Analyst Weekly, July 7, 2025

Tax Reconciliation Invoice Handed: Core Implications

The tax reconciliation invoice (nicknamed the One Huge Lovely Invoice, or OBBB) was handed and signed by President Trump on July 4, with the Senate needing a tie-breaking vote by VP Vance.

The invoice contains:

100% rapid expensing for capital investments

Greater internet curiosity deductibility

Elevated tax credit score (from 25% to 35%) for semiconductor manufacturing investments starting 2026

An enlargement of the Orphan Cures Act, shielding multi-condition orphan medicine from Medicare value negotiations

A $5 trillion improve within the debt ceiling, permitting new Treasury issuance weighted towards short-term T-bills

Funding Takeaway:

Optimistic for capex-heavy sectors: industrials, protection, chemical compounds, and telecoms profit from full expensing.

Semiconductors (gear makers and fab-heavy companies) stand to achieve from the improved manufacturing tax credit score.

Pharma/biotech companies with orphan drug pipelines profit from the expanded pricing exemption.

Treasury market impression: Emphasis on short-duration issuance (20% → 30% T-bill share) favors decrease curiosity price however will increase rollover threat – supportive of the brief finish of the curve over lengthy bonds

Firms that profit from a number of provisions of the tax invoice embody:

Industrials & Supplies: UPS (UPS), Worldwide Paper (IP), Northrop Grumman (NOC), Common Dynamics (GD), Lockheed Martin (LMT)

Pharma/Biotech: Pfizer (PFE), Vertex (VRTX), Novartis (NOVN-CH), Amgen (AMGN), Illumina

Chemical substances: Celanese (CE), Dow (DOW), LyondellBasell (LYB)

Telecom/Media: AT&T (T), Verizon (VZ)

Client & Staples: Altria (MO), Yum! Manufacturers (YUM), Tyson Meals (TSN)

Rising Tariffs, Shifting Provide Chains: Vietnam as a Take a look at Case and North America as a Commerce Winner

Opposite to standard perception amongst some buyers, latest US commerce offers are usually not resulting in decrease tariffs. As a substitute, the Trump administration is locking in a common 10% tariff flooring, with country-specific charges which can be usually considerably increased. Particularly, Asian nations are being focused as a consequence of their proximity to China and the administration’s give attention to curbing transshipment, the apply of routing Chinese language items by third nations to keep away from direct tariffs. This strategy is aimed toward imposing stricter guidelines of origin and shutting longstanding commerce loopholes.

The brand new US-Vietnam commerce deal illustrates this coverage in motion. Vietnam will face a 20% tariff on most of its items and a 40% charge on items imported from China after which shipped to the US This deal additionally exempts US items from Vietnamese tariffs, underscoring its uneven nature.

In distinction, Mexico and Canada are rising as beneficiaries of the administration’s commerce coverage. Each already adjust to stringent guidelines of origin underneath USMCA and face no common tariff, making a widening price benefit over Vietnam. This may increasingly speed up onshoring and provide chain migration nearer to the US.

Whereas Vietnam has but to verify the tariff particulars, the coverage framework now has clear boundaries, providing some certainty to Vietnam-exposed equities, which have underperformed since late 2024. India might strike a deal subsequent, with diplomatic strain mounting on Japan, the place negotiations stay stalled. The early completion of the Vietnam deal is seen as a strategic transfer to affect talks with different key buying and selling companions within the Asia-Pacific area.

In abstract, a brand new take care of Vietnam:

Raises tariffs to twenty% on most Vietnamese imports

Hikes to 40% on items made in China and rerouted by way of Vietnam

US items enter Vietnam tariff-free

Funding Takeaway:

Tariffs are going up, not down, even underneath commerce offers. That is damaging for multinationals sourcing by way of Asia.

July 9 is the deadline for Trump’s new reciprocal tariff bulletins, concentrating on tariffs above 10% beginning August 1.

Vietnam now serves as a check case for “guidelines of origin” enforcement to forestall tariff evasion by way of transshipment.

Capital rotation towards North American suppliers: We see Mexico and Canada positioned as relative winners. These nations already adjust to stricter origin guidelines underneath USMCA and keep away from the brand new tariffs.

Industrials and logistics companies with publicity to US-Mexico/Canada commerce might profit from commerce re-routing and provide chain onshoring.

Bitcoin on the Verge of a Breakout? This Week May Be Essential

This week may turn into some of the vital for your complete crypto market within the second half of the yr. Bitcoin has just lately approached its all-time excessive, which was set in Might at $110,872.

Above this degree, there aren’t any clear technical reference factors on the chart. Nevertheless, instruments like Fibonacci extensions can nonetheless present steering. The subsequent potential value goal is close to $130,000, based mostly on the 161.8% retracement of the latest correction.

As is well-known, value motion within the crypto market can transfer rapidly. However solely a transparent breakout above the file excessive would considerably enhance the probabilities of reaching this subsequent goal.

Due to the sharp rally since April, a number of assist zones—so-called Truthful Worth Gaps—have fashioned beneath present ranges. The primary of those zones lies between $98,000 and $100,000. This space was efficiently defended three weeks in the past and will act as a assist once more.

If this zone fails to carry, nonetheless, a pullback towards the $86,000 to $92,000 vary may comply with.

Bitcoin, weekly chart

Capital Allocation Dilemma: Structural Strengths of Europe and the US

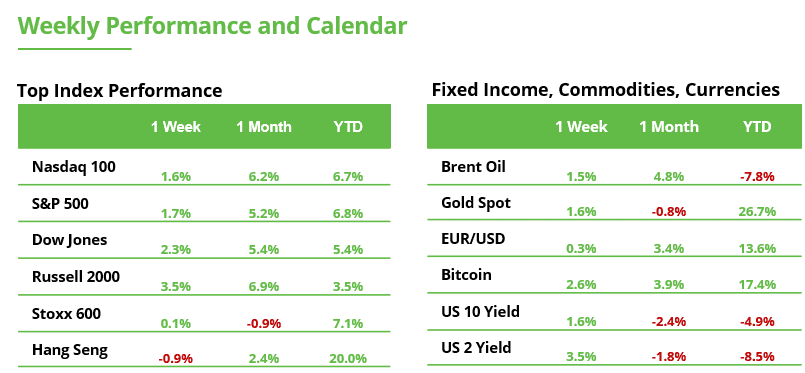

The place ought to I make investments my cash – in Europe or the US? Few funding subjects have sparked as a lot debate in 2025. Many buyers stay unsure. To date this yr, European fairness markets have outperformed their US counterparts. The STOXX Europe 600 is up 7.6%, in comparison with a 5.9% achieve within the S&P 500. The lead is slim, however that’s solely half the story.

Forex results add one other layer of complexity. Because the starting of the yr, the US greenback has misplaced round 14% towards the euro. For US buyers with European holdings, that’s created a major enhance in returns. Conversely, the weaker greenback has eroded earnings for European buyers in US property. From a global perspective, the weaker greenback may really seem enticing, appearing like a built-in low cost for shares.

Structurally, Europe is extra defensively positioned, much less growth-oriented, however presents increased dividend yields on common. In distinction, the US is pushed by innovation, simpler entry to enterprise capital and lighter regulation. In an surroundings that favors development, the US might have the sting, particularly with megatrends like synthetic intelligence and robotics.

Lengthy-term buyers trying to diversify broadly can hardly keep away from allocating to each areas. It’s much less about “either-or” and extra about getting the weighting proper. On a stock-by-stock degree, there are additionally development alternatives in Europe and enticing dividend performs within the US.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.