On-chain knowledge exhibits each main Bitcoin cohort is now aligned in conduct, with accumulation being dominant throughout the community.

Bitcoin Accumulation Development Rating Is Hinting At Market-Extensive Shopping for

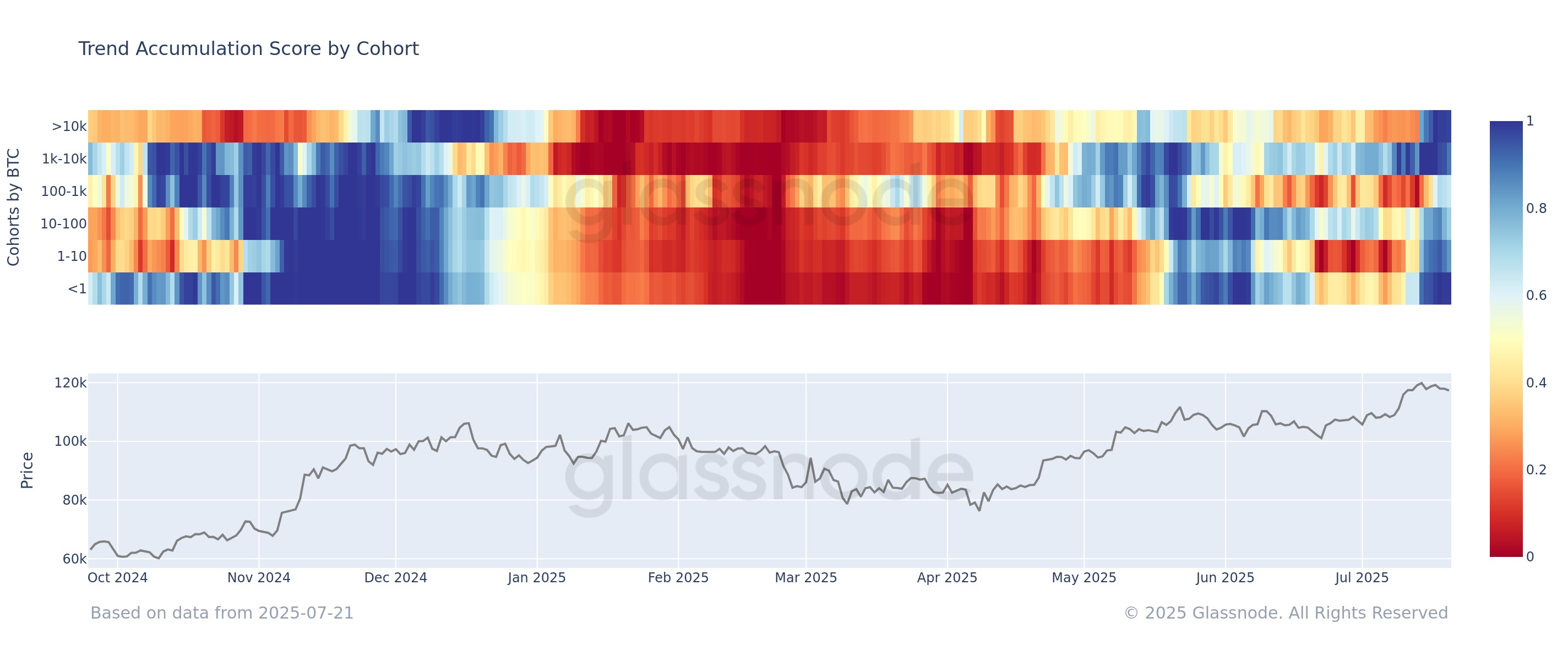

In a brand new put up on X, the on-chain analytics agency Glassnode has shared about how the conduct of the assorted Bitcoin cohorts has regarded from the attitude of the Accumulation Development Rating not too long ago. The Accumulation Development Rating is an indicator that tells us about whether or not the BTC traders are accumulating or distributing. The metric takes into consideration two elements when calculating its worth: the stability adjustments taking place within the wallets of the holders and the scale of the wallets themselves. The second weighting issue implies that bigger entities have a bigger affect on the rating.

The metric’s worth can lie between 0 and 1, with the 2 extremes akin to good behaviors of accumulation and distribution, respectively. The 0.5 mark acts because the boundary between the 2 sorts of behaviors.

Now, here’s a chart that exhibits the pattern within the Bitcoin Accumulation Development Rating for various segments of the community over the previous 12 months:

The worth of the metric seems to have been fairly near 1 in latest days | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin Accumulation Development Rating was exhibiting combined conduct throughout the investor cohorts earlier, implying the holders have been divided on the cryptocurrency’s consequence. Lately, nevertheless, a shift has occurred, with all investor teams exhibiting some extent of accumulation. Three cohorts specifically stand out for his or her aggression: shrimps, whales, and mega whales.

The shrimps, traders with lower than 1 BTC, have been exhibiting gentle distribution earlier than the most recent rally, however following it, they’ve modified their tune and began exhibiting aggressive accumulation as a substitute. The whales, holding between 1,000 and 10,000 BTC, have been already shopping for with conviction when the remainder of the market was unclear, they usually have solely continued this pattern for the reason that new all-time excessive (ATH) within the asset.

Lastly, the most important of holders on the community, these with greater than 10,000 BTC, have damaged a distribution streak to point out ranges of shopping for not seen since December 2024. “The alignment throughout pockets sizes suggests broad-based conviction behind the present BTC uptrend,” notes Glassnode.

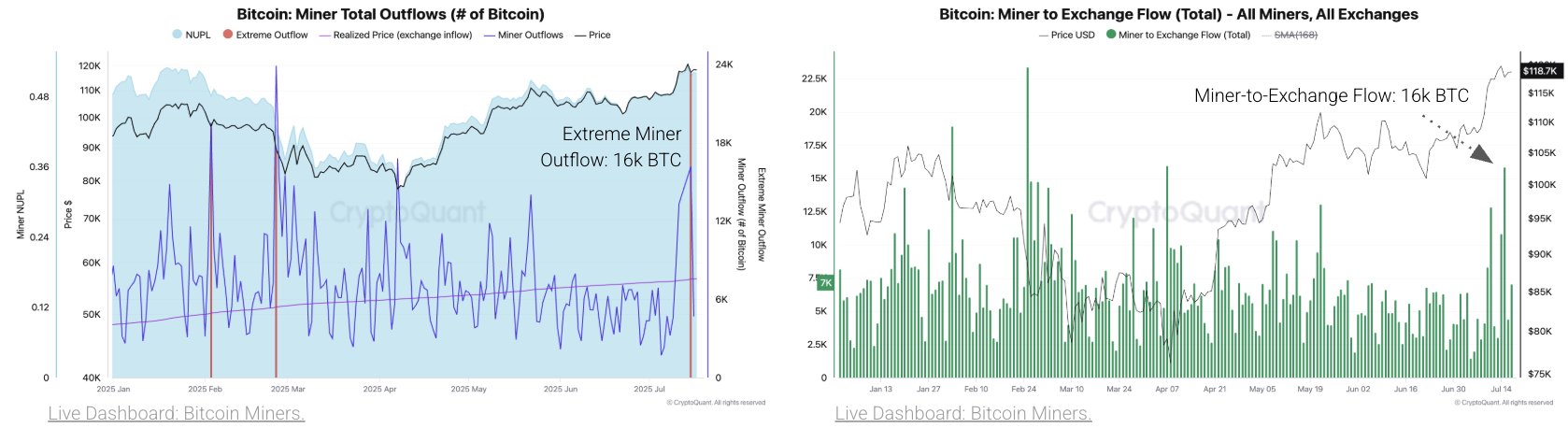

Whereas the traders as a complete have been shopping for, it’s not like there hasn’t been any promoting achieved in any respect. One group that has been liable for distribution within the newest leg of the rally has been the miners, in accordance with knowledge from analytics agency CryptoQuant.

The pattern in a few miner-related indicators | Supply: CryptoQuant on X

As is seen within the left chart, Bitcoin miners made a major quantity withdrawals from their wallets not too long ago. What they needed to do with these cash could also be answered by the second graph, which exhibits many of the 16,000 BTC outflow went to centralized exchanges.

Miners deposit to those platforms once they wish to promote, so this withdrawal spree may very well be a sign that this cohort took benefit of the rally to take earnings.

BTC Value

Bitcoin has taken to sideways motion in the course of the previous week as its value remains to be floating across the $118,000 degree.

Appears like the worth of the coin has cooled down in latest days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.