Bitcoin is below stress, however bears proceed to fail of their makes an attempt to interrupt key demand ranges. Regardless of a unstable macro backdrop pushed by the continuing Israel-Iran battle, BTC stays firmly supported above $103,600, a vital worth flooring. This resilience highlights that patrons are nonetheless defending their floor, whilst concern and uncertainty dominate the broader market.

Many analysts consider that Bitcoin is organising for a decisive transfer as soon as geopolitical tensions start to chill. The worth stays caught in a slim vary, but continues to commerce close to all-time highs—an indication of energy amid chaos. Buyers are ready for readability, with most anticipating a unstable breakout as soon as the route turns into clearer.

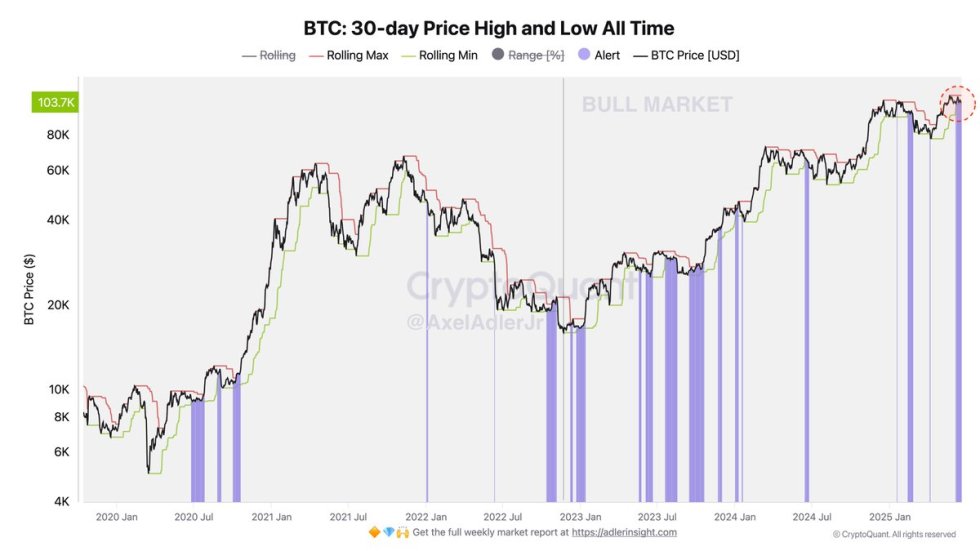

Information from CryptoQuant provides weight to this view, displaying that Bitcoin is at the moment in a pronounced squeeze on the every day timeframe. The sort of worth compression usually precedes giant directional strikes and a surge in volatility. Because the vary tightens and market individuals develop extra cautious, a breakout—both to the upside or draw back—turns into more and more doubtless.

Bitcoin Consolidates As Volatility Builds

Bitcoin stays in a consolidation part, puzzling traders with its muted worth motion amid mounting world tensions. Regardless of the geopolitical chaos and fears of broader battle, Bitcoin’s fundamentals stay sturdy. Institutional adoption continues to develop, on-chain metrics present provide is steadily declining on centralized exchanges, and long-term holders stay resilient. This backdrop usually helps bullish momentum, but BTC stays range-bound.

The scenario within the Center East has added a contemporary layer of uncertainty. As hostilities between Israel and Iran escalate, the specter of US intervention looms bigger. Markets are pricing in the opportunity of a broader battle that might destabilize world equities, oil, and currencies. Bitcoin has traditionally responded nicely to uncertainty, thriving throughout macroeconomic dislocations. Nevertheless, it’s nonetheless largely seen as a danger asset. In a risk-off surroundings—the place traders flee to money, bonds, and safe-haven property like gold—Bitcoin might expertise sharper declines in comparison with conventional markets.

High analyst Axel Adler highlights a technical setup that could possibly be the prelude to Bitcoin’s subsequent main transfer. On the every day timeframe, BTC is getting into a pronounced squeeze, a sample typically adopted by surging volatility. With narrowing worth motion and decreased momentum, Bitcoin is constructing stress. If geopolitical tensions resolve or shift route, the squeeze might end in a breakout. But when world instability worsens, particularly with US navy involvement, the market might pivot right into a sell-off.

For now, the market seems to be ready. Bitcoin’s route over the approaching periods will doubtless rely upon how the macro scenario evolves and whether or not investor sentiment shifts towards concern or renewed optimism. Merchants ought to watch carefully—this squeeze might not final for much longer.

Worth Holds Regular Above Help In Tight Vary

The every day Bitcoin chart reveals BTC buying and selling just under $105,000, in a decent consolidation vary between the $103,600 assist zone and the $109,300 resistance stage. Worth motion continues to coil inside this channel, suggesting the market is in a state of equilibrium, ready for a transparent catalyst to drive the subsequent main transfer. Regardless of latest promoting stress, bears have failed to interrupt under the $103,600 stage—a key construction that served because the earlier all-time excessive in December 2024.

The 50-day easy shifting common (SMA) sits simply beneath the present worth at $104,525 and is appearing as short-term dynamic assist. Beneath that, the 100-day and 200-day SMAs stay well-structured in bullish alignment, reinforcing the longer-term uptrend. Quantity, nonetheless, stays subdued, indicating that merchants are hesitant to commit closely till macro readability emerges.

This compression in worth might construct right into a breakout try, significantly if Bitcoin holds above $104K and manages to reclaim $106K–$107K ranges within the coming periods. A powerful transfer above $109,300 might set off one other leg increased, whereas an in depth under $103,600 might open the door to additional draw back. Till then, Bitcoin stays in a holding sample amid a broader backdrop of world uncertainty.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.