Oracle bolstered the case for the bogus intelligence spending increase when it reported its quarterly outcomes on September 9. The cloud computing big’s backlog soared 359% to $455 billion, pushed by spending from AI hyperscalers like Amazon, a blockbuster cope with OpenAI, and extra.

Vertiv (VRT), which works with Nvidia, is a behind-the-scenes agency that advantages instantly from the AI information middle increase. The Ohio-based agency’s rising portfolio helps ensure that the high-density computing energy wanted to gasoline the AI age runs as easily as potential 24/7.

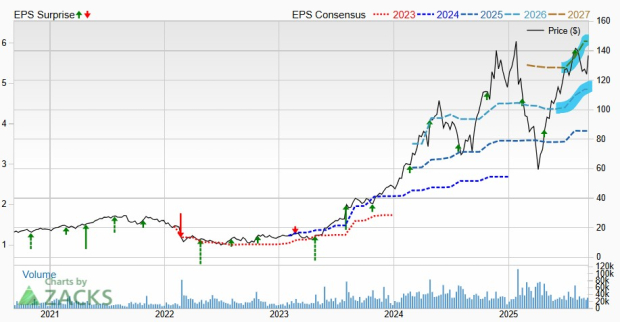

Vertiv earns a Zacks Rank #1 (Sturdy Purchase) proper now, pushed by its bettering earnings outlook. The picks-and-shovels AI inventory can be gaining extra consideration from Wall Avenue analysts, and could possibly be on the verge of a technical breakout whereas buying and selling 12% beneath its common Zacks value goal.

It’s time for buyers to think about shopping for Vertiv, which already blew away all the AI hyperscalers during the last three years.

Picture Supply: Zacks Funding Analysis

Purchase AI Inventory Vertiv Now and Maintain Eternally

Vertiv’s {hardware}, software program, analytics, and ongoing providers portfolio is concentrated on energy, cooling, and IT infrastructure. Its product classes embrace important energy, thermal administration, racks & enclosures, monitoring & administration, and past.

In different phrases, Vertiv operates within the background of huge tech and AI, supporting the fixed growth and the day-to-day operations of AI information facilities and the broader technology-driven economic system.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

The digital infrastructure firm has by no means been extra important and in demand. The big growth of knowledge facilities requires large quantities of high-performance computing energy that operates at peak efficiency 24/7. Vertiv has partnered with the present titan of AI, Nvidia (NVDA), to assist remedy future information middle effectivity and cooling challenges.

VRT posted one other beat-and-raise quarter on the finish of July that pushed its 2026 earnings estimate 11% larger. Vertiv’s current wave of upward revisions earned it a Zacks Rank #1 (Sturdy Purchase) and restarted its spectacular upward revision pattern that started in 2023.

The agency additionally accomplished its acquisition of Nice Lakes Knowledge Racks & Cupboards on August 20, furthering Vertiv’s “capabilities to customise at scale and configure at velocity for AI and high-density computing environments.”

The corporate is projected to develop its income by 25% in 2025 and 16% subsequent 12 months to $11.55 billion—double its 2021 complete. Vertiv is anticipated to increase its adjusted earnings per share (EPS) by 34% this 12 months and 27% subsequent 12 months.

The information middle infrastructure firm’s sturdy bottom-line development outlook is much more spectacular since VRT grew its EPS by 60% final 12 months and 236% in 2023.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Wall Avenue is paying extra consideration to Vertiv than ever earlier than. Zacks has 23 brokerage suggestions for VRT, up from 19 three months in the past—18 of these suggestions are “Sturdy Buys.” This is sensible contemplating its large AI-boosted development and talent to increase steadily irrespective of which AI hyperscalers ultimately dominate or what AI upstarts flip into the following Wall Avenue darlings.

The dividend-paying AI infrastructure inventory has climbed 900% previously three years, blowing away all the AI hyperscalers (Meta is one of the best performer of that group, up 345% previously three years).

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

VRT outclimbed Nvidia previously 12 months, but it trades round 12% beneath its pre-DeepSeek highs from January and its common value goal. On the valuation aspect, Vertiv trades at a 30% low cost to its highs at 30.1X ahead 12-month earnings and practically in-line with Tech’s 28.6X regardless of VRT inventory leaping 900% in three years vs. Tech’s 107%.

VRT inventory surged above its 50-day earlier this week. Now all it wants is somewhat bit extra momentum earlier than it breaks above the highest of its buying and selling vary to surge to new all-time highs.

5 Shares Set to Double

Every was handpicked by a Zacks skilled because the #1 favourite inventory to achieve +100% or extra within the coming 12 months. Whereas not all picks might be winners, earlier suggestions have soared +112%, +171%, +209% and +232%.

Many of the shares on this report are flying beneath Wall Avenue radar, which gives an ideal alternative to get in on the bottom flooring.

Right now, See These 5 Potential Dwelling Runs >>

Need the most recent suggestions from Zacks Funding Analysis? Right now, you possibly can obtain 7 Greatest Shares for the Subsequent 30 Days. Click on to get this free report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Vertiv Holdings Co. (VRT) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.