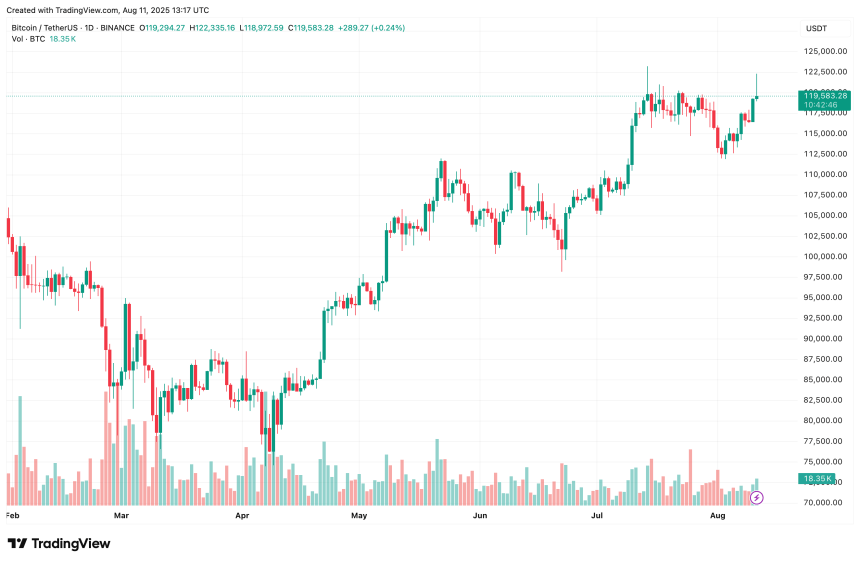

Earlier right this moment, Bitcoin (BTC) surged previous $122,000 for the primary time since July 13, coming near a brand new all-time excessive (ATH) earlier than paring some features, buying and selling barely above $119,500 on the time of writing.

Bitcoin Eyes New ATH With Retail-Pushed Rally

In keeping with a current CryptoQuant Quicktake submit by contributor ShayanMarkets, the common executed order measurement within the Bitcoin futures market has declined considerably over the previous few months. This implies that the current value rally is being pushed primarily by retail buyers fairly than institutional gamers.

Associated Studying

For context, the common executed order measurement is calculated by dividing the overall traded quantity by the variety of executed orders. This metric helps establish whether or not market exercise is dominated by retail members or large-scale buyers.

ShayanMarkets shared the next chart exhibiting massive yellow and inexperienced clusters in late 2024 and early 2025, which corresponded with substantial whale inflows and fueled robust bullish rallies.

Nevertheless, current weeks have seen a noticeable rise in purple clusters, indicating that smaller, retail-sized orders are taking a bigger share of market exercise. The analyst famous that traditionally, whale dominance close to market peaks has typically coincided with native tops.

Whale involvement within the BTC futures market has declined since Q2 2025, which may imply that institutional consumers are both holding present positions from decrease ranges or ready for extra favorable re-entry factors. ShayanMarkets concluded:

This dynamic leaves Bitcoin ready the place a bullish breakout above its prior ATH may materialize within the coming weeks, until renewed whale exercise emerges to dump positions, triggering a distribution section.

Latest on-chain evaluation means that BTC might presently be in a distribution section. In a separate CryptoQuant submit, analyst BorisVest famous that buyers are using a technique referred to as Sensible dollar-cost averaging (DCA) to build up BTC at present ranges forward of potential value appreciation.

Sensible DCA is an upgraded model of the standard DCA technique, the place funding quantities and timing are adjusted primarily based on market circumstances as an alternative of fastened intervals. In crypto, it typically makes use of indicators like transferring common or RSI to extend shopping for throughout undervaluation phases.

Is BTC At Danger Of A Worth Correction?

Whereas rising retail participation within the BTC futures market can sign natural demand for the flagship cryptocurrency, different indicators level to a attainable value correction that might disrupt Bitcoin’s bullish momentum.

Associated Studying

For instance, recent on-chain knowledge reveals an uptick in Binance whale-to-exchange flows, typically a precursor to near-term value pullbacks. As well as, current modifications in Bitcoin whales’ realized cap counsel a level of fragility available in the market.

That stated, not all indicators are bearish. Some analysts imagine BTC could possibly be gearing up for an additional rally within the second half of the 12 months, with targets as excessive as $150,000. At press time, BTC trades at $119,583, up 0.8% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com