Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has surged 7% within the final 24 hours to commerce at $92,844 as of 5:56 a.m. EST on a 21% enhance in every day buying and selling quantity to $86.22 billion.

That BTC value surge began quickly after Vanguard reversed its lengthy‑standing ban on buying and selling Bitcoin ETFs on its platform, opening the door for tens of millions of conservative, lengthy‑time period buyers to achieve straightforward publicity to the main crypto.

Bloomberg ETF analyst Eric Balchunas referred to the transfer because the “Vanguard Impact,” noting that Bitcoin jumped round 6% instantly after the US market open on the primary day Vanguard shoppers might commerce Bitcoin ETFs.

THE VANGUARD EFFECT: Bitcoin jumps 6% proper round US open on first day after bitcoin ETF ban lifted. Coincidence? I feel not. Additionally $1b in IBIT quantity in first 30min of buying and selling. I knew these Vanguardians had just a little degen in them, even among the most conservative buyers… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

Balchunas additionally highlighted that BlackRock’s IBIT spot Bitcoin ETF noticed round $1 billion in buying and selling quantity inside the first half-hour of that session.

Bitcoin Value Boosted By ETF Demand

ETF move knowledge from Farside Traders exhibits that US spot Bitcoin funds have flipped again into web inflows. That is after a tough November, when redemptions exceeded $4.3 billion. Current every day prints present cash returning to key merchandise like IBIT and FBTC.

Pushing the working complete of web creations greater once more and hinting that the worst of the promoting stress could also be over for now. Analysts notice that even modest optimistic flows can have an outsized impression on the Bitcoin value. It’s because spot ETFs should purchase precise Bitcoin out there, eradicating provide at a time when new issuance is already restricted after earlier halving occasions.

If the present multi‑day influx streak continues, particularly with Vanguard accounts now capable of entry these funds, it might act as a gentle bid underneath the market and assist any makes an attempt by BTC to reclaim the $100,000 area.

Bitcoin On‑Chain Indicators Present Therapeutic

On‑chain knowledge suppliers exhibits that the most recent market crash drove a considerable amount of quick‑time period speculative cash into loss. Nonetheless, lengthy‑time period holders principally stayed put. This means that the selloff was extra about leverage and weak fingers than a change in lengthy‑time period conviction.

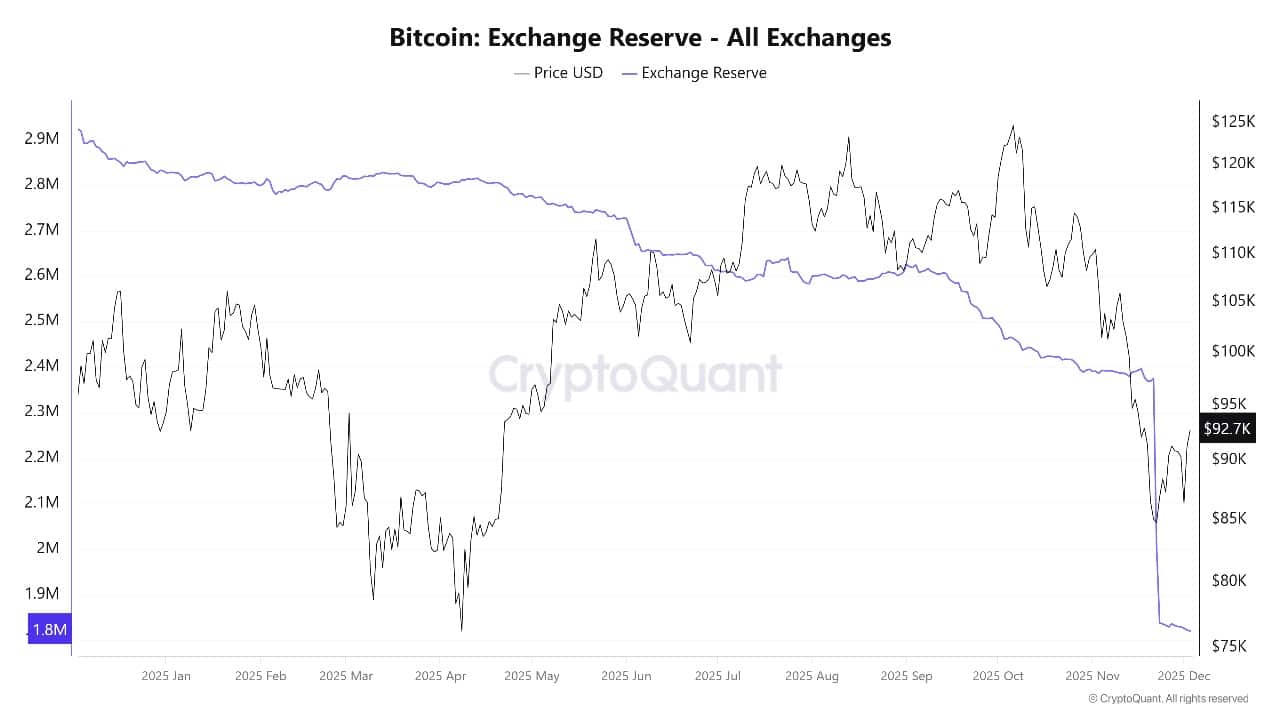

Change balances have began to tick decrease once more in addition to cash transfer again into chilly storage, which normally indicators renewed accumulation fairly than ongoing panic promoting.

Bitcoin Change Reserve (All Exchanges) Supply: CryptoQuant

Bitcoin Value Prediction: Key Ranges To Watch

The every day chart exhibits Bitcoin rebounding from a latest low close to $80,000, with the worth now buying and selling round $92,800 and making an attempt to push again above a descending resistance line that began from the November high.

The 50‑day easy shifting common (SMA) sits simply above $100,000, whereas the 200‑day SMA is greater close to $110,000, making a technical zone that bulls have to reclaim to verify that the broader uptrend is again in full management.

The RSI is recovering from oversold territory towards the mid‑40s to low‑50s space. In the meantime, the MACD is making an attempt to show upward from destructive values, and the ADX across the excessive‑30s exhibits the latest downtrend was sturdy however might now be shedding steam.

BTCUSD Evaluation Supply: Tradingview

If patrons can push BTC above the downward sloping inexperienced resistance channel proven on the chart, the subsequent upside targets sit close to $109,500 (across the 200‑day SMA) after which the prior vary highs round $126,000, which match the higher inexperienced development line.

On the draw back, rapid assist is discovered slightly below $90,000 alongside the mid‑channel line, with stronger assist nearer to $74,000.

A transparent break beneath that decrease inexperienced assist band on the chart would warn that the latest bounce has failed and open the door to a deeper correction earlier than bulls attempt once more.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection