The AUD/USD weekly forecast stays bullish amid greenback weak point.

Fed repricing with greater odds of a fee reduce and delicate macro knowledge weakened the buck.

Commodity costs and China-linked danger flows supported the Aussie.

The AUD/USD worth closed the week close to mid-0.6500, marking 1.45% positive aspects final week, led by broad US greenback weak point and agency commodity sentiment.

What occurred with AUD/USD final week

The dominant theme was fast Fed repricing final week. Markets ramped up wagers that the Federal Reserve will start easing in its December assembly, weighing on the US yields and denting the US greenback, which acted as a headwind for the Aussie. Based on the CME FedWatch Device, the likelihood of a 25-bps fee reduce by the Fed is now close to 87%.

–Are you to study extra about day buying and selling brokers? Test our detailed guide-

Commodity costs and China-linked danger flows additionally supported this pattern. Iron ore and base metallic stability supported the time period construction for the Aussie, whereas Asian equities remained resilient, sustaining a constructive danger urge for food.

On the home entrance, Australian knowledge remained blended, with shopper spending exhibiting pressure, whereas the labor market remained comparatively resilient, leaving the RBA in a affected person and data-dependent stance. The RBA’s impartial tone capped the Aussie’s energy. The uptick within the pair was primarily attributed to the softness of the buck moderately than Australia’s home macroeconomic pivot.

The US knowledge, together with Sturdy Items Orders, Chicago PMI, and Retail Gross sales, confirmed weak point, whereas Fed members additionally left dovish remarks, cementing the percentages of aggressive easing in 2026 as effectively. Liquidity remained skinny into the US Thanksgiving vacation, and the CME outage triggered intraday volatility.

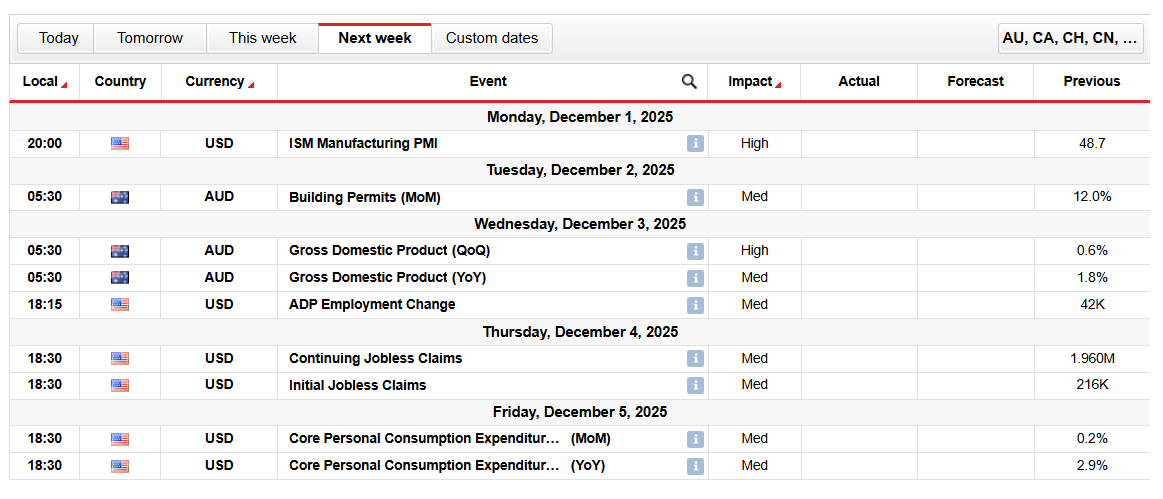

AUD/USD Key Occasions Subsequent Week

The next week’s course depends upon three variables:

Australian GDP

US knowledge (PMIs and Core PCE) and Fed communicate

Threat sentiment, relying on China and commodity momentum

Within the occasion of a Fed shock, shifting away from easing, the AUD/USD may see a resumption of the draw back. Nonetheless, the trail of least resistance lies on the upside.

AUD/USD Weekly Technical Forecast: Consumers Eyeing 0.6700 Above 200-DMA

The AUD/USD each day chart reveals constant help by the 200-day MA. Nonetheless, the worth stays inside a broad vary of 0.6400 to 0.6600. The transfer above 20-, 50-, and 100-day MAs suggests a strong case for the upside. In the meantime, the RSI can be heading north at 56.00.

–Are you to study extra about crypto alerts? Test our detailed guide-

The bulls may finally goal for the 0.6700 stage, which is the swing excessive for September. Conversely, dropping down, the pair may check the 200-day MA close to 0.6465. Shifting beneath the extent may check the demand zone at 0.6370-0.6420.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you may afford to take the excessive danger of shedding your cash.