BTC USD is firmly above $110K, and the newest Bitcoin technical evaluation on the finish of September 2025 is right here! Bull markets – all people loves them! Besides the bears, after all… However lets the query circling round recently – Will the Bull market proceed or is it over? The place is Bitcoin headed subsequent – ought to I promote, maintain or purchase? People who find themselves critical about their funds and take into account themselves traders have to make knowledgeable choices when tackling such questions. They usually do! One of many areas we get data from is value motion and conducting technical evaluation.

A very powerful degree in $BTC for half of this 12 months. pic.twitter.com/zihEyLg5OO

— Sam KB (@sam_kb_) September 29, 2025

As at all times, it’s actually wholesome to fill the image with different trusted merchants’ ideas. On this case, with Sam’s touch upon how essential the $112,000 degree has been recently.

DISCOVER: Finest Meme Coin ICOs to Put money into 2025

And with out additional ado, allow us to dig into the charts!

How is BTC USD Shaping Up For October? Bitcoin Finish of Month Technical Evaluation

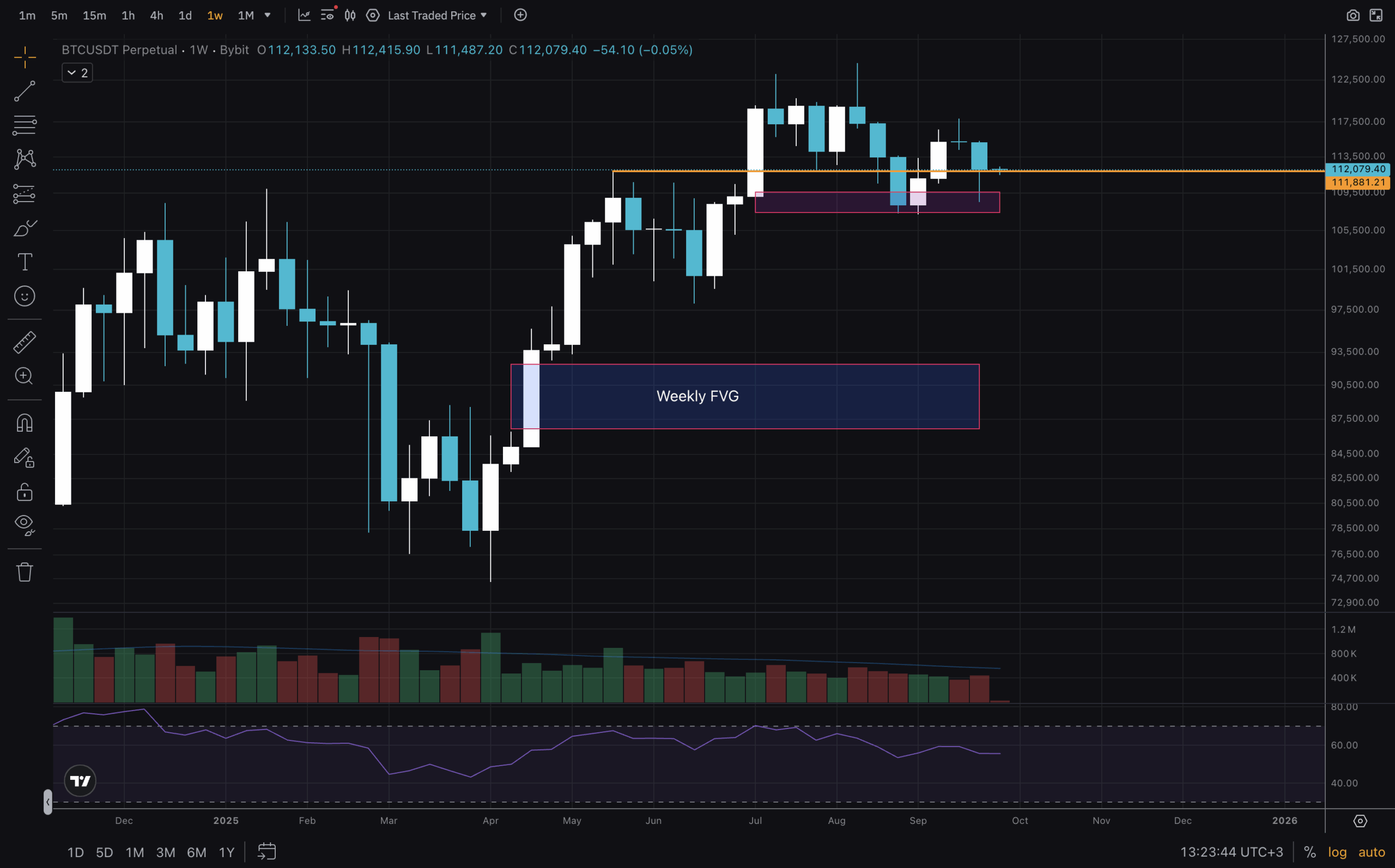

(Supply, TradingView – BTCUSD)

1W timeframe – a very good place to start! To not take too lengthy right here, we want to discover that in February of 2024 and April of 2025 there are Weekly Honest Worth Gaps. Each stay unfilled. I’d quite say the 2024 is unlikely to get stuffed throughout this bull market. And the upper the worth holds above $100,000, the much less seemingly it turns into for the 2025 hole to be stuffed.

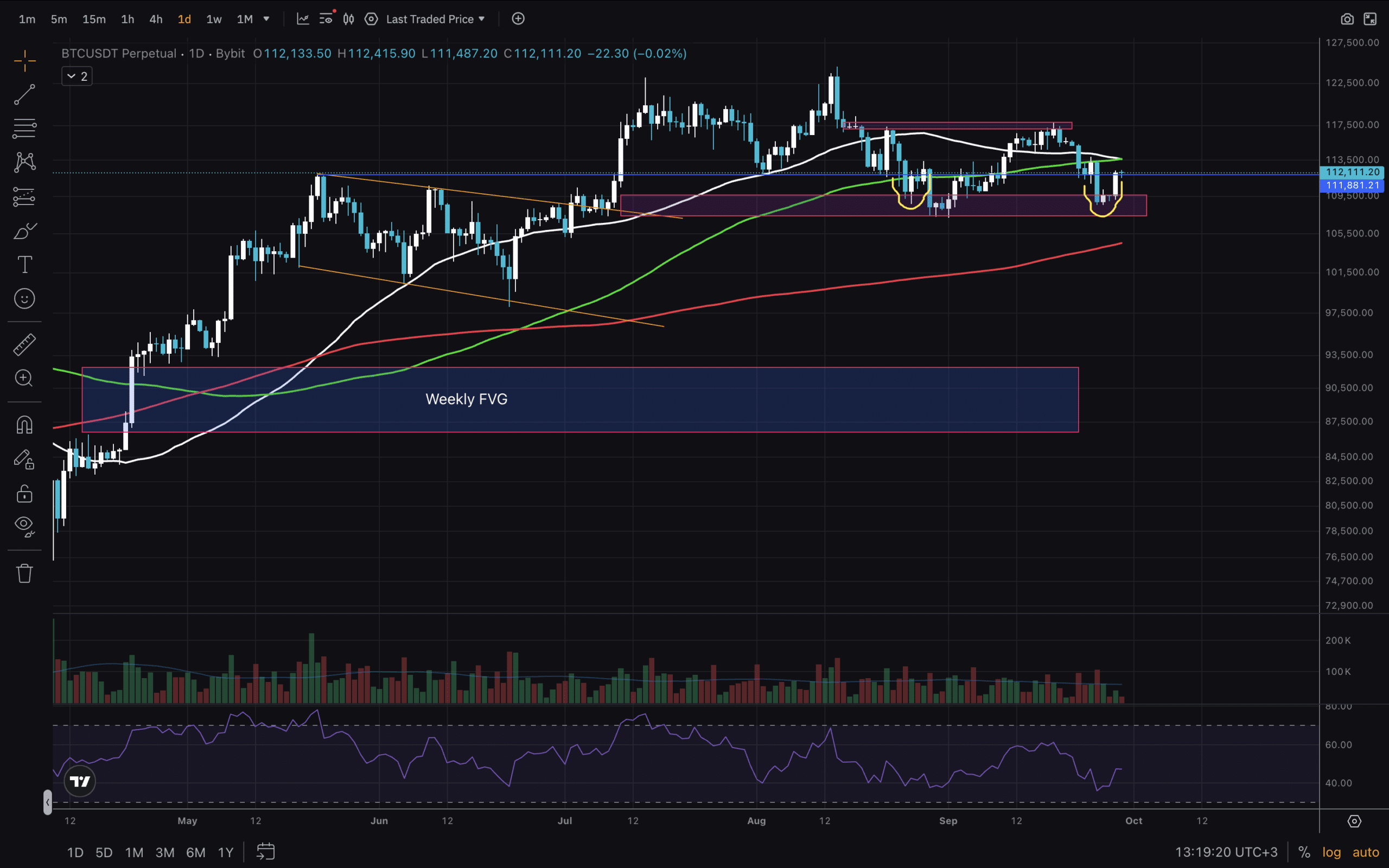

(Supply – TradingView, BTCUSD)

Going again to Sam’s touch upon the significance of $112,000 degree for Bitcoin value evaluation, on this chart it’s the orange line. And what’s essential right here, moreover that degree, is final week’s candle. Half of the candle is a physique, and half of it’s a wick, with the wick being beneath that key degree. This, by itself, might be an indication of energy!

DISCOVER: Prime Solana Meme Cash to Purchase in 2025

(BTCUSD)

Zooming in on the 1D chart, one other marker for an uptrend and assist are the shifting averages. At present, the BCT USD value is beneath MA50 and MA100, with MA50 about to go beneath MA100 – not nice. However MA200 remains to be beneath at which is a powerful and essential degree. The opposite particulars will likely be mentioned in additional element beneath.

DISCOVER: Prime 20 Crypto to Purchase in 2025

Zooming in On BTC USD: Bitcoin Technical Evaluation on Decrease Timeframe + Conclusions

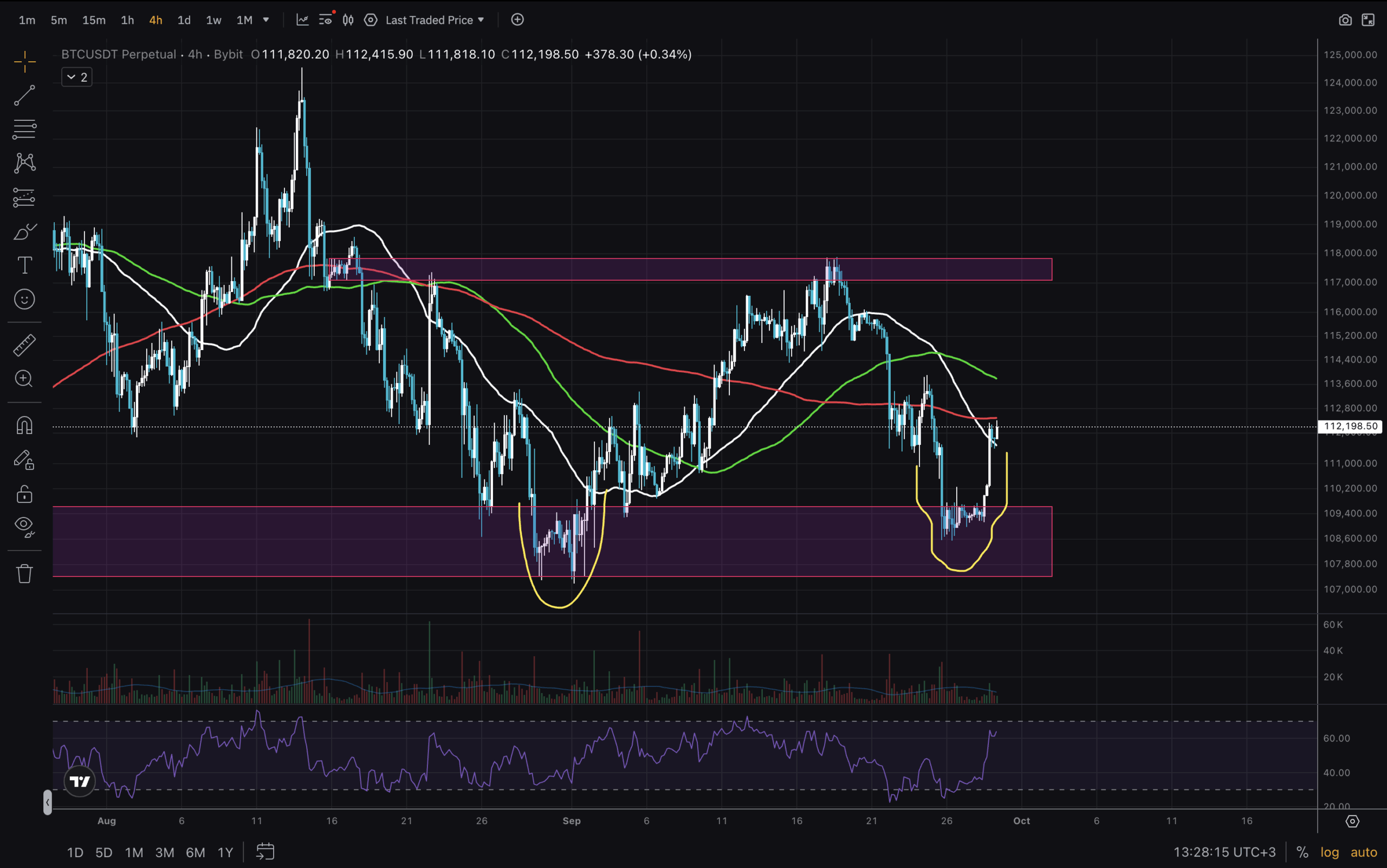

(BTCUSD)

On the 4H I’ve adjusted the left yellow bounce zone to the underside one, which I thought-about a deviation. If it had been, the BTC USD value wouldn’t go this far down a second time.

This makes this zone extra of a requirement/liquidity assist space. Primarily, we’ve got a $10k vary between $108,000 and $118,000. The final excessive that touched the resistance zone is definitely a Greater Excessive on this decrease timeframe, and now we’re shifting up from a Greater Low. That may be a good begin!

Bulls wish to see all Shifting Averages reclaimed after which a clear break above that $118,000 key degree. Commerce safely!

DISCOVER: Subsequent 1000X Crypto – Right here’s 10+ Crypto Tokens That Can Hit 1000x This 12 months

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Bitcoin Technical Evaluation: Finish of September 2025 Insights

Key degree to carry is $110,000 – $112,000

1D chart exhibits bearish elements, but construction stays bullish

Count on value to be uneven round Month-to-month shut

Key degree to reclaim for upward continuation is $118,000.

The submit BTC USD Targets Finish of September: Bitcoin Technical Evaluation for October appeared first on 99Bitcoins.