Bitcoin is as soon as once more on the heart of market turbulence, buying and selling simply above the $110,000 degree, which many analysts view as a crucial zone of demand. Whereas BTC is holding this help for now, volatility has surged as bears improve strain and investor sentiment grows cautious. The market is carefully watching whether or not Bitcoin can preserve its footing or if a deeper correction will unfold.

Associated Studying

One of many largest elements fueling this uncertainty is the latest capital rotation from Bitcoin to Ethereum, a shift that has rattled Bitcoin loyalists. Ethereum’s resilience and whale accumulation have put BTC underneath extra scrutiny, elevating fears that Bitcoin’s dominance available in the market might weaken if the pattern continues.

Including to the warning, high analyst Axel Adler highlighted contemporary information displaying a surge in BTC+ETH inflows to exchanges following Bitcoin’s all-time excessive of $124,000. On the similar time, stablecoin inflows lagged considerably, signaling that the latest improve in provide on exchanges was not met with contemporary liquidity. This imbalance usually factors to profit-taking and extra promoting strain.

Bitcoin Influx Ratio Alerts Bearish Setup

In keeping with Adler, the latest weak spot in Bitcoin is strongly linked to change stream dynamics. He factors to the Influx Ratio (BTC+ETH ÷ Stablecoins), a key indicator that measures the steadiness between main crypto inflows and stablecoin liquidity. Just lately, this ratio spiked to 4.0×, coinciding with a wave of promoting strain and a noticeable worth pullback. Adler explains this as a traditional case of extra provide overwhelming contemporary liquidity, a dynamic that has traditionally positioned downward strain on Bitcoin.

Since then, the ratio has eased to round 2.7× on a 7-day transferring common, and influx volumes of majors have cooled to roughly $5 billion per day. Whereas this marks an enchancment from the extremes, it nonetheless indicators that inflows of BTC and ETH are comparatively excessive in comparison with the stablecoin capital obtainable to soak up them. Merely put, there’s not sufficient new demand flowing in to help sustained upward motion at present ranges.

Adler’s evaluation means that Bitcoin stays in a bearish setup, with restricted shopping for liquidity protecting rallies capped. Nevertheless, he additionally cautions that crypto markets are extremely dynamic, and traits can shift shortly. A sudden resurgence in stablecoin inflows or renewed institutional demand might reverse the present imbalance, sparking one other bullish leg. For now, although, the info leans bearish, highlighting the significance of monitoring change flows as BTC navigates this crucial section.

Associated Studying

BTC Testing Pivotal Resistance Stage

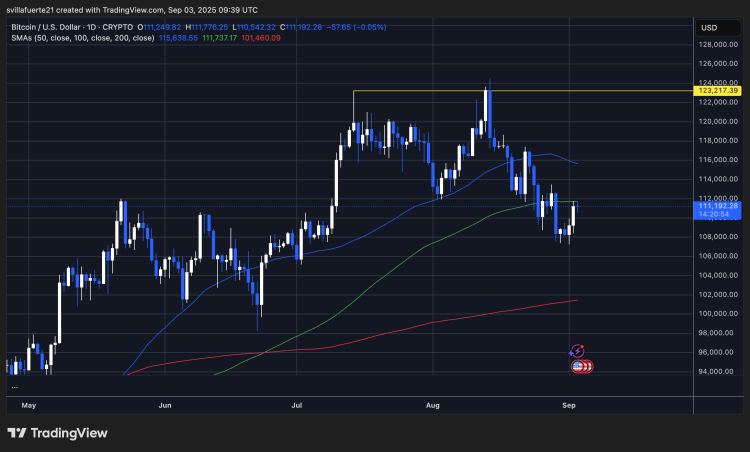

Bitcoin is at the moment buying and selling close to $111,192, displaying a modest restoration after final week’s volatility that pushed the worth under $108,000. The chart highlights Bitcoin’s try to reclaim momentum, with the worth hovering simply above the 100-day SMA (inexperienced line at ~$111,737). This transferring common now acts as quick resistance, and BTC wants a transparent breakout above it to sign energy.

On the upside, the 50-day SMA (~$115,638) represents the subsequent main barrier. If bulls handle to push above this degree, it will open the trail to retesting the native peak round $123,217, marked as a key resistance line. Nevertheless, Bitcoin’s incapability to maintain beneficial properties above the 100-day SMA in latest periods means that sellers stay energetic.

Associated Studying

Help lies round $108,000, with stronger demand possible on the 200-day SMA (~$101,460). A breakdown under $108,000 might expose BTC to deeper losses, doubtlessly dragging the worth towards the psychological $100,000 degree.

Bitcoin stays in a consolidation zone, caught between main transferring averages. A decisive transfer above $115,000 would tilt momentum bullish once more, whereas a failure to carry present ranges dangers renewed promoting strain. Bulls should defend $108,000 to stop additional draw back.

Featured picture from Dall-E, chart from TradingView