Written by: The MacroButler

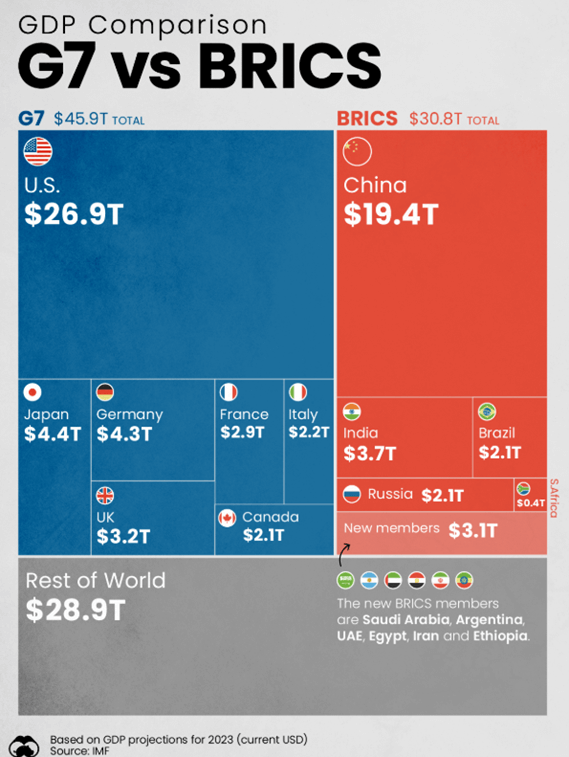

Past the fading grandeur of the G7 and G20—golf equipment of countries cast within the aftermath of World Battle II and now mired in financial stagnation and demographic decay—a brand new alliance has emerged on the geoeconomic map: BRICS+.

This coalition—Brazil, Russia, India, China, and South Africa—represents a rising league of countries decided to broaden their commerce affect, safe useful resource flows, and accumulate the financial surpluses that when enriched Europe’s nice empires.

First conceived in 2001 by ‘Authorities Sachs’ economist Jim O’Neill as “BRIC,” the time period started as a mere market classification for economies whose progress threatened to redraw the steadiness of worldwide commerce. However what started as a banker’s shorthand swiftly grew to become a council of ambition. By 2006, the unique 4 have been already assembly to strengthen business ties, coordinate funding, and align political methods. In 2009, their first official summit in Yekaterinburg marked greater than diplomacy—it signalled the return of a multipolar world, the place the commerce routes, assets, and bullion now not flowed solely to the outdated imperial capitals, however to new centres of wealth creation.

In 2010, South Africa was introduced into the fold, remodeling BRIC into BRICS and lengthening the league’s attain to Africa’s mineral-rich shores. From that second, BRICS matured from a market label right into a buying and selling and political bloc with imperial ambitions of its personal—decided to tilt the scales of worldwide commerce away from Western monopolies, rewrite the foundations of finance, and channel commerce and funding flows alongside routes they management, not these dictated by the G7, the G20, the IMF, or the World Financial institution.

By 2025, BRICS had grown into BRICS+, a formidable buying and selling confederation of 11 full members—Brazil, Russia, India, China, South Africa, Saudi Arabia, Egypt, the United Arab Emirates, Ethiopia, Indonesia, and Iran—controlling huge reserves of commodities and strategic items, alongside the markets and labour forces to refine and eat them. Additional increasing its attain, the bloc launched a brand new “companion nation” class on January 1, 2025, bringing Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Thailand, Uganda, Uzbekistan, and Nigeria into its orbit. Whereas not full members, these companions now take part in BRICS+ summits and ministerial conferences, and should endorse the bloc’s declarations, deepening their integration into its rising sphere of financial and political affect.

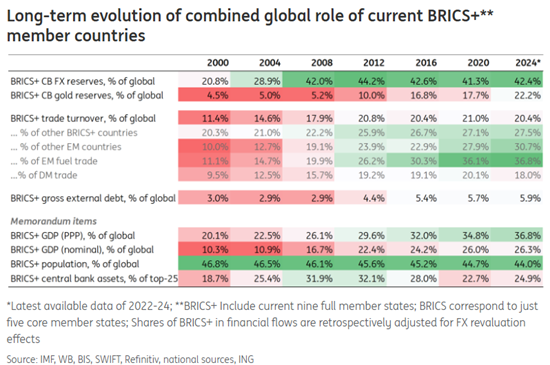

Collectively, these nations now command roughly 40% of worldwide output in buying energy phrases, in accordance with IMF figures from April 2025—surpassing the financial may of the outdated developed market powers in key arenas of commerce and manufacturing. By 12 months’s finish, their share is ready to climb to 41%, leaving the G7’s diminished 28% of their wake. The tide of bullion, commodities, and commerce is now not flowing to the getting old imperial ports of the West, however towards a rising consortium of resource-laden, market-hardened economies intent on securing the world’s wealth beneath their very own flags.

In inhabitants phrases, the BRICS command over 40% of the world’s individuals—a share that swells to an estimated 55.6% when their companion states, identified collectively as BRICS+, are counted. This huge reservoir of labour, shoppers, and troopers of commerce varieties the spine of the bloc’s increasing financial energy, guaranteeing that its markets develop not merely via commerce, however via the sheer demographic drive that has all the time underpinned nice mercantile empires.

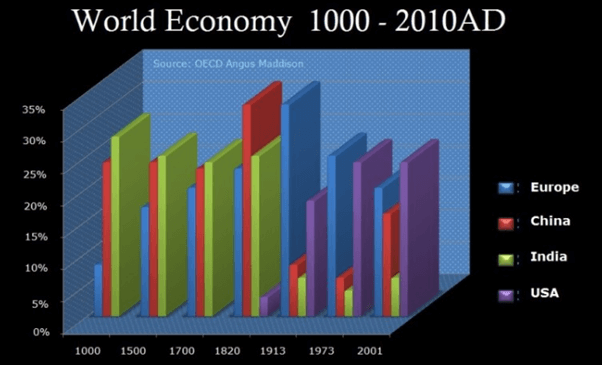

When you’ve learn a little bit of historical past—and even simply skimmed the CliffsNotes— the U.S. and the West haven’t been calling the financial photographs perpetually. The worldwide crown has handed via extra fingers than an affordable bottle of wine: Mesopotamia, Egypt, Persia, Greece, Rome, China, the Caliphates, Portugal, Spain, the Netherlands, Britain… all took their flip strutting on the world stage earlier than bowing out. Now BRICS+—Brazil, Russia, India, China, and South Africa—are lining up for his or her shot. And if historical past teaches us something, it’s that the financial sport of musical chairs by no means actually ends—somebody’s all the time about to seize the seat, and another person is about to hit the ground.

When nice powers begin fearing the longer term, the script hardly ever modifications—they stagnate, sulk, and fade. Ming China as soon as thought it had reached everlasting perfection, so it banned ocean voyages, shunned overseas commerce, and changed science with Confucian trivia. In the meantime, Europe was busy tripping over the New World and inventing buying and selling empires. Quick ahead to at the moment, and America appears to be auditioning for a Ming Dynasty reboot—unable to finance home infrastructure prices, allergic to world commerce, and comforted by the concept that being prime canine final century ensures the identical this one. Historical past suggests in any other case.

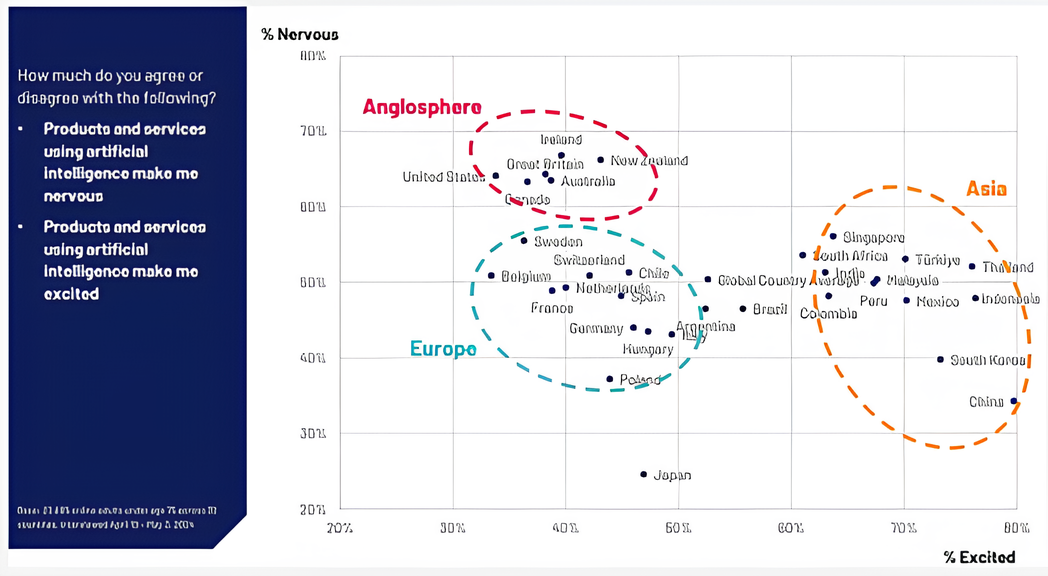

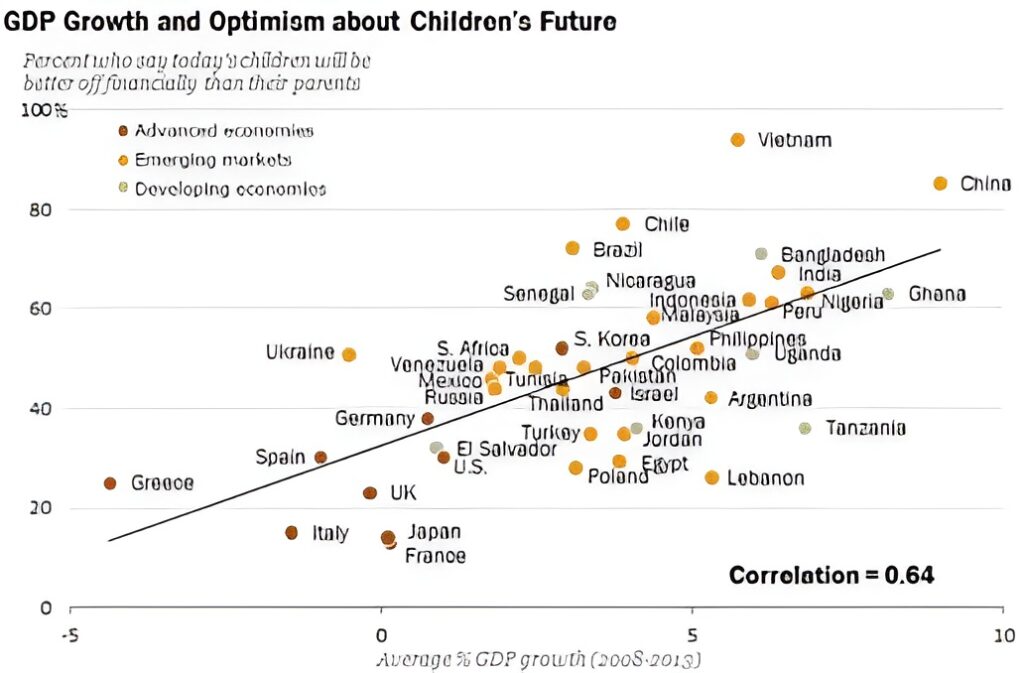

Individuals have spent a long time in a 2% progress bubble—sufficient to quadruple residing requirements over a lifetime, however sluggish sufficient that any five-year stretch seems like watching paint dry, punctuated solely by random disasters. Lose your job, your home worth, or a authorities contract, and years of “progress” vanish. No surprise change seems like a menace. Within the U.S., new tech means layoffs—encyclopaedia salesmen, carmakers, flip-phone giants, flooring merchants—one innovation at a time. In fashionable China, it’s the alternative: tech has been a golden escalator, lifting nearly everybody up so quick that shedding a job usually simply means discovering a greater one. The outcome? Individuals see change as a wrecking ball; the Chinese language see it as a development crane.

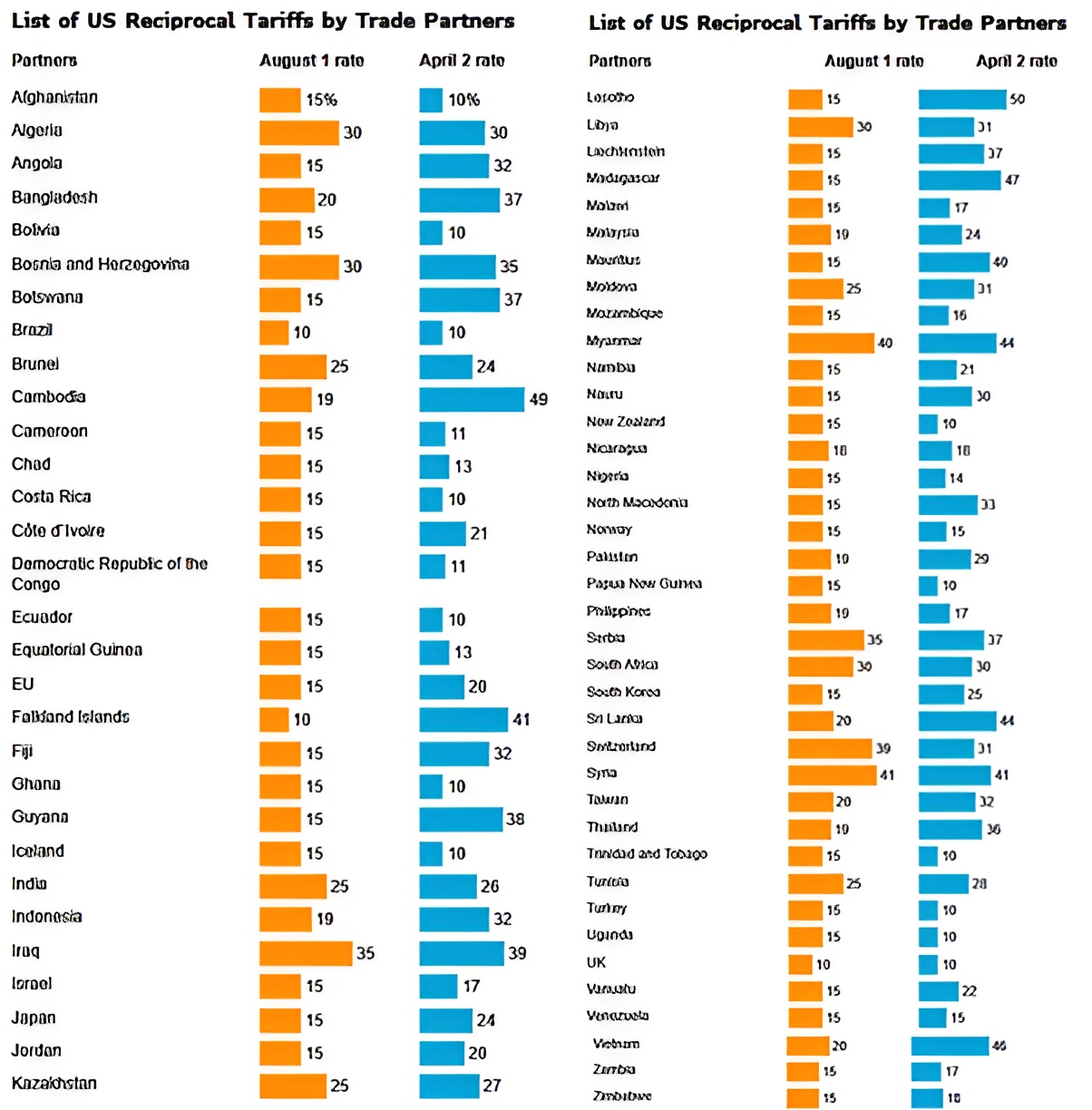

On August seventh, Donald Copperfield waved his magic tariff wand as soon as once more, proving tariffs aren’t simply financial instruments anymore—they’re geopolitical weapons geared toward BRICS and anybody daring to say “no thanks” to ‘Trumperialism’. Apparently, the Washington swamp’s favorite pastime stays spreading chaos beneath the guise of a Malthusian depopulation agenda, all whereas slapping new tariffs on the globe. Beginning August eighth at midnight ET, planet earth braced itself for a ten% world minimal tariff on imports. Canada’s tariff jumped from 25% to 35%—until you’re enjoying good beneath USMCA. Switzerland bought hit more durable, as much as 39%, inflicting some diplomatic huffing. In the meantime, 40 nations bought a 15% slap, a dozen-plus economies confronted even nastier hikes, and China and Mexico bought a 90-day keep of execution. Tariffs: the world’s new favorite geopolitical toy.

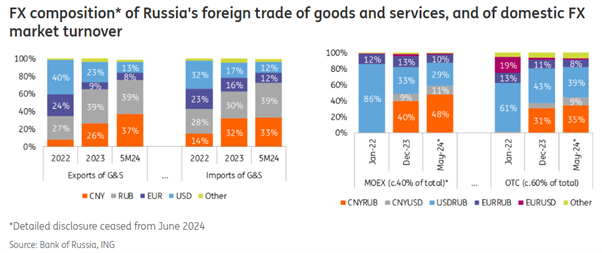

The rise of BRICS+ was virtually scripted by the Biden administration’s transfer to kick Russia off the SWIFT system—a transparent message that the U.S. is performing just like the world’s monetary dictator: comply or get lower off. Threatening China with the identical destiny if it helped Russia solely accelerated BRICS’ beginning as a geopolitical counterstrike. The plan to bankrupt Russia with sanctions backfired spectacularly. China dumped U.S. debt, and the World South caught on—U.S. monetary hegemony isn’t simply wielded; it’s weaponized. The so-called GENIUS Act? Simply the most recent chapter within the “management the cash, management the world” playbook, this time with a QR code. In the meantime, Europe, the U.S., and allies booted a number of Russian banks from SWIFT in early 2022—besides Gazprombank, as a result of Europe nonetheless wants its Russian fuel. The try to isolate Russia solely fuelled a brand new financial bloc decided to interrupt the greenback’s stranglehold—and rewrite the worldwide order.

The self-anointed “Peacemaker in Chief,” who in fact is the “Warmonger in Chief,” claws desperately to crush BRICS+ and cling to the greenback’s fading throne—a laughable charade. You’ll be able to’t drag nations to your darkish altar with threats and count on them to leap blindly into your abyss. BRICS+ rose like a phoenix from the ashes of those Neocon iron fists, the true puppeteers of U.S. overseas coverage. In the meantime, those that have performed the revolving door sport between Authorities Sachs and the US establishments pop champagne, basking within the chaos because the ‘Manipulator In Chief’ dances to their sinister tune, a marionette sure to their infernal rulebook as ‘Authorities Sachs’ and different wish to seize the assets of the World South as they tried to on the eve of the Asian Monetary Disaster in 1998.

The Neocon invoice—shamelessly backed by ruthless, un-American operatives from each events—is a darkish menace looming over worldwide safety. It hasn’t handed but, however any lawmaker who helps it deserves to be dragged out screaming, for they serve masters, not the individuals. Alongside this nightmare lurks the Commerce Evaluate Act of 2025, aiming to shackle tariffs with congressional chains—although the White Home snarls with veto threats. In the meantime, courts unravel the twisted legality of Trump’s tariffs, slapped on beneath a doubtful emergency legislation. Judges, from either side, see this as a monstrous energy seize—the likes of which hasn’t been witnessed in two centuries.

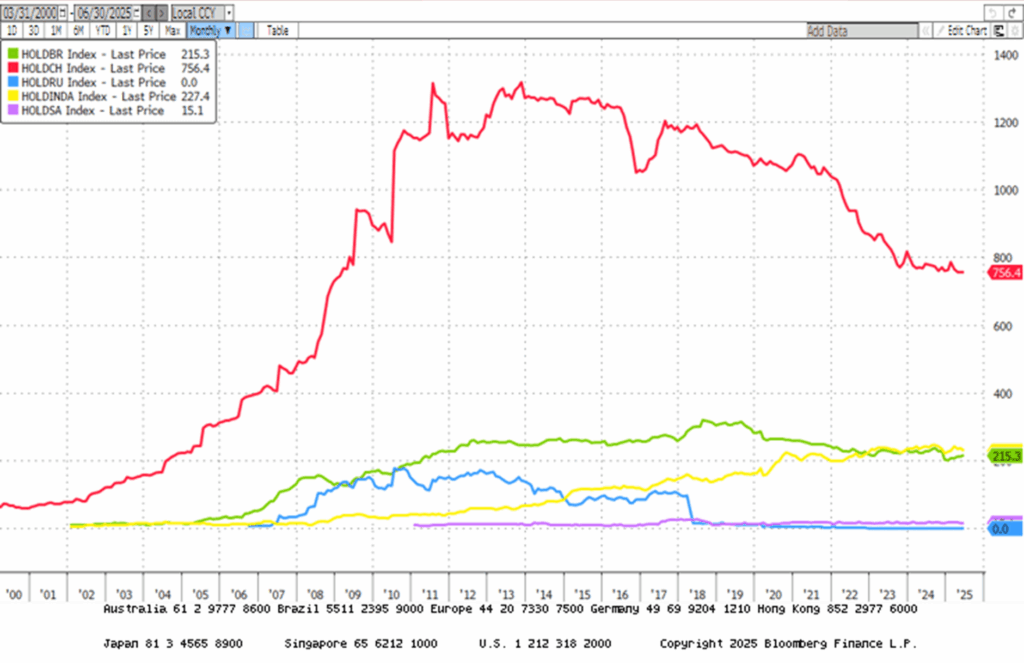

As holding USD property instantly became a geopolitical headache, it’s no shock that BRICS nations began dumping their U.S. Treasury holdings sooner than you’ll be able to say “unreliable commerce companion.” In spite of everything, why stick round when the U.S. may simply confiscate your property on a whim for not toeing their “American approach or the freeway” agenda? Particularly when that agenda conveniently entails stealing assets from rebellious nations like Russia—these courageous souls who dare to query the Malthusian depopulation plans cooked up by the American plutocracy. Who wouldn’t need out of that occasion?

US Treasury Holdings by Russia (blue line); China (pink line); India (Yellow line); Brazil (inexperienced line); South Africa (purple line).

The runner-up to the U.S. greenback in BRICS+ FX reserves is principally a blended bag of different developed-market currencies, holding a mixed 35% slice of the pie—whereas non-DM currencies barely make a dent. One massive hang-up? BRICS+ nations have simply 6% of the world’s exterior debt in comparison with the U.S.’s hefty 21%, making it robust for his or her currencies to go world.

On the commerce entrance, BRICS+ strikes a strong 20-21% of worldwide commerce—about $10 trillion a 12 months—however progress stalled after the monetary disaster because of China’s slowdown and falling oil costs. Nonetheless, the bloc’s members are cozying up, with intra-BRICS commerce climbing from 22% in 2008 to twenty-eight% now, and rising markets buying and selling with them much more. Gas commerce is the true star, doubling BRICS+’s share to 37%, making power the prime playground for de-dollarisation. With non-OECD oil demand now at 55% of the worldwide whole, who pays in what forex issues. Whereas strong stats are scarce, anecdotal experiences present renminbi, UAE dirham, and rupees being tossed round for power offers. India now pays Russia in Rubles and rupees. The renminbi’s the true heavyweight right here—Russia’s overseas commerce now prefers it over the greenback, because of the Financial institution of Russia stocking up on yuan, which made up 22% of its FX reserves. So, watch this house—BRICS+ may simply pull off the final word forex mic drop.

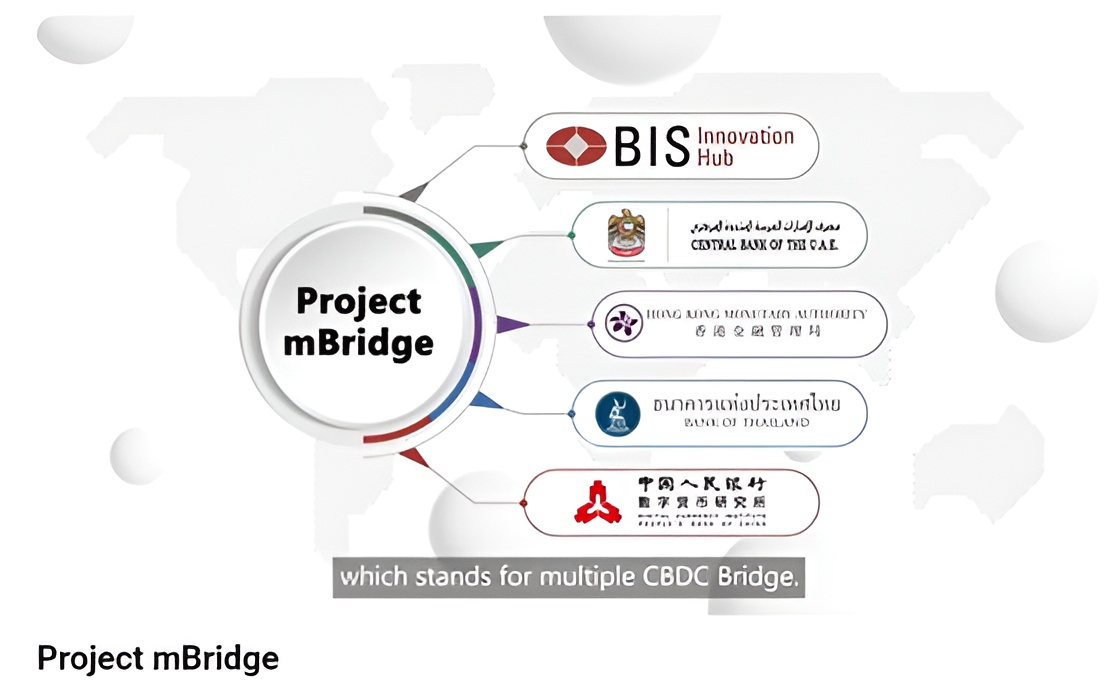

When BRICS talks about dumping the greenback, the m-Bridge undertaking usually will get name-dropped—a elaborate digital cash freeway led by the BIS and central banks from China, Hong Kong, UAE, and Thailand. It makes use of wholesale CBDCs to make massive cross-border funds sooner, cheaper, and nonstop. By bypassing the normal correspondent banking community—which frequently routes funds via the U.S. greenback and American banks SWIFT maze—m-Bridge seeks to cut back reliance on the greenback in world commerce settlements. The tech works, however getting all of the banks and regulators to agree and play good? That’s the true problem. After three years, they’ve barely rolled out a primary model. So sure, m-Bridge might at some point shake the greenback’s throne—however don’t maintain your breath. The revolution’s cooking, but it surely’s a sluggish simmer.

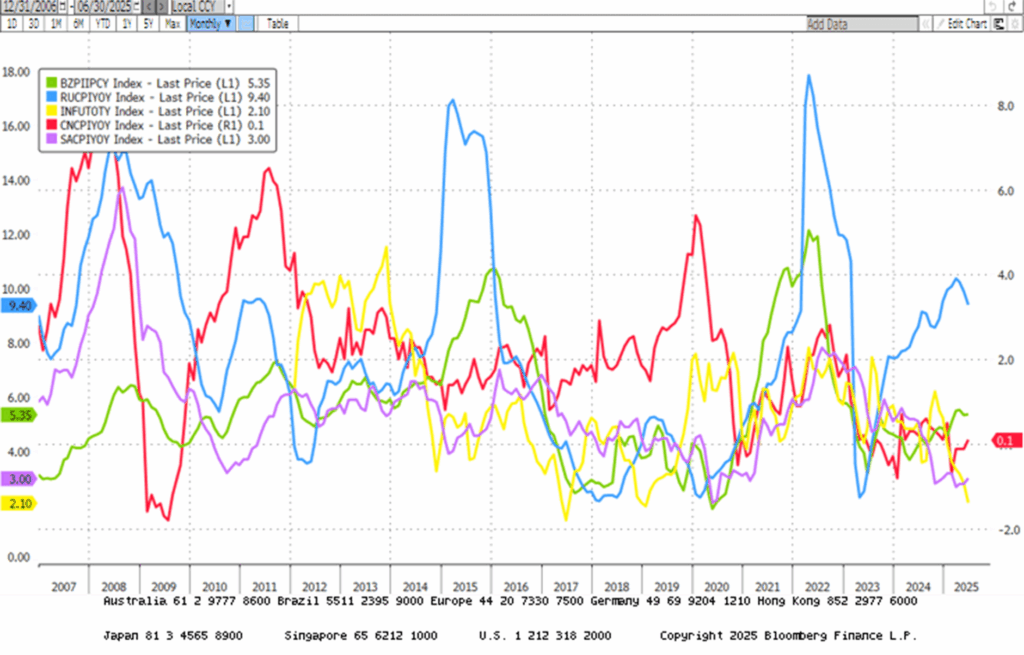

Numerous chatter a couple of BRICS forex to dethrone the greenback—however don’t maintain your breath. First, BRICS aren’t signing up for the globalist playbook the West’s been pushing since WWII. Second, they’ve all seen how the euro became a sovereignty-sapping headache, with looming debt defaults throughout Europe. And third, they’re not precisely marching in sync—China’s been caught in deflation since COVID, whereas Brazil and India wrestle with cussed inflation, which they really use to weaken their currencies in opposition to the greenback and handle debt. So yeah, a unified BRICS forex? Not anytime quickly.

CPI YoY Change in Russia (blue line); China (pink line); India (Yellow line); Brazil (inexperienced line); South Africa (purple line).

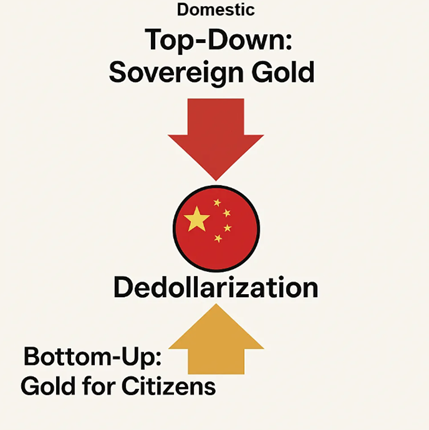

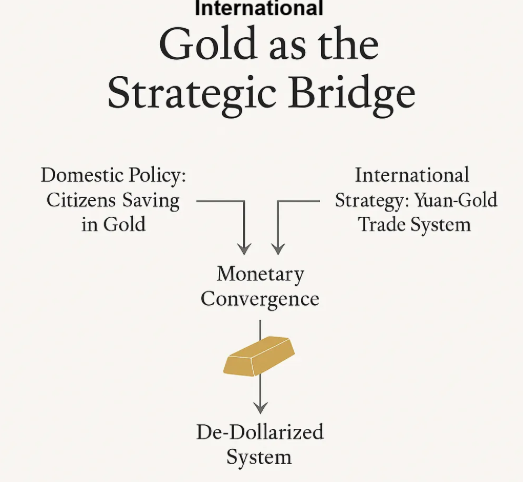

As a substitute of pushing for a BRICS forex or simply switching to the yuan as the brand new reserve forex, the savvy Chinese language leaders who get the headache of proudly owning the world’s reserve forex is quietly steering its individuals and authorities away from the U.S. greenback. Residents are being nudged to purchase gold, whereas the state builds a parallel commerce and finance system that skips the greenback altogether. The plan? Two separate tracks converging: a gold-backed home financial savings base meets a yuan-powered overseas commerce engine, creating a brand new, secure monetary center floor.

In contrast to the US which simply handed the ‘Genius Act’ to finance its perpetually wars and unfold its Malthusian agenda, China has aligned its targets with its individuals’s pursuits. It’s pushing the yuan for commerce with Belt and Street nations, whereas selling gold financial savings domestically. Internationally, gold acts as a assure for companions accepting the yuan. This gold-yuan combo varieties a bridge between nationwide ambitions and world commerce. BRICS nations are nudged towards a yuan-based system: promote uncooked supplies, receives a commission in yuan, then purchase completed items from China—closing the loop. If profitable, China will situation yuan bonds to foreigners, paying curiosity tied to gold’s worth as a hedge in opposition to forex debasement.

Suppose Bretton Woods 2 was the world on the USD customary backed by US gold? Bretton Woods 3 is BRICS on the RMB customary, with China on a gold-convertible customary.

It’s principally a reboot of what the US did post-WWII—constructing economies and affect by tying the world to its forex backed by gold. However China’s tweak? No fastened gold value and decentralized gold storage. Sensible strikes designed to dodge the pitfalls that sank Bretton Woods 2.

BRICS nations will get to peg their currencies to gold, the yuan, or no matter floats their boat. The yuan acts because the medium of trade, whereas gold serves as the final word retailer of worth. The system’s design nudges nations onto considered one of two paths: spend money on your individual financial system and watch your forex strengthen or persist with exporting uncooked supplies and turn into China’s financial satellite tv for pc.

It is going to be in all probability voluntary—however don’t child your self, the stress’s actual. Construct your business, and China turns into your companion: infrastructure, items, funding, the entire bundle. Ignore that, and also you’re caught dependent, very like how the US rebuilt Germany and Japan after WWII—besides now China’s the one doing the financing and franchising.

China’s enjoying the lengthy sport at residence too. It’s letting individuals purchase gold, providing gold-linked financial savings accounts, and pushing gold-backed funding merchandise. Subsequent up? Bonds backed by gold collateral. The purpose: construct belief within the monetary system—and reward that belief with earnings. So long as the U.S. retains wanting like a menace and the Chinese language authorities doesn’t mess up, that belief will continue to grow.

Internationally, China’s opening its bond market to overseas yuan holders, with returns pegged to gold to hedge in opposition to debasement. The cycle is straightforward: promote assets for yuan, fall again on gold as a security web, spend money on Chinese language bonds, and purchase Chinese language items. Sound acquainted? It’s principally WWII’s Marshall Plan 2.0.

China’s additionally intelligent about holding high-margin manufacturing at residence, promoting completed items overseas, and controlling the worth within the provide chain—not simply uncooked supplies.

Gold is the glue: it reassures different nations, retains home of us loyal, and steadies the ship because the greenback fades. Finally, the plan is to shift from gold to yuan as soon as the yuan earns sufficient belief—then possibly ditch gold if the time’s proper. Keep in mind, China invented summary cash and had markets earlier than capitalism was even a factor—they’re not enjoying dumb.

This isn’t some secret plot—it’s historical past repeating. Main cash system shifts comply with wars. Right now’s battlefield? Commerce offers, financial savings, and bonds. The blueprint is in movement.

The BRICS didn’t precisely wait round for the “Manipulator In Chief” to sprinkle further tariffs like confetti earlier than dialling down their love affair with U.S. Treasuries. Nope, they began ghosting Uncle Sam’s commerce occasion approach again in 2018 throughout the first act of “Donald Copperfield.” Guess they noticed the tariff magic coming and determined to tug a disappearing act early!

Exports from Russia (blue line); China (pink line); India (Yellow line); Brazil (inexperienced line); South Africa (purple line) into the US.

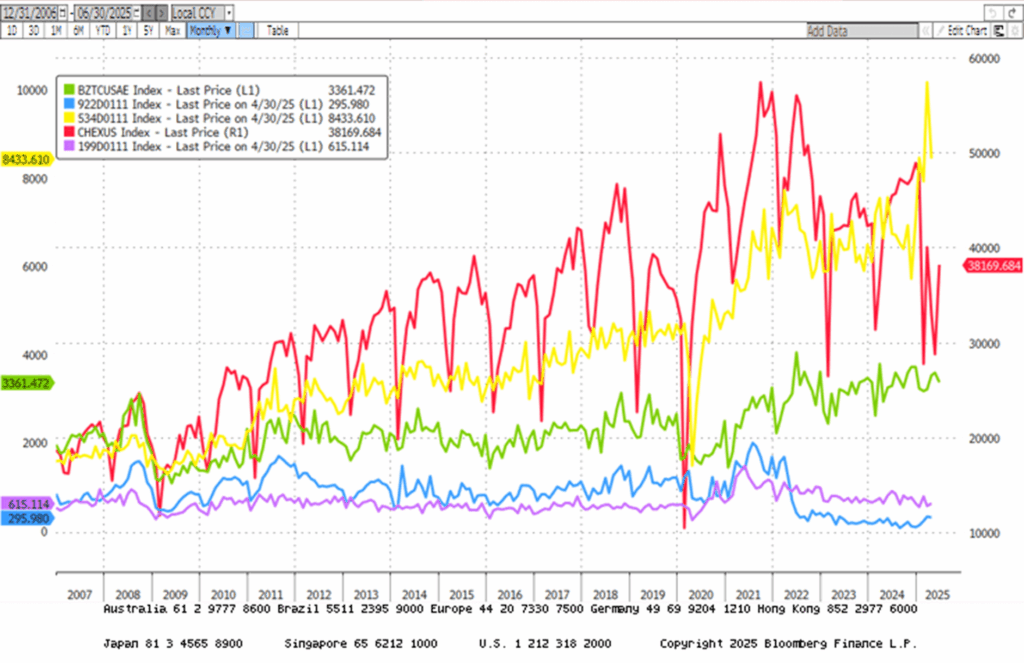

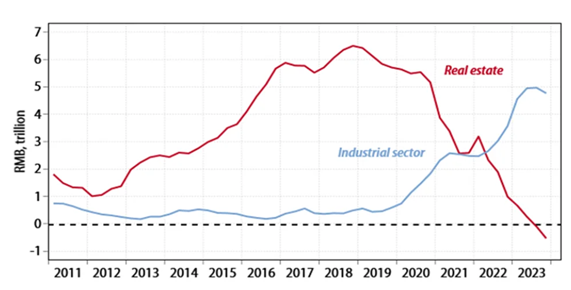

For all of the Western “China specialists” who’ve by no means set foot within the Center Kingdom and churn out papers from their cozy Texan workplaces: cease obsessing over China’s actual property disaster as if it’s the apocalypse. In contrast to the U.S., Chinese language corporations lean on financial institution loans—not fickle monetary markets—for progress. Since 2019, Beijing has redirected lending from actual property to high-tech industries like EVs, AI, and equipment, spawning world gamers like BYD, Huawei, and Zoomlion that crush Western opponents on value and high quality. In the meantime, the “actual property disaster” that supposedly dooms China? Beijing doesn’t even blink—Chinese language of us are housed, banks are state-controlled, and the federal government is gearing up for an industrial Blitzkrieg. In the meantime, the western world remains to be caught ready for the Germans to return via the Maginot Line, distracted by “saving the planet” whereas China speeds forward.

For these within the West nonetheless clinging to the fantasy that Asia is caught in trishaws and rice paddies, the 2025 World Robotic Convention in Beijing ought to’ve been a impolite awakening—showcasing corporations like Unitree, whose humanoid robots outpace something coming from the U.S., together with the pet undertaking of its very personal ex–American Rasputin.

Although missing centralized political energy, BRICS+ undeniably hinges on the rise of the Russia-China-India triumvirate—mixing Russia’s huge, low-cost pure assets, China’s cutting-edge manufacturing prowess, and India’s booming, hungry client market. Collectively, they kind a mercantilist powerhouse that’s reshaping the worldwide financial sport.

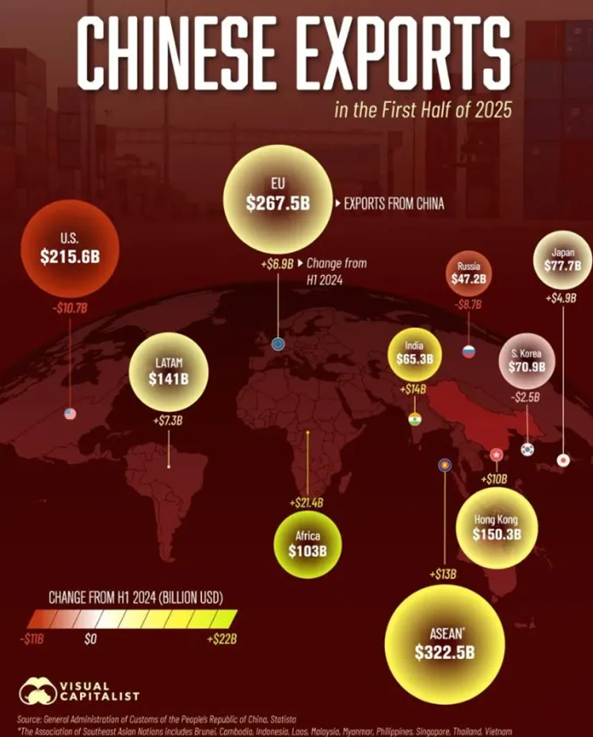

Within the first half of 2025, China’s exports inform a narrative: the World South is now the most well liked dance flooring, whereas the West is sitting out. ASEAN leads the occasion with $322.5B in imports, Africa’s exports surged by $21.4B, India’s buying spree grew by $14B, and Latin America stored the rhythm going with $7.3B extra. In the meantime, the U.S. and Wester Europe are exhibiting the chilly shoulder. China’s clearly hedging its bets, cozying as much as resource-rich, much less choosy companions within the World South to dodge Western commerce tantrums. It’s a savvy geopolitical pivot—much less drama, extra diversified buying carts. Appears to be like like the way forward for Chinese language exports isn’t Wall Avenue, it’s Essential Avenue… someplace across the equator.

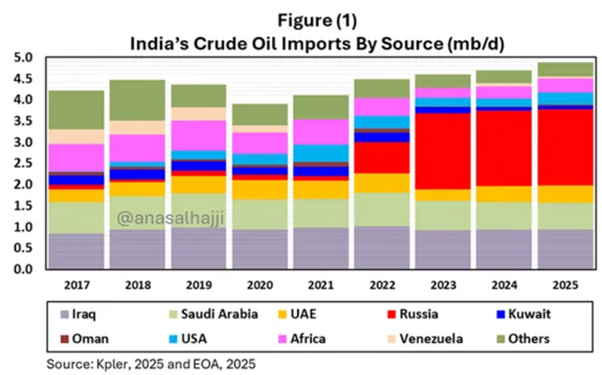

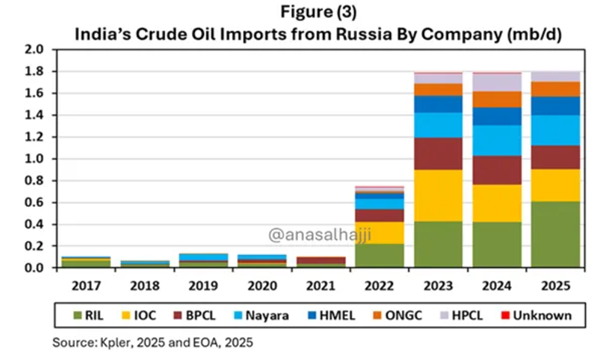

So, whereas chopping again on commerce with the U.S. and even Europe, BRICS+ nations are cozying up and buying and selling extra with one another. Take India’s love affair with Russian oil: imports skyrocketed from a modest 68,000 barrels per day pre-USD weaponization to over 2 million—as a result of why pay full value when you’ll be able to snag a reduction? Practically 40% of India’s crude now comes from Russia, at $10–$20 cheaper per barrel than Center Japanese oil. In the meantime, U.S.-India commerce hits $118 billion, with the U.S. operating a $45 billion deficit—so certain, slap on tariffs and threaten jobs, however India’s smirking behind the scenes. China’s nonetheless guzzling Russian oil too, and different Asian exporters can’t fill the void. G7 and EU sanctions might have rerouted oil flows however didn’t crimp world provide or demand, particularly not in India. India oil imports from Russia grew steadily, changing costly, high-shipping-cost crude from the U.S., Africa, and South America. A lot of the Russian reductions come from delivery complications, not refinery sweetheart offers. Certainly, India swapped expensive imports from afar for cheaper Russian barrels nearer to residence—making the sanctions and U.S. threats appear like an expensive sport of musical chairs no person wished to play.

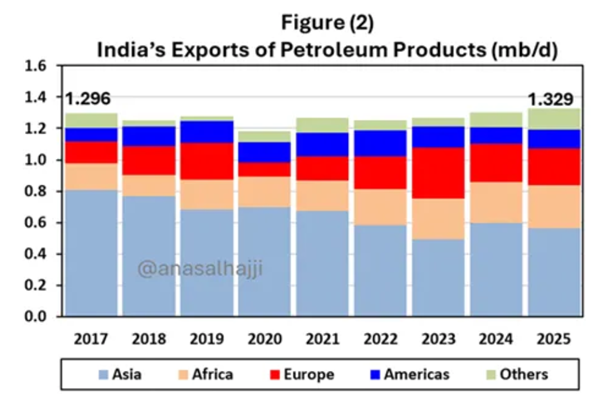

A well-liked fable amongst western warmongers claims India is importing tons of Russian crude simply to refine and export petroleum merchandise. However the info say in any other case: India’s petroleum product exports at the moment are just about the identical as in 2019—lengthy earlier than Russia invaded Ukraine. In actual fact, there was a refined shuffle slightly than a surge: exports to Europe have gone as much as exchange Russian merchandise banned by the EU in early 2023, whereas exports to Asia slipped. As Europe slowed and bought choosy about something linked to Russian oil, Indian refiners discovered new clients in Africa and elsewhere. If the EU tightens the ban, count on Indian merchandise to shift additional towards the Center East and Africa. Plus, Indian refineries can simply show they’re utilizing non-Russian crude, since they import lots from different nations already. Apparently, the G7/EU sanctions on Russian crude in late 2022 allowed imports of modified Russian oil—like refined merchandise—so Indian exports to the EU and US nonetheless comply with the foundations. In the meantime, new refineries in Kuwait, UAE, and Oman have stepped in to serve Asian markets that Indian exports used to cowl. So, no conspiracy right here—only a world sport of provide chain musical chairs.

One other fable floating round is that solely India’s non-public corporations import Russian crude. Nope—each non-public and government-owned refiners have been loading up on Russian oil for the reason that Ukraine invasion. So, it’s a group effort, not a personal occasion.

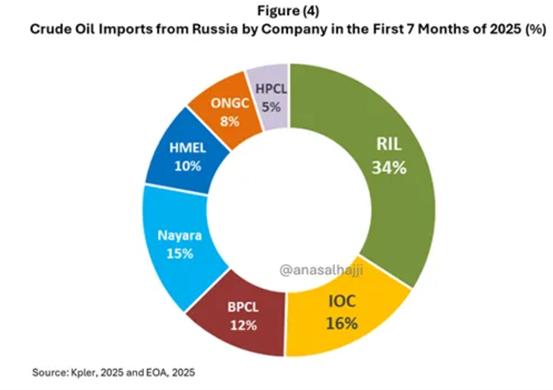

Right here’s the news: non-public corporations deal with about 60% of India’s Russian crude imports, with government-owned companies selecting up the remainder. Reliance Industries (RIL) alone accounts for roughly a 3rd of the full. On the federal government aspect, Indian Oil Company (IOC) brings in 16%, Bharat Petroleum Company (BPCL) 12%, and Oil and Pure Fuel Company (ONGC) 8%, with its subsidiary HPCL at 5%. Personal gamers Nayara and HMEL chip in 15% and 10%, respectively. The underside line? Nearly each Indian refiner has a chunk of the Russian crude pie.

One other basic case of BRICS mercantilism cashing in on the U.S. “tarrified” mess is how China and Brazil reorganized the espresso provide chain amid growing tariffs from Donald Copperfield. After the ‘Manipulator in Chief’ slapped Brazil—the most important South American financial system—with 50% tariffs on key items, China didn’t waste a second. As a substitute, it jumped in to cozy as much as Brazil’s espresso business, one of many hardest-hit sectors for the reason that U.S. has lengthy been the world’s prime espresso purchaser. China even flexed its assist by granting export permits to 183 new Brazilian espresso corporations for 5 years—as a result of apparently, espresso is changing into China’s new day by day important. In the meantime, Brazil’s President Lula isn’t shy about calling his BRICS buddies for backup—Xi Jinping, Modi, and Putin. China’s International Minister Wang Yi didn’t maintain again both, calling U.S. tariffs “bullying,” a violation of UN and WTO guidelines, and promising to ramp up cooperation with World South allies. Lula even proposed a BRICS summit to reply collectively to those tariffs, telling the ‘Bully In Chief’ he’s no “emperor of the world,” regardless of his world-domination fantasies.

To wage commerce amongst themselves, BRICS+ nations should safe the battlefield of commerce past the attain of Western Malthusians, whose technique is to sabotage their rise as a brand new mercantilist stronghold of prosperity.

When water is blocked, it seeks one other path; when a highway is barred, the smart traveller turns his steps elsewhere. So, it’s with nations. Mahan taught that mastery of the seas is mastery of the world, for ships carry the lifeblood of commerce, and commerce begets wealth, and wealth begets energy. For a century, the Anglo-American world rode upon these waves, their fleets guarding the ocean lanes, their currencies ruling the markets. But the ocean, huge as it’s, is however one face of the earth. Mackinder noticed one other reality: that the land, the “World Island” of Eurasia, is the axle upon which historical past turns. Railways, rivers, and roads bind its riches collectively, and whoever binds them beneath his rule might command the world with out setting sail.

In our time, the U.S. has sought to lock China inside the bars of its island chains, hemming it in like a hen in a gilded cage. However the dragon doesn’t beat its wings in opposition to the bars—it burrows via the earth. With the Belt and Street, China lays metal rails, pours concrete, and spins fibre throughout continents, weaving a web of affect that stretches from the Heartland to distant shores. Thus, as the ocean powers guard the tides, the land energy builds its highway, and the competition of empires flows on, like two rivers racing towards the identical sea.

After which there’s Russia.

After the 2022 invasion of Ukraine, the West unleashed its full arsenal of sanctions—no {dollars}, no euros, no Swift, no tank components, no chips, no Davos champagne toasts. Briefly, an try to exile Moscow from the ocean-based, dollar-dominated system. Russia’s reply? Double down on Mackinder’s imaginative and prescient—land energy over sea energy—by turning to its huge community of rivers. The Volga, the Don, the Ob, the Lena—names hardly ever heard in discussions of worldwide commerce—are being linked with ports, canals, and railways to knit collectively a Eurasian commerce artery that bypasses Western-controlled seas. In doing so, Moscow isn’t simply surviving sanctions—it’s redrawing the map of Eurasian connectivity.

When the river meets the mountain, each discover their course: China brings wealth and imaginative and prescient, Russia brings land and assets. Collectively, they weave roads, rails, and rivers into an internet the seas can’t contact, shaping a commerce realm past the attain of navies and sanctions. On this assembly of Heartland and ambition, the map of affect is redrawn—not by conquest, however by connection.

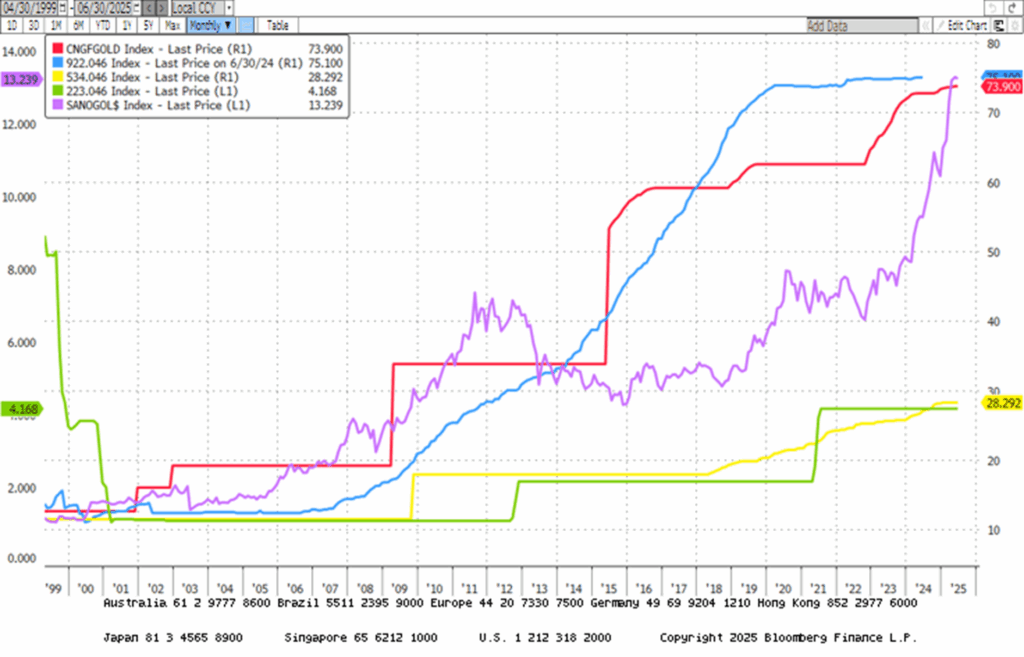

Briefly, BRICS+ are simply doing what economics 101 teaches—enjoying to their strengths and buying and selling sensible. Since 2022, they’ve additionally been on a gold-buying spree, now hoarding over 20% of the world’s gold. Q2 2025 noticed a 41% leap in gold grabs, as these nations ditch the U.S. greenback and chase monetary freedom. Russia and China are the golden heavyweights, holding almost three-quarters of BRICS’ stash. With over 10 new members becoming a member of in 2025, BRICS is popping the worldwide monetary sport right into a multipolar showdown, buying and selling extra in non-dollar currencies. Gold costs are hitting document highs because of world drama and diversification fever. Even India’s leaping on the bandwagon, including 19.2 tonnes final 12 months, as a result of when the cash will get messy, shiny metallic seems like a secure guess.

Gold Reserves in troy ounces in Russia (blue line); China (pink line); India (Yellow line); Brazil (inexperienced line); South Africa (purple line).

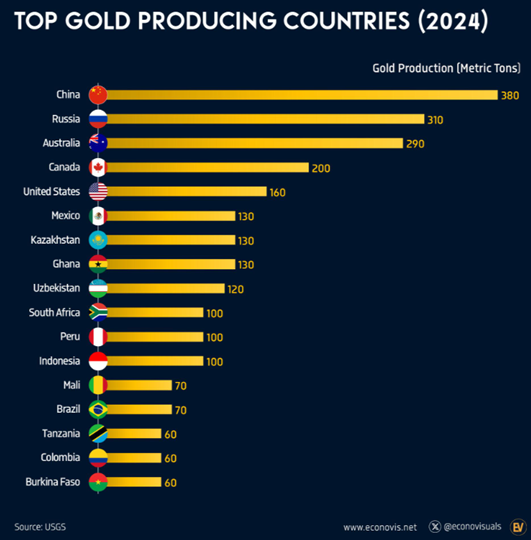

Not solely are BRICS and their new members busy piling up gold reserves whereas ditching US Treasuries, however few within the West understand additionally they sit on a number of the greatest gold deposits on the planet—making them prime gold producers too. Discuss having your shiny cake and consuming it!

From the geopolitical theatre standpoint, China’s made it clear: Russia received’t lose, as a result of subsequent up may be them. The one defence in opposition to reckless Neocons is a united entrance—Russia, China, India, and others standing sturdy in opposition to the West. India and China as soon as dominated world finance; Europe misplaced that after two world wars. The countless wars these Neocons wage? They lose each time. They suppose it’s only a Russia battle, and China can wait its flip. Nope. This can be a showdown with NATO, and the remainder of the world uninterested in Neocon conceitedness is able to rewrite the foundations as soon as World Battle 3 ends.

These delusional warmongers are the final word armchair warriors—filled with swagger however by no means stepping onto the battlefield themselves. As a substitute, they fortunately ship everybody else’s youngsters to battle and die for his or her grandiose goals of worldwide domination and glory. Paradoxically, they’re chasing the very conquest they accuse others of pursuing. Their typical narrative? Russia is on the ropes, about to be squashed like an insignificant ant. Actuality? Not a lot.

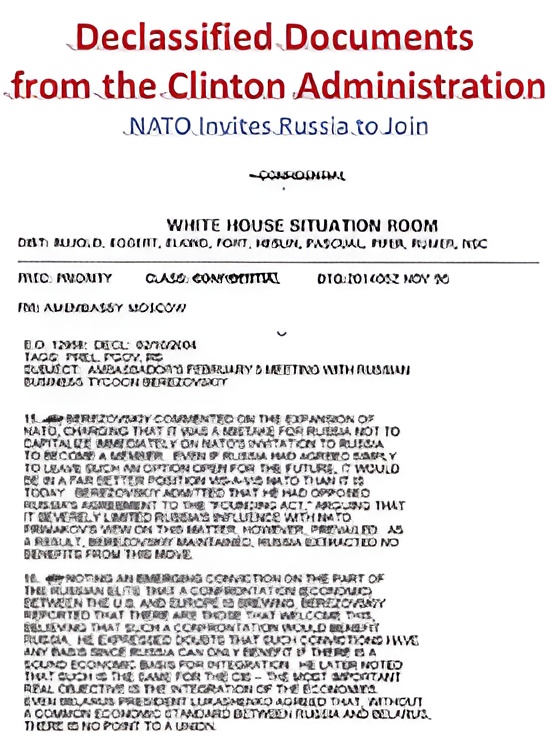

The faux information media has been the drumbeat behind EVERY SINGLE WAR—as a result of, effectively, that’s their job. Even Tulsi Gabbard uncovered that the CIA’s Challenge Mockingbird remains to be alive and kicking, with its military of “journalists” peddling lies. Take the current papers that bust the parable of Putin as simply one other oligarch. The truth is that, in 2000, when the plot was to grab management by blackmailing Yeltsin into appointing their puppet Boris Berezovsky, a widely known rip-off was in play, ‘Authorities Sachs’ and its Wall Avenue friends have been trying to loot Russia’s pure assets.

The “oligarchs’ puppet” Putin fable—pure fantasy. In contrast to the Western warmongers of NATO and the Washington swamp pushing world depopulation, Putin and Xi really know how you can restrain and negotiate for his or her mercantilist agenda. Declassified Clinton-era docs present Berezovsky wasn’t even into Putin—he most popular Igor Ivanov. Putin barely knew Berezovsky, and the oligarchs had no actual maintain on him. They only wanted a loyal stooge to guard Yeltsin’s crew from jail time. Enter Putin, who promptly advised the oligarchs to maintain their cash however get out of politics—then locked up or exiled the troublemakers. Now, the oligarchs left are state made, like Rotenberg and Timchenko, cozy with Putin, not puppet masters. So no, Putin wasn’t their creation—he’s the one holding the strings, whereas the West retains flailing round like a spoiled baby.

The one silver lining on this insane rhetoric? Possibly Europeans will lastly get off their couches and demand actual political change—as a result of with out it, no TV exhibits subsequent 12 months. Has Donald Copperfield discovered Europe will NEVER make peace with Russia, so he’s simply enjoying alongside to promote World Battle III? Truthfully, that’s the best-case state of affairs. In any other case, if nuclear warfare breaks out, neglect the flamboyant spots—keep away from main cities and navy targets. The logic is brutal however clear: first hit the navy, then the financial system, and eventually, the crowded inhabitants centres. Survival tip: don’t be the place the fireworks begin.

Battle is the quickest method to bankrupt an empire, and France’s historical past is a textbook instance. Donald Copperfield appears poised to repeat this cycle. Beginning in 1558, Henry II drained fortunes preventing the Habsburg-Valois Wars earlier than defaulting. Then in 1648, the younger Louis XIV juggled debt amid the Thirty Years’ and Franco-Spanish Wars, finally suspending funds and manipulating forex. By 1661, scandal erupted as Finance Minister Fouquet was arrested for embezzlement whereas the debt continued to spiral. Lastly, after the Battle of Spanish Succession in 1715, France went bust once more, conveniently pretending some money owed by no means existed. Historical past exhibits that warfare and debt are inseparable, and empires inevitably pay the worth.

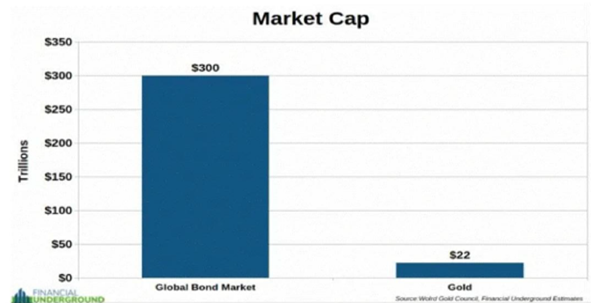

Because the world marches towards WW3, historical past delivers a transparent warning: warfare triggers stagflation, inflationary busts, and authorities energy grabs edging nations towards default—a battle already raging this decade as bondholders bleed worth. Many years of reckless spending and financial distortion have pushed the western world to the brink. The “Massive Lovely Invoice” is simply one other salvo in countless debt and denial. Bond markets—not shares—are sounding the alarm: hovering yields, synchronized selloffs, and shadow consumers expose a system shedding belief. Behind the scenes, the U.S. has already defaulted silently via inflation. But many nonetheless worship U.S. Treasuries as “risk-free,” ignoring that since 1971, bonds have fuelled a $300 trillion debt beast whereas all of the world’s gold is price simply $22 trillion. The actual query: belief politicians’ paper guarantees or centuries of actual worth?

On the finish of the day, empires are inclined to commit suicide in three acts: (1) reckless fiscal mismanagement fuels inflation to paper over debt; (2) when borrowing runs dry, they unleash tyranny at residence and begin blaming an exterior bogeyman—this time, Putin; and (3) door quantity three swings open—default, authorities collapse, and a contemporary regime promptly disowning the outdated money owed. Basic tragedy, similar script, completely different solid and we simply entered stage 2.

On this context, the trail to actual prosperity stays paved with tangible property, not fragile IOUs not genius digital tokens, Bodily gold and silver—free from counterparties, free from surveillance—stand as the final word antifragile shields. Past valuable metals, broader commodities guard in opposition to a fracturing world provide chain.

Money should be wielded with precision: favor short-dated USD investment-grade bonds and T-bills to take care of revenue and swift agility.

In equities, hunt for lean, low-debt, high-cash-flow champions—companies able to thrive amid reshoring, commerce wars, and surging protection budgets. As a result of the true enemy isn’t subsequent door; it’s the warmongers pulling the strings.

The Goldilocks period is lifeless. The age of Gold In Heaps—is the brand new survival playbook.

Always remember that Gold is the forex of Kings, Silver the cash of Gents; Barter is the cash of Peasants, however Debt is the cash of Slaves.

KEY TAKEWAYS.

Because the golden mercantilist BRICS future unfolds, the important thing takeaways are:

BRICS has developed from a market label into a strong coalition of resource-rich, populous nations reshaping world commerce and finance, overtaking the fading Western empires to command almost half the world’s financial output and inhabitants.Historical past taught us that world energy is a unending sport of musical chairs—and whereas the West clings to fading glory, BRICS is gearing as much as declare the following throne, with China driving innovation as an elevator up whereas America watches progress like paint drying.The 2025 tariff blitz turned financial instruments into blunt geopolitical weapons, pushing BRICS and the World South to unite in opposition to U.S. monetary domination—and proving you’ll be able to’t bankrupt them with out backfiring spectacularly.BRICS didn’t look ahead to the tariff tantrums to ditch U.S. Treasuries—they ghosted Uncle Sam again in 2018, as Russia’s assets, China’s factories, and India’s booming market teamed as much as throw the World South’s hottest commerce occasion, leaving the West out within the chilly.BRICS+ are enjoying economics 101 by buying and selling sensible, hoarding over 20% of the world’s gold, ditching the greenback, and leveraging their large gold reserves to gasoline a brand new multipolar monetary showdown.BRICS received’t rush a unified forex, however China’s quietly constructing a gold-backed, yuan-fuelled monetary system that rewrites the worldwide playbook—suppose Bretton Woods 3.0 with a better twist, the place nations select progress or dependence, and gold holds the keys to a brand new world order.Because the US financial system shifts into an inflationary bust, buyers will as soon as once more have to concentrate on the Return OF Capital slightly than the Return ON Capital, as stagflation spreads.Bodily gold and silver stay THE ONLY dependable hedges in opposition to reckless and untrustworthy governments and bankers.Gold and silver are everlasting hedge in opposition to “collective stupidity” and authorities hegemony, each of that are plentiful worldwide.With continued decline in belief in public establishments, significantly within the Western world, buyers are anticipated to maneuver much more into property with no counterparty danger that are non-confiscable, like bodily Gold and Silver.Lengthy dated US Treasuries and Bonds are an ‘un-investable return-less’ asset class which have additionally misplaced their rationale for being a part of a diversified portfolio.Unequivocally, the dangerous a part of the portfolio has moved to fastened revenue and subsequently slightly than chasing long-dated authorities bonds, fastened revenue buyers ought to concentrate on USD investment-grade US company bonds with a length not longer than 12 months to handle their money.On this context, buyers must also be ready for a lot increased volatility in addition to uninteresting inflation-adjusted returns within the foreseeable future.

HOW TO TRADE IT?

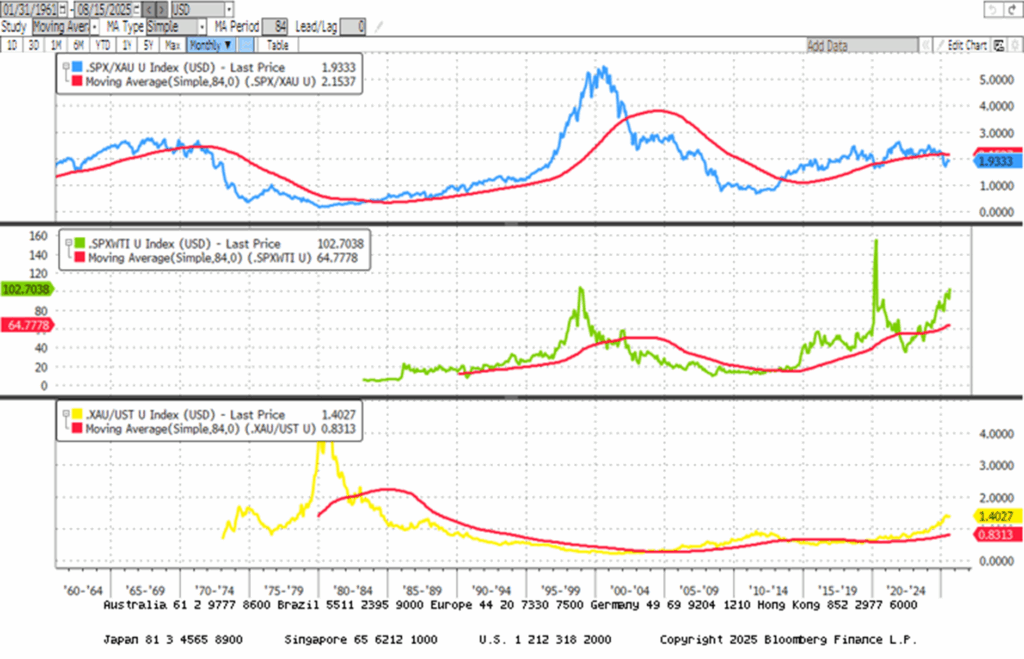

As of August fifteenth , 2025, the US stays in an inflationary increase, however with the S&P 500 to Gold ratio now under its 12 months under its 7-year transferring common for nearly 7 months, an inflationary bust will materialize a lot prior to Wall Avenue pundits and their parrots are keen to inform their shoppers. On this context, buyers ought to keep calm, disciplined, and use market knowledge instruments to anticipate modifications within the enterprise cycle, slightly than fall into the ahead confusion and phantasm unfold by Wall Avenue.

Savvy buyers worldwide—these not nonetheless shackled by the Western propaganda machine and its Keynesian fairy tales—have already grasped the brutal reality: the more durable the West pushes its Malthusian depopulation agenda via countless wars in opposition to BRICS, the stronger the unbreakable bond between Russia, China, and India turns into. From the following decade onward, this Triumvirate will forge the brand new financial coronary heart of the planet, reshaping the world order of their unstoppable rise.

Because the Romans used to say, ‘verba volant, scripta manent’—spoken phrases fly away, written phrases stay, a motive why individuals should write to be learn and heard.

Greater than half of the world’s inhabitants resides inside a comparatively compact geographic zone encompassing China, India, Southeast Asia, and components of Central Asia. At its middle, Hong Kong—traditionally a Chinese language metropolis beneath English legislation—occupies a strategic place as a monetary, business, maritime, and logistical hub. Surrounding it are the economic powerhouse of China, the labor-rich economies of Southeast Asia, the resource-abundant areas of Russia and the Central Asian republics and the patron wealthy India. The disruption of conventional westward commerce routes following the Ukraine battle has redirected Central Asian uncooked supplies southward, facilitating intra-regional commerce. With the flexibility to transact in native currencies slightly than {dollars}, these economies face fewer exterior commerce constraints, setting the stage for intensified regional integration and probably one of the crucial important Ricardian progress booms in fashionable historical past.

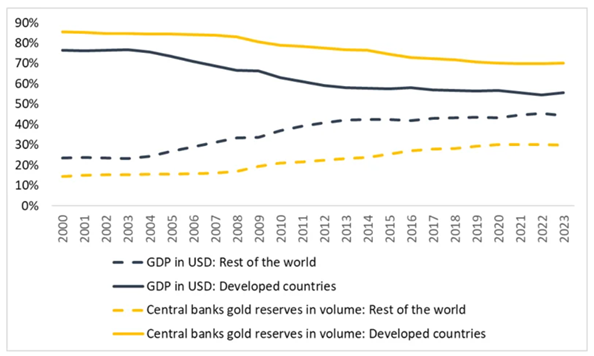

The BRICS+ bloc is leveraging demographic scale, industrial capability, and commodity safety to advance a multipolar financial order impartial of Western monetary dominance. Intra-regional commerce, infrastructure funding, and settlement in native currencies are decreasing reliance on the U.S. greenback, eroding the leverage of transatlantic establishments. This shift parallels a broader world realignment: developed economies’ share of world GDP has fallen from 80% to close 50% since 2000, whereas rising markets have risen from 20% to the identical stage.

Equally, gold reserves are shifting: the share held by developed-world central banks is declining, whereas emerging-market central banks now maintain a quickly rising portion—mirroring the historic transfers of gold from Europe to the U.S. between 1900 and 1945. This shift alerts a lack of competitiveness, as capital and gold circulate to areas the place entrepreneurs are higher handled and debt sustainability is stronger. Simply because it was silly to carry European bonds throughout the First World Battle when gold was transferring to America, it’s now dangerous to carry Western sovereign debt whereas gold migrates towards Asia. These flows, already effectively underway, are irreversible and traditionally precede forex revaluations—which means Western currencies are prone to weaken as emerging-market currencies strengthen.

Within the age of everlasting disaster—the place markets convulse, money owed swell, and belief in authority rots—stability is a relic. Energy lurches from emergency to emergency, each eroding what little autonomy stays. In such a world, salvation won’t come from the glitter of digital illusions or the empty script of coverage speeches. It is going to come from the chilly, immutable weight of gold.

The brand new order calls for compliance, surveillance, and central management; fiat currencies march in lockstep towards their very own erasure. Bitcoin, stablecoins, and the remainder of the digital menagerie will probably be absorbed or damaged. Antifragile and Non-Confiscable Gold alone resists absorption—past counterparty attain, past algorithmic management, past confiscation by bureaucratic decree.

Because the American empire stumbles via its boom-bust loss of life cycle, buyers need to comply with the gold as historical past’s verdict is unchanged: tangible property endure whereas paper guarantees burn. The long run won’t be received by those that innovate quickest, however by those that maintain what can’t be printed, censored, or erased. Gold has outlasted empires; it would outlast this one.

In a nutshell, the playbook is straightforward: don’t get confiscated, don’t get frozen, and don’t get poor making an attempt to get wealthy. In occasions like these, liberty and liquidity reside in private vaults—not in banks. And all the time bear in mind: In Gold We Belief—As a result of Gold Is For Battle.

On the finish of the day, ‘The Want for Gold just isn’t for gold. It’s for the technique of freedom and advantages’ .

Need the total deep dive? You’ll be able to learn The MacroButler’s unique article on his Substack

https://themacrobutler.substack.com/p/brics-gold-glory-the-dawn-of-a-new