As we’re watching Bitcoin’s worth motion intently, a large choices expiration occasion approaches this Friday, and about $23 billion in Bitcoin choices contracts are set to run out, making a catalyst for flash volatility. This occasion follows a interval of already sharp market motion, the place Bitcoin’s worth jumped to only under $90,000 final week earlier than in the present day’s dump cancelled its personal run.

7d

30d

1y

All Time

Right here, I, Akiyama Felix, originating from the Crypto Class of 2018, will break down the idea of choice expiration and clarify why it issues for us in crypto.

Choices Expiration and Why It Impacts Bitcoin and the Market

Consider a Bitcoin choice as a contract that provides us the proper, however not the duty, to purchase or promote Bitcoin at a selected worth on a future date. It’s like placing a down fee on a automobile to lock in in the present day’s worth, however you may stroll away by simply shedding the deposit.

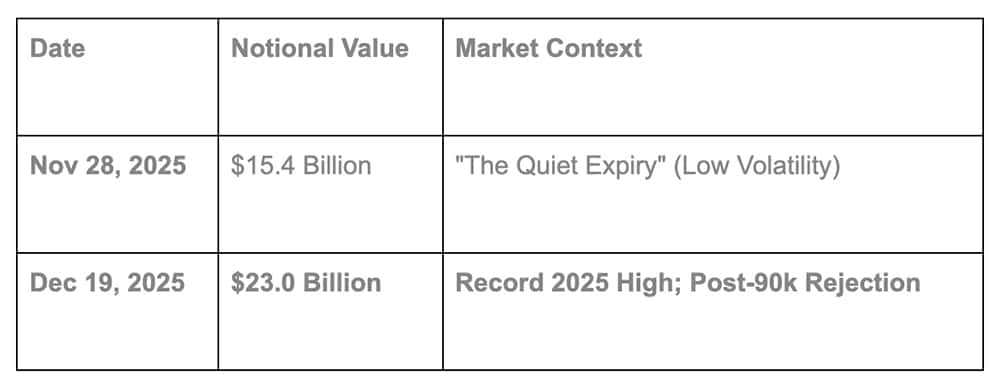

Tomorrow, $23 billion price of those choices will expire on Deribit, the most important crypto choices change. Based on a report from Bloomberg, this determine represents over half of all open contracts on the platform. Once they expire, crypto merchants can be compelled to decide on whether or not to execute their trades, which then will create a wave of shopping for and promoting that may rock the market.

(supply – Coinglass)

Whereas $23B is the headline, the true story is the ‘Max Ache’ level on Bitcoin worth, which is presently sitting close to $85,000.

Having watched this metric all week, I’ve seen market makers actively hedging to maintain the value pinned under $88,000, suggesting that any breakout try earlier than 8:00 AM UTC Friday will face heavy resistance. As we all know, Massive portfolio merchants might try to push the spot worth towards this stage to learn their very own positions.

(supply – BTC USD, TradingView)

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

How May This Expiry Affect Your Bitcoin?

Nonetheless, massive expiries don’t at all times assure chaos, however they completely improve the percentages of it. The hours main as much as and instantly following the expiration are identified for unpredictable worth motion and sudden Bitcoin liquidations. For us, although, this implies we must always put together for a bumpy experience.

The expansion of those occasions highlights how a lot the market has matured. This yr, Deribit has repeatedly hit file open curiosity, with a $15 billion expiry changing into nearly routine. The growth of regulated merchandise from establishments just like the CME with its crypto derivatives additionally reveals that skilled merchants are deeply concerned.

Nonetheless, not each expiry leads to a crash. A equally massive $15.4 billion expiry in late November produced little or no volatility. Some analysts imagine this was as a result of higher hedging methods from institutional gamers, an indication that the market is getting higher at absorbing these shocks.

This expiry is especially heavy as a result of it’s successfully the ‘final stand’ for the 2025 Santa Rally. Merchants are both rolling into 2026 or capitulating, which is why we noticed that $148M liquidation spike on Wednesday.”

For now, we wait and be bullish as a result of the expirations are extra of a automobile as an alternative of a reason for volatility.

DISCOVER: 10+ Subsequent Coin to 100X In 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit Bitcoin Braces for Affect as $23 Billion Choices Bomb Set to Expire appeared first on 99Bitcoins.