The AUD/USD weekly forecast stays cautious as traders steadiness stronger US greenback demand in opposition to firmer Australian inflation information.

The Australian CPI exceeded expectations, declining expectations for additional RBA easing.

Merchants anticipate commentary from Fed officers, RBA coverage choices, and nonfarm payrolls for extra impetus.

The AUD/USD weekly forecast stays subdued, because the pair trades close to 0.6540 with a gradual US greenback amid the Fed’s cautiousness and shifting threat sentiment. The buck gained assist from expectations of much less dovish Fed fee cuts. Fed Chair Jerome’s cautious remarks concerning a December fee reduce lifted the greenback additional.

-Are you interested by studying about the very best AI buying and selling foreign exchange brokers? Click on right here for details-

The traders remained defensive as rates of interest declined to three.75%-4.00%, whereas information appeared restricted amid the extended US authorities shutdown. In the meantime, the US Greenback Index climbed to 99.70, marking its three-month excessive.

From Australia, the home inflation information got here in stronger than anticipated. The trimmed imply CPI for Q3 rose to 1.0% QoQ and three.0% YoY. Whereas the month-to-month CPI elevated to three.5% YoY, it restricted hopes for an additional fee reduce by the RBA within the close to time period. Governor Bullock emphasised a tighter labor market, reaffirming the RBA’s cautious stance.

Moreover, given the commerce connections between Australia and China, the manufacturing PMI dropped to 49.0, signaling contraction. In the meantime, the non-manufacturing PMI rose to 50.1. This blended information and the progressing China-US commerce state of affairs stored Aussie in a fragile steadiness.

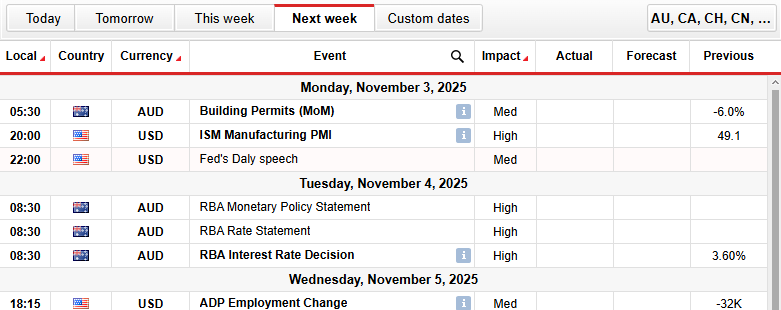

AUD/USD Key Occasions Subsequent Week

The numerous occasions within the coming week embody:

USD ISM Manufacturing PMI

RBA Financial Coverage Assertion

RBA Charge Assertion

RBA Curiosity Charge Determination

Fed’s Daly Speech

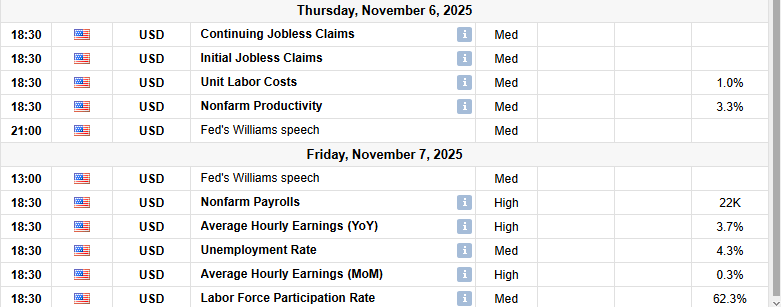

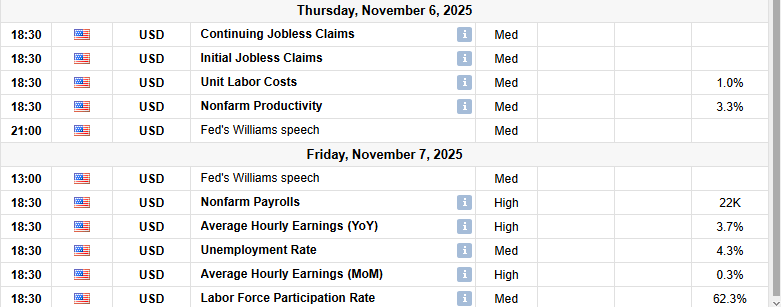

USD Nonfarm Payrolls

USD Common Hourly Earnings (YoY)

USD Common Hourly Earnings (MoM)

Subsequent week, merchants await the Fed’s Daly speech, the ISM manufacturing PMI, and the RBA rate of interest resolution with a press release. The central financial institution is anticipated to carry the charges. So, the main target will probably be on the coverage assertion.

Alternatively, the nonfarm payrolls information stays the first catalyst for the markets, because the markets missed the earlier information amid the shutdown.

AUD/USD Weekly Technical Forecast: Wobbling Round Key MAs

The AUD/USD worth consolidates close to 0.6550, after temporary beneficial properties round 0.6620 earlier within the week. The value stays beneath the confluence of 20-day and 100-day MAs round 0.6530. Nonetheless, the 200-day MA at 0.6440 continues to lend average assist. In the meantime, the RSI across the 50.0 stage signifies a impartial momentum.

-Are you interested by studying in regards to the foreign exchange indicators? Click on right here for details-

A decisive breach above the 0.6615 stage might ignite an uptrend, marching in the direction of 0.6670 and 0.6730. Conversely, a break beneath the 0.6530 stage might set off additional draw back in the direction of 0.6440 and 0.6380, inviting broader promoting stress.

Help Ranges

Resistance Ranges

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you may afford to take the excessive threat of dropping your cash.