Be a part of Our Telegram channel to remain updated on breaking information protection

Solana worth is going through resistance after breaking out of an prolonged consolidation zone inside the $127 space. SOL worth is down a fraction of a share within the final 24 hours, regardless of a ten% surge within the final week, buying and selling at $138.78 as of 01:18 a.m. EST.

This slight drop occurred simply hours after Morgan Stanley filed a Kind S-1 with the US Securities and Trade Fee (SEC) for a Solana Belief.

Solana’s weekly surge comes amid a begin of the 12 months rally that noticed Bitcoin worth climb again above the $93,500 area.

Nonetheless, a key historic sample on the SOL 3-day chart suggests a possible restoration. Each time Solana touches help round $120, it’s adopted by a sustained surge to recuperate any losses. Can the Solana token ship on this sentiment?

Morgan Stanley Information For Solana ETF: Why This Might Be A Main Worth Catalyst

Morgan Stanley, a Wall Avenue heavyweight, has filed a Kind S-1 with the US SEC, searching for approval for a spot BTC exchange-traded fund (ETF) and a Solana belief, additional advancing its ambitions in digital property.

SHOCKER: Morgan Stanley simply filed for a spot Bitcoin and Solana ETF. H/t @TheBlock__ pic.twitter.com/AmYLeDTJBy

— Eric Balchunas (@EricBalchunas) January 6, 2026

The Morgan Stanley Solana Belief is supposed to trace the value of Solana and permit buyers acquire publicity to SOL via conventional funding autos. This removes the necessity for direct custody of the token.

In accordance with SoSoValue knowledge, Solana funds have grown to greater than $1 billion in whole internet property, following cumulative internet inflows of almost $800 million and day by day whole inflows of $9.22 million.

Traditionally, ETF filings and approvals have performed a crucial position in boosting institutional participation, as seen with BTC sport ETFs.

Solana Worth Evaluation: Bullish Breakout In Focus

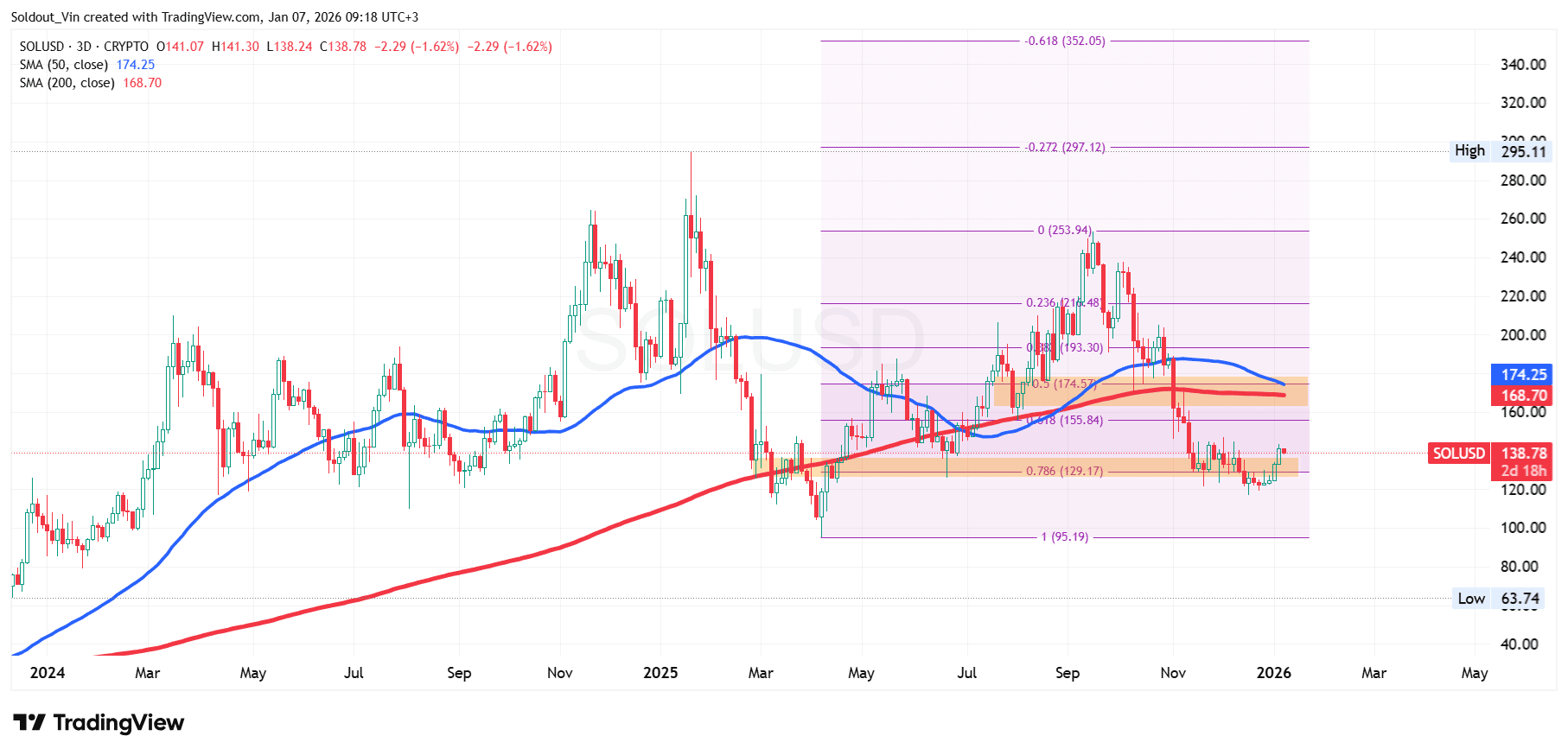

The SOL worth chart evaluation on the 3-day timeframe exhibits that Solana has damaged out of the $135 help degree, which coincides with a decrease help space throughout a consolidation section that has capped the asset beneath the $168 resistance.

With the tried surge, key Fibonacci Retracement ranges to look at are $155.84 (0.618 Fib degree) and $174.57 (0.5 Fib degree), with the 50-day and 200-day Easy Transferring Averages (SMAs) at $174.25 and $168.70, respectively.

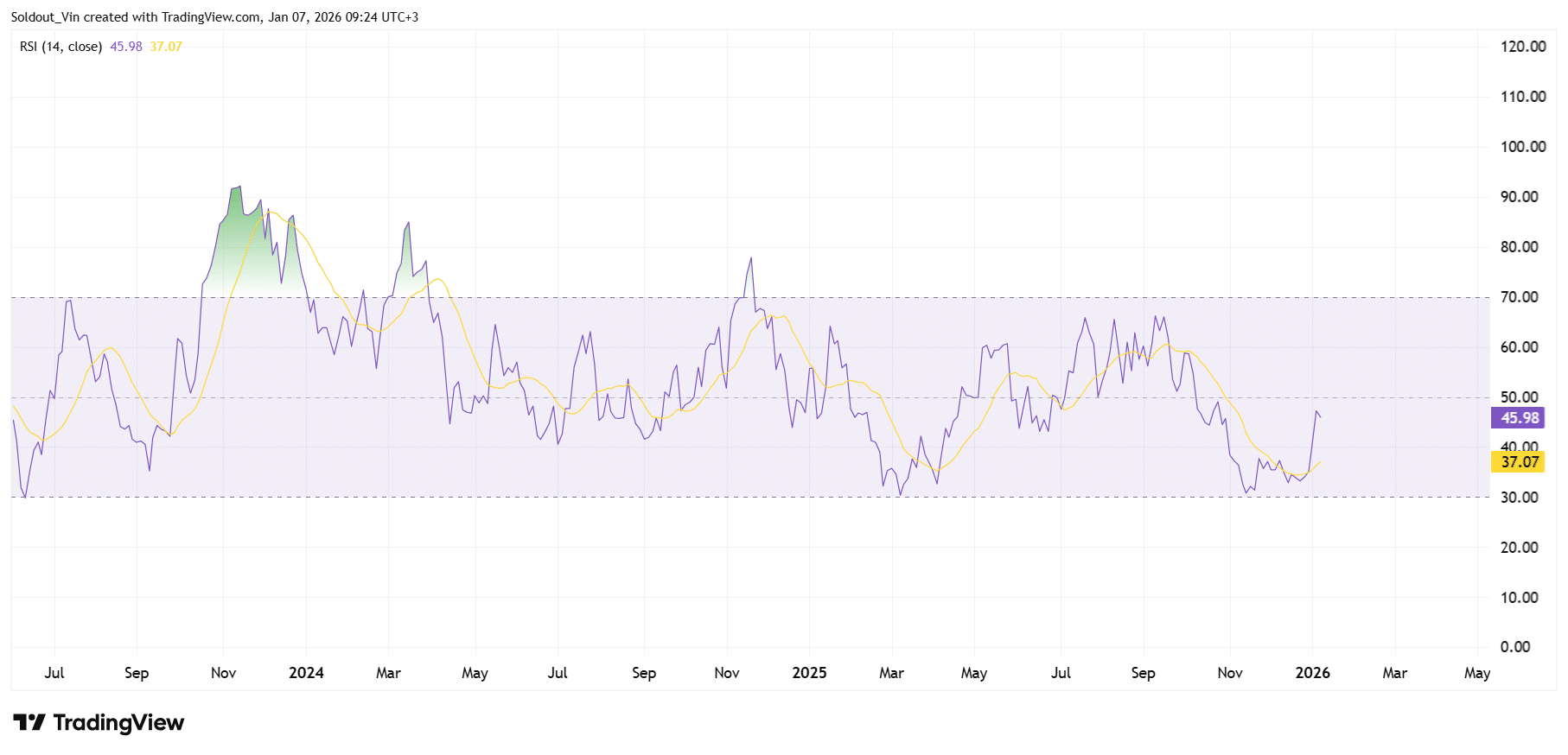

The Solana Relative Power Index (RSI) is at 45.98 and rising, indicating that purchasing strain is growing however nonetheless inside the equilibrium zone. There’s some resistance on the 47.7 space, but when it rises larger than this, patrons might take full management to push Solana worth previous the $155.84 rapid resistance.

The buying and selling quantity surged by over 14% within the final 24 hours to $6.26 billion, indicating market exercise has picked up. Regardless of this, Solana is down from the $143.09 degree, as proven by the current candle on the 3-day chart.

Can The SOL Worth Soar To $200?

In accordance with the SOL/USD chart evaluation, the SOL worth is at the moment poised for a bullish breakout continuation. Due to this fact, the $200 degree is feasible, so long as the Solana worth continues to commerce above the $129.17 space (0.786 Fib degree).

This might occur, as each time the value of Solana has dropped again to the $120 zone from February 2024, it has recovered massively.

With the current correction from the $143 degree, buyers are nonetheless cautious, because the asset nonetheless has the chance to drop again to the $121.41 long-term help space.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection