Ethereum is as soon as once more within the highlight as institutional demand and whale accumulation proceed to form the market, even within the face of a latest correction. Regardless of worth retracements which have launched uncertainty, the broader development reveals that enormous buyers are steadily rotating capital into ETH. Headlines about whales transferring important quantities of funds to build up Ethereum have dominated the information cycle, reinforcing the view that ETH stays a cornerstone asset for the subsequent part of the market.

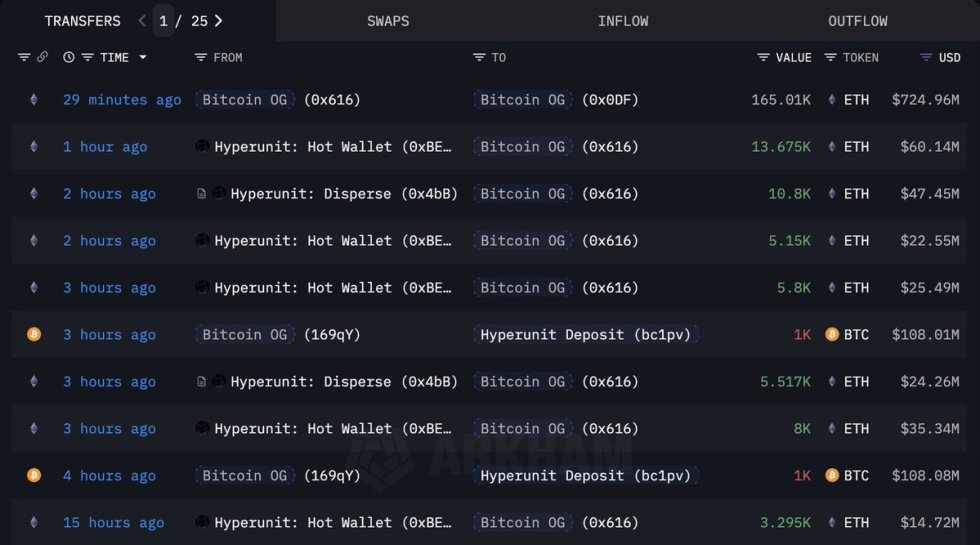

Some of the notable gamers driving this development is an enormous Bitcoin OG pockets that has repeatedly caught analysts’ consideration. In line with Lookonchain, this whale has offered one other 2,000 BTC, value roughly $215 million, and instantly bought 48,942 ETH ($215M) spot over the previous 4 hours. This aggressive transfer provides to an already substantial place, reflecting a decisive capital rotation technique away from Bitcoin and into Ethereum.

Such transactions spotlight the rising confidence amongst whales and establishments in Ethereum’s long-term worth, significantly as community exercise and adoption stay sturdy. Whereas short-term volatility continues, these large-scale strikes level to a deeper underlying development: Ethereum’s position because the main various to Bitcoin is strengthening, and the market is making ready for the subsequent stage.

Whale Accumulation Sparks Ethereum Hypothesis

In line with Lookonchain, the Bitcoin OG investor has now amassed an astonishing 886,371 ETH, valued at roughly $4.07 billion. This large accumulation has rapidly turn into probably the most mentioned developments within the crypto market, sparking intense hypothesis about Ethereum’s trajectory within the months forward. Many analysts view this as a transparent case of “sensible cash positioning,” with whales and establishments more and more treating Ethereum because the main various to Bitcoin within the ongoing capital rotation.

The size of those purchases suggests greater than easy hypothesis. Massive gamers are signaling confidence in Ethereum’s long-term position, particularly given its dominance in DeFi, stablecoins, and community exercise. By staking a lot of those holdings, the whale additionally demonstrates conviction in Ethereum’s means to generate yield whereas securing the community, additional underscoring ETH’s utility past worth hypothesis.

Nevertheless, dangers stay. Bitcoin has struggled to take care of its uptrend, and uncertainty round its means to get well momentum weighs closely on the broader market. On the identical time, a number of altcoins are dealing with steep corrections, highlighting the fragility of sentiment throughout this part.

Testing Help Amid Consolidation

Ethereum (ETH) is presently buying and selling round $4,414 after one other failed try to interrupt above the $4,500 resistance zone. The chart exhibits ETH caught in a consolidation part, with worth motion forming a sideways vary since mid-August. Regardless of latest volatility, ETH stays above the 200-day SMA close to $4,220, a crucial assist that continues to draw consumers throughout dips.

The 50-day and 100-day SMAs, now clustered round $4,460, are performing as dynamic resistance, preserving upside momentum capped. Every rejection from this zone highlights market hesitation, as merchants await affirmation of course. If ETH holds above $4,400, a push again towards $4,600–$4,800 stays attainable. Nevertheless, a breakdown under $4,300 may set off additional draw back towards the $4,200 assist area.

Momentum indicators recommend a cooling part after Ethereum’s robust rally in July and early August. Value compression right here alerts that the market is making ready for its subsequent important transfer. Essentially, on-chain knowledge exhibiting whale accumulation and shrinking trade reserves continues to assist a bullish longer-term outlook.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.