Traders are overwhelmed by infinite market knowledge, unpredictable swings, and the sheer complexity of constructing good buying and selling choices. That’s why AI inventory evaluation instruments have develop into indispensable in 2025. Based on Statista, world property managed by robo-advisors are anticipated to hit $2.8 trillion by 2025, whereas MarketsandMarkets experiences the AI in Fintech market is projected to develop to $42 billion by 2028.

We examined and researched dozens of platforms and narrowed the sphere to the 20 greatest AI inventory evaluation instruments. This record is designed for retail buyers, day merchants, hedge fund managers, and monetary advisors who need sharper insights, quicker choices, and an edge of their buying and selling methods.

Whether or not you’re after inventory screeners, AI-driven alerts, robo-advisors, or predictive analytics, this listicle is your roadmap to smarter investing.

What’s AI Inventory Evaluation?

AI inventory evaluation refers to the usage of synthetic intelligence, machine studying, and pure language processing to judge securities, forecast inventory actions, and help in buying and selling choices.

As an alternative of relying solely on conventional technical and basic evaluation, these instruments ingest large datasets—worth actions, earnings experiences, information sentiment, and even social media chatter—to offer insights that will take people weeks to course of.

For companies and particular person buyers alike, AI-powered inventory instruments assist to:

Establish undervalued shares quicker.

Predict market actions with increased accuracy.

Automate buying and selling to cut back emotional choices.

Handle threat and optimize portfolio allocation.

Fast Comparability of Greatest 20 AI Inventory Evaluation Instruments

When evaluating inventory evaluation software program, an important resolution components are pricing, accuracy of AI predictions, availability of free trials, scores, and goal person sort. These columns will assist readers shortly scan and determine which device suits their wants.

Software Identify

Greatest For

Beginning Value

Free Trial?

Score (G2/Trustpilot)

Key AI Function

Commerce Concepts

Day Merchants

$84/mo

Sure

4.5/5

AI inventory alerts

TrendSpider

Technical Analysts

$39/mo

Sure

4.6/5

Automated charting

Zacks Funding

Worth Traders

$249/yr

No

4.3/5

Inventory rating AI

Kavout

Quant Merchants

$99/mo

Sure

4.4/5

AI inventory scores

Inventory Rover

Elementary Traders

$7.99/mo

Sure

4.7/5

Deep basic AI

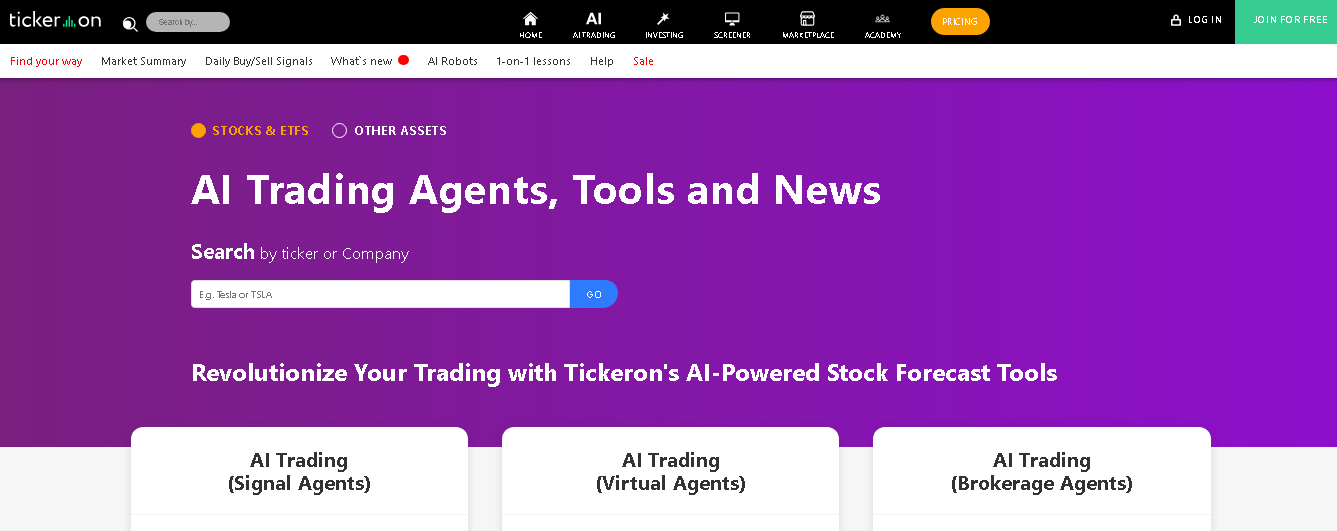

Tickeron

Swing Merchants

$50/mo

Sure

4.5/5

Sample recognition AI

Atom Finance

Inexperienced persons

Free / $9.99

Sure

4.2/5

AI-powered insights

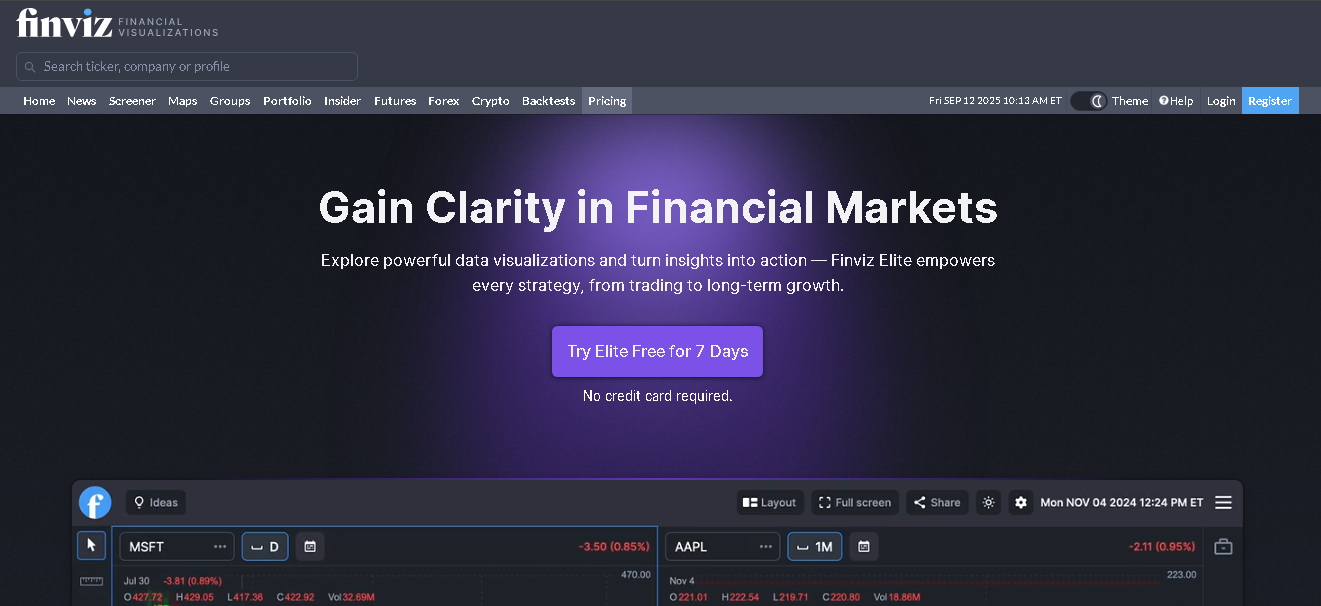

Finviz Elite

Lively Merchants

$39.50/mo

No

4.4/5

AI inventory screener

BlackBoxStocks

Choices Merchants

$99.97/mo

No

4.6/5

AI alerts & scanners

Sentieo

Institutional Use

Customized Quote

Sure

4.7/5

NLP-based analysis AI

Portfolio123

Quant Traders

$29.95/mo

Sure

4.3/5

Customized AI fashions

QuantConnect

Algo Builders

Free–$8/mo

Sure

4.6/5

AI-driven backtesting

EquBot (IBM Watson)

ETF Traders

Varies

No

4.2/5

Watson AI inventory picks

TradingView AI

Chartists

$14.95/mo

Sure

4.8/5

AI-powered alerts

Capitalise.ai

Non-coders

Free / Plans

Sure

4.4/5

No-code AI automation

Yewno

Edge

Hedge Funds

Customized Quote

Sure

4.5/5

Koyfin

Analysts

$15/mo

Sure

4.7/5

AI market dashboards

Alpaca AI

Algo Merchants

Free–$10/mo

Sure

4.3/5

AI-powered brokerage

Thinkorswim AI

Superior Merchants

Free (TD Ameritrade)

No

4.6/5

AI backtesting instruments

Quantitative Brokers

Establishments

Customized

No

4.5/5

AI execution algos

Greatest AI Inventory Evaluation Instruments in 2025

Now, let’s break down every of the 20 instruments with detailed evaluations, pricing, professionals & cons, and who they’re greatest suited to.

1. Commerce Concepts – AI-Powered Inventory Scanner for Lively Merchants

Commerce Concepts is without doubt one of the most acknowledged AI inventory evaluation instruments available in the market. It makes use of proprietary AI named Holly that runs tens of millions of buying and selling simulations in a single day and generates inventory picks each morning. Day merchants and energetic buyers depend on it for real-time alerts, backtesting, and AI-driven alerts that assist seize short-term alternatives.

Key Options

AI Inventory Alerts

Commerce Concepts’ AI engine Holly generates every day commerce alerts primarily based on backtested methods. Every alert comes with entry, stop-loss, and exit ranges, serving to merchants act shortly with out second-guessing.

Backtesting Simulator

The built-in OddsMaker function permits you to backtest any buying and selling technique with out coding. This offers merchants confidence of their strategies earlier than placing actual cash in danger.

Brokerage Integration

Commerce Concepts integrates with brokers like Interactive Brokers and E*TRADE, permitting customers to execute trades immediately from the platform.

Chart-Based mostly Scans

Superior scanning instruments assist you to filter shares by worth motion, technical setups, and quantity surges so that you by no means miss a breakout.

AI Buying and selling Bots

The platform even helps absolutely automated buying and selling bots, making it very best for merchants who need AI to execute methods with out fixed monitoring.

Execs & Cons

Execs

Cons

Extremely correct AI commerce alerts

Costly in comparison with friends

Direct dealer integration

Studying curve for rookies

Strong backtesting simulator

No free plan, solely trial

Helps automated buying and selling

Targeted primarily on short-term trades

Pricing

Normal Plan: $84/month ($999/12 months)

Premium Plan: $167/month ($1,999/12 months) – consists of AI Holly and superior options

7-day trial obtainable for $11

Greatest For Day Merchants Who Need Actual-Time AI Picks

Commerce Concepts is greatest for day merchants and energetic swing merchants who want fast-moving alerts backed by AI.

Day merchants — real-time AI inventory alerts with clear entry/exit ranges

Swing merchants — AI-generated setups for short-term features

Merchants who need automation — run methods with Holly’s bots

Traders testing methods — backtest concepts earlier than committing capital

When you’re utilizing Commerce Concepts, a hidden gem is the “Surge Alerts” function. It helps you catch uncommon quantity spikes earlier than they develop into information—providing you with a head begin over most retail merchants.

Greatest Alternate Software: TrendSpider

If Commerce Concepts feels expensive or complicated, TrendSpider is a strong different, particularly for many who favor automated technical charting as an alternative of AI inventory picks.

2. TrendSpider – Automated Technical Evaluation with AI Precision

TrendSpider is designed for technical analysts and swing merchants who rely closely on charting. As an alternative of manually drawing trendlines and scanning for patterns, TrendSpider’s AI-powered charting engine does the heavy lifting. It’s constructed for merchants who wish to save time whereas making certain accuracy of their technical setups.

Key Options

Automated Trendline Detection

TrendSpider mechanically attracts correct trendlines, help, and resistance ranges, eliminating human error in technical evaluation.

Multi-Timeframe Evaluation

You may overlay a number of timeframes on a single chart. This enables merchants to see whether or not a sample is aligning throughout every day, weekly, and month-to-month charts for stronger confirmations.

Sensible Alerts

Set alerts that set off not simply on worth but in addition on trendline breaks, indicator crossovers, or candlestick patterns, making certain you by no means miss important setups.

Backtesting Engine

The platform provides an easy-to-use backtester that allows you to see how any technique would have carried out traditionally, with out writing code.

Raindrop Charts

A novel function unique to TrendSpider, Raindrop Charts mix worth motion and quantity circulation right into a single visualization, giving merchants a deeper perspective on market sentiment.

Execs & Cons

Execs

Cons

Automates charting for quicker evaluation

Restricted fundamentals knowledge

Revolutionary Raindrop Charts

Can overwhelm rookies

Extremely customizable alerts

Lacks AI commerce suggestions

Strong backtesting device

Extra helpful for swing than day buying and selling

Pricing

Premium Plan: $39/month

Elite Plan: $79/month

Superior Plan: $129/month

7-day free trial obtainable

Greatest For Swing Merchants and Technical Analysts

TrendSpider is greatest for merchants who depend on charting and technical setups.

Swing merchants — correct trendline detection throughout timeframes

Technical analysts — distinctive Raindrop Charts for sentiment evaluation

Technique builders — built-in backtesting with out coding

Lively merchants — customized alerts for breakouts and reversals

One underused function in TrendSpider is the Market Scanner, which helps you to display for setups throughout a number of tickers utilizing technical standards. Mix this with Sensible Alerts to construct a totally automated buying and selling workflow.

Greatest Alternate Software: TradingView AI

If you need a extra community-driven platform with AI-powered alerts, TradingView is a wonderful different. It additionally provides entry to one of many largest social buying and selling networks.

3. Zacks Funding Analysis – AI-Powered Inventory Rankings for Worth Traders

Zacks Funding Analysis has lengthy been trusted by worth buyers for its proprietary Zacks Rank system, which makes use of a mix of AI and quantitative fashions to determine shares prone to outperform. Whereas not a buying and selling bot like Commerce Concepts, Zacks shines in basic inventory analysis and long-term funding insights.

Key Options

Zacks Rank System

The guts of Zacks is its AI-driven inventory rating mannequin that charges shares from #1 (Sturdy Purchase) to #5 (Sturdy Promote). The mannequin is predicated on earnings estimate revisions, traditionally a strong predictor of inventory efficiency.

Portfolio Monitoring & Alerts

Traders can observe their portfolios and obtain alerts when a inventory’s Zacks Rank modifications, making it simpler to react to earnings revisions.

Inventory Screeners

Zacks consists of superior screeners that filter shares by progress, worth, momentum, and earnings revisions.

Fairness Analysis Experiences

Customers get entry to detailed analysis experiences with basic knowledge, analyst commentary, and AI-based scoring.

Premium Analysis Instruments

Premium members can entry extra rating fashions, together with the Zacks Trade Rank, which evaluates whole sectors for outperformance potential.

Execs & Cons

Execs

Cons

Confirmed Zacks Rank mannequin

Restricted technical evaluation options

Sturdy deal with fundamentals

Interface feels dated

Dependable long-term insights

No AI buying and selling automation

Nice for worth and progress buyers

Premium plans are expensive

Pricing

Zacks Premium: $249/12 months

Zacks Investor Assortment: $495/12 months

Zacks Final: $2,995/12 months

No free trial, however restricted free content material is on the market

Greatest For Worth and Lengthy-Time period Traders

Zacks is greatest for buyers who prioritize fundamentals over technicals.

Lengthy-term buyers — depend on Zacks Rank to determine outperformers

Worth buyers — deep basic analysis with AI scoring

Revenue buyers — evaluation of dividend shares with stability rankings

Sector-focused buyers — profit from Zacks Trade Rank system

Zacks’ secret energy is the Earnings ESP (Anticipated Shock Prediction) metric. It highlights shares with a excessive probability of beating earnings, which traditionally drives worth jumps post-report.

Greatest Alternate Software: Inventory Rover

If you need extra hands-on basic evaluation with customizable dashboards, Inventory Rover is a wonderful different with highly effective screening and AI options.

4. Kavout – AI-Powered Inventory Scores for Quant Traders

Kavout is a quantitative investing platform that mixes machine studying, predictive analytics, and massive knowledge to generate actionable alerts. Its standout function is the Kai Rating, an AI-generated inventory score that helps buyers shortly gauge the potential of any given inventory. Quant merchants and hedge funds typically use Kavout to filter by 1000’s of securities effectively.

Key Options

Kai Rating (AI Inventory Score)

Kavout’s Kai Rating charges shares on a 1–9 scale, with increased scores indicating stronger purchase potential. It’s primarily based on multi-factor fashions analyzing technicals, fundamentals, and different knowledge.

Various Information Integration

The platform incorporates information sentiment, SEC filings, and market alerts into its fashions, giving buyers a broader perspective past conventional metrics.

Customized Quant Fashions

Quantitative merchants can construct customized AI-driven fashions to check and refine methods, making it a versatile choice for extra superior customers.

Portfolio Administration Instruments

Kavout helps observe portfolio efficiency, threat, and publicity whereas offering AI-generated insights to optimize allocations.

Information Feeds for Establishments

For hedge funds and fintech builders, Kavout provides API entry to AI alerts and scores, enabling customized integrations into present platforms.

Execs & Cons

Execs

Cons

Distinctive Kai Rating simplifies inventory choice

Pricing could also be excessive for retail merchants

Sturdy quant analysis instruments

Steeper studying curve

Incorporates different knowledge sources

Much less beginner-friendly

API entry for superior customers

Restricted social/group options

Pricing

Retail Plans: Beginning at $99/month

Institutional Plans: Customized pricing

Free trial obtainable upon request

Greatest For Quantitative and Institutional Traders

Kavout is greatest for quants, hedge funds, and severe particular person buyers who need AI to boost decision-making.

Quant merchants — use Kai Rating to determine alternatives shortly

Hedge funds — combine AI alerts through API

Lively buyers — mix technical, basic, and sentiment evaluation

Establishments — create customized AI fashions for proprietary methods

A hidden gem in Kavout is its integration of SEC submitting evaluation. By parsing filings with AI, it could uncover early warning alerts or bullish indicators that conventional screeners typically miss.

Greatest Alternate Software: Tickeron

When you favor AI-powered sample recognition and buying and selling alerts as an alternative of quant modeling, Tickeron is a powerful different, designed extra for retail merchants.

5. Inventory Rover – Elementary Evaluation Enhanced by AI

Inventory Rover is without doubt one of the most revered platforms for basic buyers. Not like chart-heavy platforms, Inventory Rover is constructed to dig into monetary statements, valuations, and portfolio efficiency, all enhanced with AI-driven scoring and screening. It’s extensively utilized by worth buyers, dividend seekers, and portfolio managers who want deep, structured knowledge.

Key Options

Deep Elementary Screening

Inventory Rover permits you to display throughout 650+ metrics, from income progress to dividend payout ratios. Its AI-enhanced filters assist uncover undervalued alternatives.

Honest Worth & Margin of Security Scores

The system mechanically calculates Honest Worth estimates and Margin of Security scores to information long-term buyers in evaluating whether or not a inventory is overpriced or undervalued.

Portfolio Administration & Rebalancing

Traders can observe whole portfolios, run what-if rebalancing eventualities, and measure efficiency towards benchmarks.

Analysis Experiences

Every inventory has an AI-generated analysis report masking fundamentals, valuation, and analyst scores.

Dividend Evaluation Instruments

Specialised dashboards observe dividend yields, progress charges, and sustainability, making it a best choice for revenue buyers.

Execs & Cons

Execs

Cons

Extraordinarily deep basic knowledge

Much less helpful for day merchants

AI-based Honest Worth & Security scores

Interface can really feel overwhelming

Sturdy portfolio monitoring instruments

Restricted technical charting

Nice for dividend buyers

Premium plans wanted for greatest options

Pricing

Necessities Plan: $7.99/month

Premium Plan: $17.99/month

Premium Plus Plan: $27.99/month

14-day free trial obtainable

Greatest For Lengthy-Time period and Dividend Traders

Inventory Rover is greatest for long-term buyers who depend on fundamentals to information inventory choice.

Worth buyers — use Honest Worth scores to search out bargains

Dividend buyers — analyze yield stability and payout security

Portfolio managers — optimize allocations with rebalancing instruments

Analysis-focused buyers — entry structured AI-driven experiences

Inventory Rover’s Margin of Security device is usually missed. It helps buyers quantify threat by evaluating a inventory’s intrinsic worth to its present worth—a strong addition for Buffett-style investing.

Greatest Alternate Software: Zacks Funding Analysis

If you need a extra AI-driven rating system targeted on earnings revisions, Zacks is a superb different for long-term basic buyers.

6. Tickeron – AI Sample Recognition for Swing Merchants

Tickeron is an AI-driven buying and selling platform that makes a speciality of sample recognition and predictive analytics. It scans 1000’s of securities to detect technical patterns, pattern formations, and probability-based commerce setups. Swing merchants and energetic buyers use Tickeron to identify worthwhile alternatives with quantified chances hooked up to every sign.

Key Options

AI Sample Recognition

Tickeron mechanically identifies chart patterns like head and shoulders, triangles, and flags whereas assigning a confidence chance rating for every.

AI Predictions Engine

The platform gives chance forecasts for short- and mid-term inventory worth actions, serving to merchants deal with high-likelihood setups.

Actual-Time Alerts

Merchants can obtain alerts through net and cellular when AI spots a commerce alternative, saving hours of handbook chart scanning.

AI Robots (Buying and selling Bots)

Tickeron permits customers to deploy AI-powered buying and selling robots that execute trades primarily based on pre-set methods and AI predictions.

Social Buying and selling & Group

The platform has a community-driven side, permitting merchants to check methods, observe others, and talk about AI alerts.

Execs & Cons

Execs

Cons

Highly effective sample recognition AI

May be costly for premium plans

Assigns chances to every commerce

Not very best for long-term buyers

Helps automated AI bots

Restricted backtesting flexibility

Consists of social/group options

Studying curve for brand spanking new merchants

Pricing

Free Plan: Restricted entry to alerts

Premium AI Robots: $50/month and up

Customized AI Subscriptions: $90–$250/month

Free trial obtainable

Greatest For Swing Merchants and Sample-Based mostly Merchants

Tickeron is greatest for swing merchants and short-term buyers who wish to commerce primarily based on chances.

Swing merchants — use AI sample recognition for setups

Lively merchants — real-time alerts for technical formations

Choices merchants — probability-based alerts for strike timing

Algorithmic merchants — deploy AI bots with out heavy coding

One underutilized function in Tickeron is the Confidence Score. Merchants can filter alerts by chance thresholds, focusing solely on setups with 70%+ confidence, which considerably reduces noise.

Greatest Alternate Software: BlackBoxStocks

If you need a platform with AI-powered choices alerts and real-time scanners, BlackBoxStocks is a wonderful different for energetic merchants.

7. Atom Finance – AI-Powered Analysis Platform for Inexperienced persons

Atom Finance is a contemporary AI-driven monetary analysis device constructed for retail buyers who need institutional-quality knowledge with out the complexity of Bloomberg. It combines clear dashboards, AI-powered insights, and collaboration options, making it very best for rookies and informal buyers seeking to step up their evaluation sport.

Key Options

AI-Powered Insights

Atom makes use of AI to focus on key drivers behind inventory actions, earnings updates, and analyst commentary, so customers can shortly grasp what issues most.

Trendy, Person-Pleasant Interface

The platform is designed with simplicity in thoughts, giving retail buyers entry to Wall Road-level knowledge with out being overwhelming.

Collaboration Instruments

Traders can share notes and concepts with friends immediately contained in the platform, making it straightforward for groups or small investing teams to remain aligned.

Monetary Modeling Instruments

Atom Finance gives light-weight monetary modeling options, permitting customers to construct fast forecasts and eventualities with out spreadsheets.

Portfolio Monitoring

The system tracks portfolios and gives AI-generated alerts on related information, earnings, and market occasions that would have an effect on positions.

Execs & Cons

Execs

Cons

Intuitive and beginner-friendly

Restricted technical evaluation instruments

Institutional-level knowledge entry

Not constructed for day buying and selling

Collaborative options for groups

Free plan has restricted performance

Inexpensive pricing

Much less customization in comparison with professional platforms

Pricing

Free Plan: Restricted entry

Premium Plan: $9.99/month

Free trial obtainable

Greatest For Newbie and Informal Traders

Atom Finance is greatest for retail buyers who need easy, AI-enhanced insights with out steep studying curves.

Inexperienced persons — acquire Wall Road-style analysis in plain language

Informal buyers — AI alerts on earnings and inventory occasions

Investing golf equipment — collaborative options for shared analysis

Retail merchants — inexpensive entry into superior inventory evaluation instruments

Atom Finance shines when used as a light-weight different to Bloomberg terminals. A wise method to make use of it’s combining its AI information evaluation with one other platform’s technical instruments for a whole analysis workflow.

Greatest Alternate Software: Koyfin

When you want a extra analytics-heavy, customizable dashboard for market knowledge, Koyfin is a powerful different to Atom Finance.

8. Finviz Elite – AI Inventory Screener for Lively Merchants

Finviz is without doubt one of the hottest inventory screeners on this planet, and the Elite model takes it to the subsequent degree with real-time AI-enhanced knowledge, backtesting, and superior screening filters. Lively merchants use Finviz Elite to scan markets shortly and spot high-probability setups.

Key Options

Superior Inventory Screener

Finviz Elite permits merchants to filter shares by fundamentals, technical indicators, and customized standards. The screener is quick, intuitive, and trusted by tens of millions.

Actual-Time Information & Alerts

Not like the free model, Elite gives real-time quotes, charts, and information, making certain merchants all the time act on the freshest data.

Backtesting Capabilities

The system lets merchants backtest methods towards historic knowledge to gauge efficiency earlier than execution.

Heatmaps & Visualizations

Finviz is legendary for its sector and market heatmaps, which assist merchants immediately determine the place cash is flowing.

Insider Buying and selling & Information Integration

Elite subscribers acquire entry to insider transactions, earnings experiences, and analyst upgrades/downgrades, all displayed in easy-to-read dashboards.

Execs & Cons

Execs

Cons

Among the best inventory screeners

No AI commerce suggestions

Intuitive, visible dashboards

Premium-only real-time knowledge

Inexpensive in comparison with friends

Lacks automation or bots

Covers each technical and basic knowledge

Much less detailed basic evaluation than Inventory Rover

Pricing

Finviz Elite Plan: $39.50/month or $299.50/12 months

No free trial (free model obtainable with restricted options)

Greatest For Lively Merchants and Screeners

Finviz Elite is greatest for energetic merchants who depend on quick scanning and visible market insights.

Day merchants — real-time scans and alerts

Swing merchants — determine setups utilizing technical filters

Momentum merchants — observe scorching sectors with heatmaps

Elementary-leaning merchants — use insider knowledge for alerts

A strong however underused function in Finviz Elite is its Customized Backtests. By combining screeners with backtesting, merchants can validate methods immediately earlier than execution.

Greatest Alternate Software: Inventory Rover

For individuals who desire a fundamentals-first screener with AI-enhanced evaluation, Inventory Rover is a powerful different to Finviz.

9. BlackBoxStocks – AI Scanner for Choices and Inventory Merchants

BlackBoxStocks is an AI-powered buying and selling platform constructed for energetic inventory and choices merchants. It makes a speciality of real-time alerts, choices circulation evaluation, and AI-based scanning. Recognized for its vibrant dealer group, BlackBoxStocks is fashionable amongst those that thrive on fast-moving markets.

Key Options

AI Commerce Alerts

BlackBoxStocks’ AI engine scans the markets and delivers real-time commerce alerts with entry and exit ranges, designed for each shares and choices.

Choices Circulate Monitoring

Certainly one of its standout options is uncommon choices exercise scanning, serving to merchants spot the place institutional cash is flowing.

Market Scanners

Merchants can run AI-driven scans to detect momentum performs, quantity spikes, and technical setups, all up to date in actual time.

Built-in Information Feed

The platform features a real-time information feed so merchants don’t miss market-moving occasions that would have an effect on trades.

Group & Reside Buying and selling Rooms

BlackBoxStocks has a built-in buying and selling group, together with reside chat rooms the place merchants share methods and talk about AI alerts.

Execs & Cons

Execs

Cons

Glorious for choices circulation evaluation

Excessive month-to-month value

Sturdy AI scanning options

Steeper studying curve for rookies

Actual-time information integration

Restricted basic evaluation

Lively buying and selling group

No free trial

Pricing

Membership Plan: $99.97/month or $959/12 months

No free trial obtainable

Greatest For Lively Inventory and Choices Merchants

BlackBoxStocks is greatest suited to merchants who thrive on volatility and choices exercise.

Choices merchants — observe uncommon choices circulation for insider-like alerts

Day merchants — use AI alerts for momentum trades

Swing merchants — determine sturdy setups through scanners

Lively group merchants — be taught from shared methods and alerts

One highly effective function is the Darkish Pool Scanner, which reveals hidden institutional trades. Savvy merchants use this to anticipate strikes earlier than they present up in retail quantity.

Greatest Alternate Software: Tickeron

If you need extra AI-based sample recognition and chance scoring, Tickeron is a strong different to BlackBoxStocks.

10. Sentieo – AI-Powered Analysis Platform for Institutional Traders

Sentieo is an AI-enhanced monetary analysis platform extensively utilized by analysts, hedge funds, and institutional buyers. It combines pure language processing (NLP), market knowledge, and doc search to streamline the analysis course of. As an alternative of sifting by infinite earnings calls and filings, Sentieo’s AI extracts key insights immediately.

Key Options

NLP Doc Search

Sentieo’s AI makes use of pure language processing to investigate earnings calls, SEC filings, transcripts, and experiences, permitting analysts to floor insights that will in any other case take hours to uncover.

AI-Powered Information & Analysis Feed

The system aggregates monetary information, analysis notes, and filings into one dashboard, mechanically tagging and prioritizing what issues most.

Sentiment Evaluation

By evaluating the tone and wording of earnings calls, Sentieo highlights bullish or bearish sentiment shifts, serving to analysts predict inventory reactions.

Collaboration Instruments

Institutional groups can use shared workspaces, annotations, and thought trackers to collaborate seamlessly on analysis tasks.

Information Integration

Sentieo integrates with Bloomberg, FactSet, and different monetary knowledge suppliers, making it a versatile device for institutional analysis.

Execs & Cons

Execs

Cons

Highly effective NLP search of filings

Pricing is enterprise-level

Glorious for institutional analysis

Not designed for retail merchants

Sentiment evaluation provides predictive edge

Steeper studying curve

Collaboration instruments for groups

Requires coaching for full advantages

Pricing

Enterprise-Grade Pricing: Customized quotes solely

Free demo obtainable upon request

Greatest For Institutional Traders and Analysis Groups

Sentieo is greatest for big buyers and monetary professionals who have to course of large quantities of knowledge shortly.

Hedge funds — speed up earnings name evaluation with AI

Fairness analysis groups — streamline workflow with collaboration instruments

Portfolio managers — use sentiment evaluation to forecast worth strikes

Funding banks — combine filings and information into one workspace

A hidden benefit of Sentieo is its Redlining Software, which compares firm filings year-over-year to immediately flag delicate modifications—important for recognizing dangers others miss.

Greatest Alternate Software: Yewno|Edge

If you need AI-powered data graph evaluation for locating hidden relationships between corporations and markets, Yewno|Edge is a wonderful different.

11. Portfolio123 – AI and Quant Methods for Customized Portfolios

Portfolio123 is a quantitative investing platform that blends AI modeling, factor-based investing, and portfolio administration instruments. It’s fashionable with quant merchants, hedge fund analysts, and severe retail buyers who wish to design, backtest, and execute their very own methods.

Key Options

Customized AI Fashions

Portfolio123 permits customers to construct rule-based or AI-enhanced fashions for inventory choice and portfolio development. This flexibility appeals to each rookies and superior quants.

Issue-Based mostly Screening

The platform helps multi-factor inventory screening throughout fundamentals, technicals, and analyst expectations, letting merchants fine-tune their funding standards.

Backtesting Engine

Merchants can run sturdy backtests over a long time of market knowledge to validate methods earlier than deploying them reside.

Portfolio Administration Instruments

The system consists of rebalancing alerts, efficiency monitoring, and threat metrics, making it simpler to take care of long-term methods.

API Entry for Builders

For superior customers, Portfolio123 provides API integrations so methods may be automated and related to third-party platforms.

Execs & Cons

Execs

Cons

Sturdy backtesting capabilities

May be overwhelming for rookies

Helps factor-based fashions

Interface is much less trendy

Versatile AI-enhanced screening

Premium options may be pricey

API entry for builders

Steeper studying curve

Pricing

Screener Plan: $29.95/month

Researcher Plan: $59.95/month

Designer Plan: $99.95/month

Free trial obtainable

Greatest For Quantitative and DIY Traders

Portfolio123 is greatest for DIY quants and superior retail merchants who need deep management over methods.

Quant merchants — design and check customized multi-factor fashions

Hedge funds — use API to scale systematic methods

Lengthy-term buyers — optimize allocation with rebalancing instruments

Builders — combine AI alerts into customized programs

Portfolio123’s Rating System Builder is certainly one of its most underrated options. It permits customers to stack a number of components right into a single composite rating, turning uncooked knowledge into actionable inventory rankings.

Greatest Alternate Software: QuantConnect

When you’re extra targeted on algorithmic buying and selling and coding methods in Python, QuantConnect is a powerful different with intensive backtesting and reside deployment.

12. QuantConnect – Open-Supply AI Backtesting for Algorithmic Merchants

QuantConnect is an open-source quantitative buying and selling platform that helps AI-driven backtesting, reside algorithm deployment, and institutional-grade knowledge entry. It’s particularly fashionable amongst algo builders, quant researchers, and hedge funds on the lookout for flexibility and scale.

Key Options

Algorithm Backtesting

QuantConnect gives entry to a long time of tick-level historic knowledge, permitting merchants to backtest methods with excessive accuracy.

Multi-Asset Class Assist

The platform helps buying and selling throughout equities, choices, futures, foreign exchange, and crypto, making it some of the versatile AI buying and selling environments.

AI & Machine Studying Integration

Customers can construct machine studying fashions in Python or C#, integrating AI for predictive alerts and customized methods.

Cloud-Based mostly Reside Buying and selling

Algorithms may be deployed on to reside markets utilizing built-in brokers similar to Interactive Brokers and Alpaca.

Open-Supply Group

QuantConnect’s Lean Engine is open supply, supported by a group of quants who contribute methods, analysis, and enhancements.

Execs & Cons

Execs

Cons

Entry to institutional-grade knowledge

Requires coding expertise

Helps AI/ML mannequin integration

Steeper studying curve

Multi-asset backtesting

May be complicated for retail merchants

Open-source and customizable

Premium knowledge feeds add value

Pricing

Free Plan: Entry to group and Lean Engine

Researcher Plan: $8/month

Workforce & Establishment Plans: Customized pricing

Free tier obtainable for rookies

Greatest For Algorithmic and Quantitative Merchants

QuantConnect is greatest for algo merchants and quant builders who need most management over technique design.

Algorithmic merchants — construct and check Python/C# methods

Quant researchers — combine AI/ML into predictive fashions

Multi-asset merchants — backtest throughout shares, choices, futures, and crypto

Hedge funds — scale methods with institutional-grade instruments

A hidden benefit is QuantConnect’s Alpha Streams Market, the place quants can monetize their algorithms by licensing them to hedge funds—a novel income stream few platforms provide.

Greatest Alternate Software: Portfolio123

When you favor a extra user-friendly quant platform with much less coding, Portfolio123 is a superb different for constructing AI-powered inventory methods.

13. EquBot (IBM Watson) – AI-Powered ETFs for Passive Traders

EquBot is an AI funding platform constructed on IBM Watson that powers AI-driven ETFs and funding methods. As an alternative of providing you with inventory screeners or scanners, EquBot packages AI portfolio administration into exchange-traded funds (ETFs), making it very best for passive buyers who need AI working behind the scenes.

Key Options

AI-Powered ETFs

EquBot manages ETFs like AIEQ (AI Powered Fairness ETF), which makes use of AI to investigate over 6,000 U.S. corporations every day and modify holdings dynamically.

IBM Watson AI Evaluation

The system leverages pure language processing and machine studying to interpret earnings experiences, information, and market sentiment.

Automated Portfolio Changes

EquBot rebalances holdings every day primarily based on AI forecasts, aiming to seize progress alternatives and handle threat.

World Information Integration

Watson processes structured and unstructured knowledge from monetary experiences, financial indicators, and world information sources to tell choices.

Accessible through ETFs

Retail buyers can entry AI-powered methods just by shopping for shares of EquBot ETFs, without having for superior buying and selling data.

Execs & Cons

Execs

Cons

Easy accessibility through ETFs

Restricted customization

Constructed on IBM Watson’s AI

Solely obtainable by ETFs

Lively AI-driven rebalancing

Expense ratios increased than passive ETFs

Appropriate for passive buyers

Much less management for energetic merchants

Pricing

Accessible by buying AIEQ ETF or different EquBot funds

Normal ETF expense ratios apply (approx. 0.75%)

Greatest For Passive Traders Utilizing AI ETFs

EquBot is greatest for buyers who need AI-managed publicity with out constructing methods themselves.

Passive buyers — purchase AI-driven ETFs for automated portfolio administration

Retirement savers — use AI ETFs for long-term progress with diversification

Busy professionals — let AI rebalance every day with out handbook effort

Fund managers — benchmark towards AI-driven methods

A intelligent method to make use of EquBot is by pairing AIEQ with a standard S&P 500 ETF. This offers you publicity to each AI-driven energetic administration and broad market indexing.

Greatest Alternate Software: Thinkorswim AI

If you need extra management and AI-enhanced buying and selling instruments for energetic methods, Thinkorswim AI from TD Ameritrade is a powerful different.

14. TradingView AI – Sensible Charting and Social Insights

TradingView is without doubt one of the most generally used charting platforms worldwide, and with its AI-powered alerts and good alerts, it has develop into a go-to alternative for retail merchants, chartists, and even professionals. Past AI, TradingView stands out with its large social buying and selling group, the place tens of millions of merchants share methods every day.

Key Options

AI-Powered Buying and selling Alerts

TradingView makes use of AI-enhanced indicators and scripts that generate purchase/promote alerts primarily based on worth motion and technical setups.

Customizable Charting Instruments

With lots of of built-in indicators and community-created scripts, customers can customise their technical evaluation to suit any technique.

Sensible Alerts

Arrange AI-driven alerts for trendline breaks, transferring common crossovers, or customized indicators, delivered on to cellular or desktop.

Social Buying and selling Community

Tens of millions of merchants publish charts and techniques on TradingView, giving customers entry to crowdsourced insights alongside AI-driven ones.

Multi-Asset Protection

TradingView helps shares, crypto, foreign exchange, and futures, making it a common buying and selling platform.

Execs & Cons

Execs

Cons

Large dealer group

Premium options locked behind paywall

AI-powered indicators and alerts

Not a devoted AI buying and selling bot

Glorious charting and scripts

Restricted basic evaluation

Cross-platform (net + cellular)

Can overwhelm rookies with too many options

Pricing

Professional Plan: $14.95/month

Professional+ Plan: $29.95/month

Premium Plan: $59.95/month

Free model with restricted options obtainable

Greatest For Chartists and Group Merchants

TradingView AI is greatest for chart-focused merchants who additionally need social insights.

Technical merchants — entry AI-enhanced alerts with customizable charts

Swing merchants — arrange automated good alerts for breakout alerts

Crypto & foreign exchange merchants — cross-asset AI charting on one platform

Social merchants — profit from methods shared by tens of millions of customers

A hidden gem in TradingView is its Pine Script AI methods. You may both code your individual or import scripts from the group that generate automated commerce alerts primarily based on AI-enhanced logic.

Greatest Alternate Software: TrendSpider

If you need deeper AI-driven chart automation like auto-trendlines and Raindrop Charts, TrendSpider is a wonderful different.

15. Capitalise.ai – No-Code AI Automation for Merchants

Capitalise.ai is a no-code buying and selling automation platform that permits merchants to create and run AI-driven methods utilizing plain language. As an alternative of coding, customers can merely sort situations like “Purchase Apple if it breaks $190 and RSI < 30,” and the system executes the commerce mechanically. It’s particularly helpful for non-coders who need AI automation with out studying programming.

Key Options

No-Code Technique Builder

Capitalise.ai lets customers create methods with pure language instructions, making automation accessible to merchants of all talent ranges.

AI Backtesting & Simulation

You may run historic simulations of plain-language methods to see how they might have carried out in previous markets.

Actual-Time Monitoring

The platform repeatedly displays reside market knowledge, executing trades mechanically when situations are met.

Dealer Integrations

Capitalise.ai integrates with brokers like Interactive Brokers, FXCM, and Alpaca, enabling direct execution.

Palms-Free Automation

As soon as a method is deployed, the platform handles execution, liberating merchants from fixed chart-watching.

Execs & Cons

Execs

Cons

No coding required

Restricted customization for superior quants

Helps backtesting and simulations

Fewer built-in methods

Seamless dealer integrations

No deep basic evaluation

Nice for rookies

Primarily targeted on automation solely

Pricing

Free Plan: Obtainable through partnered brokers (e.g., Interactive Brokers)

Premium Entry: Pricing is determined by dealer agreements

Free to make use of with supported brokers

Greatest For Non-Coders Who Need Automation

Capitalise.ai is greatest for merchants who need hands-free automation with out programming.

Newbie merchants — create AI methods with easy instructions

Swing merchants — automate entry/exit guidelines with out coding

Busy merchants — let AI deal with execution whereas away from screens

Non-technical buyers — experiment with backtesting and automation simply

A wise trick with Capitalise.ai is combining a number of situations in plain English, similar to “Purchase Tesla if RSI < 30 and MACD crosses up,” to create multi-factor AI methods with out writing a single line of code.

Greatest Alternate Software: Alpaca AI

If you need a brokerage-first AI platform with coding flexibility, Alpaca AI is a powerful different that provides algorithmic and automatic buying and selling instruments.

16. Yewno|Edge – AI Information Graphs for Institutional Merchants

Yewno|Edge is an AI-powered funding analysis platform that leverages data graphs to uncover hidden relationships between corporations, sectors, and macroeconomic drivers. It’s designed for institutional buyers, hedge funds, and analysts who have to transcend surface-level inventory knowledge.

Key Options

AI Information Graph Know-how

Yewno’s data graph maps tens of millions of connections between corporations, patents, information, and monetary metrics, serving to buyers spot non-obvious correlations.

ESG and Thematic Evaluation

The platform excels in ESG (environmental, social, governance) evaluation and thematic investing, giving insights into how world developments affect portfolios.

Danger Monitoring

AI repeatedly displays exposures throughout portfolios, flagging hidden dangers similar to provide chain dependencies or sector-specific vulnerabilities.

Institutional Information Feeds

Customers can entry knowledge feeds and APIs for integration into proprietary buying and selling platforms.

Thought Discovery Engine

By analyzing cross-sector relationships, Yewno suggests funding alternatives that conventional screening instruments would possibly miss.

Execs & Cons

Execs

Cons

Distinctive data graph AI

Not beginner-friendly

Glorious for thematic and ESG investing

Pricing is enterprise-level

Sturdy institutional use circumstances

Much less deal with retail merchants

API and knowledge integration

Requires coaching to maximise worth

Pricing

Enterprise Pricing Solely: Customized quotes primarily based on use case

Free demo obtainable for establishments

Greatest For Hedge Funds and Institutional Traders

Yewno|Edge is greatest for establishments in search of superior AI insights past conventional fundamentals and technicals.

Hedge funds — spot hidden correlations and cross-sector dangers

ESG-focused funds — consider corporations primarily based on non-financial components

Portfolio managers — handle systemic and provide chain threat

Quant researchers — combine AI graph knowledge into proprietary fashions

A hidden energy of Yewno|Edge is its skill to identify patent possession overlaps. Traders can determine which corporations is likely to be positioned to guide in rising applied sciences earlier than the market acknowledges them.

Greatest Alternate Software: Sentieo

If you need AI-powered NLP search and sentiment evaluation of filings, Sentieo is a powerful different for research-heavy institutional buyers.

17. Koyfin – AI Market Dashboards for Analysts

Koyfin is a market analytics platform that gives AI-powered dashboards, visualization instruments, and analysis knowledge for shares, ETFs, mutual funds, and macroeconomic indicators. It’s designed for analysts, portfolio managers, and retail buyers who need institutional-grade knowledge offered in an accessible method.

Key Options

AI-Powered Dashboards

Koyfin aggregates monetary knowledge into interactive dashboards with AI-driven insights, making it straightforward to identify developments throughout equities, bonds, and ETFs.

Elementary & Macro Evaluation

Customers can run basic screens alongside macroeconomic knowledge, creating a whole image of firm and market efficiency.

Information Visualization Instruments

The platform excels at visible analytics, providing charts, scatterplots, and heatmaps for earnings, valuations, and sector developments.

Customized Watchlists & Alerts

Traders can observe customized watchlists with AI-generated alerts on information, earnings, and efficiency shifts.

World Information Protection

Koyfin gives protection of U.S. and worldwide markets, making it appropriate for globally diversified portfolios.

Execs & Cons

Execs

Cons

Institutional-grade dashboards at low value

Restricted buying and selling execution options

Sturdy visualization and charting

No AI buying and selling bots

Covers each macro and micro knowledge

Premium plan wanted for full knowledge entry

Inexpensive in comparison with Bloomberg

Some options nonetheless in improvement

Pricing

Free Plan: Restricted performance

Necessities Plan: $15/month

Skilled Plan: $35/month

Free trial obtainable

Greatest For Analysts and Information-Pushed Traders

Koyfin is greatest for buyers who depend on visible knowledge evaluation and broad market protection.

Fairness analysts — use AI dashboards for valuations and developments

Portfolio managers — mix macro and inventory knowledge for allocation choices

World buyers — observe worldwide markets with ease

Analysis-driven merchants — entry visualizations for fast evaluation

A hidden gem in Koyfin is its Earnings Shock Charts, which visualize how corporations react after earnings beats or misses. This helps merchants anticipate short-term volatility.

Greatest Alternate Software: Atom Finance

If you need a lighter, beginner-friendly platform with collaborative options, Atom Finance is a superb different to Koyfin.

18. Alpaca AI – AI Brokerage and Algo Buying and selling Platform

Alpaca AI is a commission-free brokerage and algorithmic buying and selling platform that provides AI-driven alerts, automation, and developer-friendly APIs. It’s fashionable amongst algo merchants, fintech builders, and retail buyers who wish to combine buying and selling bots immediately with a dealer.

Key Options

AI-Powered Buying and selling Alerts

Alpaca AI gives predictive fashions and alerts that assist merchants make knowledgeable purchase/promote choices with out handbook screening.

Fee-Free Brokerage

The platform provides zero-commission inventory and ETF buying and selling, making it engaging for cost-conscious merchants.

Algo Buying and selling API

Builders can use Alpaca’s REST and WebSocket APIs to construct and deploy customized buying and selling bots in Python or different languages.

Paper Buying and selling Atmosphere

Merchants can check methods in a risk-free simulated atmosphere earlier than going reside.

Dealer Integrations

Alpaca helps connections to third-party AI and automation platforms, increasing its flexibility for merchants.

Execs & Cons

Execs

Cons

Fee-free buying and selling

Restricted analysis instruments in comparison with friends

Sturdy API help for builders

Extra coding-heavy for rookies

Helps AI and automation

Restricted worldwide availability

Paper buying and selling for testing

Premium AI alerts could value further

Pricing

Free Brokerage Account with commission-free buying and selling

Premium AI Options: Varies relying on integrations and add-ons

Free paper buying and selling obtainable

Greatest For Algo Merchants and Builders

Alpaca AI is greatest for merchants who need brokerage companies built-in with AI and automation instruments.

Algo builders — use APIs to deploy Python buying and selling bots

Value-conscious merchants — reap the benefits of commission-free buying and selling

Backtesters — use paper buying and selling for technique refinement

Fintech startups — combine brokerage features into customized apps

A intelligent use case is combining Alpaca with Capitalise.ai, letting you construct plain-language methods that execute by Alpaca’s brokerage—very best for non-coders who need reside automation.

Greatest Alternate Software: Capitalise.ai

If you need no-code automation with plain language instructions, Capitalise.ai is an ideal different that pairs effectively with Alpaca.

19. Thinkorswim AI – Superior AI Instruments for Lively Merchants

Thinkorswim, TD Ameritrade’s flagship buying and selling platform, consists of AI-powered backtesting and technique evaluation instruments that cater to energetic merchants and professionals. With a variety of options masking technicals, fundamentals, and derivatives, it’s a powerhouse for anybody buying and selling throughout a number of asset lessons.

Key Options

AI Backtesting Instruments

Merchants can backtest customized methods utilizing historic knowledge with AI enhancements, refining setups earlier than committing capital.

Paper Buying and selling Simulator

Thinkorswim consists of among the finest paper buying and selling environments, letting merchants observe methods in real-time situations with out threat.

Customized Scripting with thinkScript

The thinkScript language permits merchants to create AI-like situations, customized indicators, and buying and selling alerts customised to their methods.

Superior Choices Buying and selling

Thinkorswim excels in choices evaluation, providing chance calculators, choices chains, and technique optimizers with AI-driven insights.

Multi-Asset Assist

The platform helps buying and selling in shares, ETFs, futures, choices, and foreign exchange, making it versatile for various methods.

Execs & Cons

Execs

Cons

Highly effective AI backtesting instruments

Complicated interface for rookies

Glorious choices analytics

U.S.-only availability

Free with TD Ameritrade account

Requires steep studying curve

Extremely customizable scripting

May be resource-heavy on PCs

Pricing

Free Platform with a TD Ameritrade brokerage account

No extra software program value

Greatest For Superior and Multi-Asset Merchants

Thinkorswim AI is greatest for severe merchants who need sturdy AI instruments with out further subscription prices.

Choices merchants — use AI chance calculators for technique refinement

Superior inventory merchants — construct customized indicators with thinkScript

Futures and foreign exchange merchants — commerce a number of asset lessons in a single place

Educators & college students — observe with paper buying and selling in reside situations

A hidden gem in Thinkorswim is the OnDemand function, which lets merchants replay previous market days tick by tick. That is invaluable for testing methods in historic situations with AI insights.

Greatest Alternate Software: QuantConnect

If you need a coding-focused open-source AI platform with institutional knowledge entry, QuantConnect is a powerful different to Thinkorswim.

20. Quantitative Brokers – AI Execution Algorithms for Establishments

Quantitative Brokers (QB) is a fintech agency specializing in AI-driven execution algorithms for institutional buyers. Not like retail-focused instruments, QB’s options are customised for hedge funds, asset managers, and huge buying and selling corporations in search of to optimize execution prices and cut back slippage in high-volume trades.

Key Options

AI-Powered Execution Algos

QB makes use of predictive fashions and real-time market knowledge to attenuate execution prices whereas maximizing commerce effectivity throughout equities, futures, and stuck revenue.

Transaction Value Evaluation (TCA)

The platform gives detailed TCA experiences, serving to establishments consider execution efficiency and refine methods.

Sensible Order Routing

AI repeatedly displays liquidity and volatility to route orders throughout a number of venues, attaining higher fills and lowered market affect.

Customizable Algorithms

Institutional shoppers can customise algorithms to align with their portfolio methods and compliance necessities.

Multi-Asset Class Protection

QB helps equities, futures, and stuck revenue, making it appropriate for diversified institutional portfolios.

Execs & Cons

Execs

Cons

Trade-leading execution algorithms

Not obtainable to retail merchants

Sturdy deal with decreasing slippage

Pricing just for establishments

Customizable methods

Requires integration with present programs

Detailed transaction value evaluation

Restricted transparency on AI fashions

Pricing

Enterprise Pricing Solely: Customized quotes primarily based on buying and selling quantity and necessities

No free trial

Greatest For Institutional Traders and Hedge Funds

Quantitative Brokers is greatest for large-scale establishments prioritizing execution effectivity.

Hedge funds — cut back market affect on high-volume trades

Pension funds — optimize execution throughout equities and stuck revenue

Asset managers — combine AI routing to attenuate prices

Buying and selling corporations — profit from customizable execution methods

A novel energy of Quantitative Brokers is its ClariFI device, which permits portfolio managers to run pre-trade simulations of execution methods, serving to them anticipate prices earlier than coming into the market.

Greatest Alternate Software: Yewno|Edge

If you need AI for analysis and thematic investing moderately than execution, Yewno|Edge is a powerful institutional-grade different.

Why These AI Inventory Evaluation Instruments Stand Out in 2025

From day merchants looking for fast entries to institutional buyers managing billions, AI has develop into the core of inventory evaluation in 2025. These 20 instruments present a large spectrum of options—predictive analytics, automated commerce alerts, basic scoring, sentiment monitoring, and execution optimization—all designed to make buying and selling smarter and extra environment friendly.

The bottom line is to not use all of them, however to select the one that matches your funding model, objectives, and threat urge for food.

How Pearl Lemon Make investments Can Assist You Use AI in Your Buying and selling

At Pearl Lemon Make investments, we focus on serving to merchants and buyers harness the facility of AI and superior monetary methods. Whether or not you’re a retail investor who needs to combine AI into your portfolio choices or an institutional shopper in search of to refine execution with algorithmic methods, our staff can information you each step of the way in which.

We mix deep market data with the newest AI inventory evaluation instruments that will help you:

Establish undervalued property with predictive analytics

Automate methods utilizing AI-driven platforms

Optimize portfolio allocations for higher returns

Handle threat with superior modeling and forecasting

When you’re able to take your investing to the subsequent degree, schedule a session with Pearl Lemon Make investments right now and see how AI can reshape your monetary future.

FAQs

What’s an AI inventory evaluation device? An AI inventory evaluation device makes use of machine studying and predictive fashions to investigate market knowledge, forecast worth actions, and supply actionable buying and selling or investing insights.

Are AI inventory evaluation instruments higher than human analysts? AI instruments excel at processing large datasets shortly, however they work greatest when mixed with human judgment. They supply an edge, not a alternative.

Can rookies use AI inventory instruments? Sure. Platforms like Atom Finance and Capitalise.ai are beginner-friendly, whereas instruments like QuantConnect and Portfolio123 cater to superior merchants.

Do AI inventory instruments assure income? No device can assure income. They enhance decision-making accuracy however markets stay unpredictable. Danger administration is crucial.

Which AI device is greatest for day buying and selling? Commerce Concepts and BlackBoxStocks are glorious for day merchants as a result of real-time alerts and automatic buying and selling options.

What’s the perfect AI device for long-term buyers? Inventory Rover and Zacks are sturdy for basic and value-focused buyers taking a look at long-term positions.

Are these instruments costly? Pricing varies. Retail instruments like Atom Finance begin underneath $10/month, whereas institutional instruments like Sentieo and Yewno|Edge require enterprise pricing.

Can AI assist with choices buying and selling? Sure. Platforms like BlackBoxStocks and Thinkorswim AI provide options-specific AI analytics and chance fashions.

Do AI buying and selling platforms help crypto and foreign exchange? Some do. TradingView AI, QuantConnect, and Alpaca AI help a number of asset lessons past shares.

How can Pearl Lemon Make investments assist me with AI investing? We offer strategic consulting, portfolio administration, and customized AI integration customised to your funding objectives, whether or not you’re a retail or institutional shopper.