Ethereum’s value roller-coaster has drawn a dramatic wager from large gamers. Whereas many smaller merchants are bracing for extra losses, a handful of huge accounts have damaged the floor and put hundreds of thousands in an enormous present of drive.

Ethereum Whale Bets Floor

In line with on-chain knowledge, one whale opened an extended place price $101 million at an entry value of $2,247, utilizing 25x leverage. That wager paid off with roughly $950,000 in revenue, but it surely additionally value $2.5 million in charges. These numbers present simply how excessive the stakes have change into.

Excessive Charges Lower Into Beneficial properties

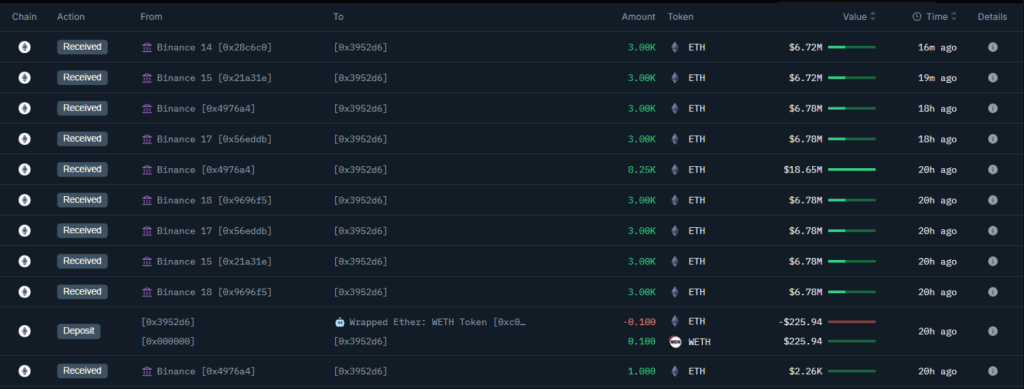

This whale additional withdrew 18,000 $ETH price $40.38M from #Binance.

Now, the whale holds 50,256 $ETH price $112.62M, at present down $2.24M

Tackle: 0x3952d69643f7a87237c7fc8bb33f8453c0b45500 https://t.co/49vC0iqMZP pic.twitter.com/rF5cX2gsXZ

— Onchain Lens (@OnchainLens) June 23, 2025

Based mostly on reviews from On-Chain Lens, one other whale moved over $40 million in Ether from Binance earlier than opening its personal leveraged commerce.

Mix the 2 wallets and also you’ve obtained about $112 million using on an ETH bounce. But these $2.5 million in charges spotlight the hidden value of massive bets.

Center East Rigidity Hits Costs

ETH slipped to about $2,113 on Sunday, marking its lowest degree in 30 days. That drop got here after US navy strikes on Iran’s nuclear websites.

United States President Donald Trump referred to as the operation a “spectacular success” and warned of extra motion if Iran didn’t again down. Merchants say the fallout from these strikes rattled international markets and fed crypto volatility.

Retail Merchants Watch Carefully

Retail merchants are inclined to promote when costs drop. However these whales have the scope to climate downswings. Their massive purchases point out that they discover worth at present ranges. Brief merchants won’t agree, nevertheless. They’re sitting in lots of brief positions, anticipating ETH to say no additional earlier than it would rise.

What The Whales See

Specialists say massive holders are inclined to have decrease break-even factors. They’ll afford to attend months or years for a payoff. Some additionally use complicated methods throughout a number of markets. That makes their strikes arduous to learn from the skin. Nonetheless, whenever you see $112 million on the road, it’s a touch that good cash senses a shopping for window.

Dangers On Each Sides

Leveraged trades amplify positive factors and losses equally. A 5% drop would set off a pressured sell-off on a 25x place. That might feed a pointy decline in ETH’s value. Then again, if the market turns up, these whales may pocket large returns nicely past what retail merchants see.

Buyers shall be watching each market swing. If geopolitical tensions cool and massive cash stays bullish, ETH may discover footing above $2,200. However one other shock—political or technical—may ship the worth tumbling once more.

Featured picture from Imagen, chart from TradingView