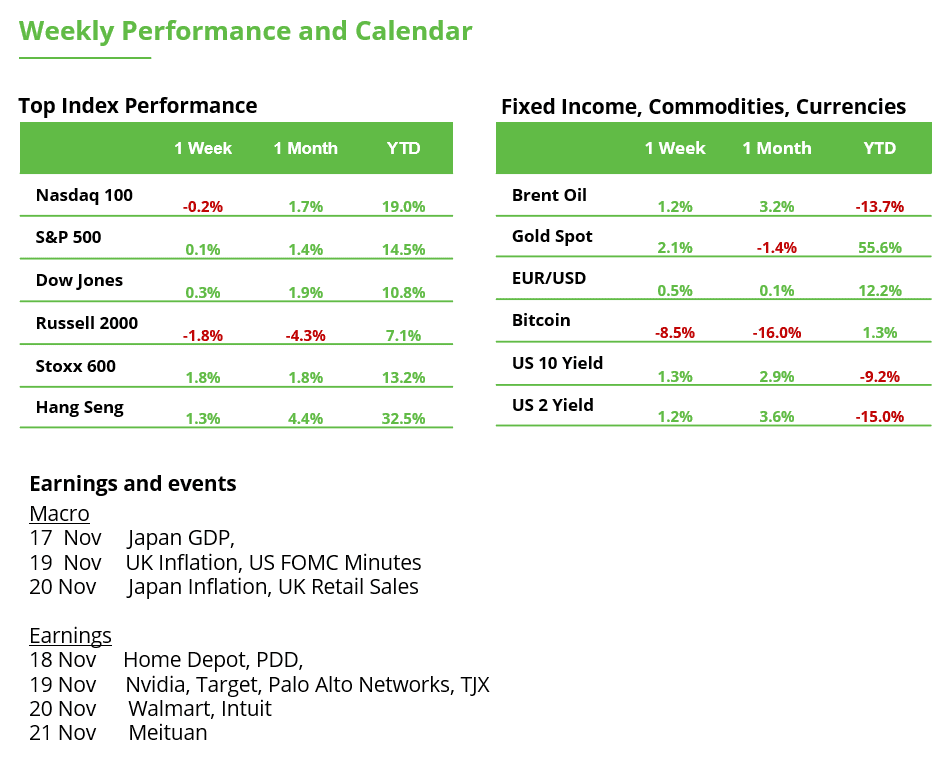

Analyst Weekly, November 17, 2025

Bitcoin’s Pullback Exams Market Conviction

Bitcoin’s break under $100K isn’t a development killer, but. The current pullback in bitcoin and the broader crypto market displays a technique of technical readjustment inside a extra unsure macroeconomic context, fairly than a structural change in development.

What’s driving the dip?

After an extended run-up, profit-taking and rising world threat aversion triggered a selloff. BTC has now slipped underneath a key help, its prior excessive that’s held for practically two years, suggesting merchants are reevaluating their threat tolerance.

What do technicals say?

With BTC now under its two-year help and main shifting averages (50 and 200 day), oversold indicators might not assure a right away rebound, suggesting this part might prolong earlier than a sturdy ground emerges

Nonetheless, the basics maintain up.

Regardless of the deterioration in sentiment, on-chain fundamentals stay stable, with greater than 70% of issued BTC nonetheless in revenue and addresses holding over 1,000 BTC rising their positions by greater than 45,000 BTC previously week, a transparent sign of institutional accumulation. This conduct factors to a market in consolidation fairly than a structural reversal.

The takeaway:

Danger self-discipline stays key. A sustained drop under the $89K–$90K vary would sign a breakdown in help and a possible shift towards a extra prolonged bearish part. But when $95K holds, this correction might evolve right into a buy-the-dip alternative for long-term traders.

The Fog, the Fed, and the Worry Gauge

The US financial system is in a holding sample and the Fed’s maintaining one foot on the brake. The chances of a December charge lower have fallen to about 53%, down sharply from near-certainty earlier than the final FOMC assembly. The Fed’s warning underscores the delicate stability between stopping a coverage overshoot and ready too lengthy to ease.

Vol’s Parallel Shift: From Calm to Warning

What’s Taking place: Volatility wakened. Because the VIX broke by 22 final week, there wasn’t only a front-end spike (the same old concern response). Your complete VIX curve shifted in parallel, with all maturities pricing in increased volatility. Which means merchants aren’t simply nervous concerning the quick time period; they’re baking in additional uncertainty throughout the board.

What’s Driving It:

Vol-control funds diminished fairness exposures.

Nvidia earnings (Nov 20) have merchants on edge.

Liquidity stays skinny, amplifying intraday spikes in implied volatility.

Why It Issues: A parallel shift increased within the VIX curve occurs when macro uncertainty (just like the Fed’s foggy path) meets market catalysts (like mega-cap earnings).

UK Funds Jitters: Why Credibility Now Issues Extra Than Ever

Markets reacted sharply at present following studies that the UK authorities might reverse plans to lift earnings tax. The volatility displays a deeper concern: fiscal credibility is important, not just for stabilising public funds, but in addition for tackling the cost-of-living disaster.

Freezing earnings tax thresholds alone gained’t be sufficient. With no clear and balanced strategy to elevating income, the UK dangers repeated tax shifts that might undermine confidence and financial resilience. Crucially, fiscal selections should help and never battle with the Financial institution of England’s efforts to convey inflation down. Final yr’s price range probably added to inflationary pressures, delaying the trail to decrease rates of interest.

A reputable price range that helps ease inflation would cut back family payments, decrease borrowing prices, and help long-term market stability. That features focused tax measures and smarter public spending, notably as well being and welfare prices proceed to develop. Equally necessary is sustaining consistency round pensions and financial savings guidelines to help long-term investor confidence.

Trying forward, proposals to repurpose ISAs to channel extra funding into UK equities might assist drive sustainable progress, with out elevating taxes.

For retail traders, at present’s developments reinforce the significance of diversification. If fiscal self-discipline holds, gilts and interest-sensitive property might profit. Inflation hedges like index-linked bonds or gold might play a smaller position as disinflation takes maintain.

Earnings on Wednesday: Nvidia Stays the Tempo-Setter of the International AI Story

The U.S. earnings season is drawing to an in depth, however one closing spotlight is including pleasure. On Wednesday after the market shut, Nvidia will report its outcomes. For a lot of traders, the inventory has lengthy been extra than simply one other tech identify. It’s seen as a barometer of the worldwide AI story, and a key issue for the continuation of the year-end rally.

After two years of AI euphoria, Nvidia now seems to have reached a stage the place progress is stabilizing at a excessive stage, however now not increasing exponentially. Wall Avenue expects third-quarter income to rise by 56.6% to $54.9 billion, whereas analysts forecast earnings per share to extend by 54.6% to $1.25.

The Nvidia inventory has come underneath stress a number of instances in current buying and selling classes. Nonetheless, the 2 key help zones (so-called Truthful Worth Gaps) have held: between $183 and $188, and $178 and $180. From a technical perspective, this means a possible check of the document excessive at $212. Ought to these helps fail — for instance, because of disappointing This autumn outcomes or a weak outlook — the inventory might retreat towards the September low close to $164.

Nvidia, weekly chart. Supply: eToro

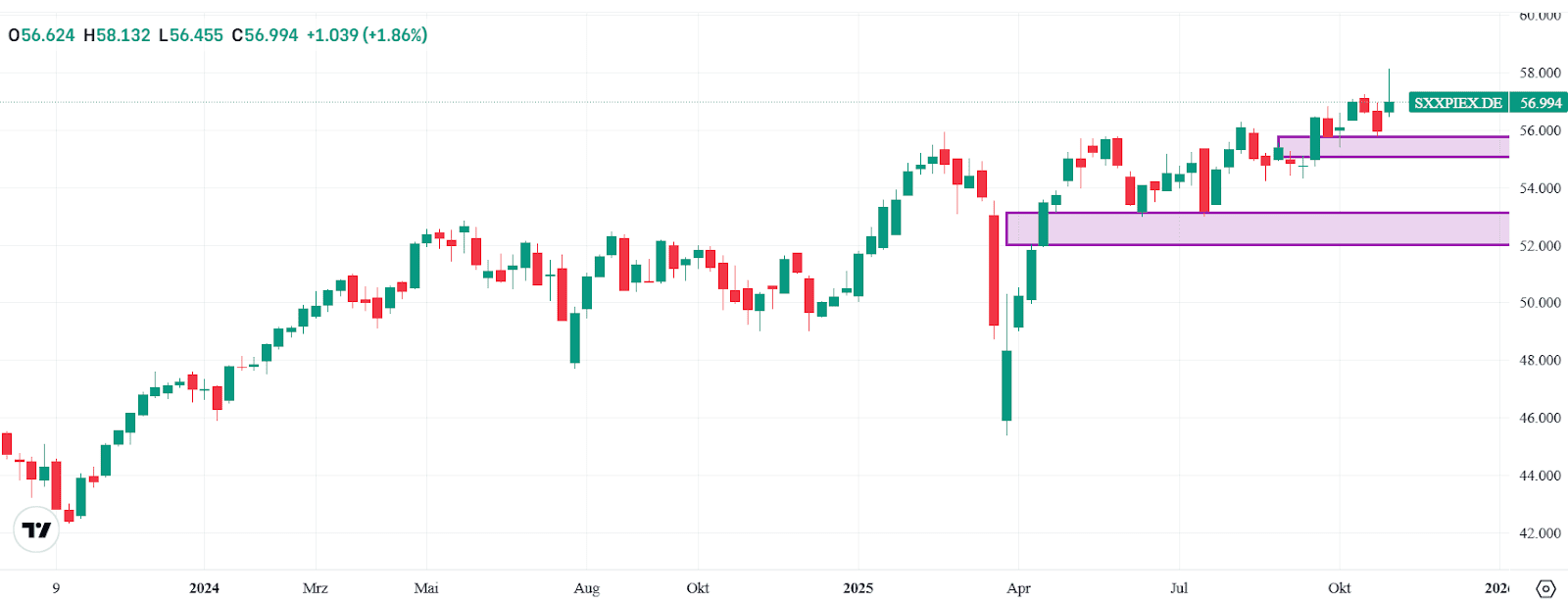

European Inventory Market: False Breakout, however Rally Probabilities Stay Intact

The STOXX Europe 600 (iShares) rose 1.8% final week to round 57 factors. Nonetheless, the false breakout, seen by the lengthy higher shadow, brought on some short-term disappointment. From a technical perspective, the probabilities for a year-end rally nonetheless look good. A continuation of the development, which means a second breakout try, stays the extra probably state of affairs.

If destructive sentiment persists, the help zone (Truthful Worth Hole) between 55.10 and 55.80 factors might come into focus. A break under that vary would cloud the short-term technical image, but it surely wouldn’t jeopardize the long-term uptrend. The subsequent help space would then be discovered between 52 and 53 factors.

STOXX Europe 600, weekly chart. Supply: eToro

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.