Ethereum is at present buying and selling above the $3,000 stage, providing a surface-level sense of stability after weeks of volatility. Nevertheless, beneath this value resilience, market sentiment stays decisively bearish. Many analysts are brazenly calling for decrease ranges within the coming months, citing weakening momentum, macro uncertainty, and chronic promoting stress throughout threat belongings. Excessive concern dominates positioning, with buyers displaying little conviction that the current restoration can evolve right into a sustained uptrend.

This pessimistic backdrop makes current institutional-linked exercise stand out. Amid widespread warning, knowledge means that Bitmine—an entity related to Fundstrat’s co-founder Tom Lee—has elevated its publicity to Ethereum.

Bitmine is a digital asset mining and funding car centered on long-term participation in blockchain infrastructure, combining mining operations with strategic accumulation of main crypto belongings. Somewhat than buying and selling short-term value swings, entities like Bitmine usually function with a multi-year horizon, emphasizing community fundamentals and uneven upside.

The distinction is notable. Whereas retail and short-term contributors stay defensive, longer-term capital seems keen to step in during times of concern. Traditionally, such divergence between sentiment and positioning has usually emerged close to transitional phases out there cycle.

Bitmine Expands Ethereum Publicity Amid Market Concern

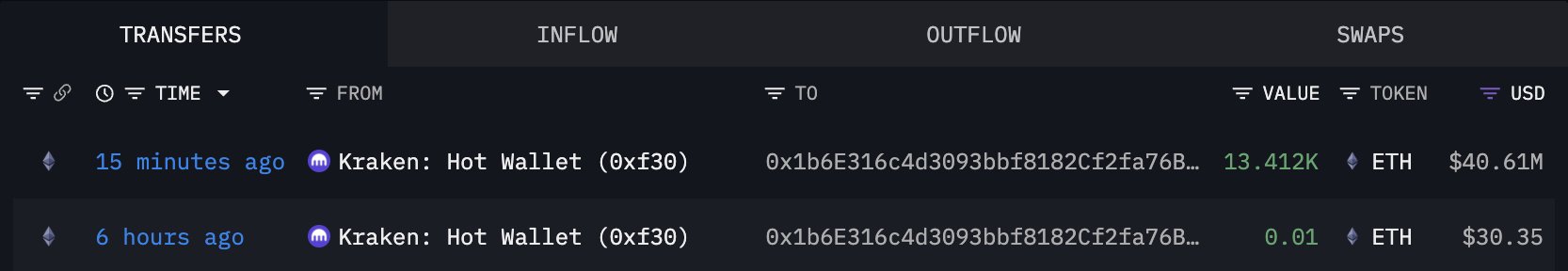

On-chain knowledge from Arkham confirms that Bitmine has added one other 13,412 ETH to its holdings, an acquisition valued at roughly $40.61 million at present market costs. The acquisition comes at a time when Ethereum sentiment stays deeply bearish, reinforcing the distinction between short-term market concern and long-term capital positioning.

Following this newest accumulation, Bitmine’s complete Ethereum holdings now stand at roughly 3.769 million ETH, with an estimated market worth of round $11.45 billion. This locations Bitmine among the many largest recognized Ethereum holders globally, highlighting the size and conviction behind its technique.

Such positioning will not be according to short-term hypothesis. As a substitute, it displays a deliberate method centered on long-duration publicity to Ethereum’s community worth and future position inside the digital asset ecosystem.

Bitmine’s accumulation conduct suggests confidence in Ethereum’s long-term fundamentals regardless of near-term volatility and widespread pessimism. Traditionally, large-scale purchases during times of maximum concern have usually occurred when costs commerce under perceived intrinsic worth.

Whereas this exercise doesn’t get rid of the danger of additional draw back within the coming months, it indicators that structurally affected person capital continues to deploy. The rising divergence between bearish sentiment and aggressive accumulation underscores a market setting the place positioning, relatively than headlines, might provide clearer perception into longer-term expectations.

Some buyers are utilizing present pessimism as a possibility to construct publicity, reinforcing the concept fear-driven environments may entice structurally affected person patrons.

Ethereum Worth Struggles to Rebuild Bullish Construction

Ethereum is at present buying and selling simply above the $3,000 stage, trying to stabilize after a protracted corrective part. The chart exhibits that ETH stays under its key medium-term shifting averages, with the 50-day and 100-day MAs nonetheless appearing as dynamic resistance overhead. Every current try and push larger has been met with promoting stress, highlighting the market’s issue in reclaiming bullish momentum.

Structurally, the worth motion because the October peak displays a transparent sequence of decrease highs and decrease lows, confirming that ETH remains to be working inside a bearish development on the day by day timeframe. Though the current bounce from the $2,800–$2,900 zone suggests the presence of demand, quantity stays muted in comparison with earlier growth phases, indicating an absence of conviction from patrons. This helps the view that the present transfer is corrective relatively than the beginning of a brand new impulsive rally.

From a help perspective, the $2,900 space is now vital. A sustained lack of this stage would expose ETH to a deeper retracement towards the $2,600–$2,700 area, the place prior consolidation occurred. On the upside, bulls would wish a decisive day by day shut above the descending shifting averages close to $3,300 to invalidate the bearish construction.

General, the chart factors to consolidation underneath resistance relatively than development reversal. Till ETH reclaims key shifting averages with increasing quantity, value motion suggests ongoing distribution and elevated threat of additional draw back.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.