What’s obtained Adobe inventory all the way down to a decade-low valuation? The Every day Breakdown digs into the spooky decline in ADBE inventory.

Earlier than we dive in, let’s ensure you’re set to obtain The Every day Breakdown every morning. To maintain getting our day by day insights, all you have to do is log in to your eToro account.

Deep Dive

Adobe Programs has been a trending subject on social media this yr, seemingly neglected within the broader tech rally regardless of its constant enterprise progress. Regardless of Adobe’s integration of AI into its merchandise, considerations persist concerning the potential destructive influence of AI on its enterprise.

Nevertheless, the corporate has continued to carry out nicely. Adobe skilled some margin strain between 2021 and 2023 however has since rebounded to the mid-30% vary. Over the previous decade, Adobe has constantly achieved at the very least 10% annual income progress with out considerably sacrificing its margins, resulting in a compound annual progress charge (CAGR) of roughly 26% in earnings over the identical interval.

Future Development Projections

Whereas Adobe has demonstrated robust progress traditionally, future progress shouldn’t be anticipated to be as aggressive. Based on Bloomberg, analysts venture the next:

Earnings progress: 13% this yr, 12.2% in 2026, and 12.3% in 2027.

Income progress: 10.2% this yr, 9.3% in 2026, and 9.3% in 2027.

Analysts at the moment have a consensus worth goal of ~$457.50 on ADBE inventory, implying virtually 34% upside to right this moment’s inventory worth. The disconnect between the inventory worth and what traders really feel is a good worth has many traders puzzled.

Wish to obtain these insights straight to your inbox?

Join right here

Diving Deeper — Valuation and Dangers

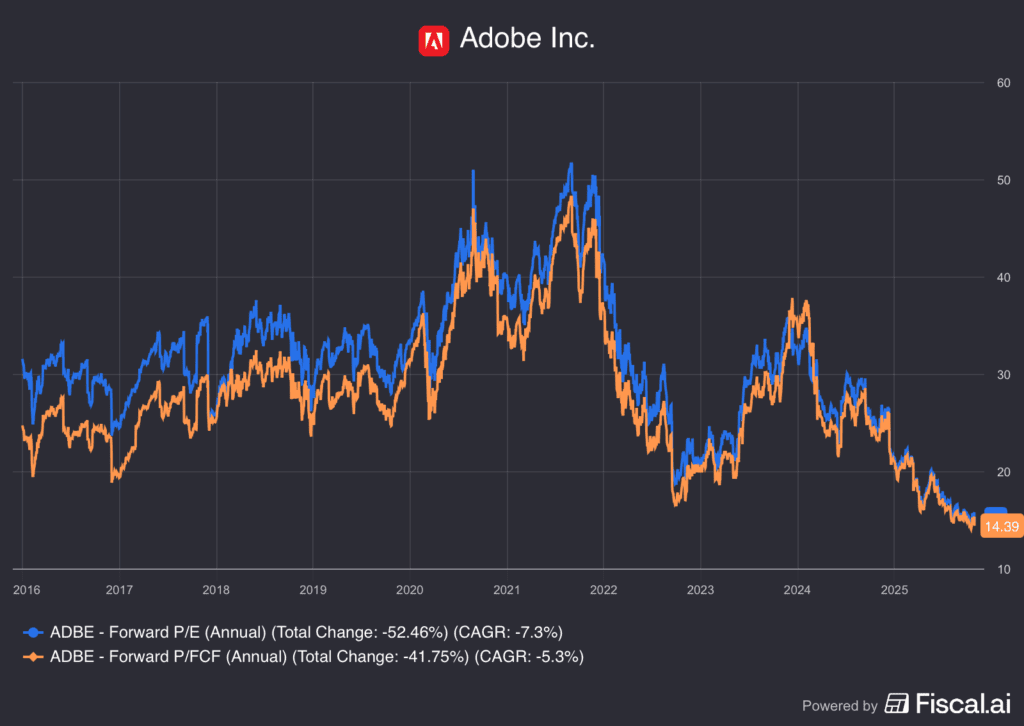

As a result of the enterprise has continued to chug alongside however the worth of Adobe inventory has not, the valuation has come down considerably over time. Under is a take a look at the ahead price-to-earnings ratio and the ahead price-to-free-cash-flow ratio. Each are are at 10-year lows.

Dangers

Traders see the corporate is rising, however they will’t ignore what else they see; ChatGPT and different AI purposes at the moment are creating footage and movies. If gross sales and margins have been to come back beneath strain, that would trigger additional concern of the inventory.

Adobe has been an underperformer amid this bull market because it lingers close to its 2023 lows and is down about 30% to date this yr. Some traders will see that as a chance, whereas others will discover it to be a crimson flag, given the efficiency of the S&P 500 and Nasdaq 100. Finally, traders should determine if the valuation and enterprise are compelling sufficient and if the present fears are justified or overblown.

Disclaimer:

Please word that because of market volatility, among the costs might have already been reached and situations performed out.