BNB worth has entered a decisive corrective section, sliding greater than 6% and breaking beneath the psychological $600 degree amid a broader crypto market downturn. The transfer was not random. Worth motion confirms a bearish flag breakdown on the every day timeframe, signaling that the latest consolidation was a continuation sample quite than a base-building construction. With market sentiment turning defensive and threat urge for food fading throughout main altcoins, BNB worth now faces mounting promoting strain at a vital juncture.

Bearish Flag Breakdown Shifts BNB Worth Decrease: Is $500 the Subsequent Cease?

BNB worth spent a number of periods forming a decent upward sloping channel following its prior decline, a textbook bearish flag formation. This sample sometimes indicators momentary aid bounce earlier than one other leg decrease, and the latest selloff validates that construction. The breakdown occurred close to the $620 rejection zone, the place sellers repeatedly capped upside makes an attempt. As soon as BNB worth misplaced the $600 help degree, promoting strain deepened, confirming that patrons had been unable to soak up provide at key resistance.

The momentum indicators are additionally titling bearish, with RSI and MACD showcasing bearish crossover. The breakdown with heightened quantity provides credibility to the transfer, indicating bearish conviction quite than a low-liquidity drift decrease.

With BNB worth now buying and selling beneath $600, this former help turns into rapid resistance. Any short-term bounce towards $600–$610 is prone to face renewed promoting strain except broader market circumstances enhance.

On the draw back, the primary technical checkpoint sits close to $560, a minor intraday response degree. Nonetheless, the extra important demand band lies between $520 and $500, the place historic shopping for curiosity beforehand emerged. A clear break beneath $500 would alter the broader medium-term construction and will expose deeper retracement ranges, although for now, the market is specializing in whether or not bulls can defend the mid-$500 area.

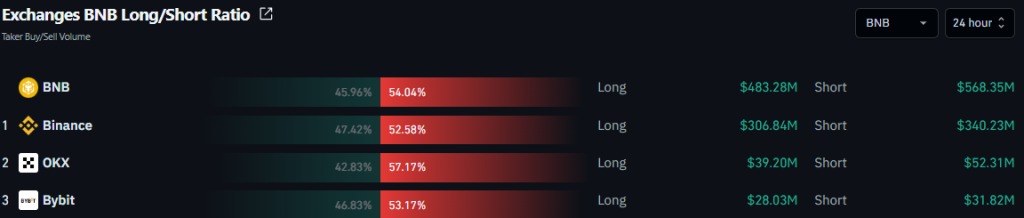

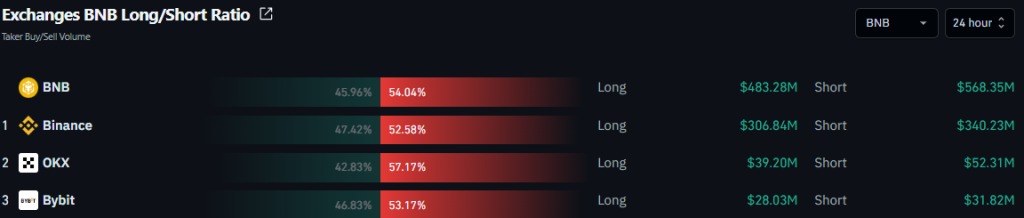

High Trade Positioning Reveals Shorts in Management

Spinoff information positioning provides weight to the bearish continuation narrative throughout the foremost exchanges over the previous 24 hours. On Binance, quick publicity stands close to $584 million in comparison with roughly $492 million in lengthy positions, indicating that sellers at the moment keep management of directional leverage On OKX, the place roughly $351 million in shorts outweighs almost $315 million in lengthy contracts, reinforcing the broader tilt towards draw back expectations amongst lively derivatives merchants. Bybit additionally displays this imbalance, with quick positions round $53 million exceeding lengthy publicity close to $40 million, suggesting that speculative positioning stays skewed in favor of additional correction quite than rapid restoration.

This constant dominance of quick publicity throughout the highest three exchanges indicators that market members should not but positioning aggressively for a rebound. As a substitute, merchants seem like leaning into continuation threat, notably after the confirmed bearish flag breakdown beneath the $600 threshold. Furthermore, Liquidation information additional helps this view. As BNB slipped below key help, leveraged longs had been flushed out, accelerating draw back momentum. In the meantime, cumulative quick liquidity now clusters above the $610–$620 area, which means any sharp restoration into that zone may set off compelled shopping for. Till that degree is reclaimed decisively, nevertheless, derivatives positioning continues to favor sellers.

Can $500 Change into the Subsequent Magnet?

BNB worth stays structurally weak beneath $600. The confirmed bearish flag breakdown shifts technical focus towards the $520–$500 area as the subsequent significant help cluster. A aid bounce towards $600–$610 is feasible, particularly if broader market circumstances stabilize. Nonetheless, with out a sustained reclaim of $610 accompanied by rising quantity and bettering lengthy/quick ratios, upside strikes are prone to be handled as corrective. If sellers keep management and derivatives positioning continues to favor shorts, the $500 zone may act as the subsequent magnet for liquidity earlier than any sturdy reversal try develops.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict Editorial Tips based mostly on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked in opposition to respected sources to make sure accuracy, transparency, and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We attempt to offer well timed updates about all the pieces crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the creator’s personal views on present market circumstances. Please do your personal analysis earlier than making funding selections. Neither the author nor the publication assumes duty on your monetary selections.

Sponsored and Ads:

Sponsored content material and affiliate hyperlinks could seem on our website. Ads are marked clearly, and our editorial content material stays fully unbiased from our advert companions.