Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

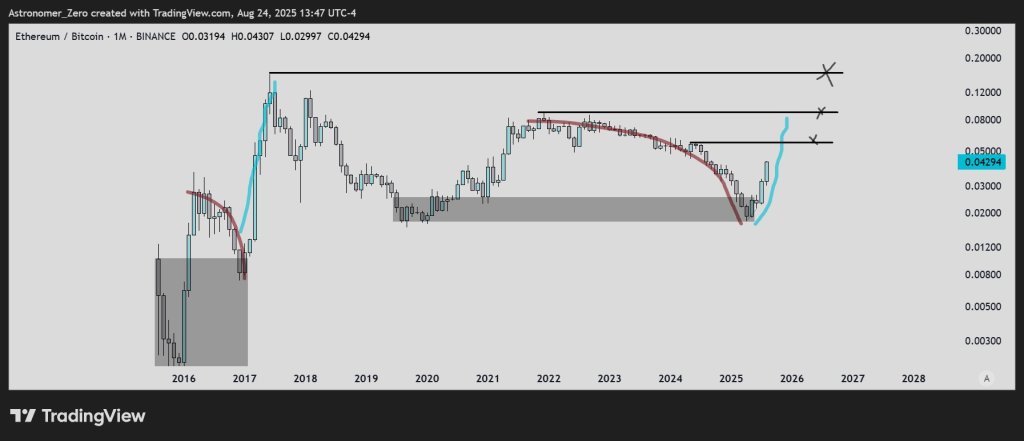

Crypto analyst Astronomer (@astronomer_zero) says his long-standing backside thesis on the ETH/BTC pair has performed out and printed express cycle targets anchored to the cross. In a chart shared on X, he reiterated that “ETH backside name” is in and framed the roadmap completely by means of ETH/BTC ranges fairly than ETH/USD, arguing that Ether’s outperformance sometimes follows Bitcoin’s impulse and that “all main liquidity comes from BTC.”

How Excessive Can Ethereum Go This Cycle?

Astronomer’s publish facilities on a multi-month “zone” on ETH/BTC that he had marked prematurely as a possible cyclical inflection. He writes that the decision seemed “delusional” when first drawn—“a ‘ridiculously lengthy’ prediction line (straight up from the underside) from what ‘might impossibly be the ETHBTC backside’ on the time”—however says the flip aligns along with his proprietary sentiment work.

“The sentiment on ETH was the worst my sentiment metric has ever tracked,” with narratives starting from “ETH is a nasty funding,” to “ETH basis is promoting,” to “SOL is the brand new ETH,” to “utility cash are lifeless.” In his phrases, “that sort of sentiment allowed us to substantiate the underside on ETHBTC in alignment with our historical plan, on the time it hit our zone.”

Associated Studying

With that backdrop, the chart and commentary lay out three ETH/BTC targets for the rest of the cycle. The primary is 0.058 BTC per ETH, which he notes was “nonetheless 35% above right here” on the time of posting and, translated instantly utilizing spot Bitcoin, “places ETH at approx. $6.500 if BTC stays at this worth.”

The second is 0.091, “just about a double from right here,” comparable to “$ETH to $10,000+, 5 figures,” a stage the place he says he “can have bought over half of my spot luggage.”

The ultimate and highest goal is 0.16, “just below a 4x from right here, placing ETH at $20,000 or increased.” He’s express that the 0.16 mark is aspirational fairly than base case: “That’s actually my highest goal, and I don’t count on that to be reached assured. However I adore it open simply in case it does occur.”

The technical logic he presents is intentionally pair-driven. By mapping the cycle with ETH/BTC, he seeks to seize relative power fairly than absolute worth and to sidestep the shifting base of BTC’s greenback worth. The implied ETH/USD ranges in his publish are easy translations of ratio × BTC worth; he provides that these USD conversions “will, actually, be underestimates as I additionally see BTC rise additional.” In different phrases, the chart’s horizontal ranges are ETH/BTC at 0.058, 0.091, and 0.16; the USD numbers are contingent and can float with Bitcoin.

Associated Studying

The analyst additionally rejects calendar heuristics outright. “The explanation I by no means speak about seasonality or ‘pink September’ or ‘promote in Might, stroll away’… is as a result of I don’t wish to promote placing your hard-earned capital on weak information… Seasonality, has neither.” He provides that “Seasons don’t work in markets, solely cycles do,” and indicators off with a jab on the meme: “For pink September, kindly, go to your native forest…”

Importantly, the pathway he describes is conditional on the identical relative-rotation dynamic that has ruled previous cycles: Bitcoin leads, Ether lags till liquidity rotates, then ETH/BTC advances by means of predefined cabinets. In that framework, the evaluation doesn’t rely upon any single ETH/USD quantity; it relies on ETH/BTC reclaiming and holding the cited bands.

Astronomer is candid about positioning psychology as nicely. He argues that whereas “it appears as if many are all bull posting ETH now and holding huge luggage,” order-flow suggests “most of these individuals haven’t purchased from down low, are fairly frozen out or are compelled to purchase increased with increased leverage.” In his view, that construction nonetheless favors upside towards the posted ETH/BTC targets: “So so long as that stays that means, I proceed to count on these targets.”

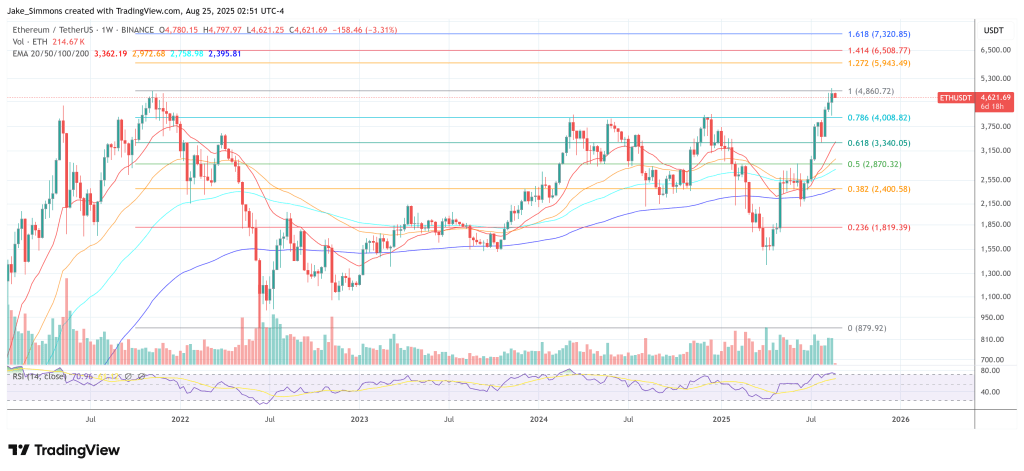

At press time, ETH traded at $4,621.

Featured picture created with DALL.E, chart from TradingView.com