Bitcoin (BTC) is making an attempt to reclaim key resistance ranges this week as merchants brace for the US Federal Reserve assembly later immediately—a pivotal occasion that might set the tone for threat property heading into November. Market volatility has tightened in latest days, with buyers watching whether or not the Fed will preserve its restrictive coverage or trace at easing amid slowing macro indicators.

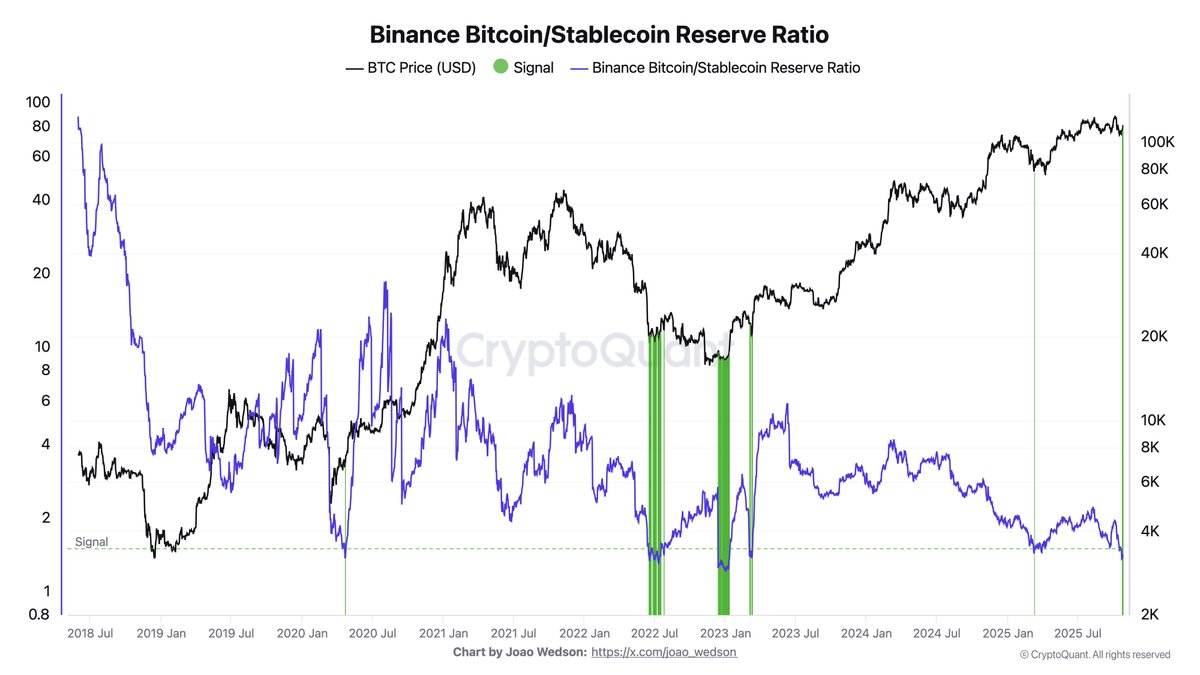

In response to high analyst Darkfost, on-chain knowledge reveals that the BTC Stablecoin Reserve Ratio on Binance is as soon as once more flashing a purchase sign, a sample that has traditionally preceded upward worth actions. The sign follows weeks of market turbulence triggered by the October tenth liquidation occasion, which erased billions in leveraged positions throughout exchanges. The ensuing spillover within the derivatives market additionally rippled into spot markets, amplifying volatility and testing investor conviction.

Whereas some members opted to hedge or rotate into stablecoins, others noticed the downturn as an accumulation alternative—a dynamic now mirrored in Binance’s shifting reserve ratios. As Bitcoin consolidates round essential ranges, merchants are positioning for what may very well be the subsequent important transfer, with macro coverage and liquidity situations doubtless dictating path.

Bitcoin Indicator Flashes Purchase Sign For The Third Time This Cycle

In response to on-chain analyst Darkfost, the latest market exercise has triggered main shifts inside Binance reserves, each in stablecoins and BTC holdings. Amid the post-liquidation restoration, one clear development has emerged from the noise: the BTC/Stablecoin reserve ratio on Binance is now flashing a purchase sign for the third time this cycle—a sample that has traditionally preceded sturdy upward strikes in Bitcoin’s worth.

Darkfost notes that this identical sign has appeared at essential turning factors previously. In January 2023, Bitcoin rallied from $16,600 to $24,800. The second occasion, in March 2023, preceded a surge from $20,300 to $73,000, marking the start of a significant bullish section. The latest incidence, in March 2025, was adopted by one other substantial transfer from $78,600 to $123,500.

This recurring sign displays a structural change inside Binance’s reserves: stablecoin holdings are rising relative to BTC reserves. In different phrases, there’s a rising quantity of stablecoins able to enter the market whereas BTC reserves proceed to fall. Such a dynamic usually creates situations for a provide shock, the place shopping for demand begins to outpace out there provide, setting the stage for a possible bullish reversal.

What makes this setup significantly notable is its context. This sample often types throughout bear markets or following deep corrections, when accumulation phases start to rebuild market energy. Seeing it develop now—whereas Bitcoin consolidates close to key assist ranges—is uncommon and suggests that enormous holders and institutional members might already be positioning for the subsequent main upward section.

Bitcoin Faces Resistance As Bulls Try To Reclaim Momentum

Bitcoin (BTC) is consolidating round $112,900, exhibiting early indicators of restoration after bouncing from its 200-day shifting common (purple line) close to $108,000. The value construction means that BTC is making an attempt to regain bullish momentum however continues to face notable resistance at $117,500, a stage that has capped a number of rallies since late August.

The 50-day (blue) and 100-day (inexperienced) shifting averages at the moment converge round $114,000–$115,000, reinforcing this zone as a short-term barrier. A clear break and every day shut above this space would affirm renewed shopping for energy and doubtlessly set off a transfer towards $120,000–$123,000, the place prior liquidity clusters exist.

On the draw back, the 200-day MA stays the essential assist to observe. So long as Bitcoin holds above it, the broader uptrend construction stays intact, regardless of latest volatility. A detailed beneath $108,000, nonetheless, may expose BTC to a deeper correction towards $102,500, the place the subsequent important assist lies.

Market members seem cautious forward of the Federal Reserve assembly this Wednesday, with merchants balancing macro uncertainty towards enhancing on-chain metrics. The continued consolidation might due to this fact act as a pre-breakout accumulation section, with a decisive transfer prone to comply with as soon as coverage readability and liquidity path are established.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.