Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth edged up by over 1% prior to now 24 hours to commerce at $88,445 as of 1:27 a.m. EST, on buying and selling quantity that dropped 8% to $39.3 billion.

This comes as buyers betting that January charge cuts will stay the identical odds hit 87% on Polymarket, a sign that the Federal Reserve might depart them untouched.

In the meantime, most Fed officers consider further curiosity cuts are acceptable so long as inflation continues to chill, in accordance with minutes launched on Wednesday, December 30.

In keeping with the minutes, policymakers slashed rates of interest earlier this month to a variety of three.5% to three.75% in a 9-3 vote.

FOMC Minutes Dec 10 2025 and Key Takeaways for 2026

The Federal Open Market Committee lower the federal funds charge by 25 foundation factors to three.50–3.75 p.c at its December assembly.

The choice handed 9-3, marking inside division and differing views on the stability between… pic.twitter.com/Z9ZA0mnloE

— Truflation (@truflation) December 30, 2025

“A number of contributors pointed to the danger of upper inflation changing into entrenched and urged that decreasing the coverage charge additional within the context of elevated inflation readings might be misinterpreted as implying diminished policymaker dedication to the two% inflation goal,” the minutes learn.

Bitcoin Worth On A Cautious Pattern As Bears And Bulls Combat For Dominance

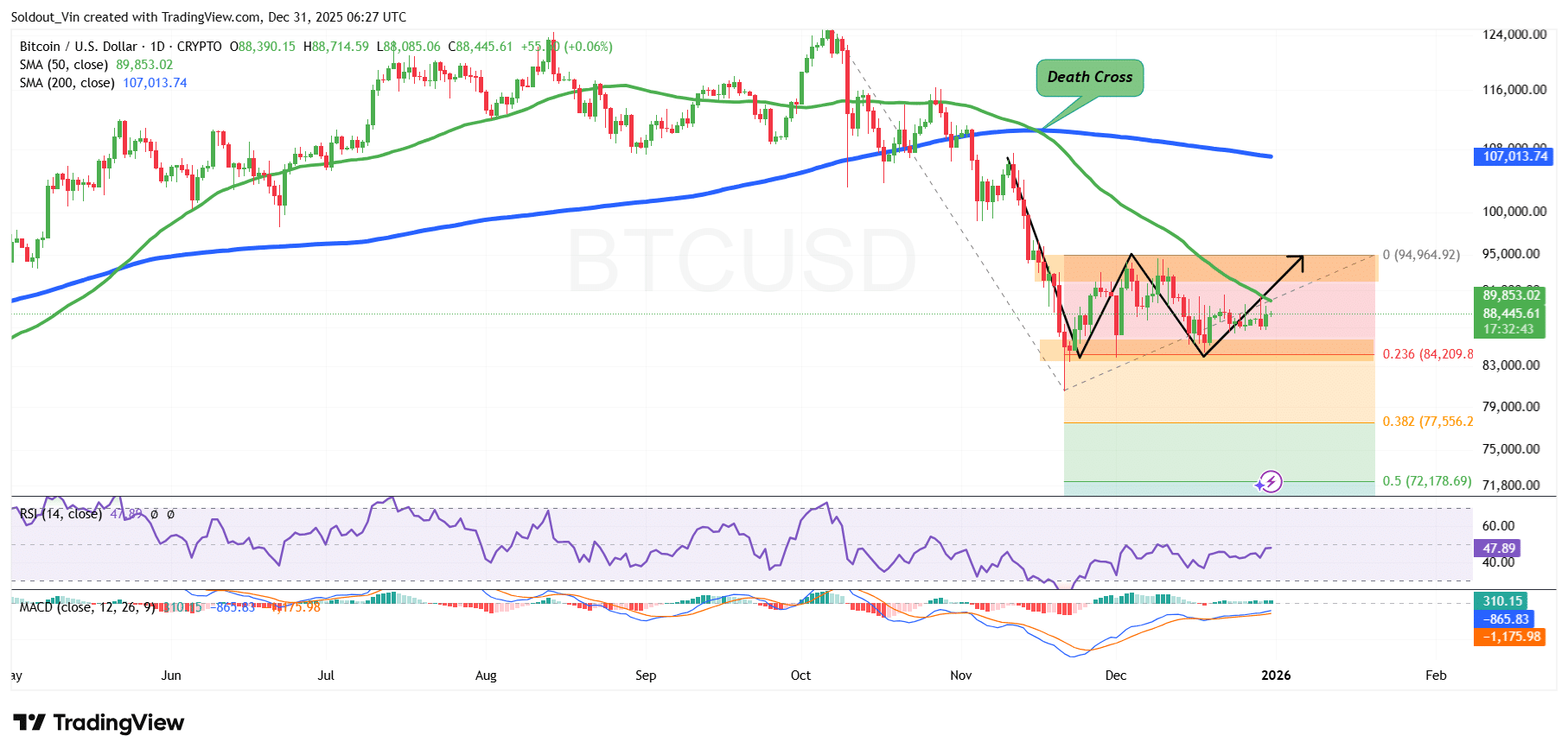

Buyers are cautious in regards to the BTC worth, because the asset trades in a sideways sample and indicators sign indecision out there.

After a surge in April and Could, the Bitcoin worth consolidated above the $100,800 help space, permitting BTC to hit its all-time excessive (ATH) round $126,200.

Nonetheless, bulls couldn’t maintain the uptrend, after which bears took management, pushing the asset down and prompting buyers to e-book earnings, as proven by the trend-based Fibonacci retracement chart.

This downtrend was additionally fueled by the Easy Shifting Averages (SMAs) forming a loss of life cross at $110,404, after the 200-day SMA crossed above the 50-day SMA.

BTC is now buying and selling beneath each SMAs, signaling that sellers nonetheless have some management.

After the downtrend, the value of BTC then hit a key help space across the $81,000 zone, now appearing as a major demand space. Since hitting this degree in late November, Bitcoin has been buying and selling in a consolidation section, with the $94,964 degree on the 0 Fib zone appearing as a hurdle above.

Nonetheless, Bitcoin is displaying indicators of a breakout, with development indicators suggesting slight bullish stress.

The Shifting Common Convergence Divergence (MACD) has turned optimistic, because the blue MACD line has crossed above the orange sign line on the each day timeframe. The inexperienced bars on the histogram are additionally rising above the impartial line, confirming elevated optimistic momentum.

In the meantime, the Relative Power Index has been buying and selling between the 40-50 zone, indicating continued consolidation. The RSI, presently at 47.89, exhibits indicators of a rebound, with patrons settling in.

BTC Worth Prediction

Based mostly on the BTC/USD chart evaluation, the BTC worth is presently in a tug-of-war, with the bears and bulls combating for dominance on the 0 and 0.236 Fibonacci Retracement ranges.

If bulls decide up from the final each day candle to take care of the upward transfer, and in the event that they push BTC above the 50-day SMA ($89,853), the Bitcoin worth may surge much more, crossing the $94,000 barrier as they aim $107,100, the earlier provide zone, and throughout the 200-day SMA.

In keeping with Michaël van de Poppe, a crypto analyst on X with over 816k followers, BTC is presently testing the 21-day MA (round $88,300) on the each day chart. An in depth above this might point out a sustained bullish rally.

Nonetheless, on the draw back, if bears take management, the value of BTC may drop again to the 0.382 Fib zone at $77,556, which is now appearing as steady help in case of a sustained drop.

Associated Information

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection