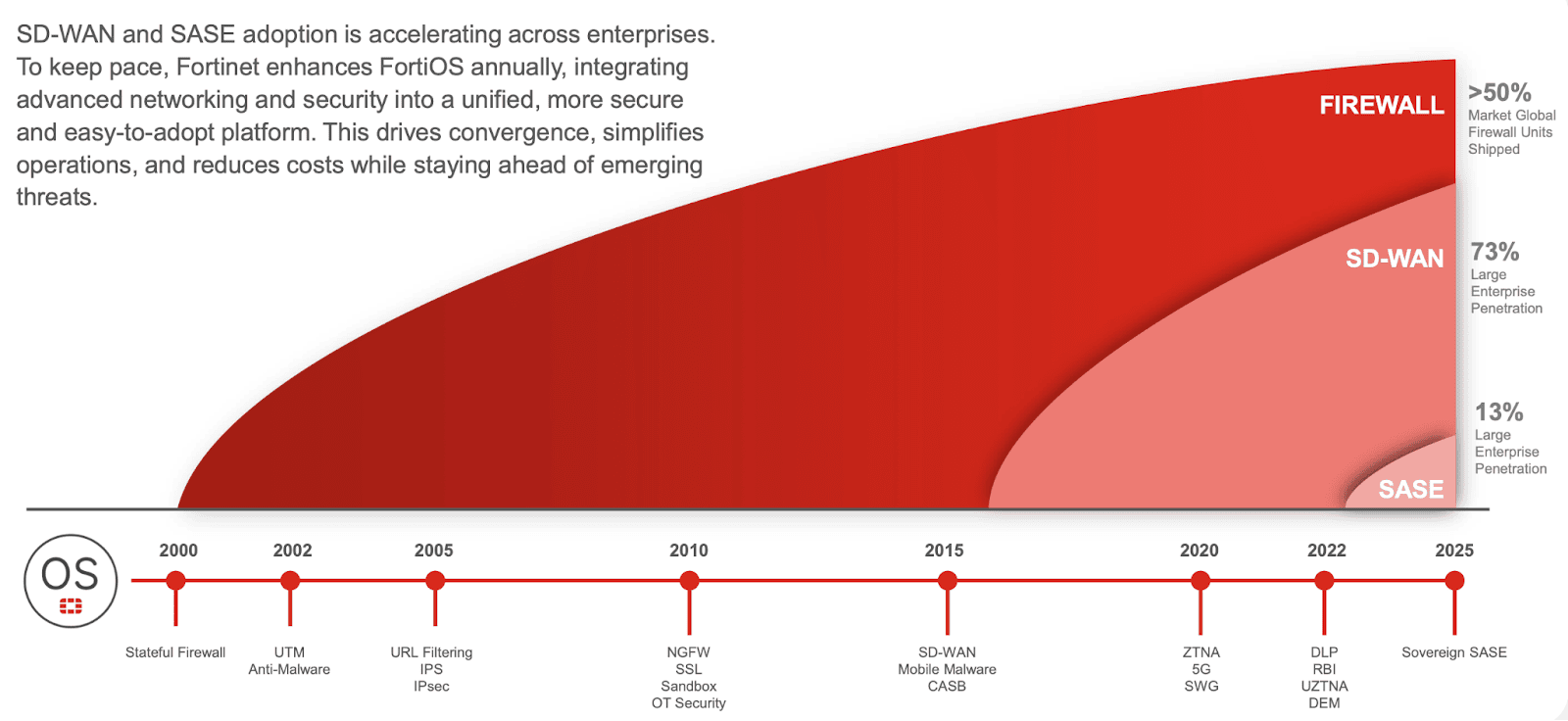

Supply: Fortinet, Could 2025 Investor Presentation

Fortinet has been an aggressive share repurchaser within the current years, particularly throughout the 2022-2023 bear market, whereas it hasn’t purchased any throughout the 2024 bull 12 months, which total displays a sensible capital allocation. The above chart was printed in Could and I count on the share repurchases to speed up because the August drop. A powerful rebound is certainly within the playing cards within the short-term.

Enterprise Overview

Within the long-term, Fortinet is effectively poised to proceed outperforming its friends due to its enterprise moat. Fortinet’s firewalls are probably the most superior on this planet, at a time the place cybersecurity threats multiply and every thing continues to grow to be extra digital, linked and powered by AI. The enterprise controls over 50% of the worldwide market share of deployed community firewalls as per its final report.

Firewalls are community safety gadgets that act like safety gates to community visitors. It protects a community from the intrusion right into a trusted inner community by untrusted and doubtlessly harmful exterior networks. That is the core of Fortinet’s enterprise and income, but it surely has efficiently expanded to different segments equivalent to its SASE line for clouds (not technically a “firewall”, but it surely is sort of a firewall for clouds) and SD-WAN which is an AI-powered community optimiser steering community intelligently throughout a number of WAN hyperlinks.

Supply: Fortinet, August 2025 Earnings Presentation

The corporate simply crossed 1,400 issued patents worldwide, and over 500 issued and pending AI patents, pushed by R&D investments. The pipeline is big and income progress catalysts ought to proceed to emerge, whereas the core enterprise stays effectively forward of competitors.

Laborious Figures Supportive of the Funding Thesis

This short-term and long-term funding alternative is very enticing, supported by the AI tailwinds and share repurchases talked about above, but additionally by its sturdy financials and valuation.

Regardless of a cautious steering resulting from macro situations, the figures present a a lot rosier image. Certainly, income elevated by 14% YoY to achieve €1.63 billion on the finish of Q2, with gross revenue margin regular at 81.3% and web earnings margin at 30.6%. Earnings per share have elevated by 54%, powered by rising earnings and a declining variety of shares (due to share repurchases).

Fortinet has had optimistic FCF yearly with out exception since its IPO in 2009 and boasts a 32% FCF margin, a mirrored image of the enterprise mannequin’s solidity all through the years. The stability sheet is subsequently pristine, with $4.56 billion of money, equivalents and brief time period investments and solely $1.0 billion in debt. The funding grade score of BBB+ is justified.

Supply: eToro, TradingView

Final however not least, Fortinet could also be the most effective worth play amongst massive cybersecurity shares due to its August inventory worth drop as you may see within the chart above. The inventory is certainly now buying and selling at round $84 per share which provides it a P/E of 32x. The PEG stands at solely 0.67x, reflecting the excessive progress charges, which makes it in my view a wonderful GARP (Development At a Affordable Worth) alternative. The P/S of 9.8x can also be enticing, considerably decrease in comparison with friends. Zscaler (ZS) is buying and selling at 16.5x gross sales and Cloudflare (NET) has a P/S of 41.4x, and each have in the meanwhile detrimental earnings (unprofitable) whereas Fortinet has been worthwhile and rising since 2009. The a lot bigger and extra established gamers equivalent to Palo Alto Networks (PANW) and Crowdstrike (CRWD) are worthwhile however they’re additionally considerably costlier at 14.4x and 25.4x gross sales, respectively.

Danger Issue To My Case

The important thing danger issue is the one which has been outlined by administration and triggered the inventory to erase 25% of its worth. The uncertainty by way of capex investments amidst a turbulent setting might trigger Fortinet prospects to postpone their refreshes and cybersecurity updates. Curiously, regardless of the cautious steering, administration did increase 2025 full 12 months billings steering midpoint by $100 million. The macro uncertainty triggered a number of financial institution analysts to announce downgrades for the inventory as capex spending could also be diminished or stagnate within the cybersecurity sector, and these downgrades, whereas brief lived, might proceed to behave as headwinds to the inventory worth restoration within the brief time period.

Backside Line

Backside line: volatility will be a possibility when it causes a inventory to unload unjustifiably, whereas the enterprise stays sturdy and continues to develop. The worth drop is a superb worth entry for a long-term funding. Its superior merchandise, at a time the place the world is turning into more and more digital and cybersecurity threats proceed to growth, ought to proceed to assist the monetary progress of the corporate. Share repurchases will doubtless restrict the draw back and the upside stays uncapped given a budget valuation versus friends.

Sources

https://investor.fortinet.com/news-releases/news-release-details/fortinet-reports-second-quarter-2025-financial-results

https://investor.fortinet.com/static-files/2d21430a-2c22-4b9d-b7f5-3f4bdaa420b6

https://www.etoro.com/markets/ftnt

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.