Bitcoin (BTC) worth has led the broader crypto market in an additional selloff. After slipping beneath its essential purchase zone round $80k final week, Bitcoin worth prolonged its selloff right now to hit $72,889 on Tuesday, February 3, for the primary time for the reason that first week of November.

Bitcoin Value Falls on Leverage Flashouts

As such, greater than 167k leveraged merchants have been flashed out, with greater than $730 million liquidated through the previous 24 hours. Out of this, greater than $528 million concerned lengthy merchants, amid the notable decline in Bitcoin’s Open Curiosity (OI).

In response to market information evaluation from CoinGlass, Bitcoin’s OI has continued to shrink for the reason that October 11 crypto capitulation to hover about $52.7 billion at press time.

Supply: Coinglass

Bitwise CIO Points Cautionary Observe

Following right now’s BTC worth capitulation to $72k right now, Matt Hougan, Bitwise CIO, acknowledged that the flagship coin is underneath the affect of a multi-month bear market. Hougan acknowledged that the Bitcoin worth has been in a bear market since early 2025, however the excessive institutional adoption and regulatory readability have blinded buyers.

“This isn’t a bull market correction or a dip. It’s a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter set into movement by elements starting from extra leverage to widespread profit-taking by OGs,” Hougan acknowledged.

What’s Subsequent?

Hougan, nevertheless, acknowledged that the Bitcoin backside is nearer as its four-year bear cycle is within the final part. Furthermore, Hougan believes that Bitcoin buyers are banking on regulatory progress and excessive institutional adoption, to drive a bullish rebound forward.

Supply: X

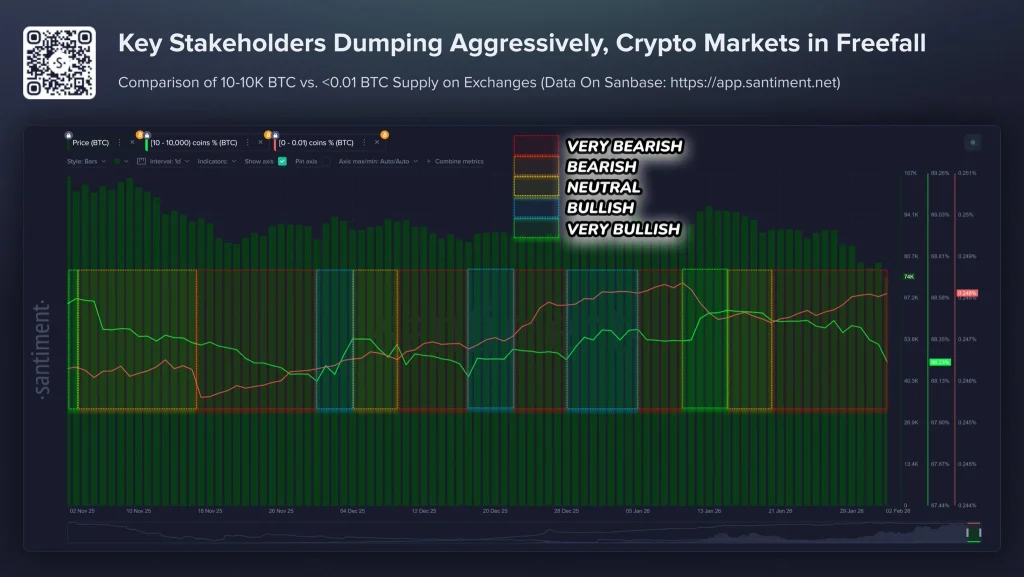

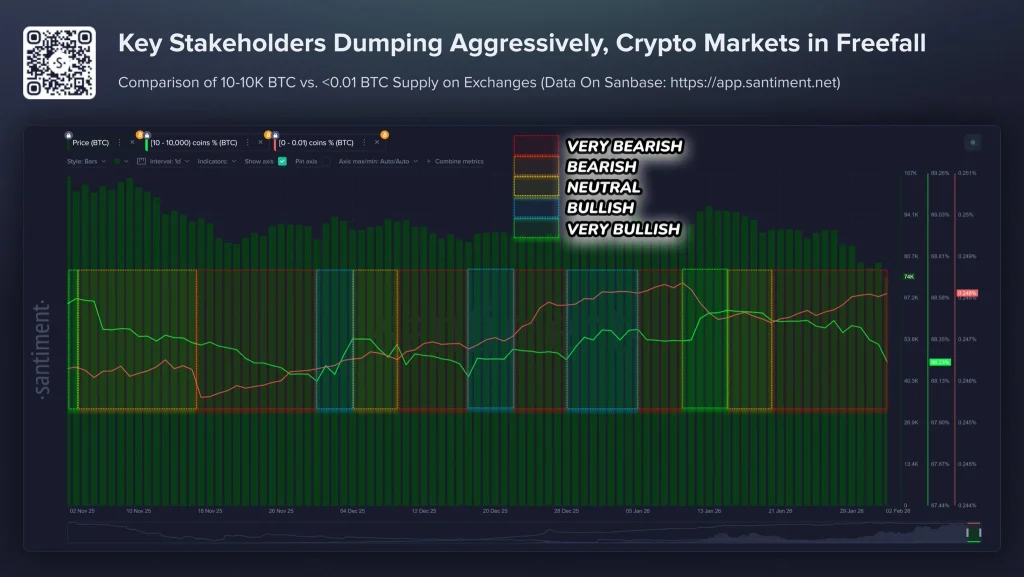

Nonetheless, onchain information from Santiment reveals that key Bitcoin buyers have been aggressively promoting whereas retail buys-back, a traditional promote sign. From a technical evaluation standpoint, if Bitcoin patrons fail to defend $73k within the coming day, an additional correction in the direction of $69k might be inevitable.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict Editorial Tips primarily based on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We attempt to offer well timed updates about every part crypto & blockchain, proper from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market situations. Please do your individual analysis earlier than making funding choices. Neither the author nor the publication assumes accountability in your monetary decisions.

Sponsored and Ads:

Sponsored content material and affiliate hyperlinks could seem on our web site. Ads are marked clearly, and our editorial content material stays fully unbiased from our advert companions.