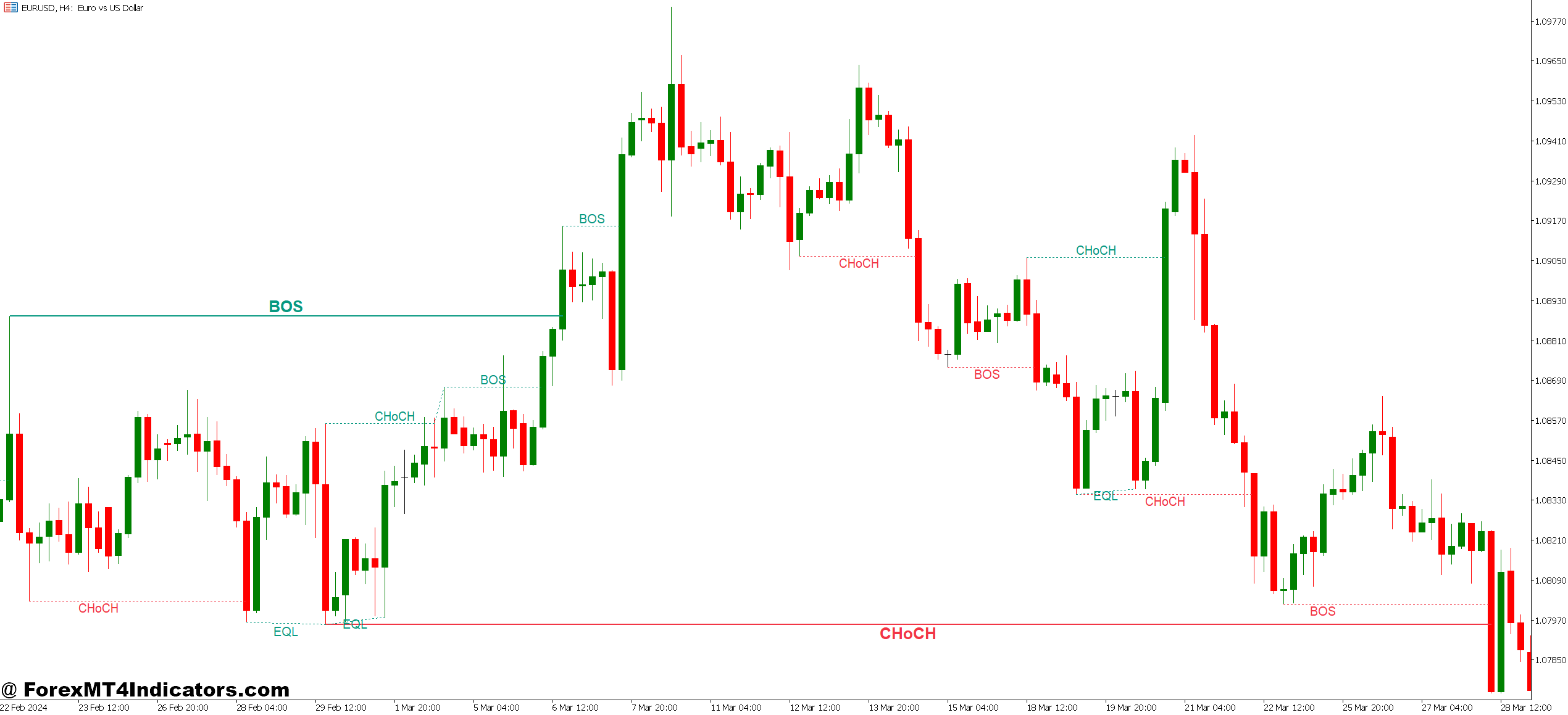

The Binary Indicator MT5 No Repaint operates as an arrow-based sign system that identifies potential entry factors for binary choices and foreign currency trading. The “binary” label refers to its easy output: up arrows for purchase alerts and down arrows for promote alerts. However right here’s the place it separates from the pack—as soon as a candle closes and the indicator plots an arrow, that arrow turns into everlasting.

Conventional indicators recalculate their values with every new tick. A shifting common crossover would possibly present a sign at 10:00 AM, however by 10:15 AM, after extra worth motion develops, the indicator repaints and reveals the crossover occurred at 9:45 AM as a substitute. This repainting creates an phantasm of accuracy in backtests whereas failing miserably in dwell buying and selling.

The no-repaint model commits to its alerts. It analyzes worth motion, volatility, and momentum components throughout candle formation, then finalizes the sign when the candle closes. Merchants can overview their charts days or even weeks later and see the very same alerts they noticed in real-time. This consistency issues when evaluating technique efficiency or studying from previous trades.

The Mechanics Behind the Alerts

Most no-repaint binary indicators mix a number of technical components right into a single choice framework. Whereas precise algorithms range between variations, the core logic usually evaluates three components: development route, momentum power, and volatility circumstances.

The development element typically depends on shifting common relationships or worth place relative to dynamic help and resistance ranges. When worth trades above a fast-moving common that’s above a slower one, the development filter reveals bullish. Momentum affirmation comes from oscillator-type calculations—just like RSI or Stochastic logic—checking whether or not present worth motion has ample power to justify a sign.

Right here’s what separates efficient implementations: they watch for candle shut earlier than committing to any sign. Throughout candle formation, the indicator would possibly present preliminary calculations internally, but it surely gained’t show an arrow till the time interval completes. On a 15-minute chart, this implies no sign seems till the quarter-hour expire and the candle closes.

Some merchants initially resist this delay. They need on the spot alerts the second circumstances align. However that impatience is exactly what repainting indicators exploit. The Binary Indicator MT5 No Repaint sacrifices the phantasm of excellent timing for the fact of reliable knowledge.

Actual-World Buying and selling Situations

Testing this indicator on GBP/JPY through the London session revealed attention-grabbing patterns. On risky days when the pair strikes 80-100 pips, the indicator generated 4-6 alerts throughout a 5-hour window. The accuracy wasn’t excellent—no indicator is—however the alerts remained constant when reviewing the session afterward.

One particular instance: GBP/JPY broke above 188.50 resistance on a Thursday morning. The indicator fired a purchase arrow at 188.65 when the 5-minute candle closed above the breakout stage. Value rallied to 189.20 over the subsequent 45 minutes. Three hours later, when checking the charts, that purchase arrow nonetheless sat precisely at 188.65. A repainting indicator may need moved it to 188.50, 188.55, and even eliminated it totally relying on subsequent worth motion.

For USD/CAD merchants specializing in each day charts, the sign frequency drops considerably—possibly 2-3 per week. However these alerts carry extra weight. When the indicator flagged a promote sign at 1.3620 after a bearish engulfing sample, it aligned with broader technical evaluation displaying resistance from the 200-day shifting common. That sign stayed legitimate through the subsequent three-day decline to 1.3480.

The important thing perception? Sign high quality varies by market circumstances. Throughout uneven, range-bound intervals, even no-repaint indicators generate false alerts. The distinction is merchants can precisely assess win charges and modify methods accordingly as a result of the historic file stays intact.

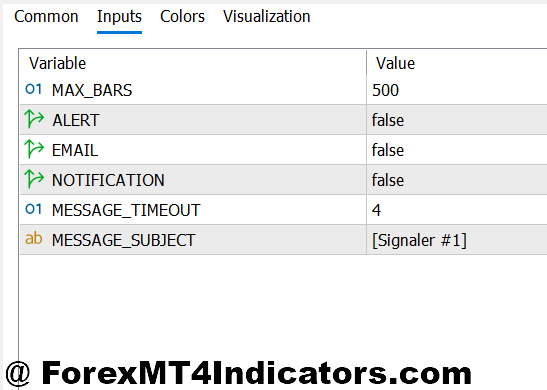

Customization for Completely different Buying and selling Kinds

Most variations of this indicator embrace adjustable parameters for sensitivity and filtering. The sensitivity setting determines how sturdy the technical circumstances should be earlier than producing a sign. Decrease sensitivity produces extra alerts with diminished reliability. Greater sensitivity creates fewer, extra selective alerts.

Merchants working 1-minute charts for binary choices typically want decrease sensitivity settings since they’re making dozens of trades per session. They settle for a 55-60% win price throughout excessive quantity. Swing merchants on 4-hour or each day charts usually enhance sensitivity to filter out noise and give attention to main reversal or continuation setups.

Alert choices matter too. E-mail notifications, push alerts to cellular units, or easy sound alarms—totally different merchants have totally different monitoring types. Scalpers watching 12 pairs concurrently want audio cues. Place merchants checking charts twice each day would possibly want e mail summaries.

That stated, over-optimization turns into a lure. Adjusting settings to completely match historic knowledge typically creates parameters that fail in dwell buying and selling. The indicator works greatest with average, common sense settings examined throughout a number of forex pairs slightly than fine-tuned for one particular pair’s previous efficiency.

Sincere Evaluation: Strengths and Limitations

The first benefit is reliability. Merchants develop real belief when their instruments don’t change their thoughts about historic alerts. This consistency allows correct efficiency monitoring, technique refinement, and psychological confidence. Realizing an arrow at yesterday’s shut will nonetheless be there tomorrow eliminates a significant supply of buying and selling frustration.

The indicator additionally simplifies decision-making. Relatively than analyzing six totally different indicators and attempting to synthesize conflicting alerts, merchants get easy directional steering. This readability helps newer merchants construct confidence whereas giving skilled merchants a fast affirmation device.

However limitations exist. No indicator predicts the long run, and no-repaint standing doesn’t equal assured accuracy. The indicator can generate a sound purchase sign at 1.1050 on EUR/USD, then worth can instantly drop 40 pips if financial information hits. The sign didn’t repaint—it was genuinely unsuitable about market route in that occasion.

Lag represents one other constraint. Ready for candle shut means merchants enter barely late in comparison with indicators that sign mid-candle. On a 30-minute chart, this delay may cost a little 5-10 pips of potential revenue. For long-term merchants, this barely registers. For scalpers concentrating on 8-pip strikes, it’s important.

The indicator additionally struggles throughout main information occasions. When the Federal Reserve pronounces coverage modifications or NFP knowledge releases, worth whipsaws violently. The indicator would possibly hearth a purchase sign, just for worth to reverse 60 seconds later—not as a result of the indicator repainted, however as a result of basic knowledge overwhelmed technical evaluation.

How It Stacks Up In opposition to Alternate options

In comparison with fundamental shifting common crossovers, the Binary Indicator MT5 No Repaint provides extra refined sign filtering. A easy 10/20 EMA crossover generates alerts consistently, together with many false alarms throughout sideways markets. The binary indicator’s multi-factor method reduces noise.

In opposition to extra complicated methods like Ichimoku Cloud or Elliott Wave indicators, the binary method trades depth for simplicity. Ichimoku offers detailed details about help, resistance, momentum, and development abruptly. However that complexity overwhelms many merchants. The binary indicator sacrifices nuance for readability.

RSI or MACD divergence methods provide comparable reliability with out the “black field” concern some merchants have about proprietary indicators. With RSI, merchants perceive precisely what they’re seeing: overbought/oversold circumstances or divergence patterns. The binary indicator requires extra belief within the underlying algorithm.

The selection is dependent upon buying and selling model and expertise stage. Merchants who need to perceive each side of their evaluation would possibly want commonplace indicators they will confirm. Those that worth streamlined decision-making and are comfy with algorithmic filtering typically want the binary method.

The way to Commerce with Binary Indicator MT5 No Repaint

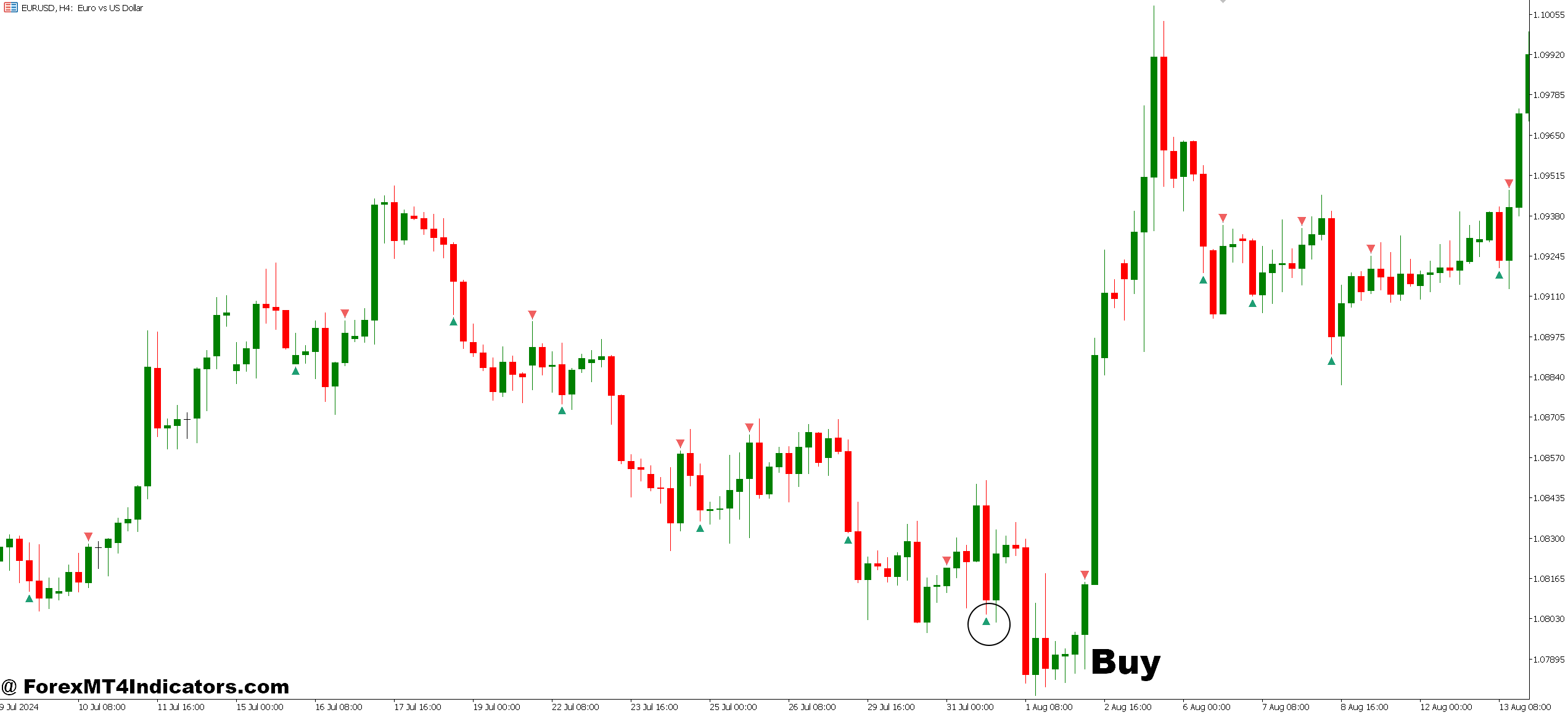

Purchase Entry

Watch for candle shut affirmation – By no means enter mid-candle if you see a preliminary sign; watch for the total interval (5-min, 15-min, 1-hour) to finish earlier than taking the purchase arrow severely.

Examine development alignment on larger timeframe – If buying and selling 15-minute charts on EUR/USD, verify the 1-hour or 4-hour chart reveals upward momentum; don’t take purchase alerts throughout sturdy each day downtrends.

Set cease loss 10-15 pips beneath sign candle – Place your cease beneath the low of the candle that triggered the purchase arrow, including 2-3 pips buffer for unfold and volatility on pairs like GBP/USD.

Goal 1.5 to 2x your danger – In the event you’re risking 20 pips, purpose for 30-40 pip revenue targets; this risk-reward ratio retains you worthwhile even with 50-55% win charges.

Skip alerts throughout main information releases – Keep away from purchase arrows that seem quarter-hour earlier than or after NFP, FOMC, or central financial institution bulletins when worth whipsaws invalidate technical evaluation.

Search for confluence with help ranges – Strongest purchase alerts happen when the arrow seems close to earlier help zones, spherical numbers (1.1000 on EUR/USD), or rising trendlines.

Cut back place measurement in ranging markets – If EUR/USD has stayed inside a 50-pip vary for 8+ hours, minimize your regular place measurement by 50% since breakout alerts typically fail in uneven circumstances.

Exit partial place at 1:1 risk-reward – Take 50% revenue when worth strikes equal to your cease distance, then let the rest run with a trailing cease to lock in features if the development continues.

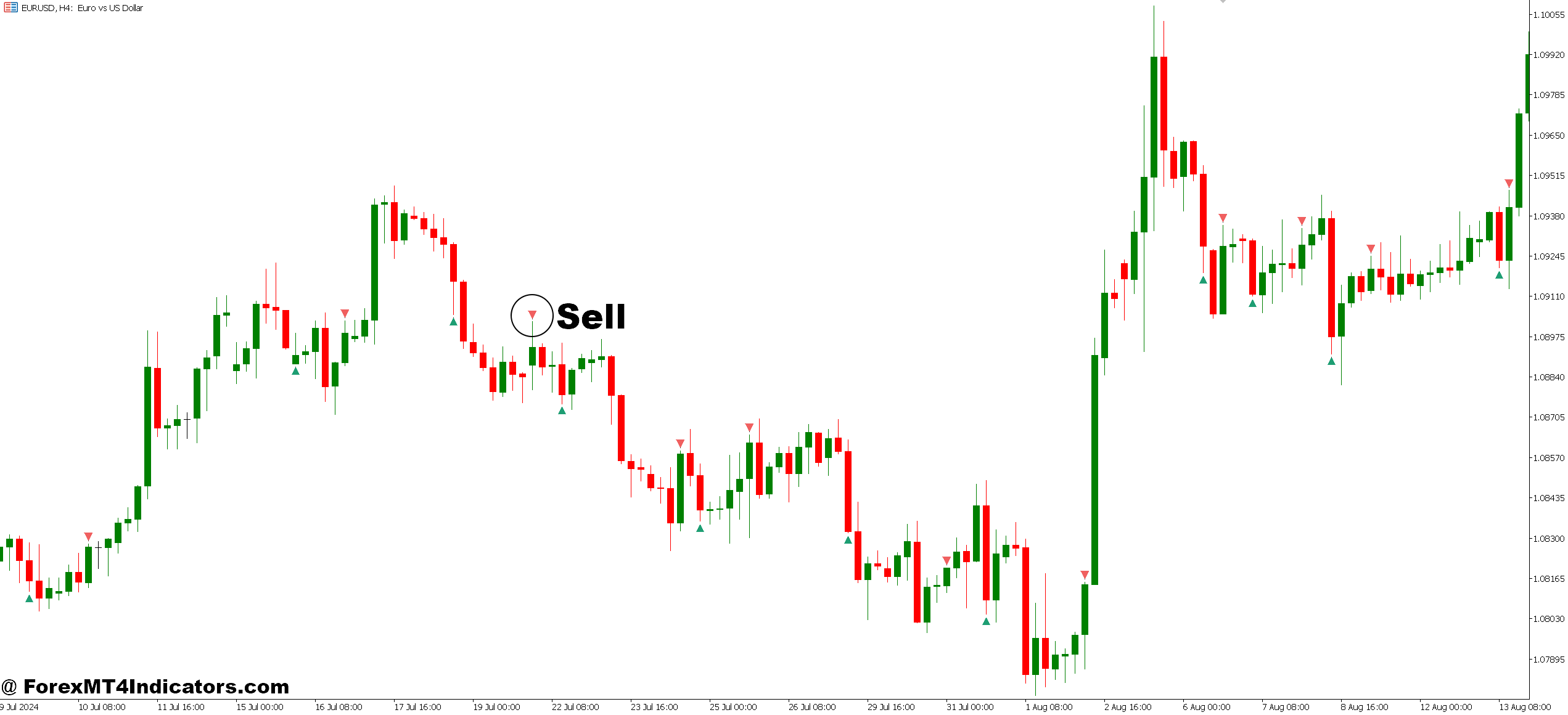

Promote Entry

Affirm the promote arrow at candle shut – Like purchase alerts, promote arrows are solely legitimate after the timeframe completes; a 4-hour promote sign isn’t confirmed till that 4-hour candle absolutely closes.

Confirm downtrend on bigger timeframe – Don’t take promote alerts on 5-minute GBP/JPY charts if the each day chart reveals a powerful uptrend; counter-trend trades have decrease success charges beneath 45%.

Place cease loss 10-15 pips above entry – Place your cease above the excessive of the sign candle plus unfold buffer; on risky pairs like GBP/JPY, add an additional 5 pips for regular fluctuation.

Use trailing stops as soon as in 20+ pip revenue – After worth strikes favorably by 20 pips, path your cease 10-15 pips behind present worth to guard features whereas permitting the downtrend to develop.

Keep away from alerts close to sturdy help zones – Skip promote arrows inside 20 pips of main help ranges, 200-day shifting averages, or earlier swing lows the place worth typically bounces.

Don’t chase alerts after 30+ pip strikes – If EUR/USD already dropped 40 pips earlier than the promote arrow seems, you’ve missed the preliminary transfer; watch for a retracement or the subsequent setup as a substitute.

Cut back danger throughout Asian session low volatility – When buying and selling USD/CAD or EUR/USD between 2-6 AM GMT, these pairs typically transfer lower than 15 pips per hour, making alerts much less dependable.

Exit if worth closes above sign candle excessive – Your promote commerce is probably going invalidated if worth reverses and closes a full candle above the place the promote arrow appeared; don’t maintain dropping trades hoping for restoration.

Closing Ideas

The Binary Indicator MT5 No Repaint addresses a real drawback in technical evaluation—the unreliability of repainting instruments that distort buying and selling historical past and inflate backtested efficiency. By committing to alerts at candle shut, it offers constant, reviewable knowledge that merchants can belief when evaluating technique effectiveness. The easy arrow system simplifies evaluation with out oversimplifying market complexity.

That stated, sensible expectations stay essential. This indicator gained’t remodel a dropping dealer right into a worthwhile one in a single day. It gained’t work equally effectively throughout all market circumstances. Uneven, low-volatility intervals generate questionable alerts whatever the indicator’s high quality. Sturdy trending days produce higher outcomes however fewer alternatives.

Sensible merchants use this device as one element of an entire buying and selling system—combining it with correct danger administration, market context evaluation, and their very own growing instinct about worth habits. They respect the no-repaint characteristic not as a result of it ensures success, however as a result of it offers trustworthy, unchanging knowledge to study from.

Beneficial MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Extra Unique Bonuses All through The Yr

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90