Because the Bitcoin white paper marks its seventeenth anniversary, the world displays on how a easy e-mail from Satoshi Nakamoto reworked international finance. Seventeen years in, BTC crypto is now leaving its adolescence and coming into maturity. From its humble beginnings at $0.00076 to at the moment’s Bitcoin worth USD of over $109,980, Bitcoin’s story shows the world’s largest rise of a decentralized monetary revolution.

From E-mail to Revolution: The Genesis of Bitcoin

On October 31, 2008, Satoshi Nakamoto launched the Bitcoin white paper to a mailing listing of cryptography fans below the topic line “Bitcoin P2P e-cash paper.”

The mail was fairly temporary, describing a peer-to-peer digital forex system. This laid the groundwork for what BTC has turned out to be at the moment, because the world’s first decentralized financial community.

Simply over a few months later, in early 2009, the primary Bitcoin block, often known as the Genesis Block, was mined. That started as a small experiment, which later developed right into a monetary revolution.

In its early days, Bitcoin crypto traded at mere fractions of a cent on platforms like New Liberty Customary in 2009, in line with a Reddit dialogue submit, the place a single BTC was valued at simply $0.0007639.

Quick ahead to 2025, and the Bitcoin worth chart tells a very jaw-dropping and bone-breaking story. Right now’s Bitcoin worth USD is close to $109,890, representing an astronomical 14.6 million % achieve since its inception. That is an achievement unmatched within the historical past of contemporary finance, having surpassed each shiny steel in existence by way of the quickest beneficial properties.

Seventeen Years of Change: From Skepticism to World Integration

“Seventeen years to the Bitcoin Whitepaper! This isn’t simply an anniversary; it’s the second when the whole crypto area transitioned from thought to actuality.It nonetheless holds the crown, accounting for over half of the market cap, and each innovation we see will be traced again to that one doc. The legacy is straightforward: the way forward for finance is constructed on transparency, know-how, and the collective perception in an open system.“

-Edul Patel, CEO of Mudrex.

Over the previous 17 years, perceptions round Bitcoin have undergone an entire transformation. What was as soon as dismissed by establishments and governments is now acknowledged as a strategic asset of significance.

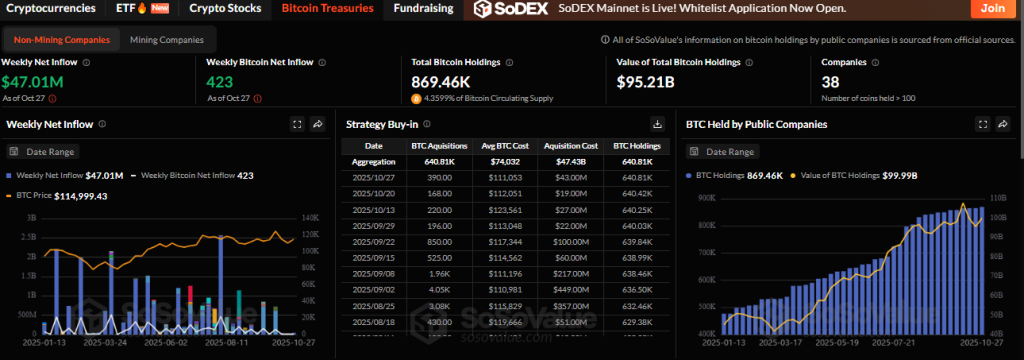

Because of its demand, the value has elevated considerably, which is obvious proof of this. Main companies now maintain Bitcoin of their treasuries, whereas nations like US, China, El Salvador, and others have built-in it into their official reserves.

The launch of spot Bitcoin ETFs in Q1 2024 marked one other vital shift, offering institutional buyers with safe, regulated publicity to BTC. The BTC ETF complete web property have reached $143.94 billion with 12 ETF issuers.

This transfer strengthened Bitcoin’s legitimacy and deepened its integration into international monetary programs. The Bitcoin white paper seventeenth anniversary arrives at a time when Bitcoin instructions a $2.18 trillion market cap and dominates 59.4% of the whole crypto market.

Its shortage is much more enticing than gold. With a tough cap of 21 million cash, its worth proposition as “digital gold” has solely grown stronger. This remained Bitcoin’s defining characteristic, and its quick development on its Bitcoin worth chart is obvious proof.

Mixed with rising institutional frameworks and an inflation-hedge narrative, Bitcoin continues to draw new waves of capital amid international financial uncertainty.

Macro Tailwinds and Yr-Finish Value Outlook

Regardless of latest volatility, Bitcoin worth at the moment stays resilient, holding agency close to $109,980 whilst international markets confronted dangers from the U.S. authorities shutdown. The Federal Reserve’s latest 25-basis-point charge lower, coupled with its determination to finish quantitative tightening (QT) on December 1, 2025, might show pivotal for Bitcoin’s subsequent transfer.

If these financial shifts inject new liquidity into markets, Bitcoin worth prediction fashions level towards a possible retest of $120,000 within the quick time period or perhaps a retest of its ATH degree.

Nonetheless, the long-term BTC narrative stays strongly bullish, with $126,296 being flipped, $135K can be the primary goal out of many larger.

As 2025 approaches its ultimate months, the Bitcoin white paper legacy stands as a testomony to resilience, innovation, and unstoppable international adoption.