The Bitcoin value has been experiencing important value fluctuations because the begin of the month, which has stored the volatility on the highs. As the worth is heading in the direction of the weekend, the rally seems to be largely calm. The volatility has compressed, ranges have tightened, and intraday swings have light. Nonetheless, a detailed commentary highlights the hidden story—the US merchants are actively promoting into this consolidation. With the merchants establishing their ‘buy-back’ plan, right here’s what the upcoming BTC value motion throughout the weekend might signify.

Bitcoin Value Stays Resilient, Not Underlying!

As lined within the earlier composition, the Bitcoin value is slowly absorbing the promoting stress, and therefore, the merchants might count on huge value motion throughout the weekend. In the meantime, the weekend commerce sometimes brings thinner liquidity and slower value discovery, which is mirrored within the present BTC value rally. With no main liquidation clusters and restricted follow-through in both path, the upcoming weekend commerce is much less more likely to show a significant breakout.

The above chart exhibits the BTC value replicating the earlier sample because it consolidates inside range-bound ranges. The present pullback could possibly be the ultimate pullback earlier than the huge breakout if it completely aligns with the sample. The RSI can also be incremental, which is printing consecutive greater highs and lows, validating the bullish trajectory. The charts are completely lined up, suggesting the worth breaching $100K within the first few days of 2026; nonetheless, the feelings of the merchants might forestall it from occurring.

U.S. Merchants Are Promoting Into Stability

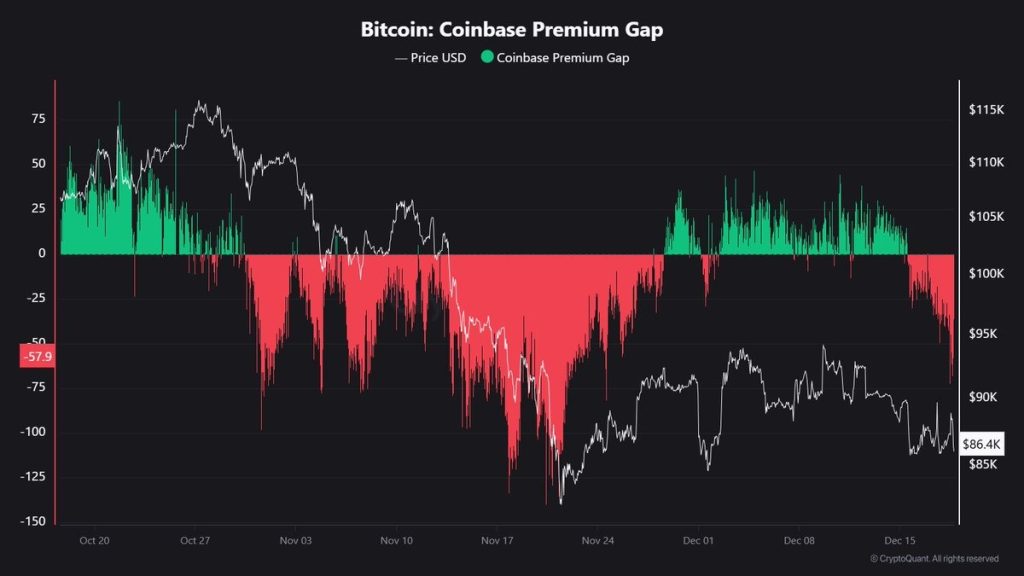

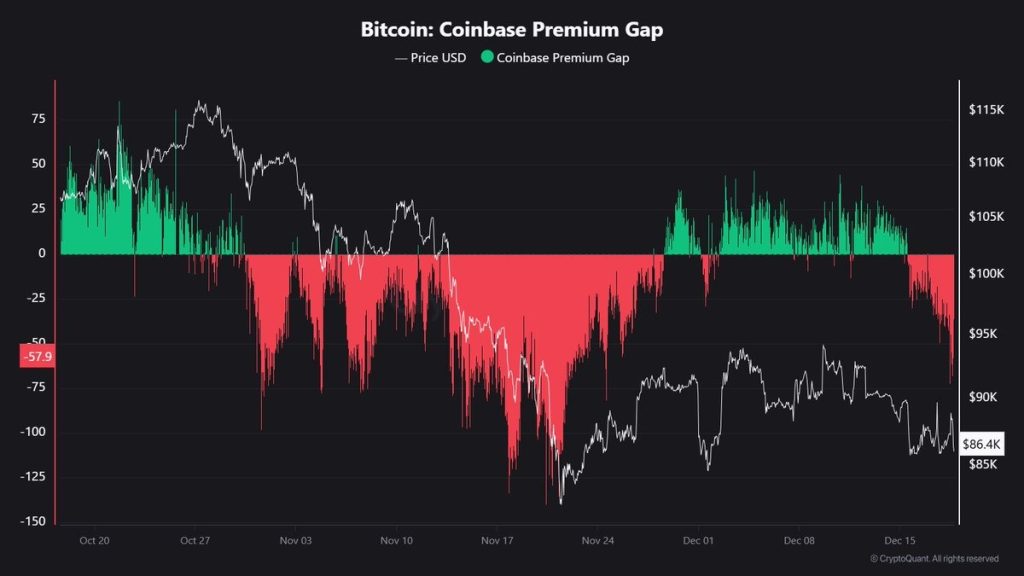

Whereas Bitcoin’s value stays range-bound, the Coinbase Premium Hole has turned sharply unfavourable, now close to -$57. This means that U.S.-based merchants are promoting at a reduction relative to offshore markets, whilst the worth avoids sharp declines.

This behaviour suggests managed distribution fairly than panic. Promoting is going down throughout steady circumstances, the place liquidity permits for orderly exits. Importantly, value has not accelerated decrease in response, which suggests that demand is actively absorbing this provide.

For merchants, this dynamic issues. When regular promoting fails to push the worth decrease, it usually marks a transition section. The market both stabilises additional or prepares for a directional transfer as soon as participation will increase.

Key Value Ranges to Watch By the Weekend

Bitcoin (BTC) value is presently compressing between $86,000 and $89,500, which defines the instant consolidation vary. So long as the worth holds above the $85,000–$86,000 assist zone, the construction stays intact and indicators absorption of U.S. promoting stress.

A sustained maintain above $89,500 would open the door for a retest of the $92,000–$94,000 resistance space, which marks prior provide and the breakdown area. That zone is more likely to entice sellers once more.

On the draw back, a clear lack of $85,000 would weaken the present setup and expose the $81,500–$83,000 demand zone, the place patrons beforehand stepped in aggressively.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict Editorial Pointers based mostly on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We attempt to supply well timed updates about all the things crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market circumstances. Please do your individual analysis earlier than making funding choices. Neither the author nor the publication assumes duty on your monetary decisions.

Sponsored and Commercials:

Sponsored content material and affiliate hyperlinks might seem on our web site. Commercials are marked clearly, and our editorial content material stays completely unbiased from our advert companions.