2025 was a difficult 12 months for the cryptocurrency market and trade, and it didn’t spare the spot Bitcoin exchange-traded funds (ETFs). The US-based Bitcoin ETF market skilled moist and dry spells in equal proportions over the course of the 12 months.

Nevertheless, BlackRock’s spot Bitcoin ETF, iShares Bitcoin Belief (ticker: IBIT), has been a standout performer at occasions this 12 months. Based on the most recent market information, the product’s efficiency in 2025 has earned it a spot amongst a few of the greatest funds within the world ETF market.

BlackRock’s IBIT Data $25 Billion Internet Influx In 2025

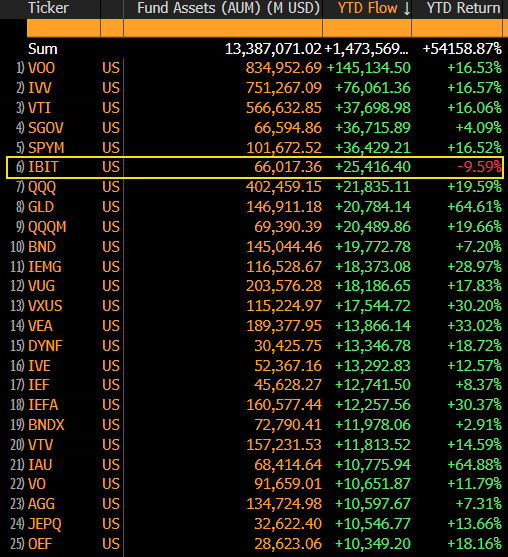

In a current submit on the social media platform X, senior Bloomberg analyst Eric Balchunas revealed that BlackRock’s Bitcoin ETF has ranked sixth in internet capital inflows previously 12 months. This feat comes regardless of the BTC exchange-traded fund posting a unfavourable return in the identical interval.

Based on information shared by Balchunas, BlackRock’s IBIT registered a internet influx of roughly $25 billion up to now this previous 12 months. What’s attention-grabbing is that the Bitcoin ETF pulled on this vital capital regardless of being the one fund with unfavourable efficiency among the many conventional fairness and bond ETFs, as noticed within the chart beneath.

Supply: @EricBalchunas on X

Apparently, SPDR’s GLD ETF, the world’s largest bodily backed gold exchange-traded product, lags behind BlackRock’s IBIT when it comes to capital inflows regardless of its 64% return within the 12 months. Notably, Vanguard’s S&P 500 ETF (VOO) led the cohort with a year-to-date capital influx of over $145 billion.

Moreover, Balchunas highlighted that whereas the crypto neighborhood would naturally complain in regards to the Bitcoin ETF’s yield, it is usually necessary to acknowledge the numerous feat of attracting the sixth-largest capital regardless of this unfavourable return. Based on the ETF skilled, this yearly efficiency is an efficient check in the long run.

Balchunas wrote:

If you are able to do $25b in a nasty 12 months, think about the move potential in 12 months.

The Bloomberg analyst did credit score the older, long-term traders (the boomers) in what he referred to as a “HODL clinic” for the constructive internet inflows seen by BlackRock’s Bitcoin ETF.

Bitcoin ETFs Report $497 Million Weekly Outflow

Based on SoSoValue information, the US-based Bitcoin ETFs closed the week with a complete internet outflow of $158 million on Friday, December 19. This introduced the ETFs’ report to about $497.05 million in outflows over the previous week.

The dismal run of performances within the Bitcoin ETF market may be seen within the worth motion of the premier cryptocurrency in current weeks. The Bitcoin worth is down by precisely 30% from its all-time excessive of $126,080.

As of this writing, the value of BTC stands at round $88,293, reflecting a 2% decline previously seven days.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Getty Photographs, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.