Alisa Davidson

Revealed: June 12, 2025 at 10:12 am Up to date: June 12, 2025 at 10:12 am

Edited and fact-checked:

June 12, 2025 at 10:12 am

In Transient

In 2025, international locations all over the world are advancing at totally different speeds in growing central financial institution digital currencies (CBDCs), balancing innovation with privateness, safety, and nationwide coverage priorities, as they put together for a digital future the place bodily money performs a diminished position.

In 2025, many governments and nationwide banks are engaged on CBDCs — central financial institution digital currencies. These are digital types of authorities cash that can be utilized like money or financial institution transfers however in a digital system. The purpose is to replace how cash works in every nation and put together for a world the place money is now not the principle method individuals pay.

Totally different international locations are shifting at their very own tempo. Some have already launched CBDCs. Others are nonetheless writing the foundations or testing the expertise. The largest focus areas are the best way to shield individuals’s privateness, how a lot management central banks ought to have, and the best way to make digital cash work with present programs.

For earlier milestones and background on the worldwide CBDC race, together with China’s early pilots and the EU’s investigation section, check with this detailed overview.

This text seems at how america, China, European Union, and Israel are constructing their CBDC programs — and the way every one displays a unique political and technical technique.

The U.S. Method: Coverage First, Privateness Nonetheless the Precedence

The USA has not but launched a digital greenback, however there have been many discussions. In the previous couple of years, the Federal Reserve has launched a number of paperwork explaining what a future CBDC may seem like within the U.S.

The U.S. is targeted on these three factors:

Defending consumer privateness and freedom;

Stopping criminality utilizing digital cash;

Retaining the U.S. greenback because the main forex on the planet.

In 2022, the U.S. Congress launched the eCASH Act — quick for Digital Forex and Safe {Hardware} Act. This invoice suggests making a digital greenback that works like money. It could be personal, work offline, and never be managed by one central database. Customers might make funds with out linking their id, much like how bodily money works at this time.

However this invoice continues to be beneath overview. There’s no official digital greenback but. The Federal Reserve and different businesses just like the U.S. Treasury and Congress are nonetheless understanding the best way to design it. Their method is slower than in different international locations as a result of they need to ensure that it suits the U.S. Structure and public expectations.

China: Transferring Quick with Central Management

China is way forward in creating and testing its CBDC, referred to as the digital yuan or e-CNY. It began small in 2020 and expanded shortly. The Folks’s Financial institution of China (PBoC) has examined the digital yuan in lots of massive cities. Folks can already use it to pay for buses, store on-line, and even obtain salaries.

By 2023, over 260 million individuals had entry to e-CNY. That makes it the most important CBDC pilot on the planet.

However China’s mannequin may be very totally different from the U.S. It’s absolutely centralized. The federal government can observe how the cash is used. It might probably comply with every transaction in actual time and cease cash from shifting if wanted. Chinese language leaders say this helps cease fraud, tax evasion, and corruption. Critics fear that it provides the federal government an excessive amount of management and never sufficient privateness to customers.

European Union: Privateness Comes First

The European Central Financial institution (ECB) is constructing a digital euro. In contrast to China, the EU places privateness and private alternative on the heart of its plan.

In October 2023, the ECB completed its analysis section and began engaged on an actual model. The digital euro might be:

Usable each on-line and offline;

Protected by privateness settings;

Constructed to work in all EU international locations;

Designed with restricted knowledge sharing, solely what’s wanted for legislation enforcement.

Banks and different firms that deal with the digital euro will solely acquire the minimal data required by anti-money laundering guidelines. Customers could have extra freedom to decide on how personal their funds are.

This plan matches the EU’s common guidelines that shield consumer rights and provides individuals extra management over how their data is used.

Israel: Constructing and Testing, however Not Dashing

In March 2025, the Financial institution of Israel launched a full draft of the digital shekel. It consists of many new options like:

Sensible contracts, which let cash comply with sure guidelines;

Offline mode, so funds nonetheless work with out the web;

Sooner and cheaper funds for native and cross-border makes use of.

Israel additionally created the Digital Shekel Problem, which invitations tech firms to check the forex in inventive methods. However though the design is prepared, Israel is ready to see how issues develop within the European Union earlier than launching its personal CBDC.

This exhibits that Israel is taking a cautious, step-by-step method. It needs to be prepared however not go first.

The Rise of No-KYC Crypto Wallets as an Various

Whereas governments construct their very own digital currencies, some customers are handing over a unique path. They need extra privateness than what CBDCs can provide.

That is the place no-KYC crypto wallets are available in. These instruments permit individuals to purchase Bitcoin with out KYC — that means they don’t have to indicate ID or private data. In contrast to conventional banks, these wallets don’t acquire consumer knowledge. That makes them enticing to those that care about privateness and freedom.

Many privacy-focused buyers consider government-issued currencies, even in digital kind, might enhance monetary surveillance. This has created extra curiosity in non-custodial wallets and decentralized exchanges that give full management to the consumer.

Smaller International locations Already Dwell — However Nonetheless Face Challenges

Whereas the world watches the U.S., China, and the EU, some smaller international locations have already gone stay with CBDCs. These embody:

The Bahamas — with the Sand Greenback;

Nigeria — with the eNaira;

Jamaica — with Jam-Dex.

These early movers confirmed that launching a digital forex is feasible. However their programs have confronted points. Many individuals nonetheless use money. Retailers are sluggish to simply accept digital cash. And a few areas have restricted web protection.

Nonetheless, they provide a check case for others, displaying what works and what wants enchancment.

The Greater Image: CBDC Plans Across the World

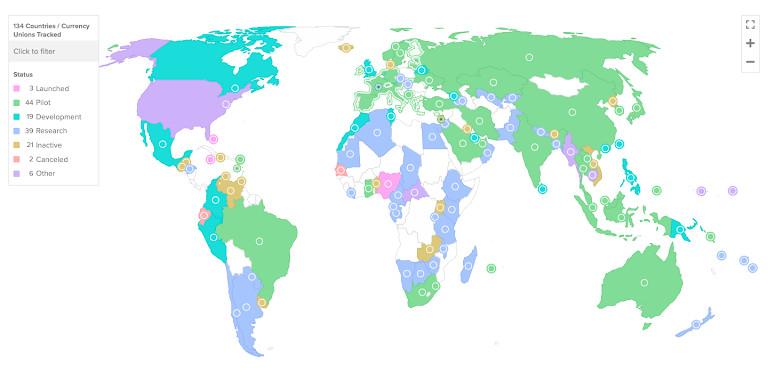

In keeping with the most recent knowledge, 134 international locations are engaged on CBDCs in some kind — whether or not it’s analysis, pilot packages, or full-scale design. Most central banks try to determine the best way to make digital cash that works safely and respects their nation’s legal guidelines.

A 2024 report by the Worldwide Financial Fund (IMF) says that CBDCs might cut back the price of cash transfers by 30–40%. They may additionally make public spending extra clear and minimize down delays in authorities funds. However there are additionally dangers: cyberattacks, technical failures, and over-centralization of consumer knowledge.

One World Development, Many Native Paths

In March 2025, Christine Lagarde, President of the European Central Financial institution, said throughout her speech:

“A digital euro might assist to make sure a socially optimum stage of information safety and would allow residents to transact within the digital financial system whereas having fun with the privateness advantages related to money.”

Her phrases spotlight the central query governments now face: the best way to carry digital forex into on a regular basis use with out shedding the freedoms individuals affiliate with conventional cash. Belief is not going to come from pace or innovation alone — it would rely on how properly new programs mirror the values they’re meant to serve.

The shift is already underway. As digital currencies transfer from concept to observe, public confidence will form their future greater than coverage timelines.

Disclaimer

In step with the Belief Mission tips, please be aware that the knowledge supplied on this web page isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. It is very important solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional data, we advise referring to the phrases and situations in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.