Bitcoin has traded inside a slender vary between $107,500 and $109,600 since final Friday, with volatility drying up as bulls and bears battle for management. This sort of worth compression sometimes precedes a big transfer, and merchants are carefully expecting the breakout. Some analysts imagine Bitcoin is making ready to push above its all-time excessive close to $112,000, fueled by sturdy fundamentals and chronic demand. Others, nonetheless, stay cautious and anticipate extra consolidation earlier than a transparent development emerges.

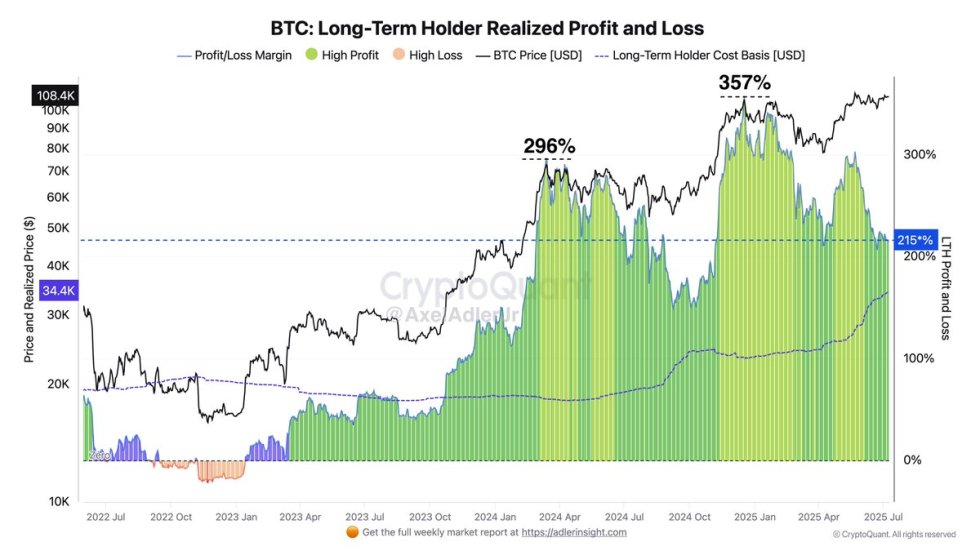

On-chain knowledge from CryptoQuant reveals that long-term holders (LTHs) are at the moment sitting on a mean unrealized revenue of 215% above their value foundation. Traditionally, when these buyers attain over 300% revenue, they start to step by step distribute their holdings again into the market. This locations BTC in a zone of orderly profit-taking, not fairly euphoria, however with a rising threat of a shift in conduct.

Whether or not the following transfer is a breakout or breakdown, the strain is constructing. Bitcoin’s resilience above $107,000 continues to draw bullish consideration, however solely a powerful push above the vary will affirm momentum. Till then, market contributors stay on edge, ready for Bitcoin to choose a route that would outline the weeks forward.

Lengthy-Time period Holders Attain Crucial Zone: Bitcoin Checks Persistence

Bitcoin’s current worth motion has annoyed many buyers, because the market continues to float sideways in low volatility. After weeks of buying and selling inside a slender vary, market contributors are starting to lose endurance. The extended consolidation presents draw back threat if momentum fails to return quickly. Regardless of this, the broader macroeconomic backdrop stays favorable. The U.S. inventory market lately reached new all-time highs, and geopolitical tensions have eased, suggesting a supportive setting for threat property like Bitcoin within the months forward.

Prime analyst Axel Adler shared insights pointing to an important on-chain sign — long-term holders (LTHs) are at the moment sitting on a mean unrealized revenue of 215% above their value foundation. Traditionally, when this metric crosses 300%, it marks a stage the place seasoned holders start to distribute cash into power. At 215%, the market is within the “orderly profit-taking” zone — not but euphoric, however approaching ranges which have traditionally led to elevated promote strain.

This on-chain sign means that whereas a breakout stays potential, upside could also be restricted until new demand steps in. If the rally fails to increase quickly, there’s a rising threat that long-term holders may start offloading positions prematurely. This dynamic creates a fragile steadiness — bulls have to ignite momentum to draw new capital, or else threat seeing provide overwhelm worth. For now, all eyes stay on $112,000 as the important thing stage that would outline Bitcoin’s subsequent main transfer.

BTC Caught Beneath Resistance

Bitcoin stays tightly range-bound between $107,500 and $109,600, with volatility persevering with to compress as bulls try to push the value above resistance. As proven within the 8-hour chart, BTC has examined the $109,300 zone a number of occasions with out managing a decisive breakout, suggesting sturdy promoting strain at this stage. On the draw back, the 50-, 100-, and 200-period transferring averages (SMA) at $107,489, $106,572, and $105,448, respectively, proceed to behave as dynamic help ranges.

Quantity stays muted, signaling a scarcity of conviction from each bulls and bears. The longer BTC stays inside this tight vary, the extra violent the eventual breakout could possibly be. The worth is at the moment hovering above all main SMAs, which is usually a bullish sign, and every dip towards the $107K zone has been met with purchaser help.

If patrons handle to reclaim $109,300 with quantity affirmation, Bitcoin may shortly revisit the all-time excessive close to $112K. Nonetheless, failure to carry above the transferring averages may ship BTC all the way down to retest $103,600 — a key help stage from late June. Total, Bitcoin’s construction suggests {that a} vital transfer is coming, however directionality will rely upon whether or not bulls can break resistance or bears regain momentum.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.