Be a part of Our Telegram channel to remain updated on breaking information protection

US crypto alternate Coinbase predicts the stablecoin market may greater than quadruple by 2028 to achieve $1.2 trillion.

In an Aug. 21 report known as ”New Framework for Stablecoin Development,” Coinbase mentioned the sector’s progress will probably be ”underpinned by an bettering coverage panorama and accelerating adoption traits.” The sector’s market capitalization stands at $288.39 billion now, according to CoinMarketCap.

Coinbase mentioned the stablecoin market has grown at a compound annual progress price of roughly 65% since 2021. The typical adjusted transaction volumes have additionally surged to $15.8 trillion for the seven months by July 31, up from $10.3 trillion over the identical interval in 2024, the report mentioned.

Surging Stablecoin Demand Will Not Push US Treasury Yields Down A lot

As stablecoins develop, issuers’ demand for US Treasury payments will soar as effectively. Coinbase initiatives that the Treasury might want to difficulty round $5.3 billion of latest short-term debt each week for 3 years straight simply to cater to the demand.

Personal stablecoin issuers like Tether and Circle have already change into the highest consumers of US authorities debt, even eclipsing nations like South Korea, the United Arab Emirates (UAE), and Germany, the report famous.

Stablecoins already maintain extra U.S. Treasuries than Germany—the third-largest nationwide financial system on the planet. pic.twitter.com/th1WryeKch

— Bitwise (@BitwiseInvest) August 22, 2025

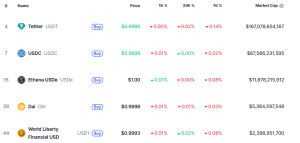

Tether’s USDT and Circle’s USDC are at present the most important stablecoins by market cap, and the 2 of them alone “have been the seventh largest consumers of US treasuries in 2025 YTD by June 30,” Coinbase wrote.

Largest stablecoins by market cap (Supply: CoinMarketCap)

Some analysts have expressed issues that the demand from stablecoins will push Treasury yields down a lot decrease, primarily making authorities borrowing low cost.

However Coinbase argues that whereas the stablecoin demand will push yields down, it is going to solely decrease 3-month Treasury yields by round 4.5 foundation factors (0.045%).

“Our baseline estimates counsel the impression on 3-month T-bill yields is small in week 1 and grows by weeks 2-3 earlier than really fizzling out,” Coinbase wrote.

“We expect the forecast doesn’t require unrealistically giant or everlasting price dislocations to materialize; as an alternative, it depends on incremental, policy-enabled adoption compounding over time,” the alternate added.

Coinbase additionally talked about the July signing of the GENIUS Act, which the alternate believes “may cut back the chance that giant redemptions will flip right into a cascade of compelled T-bill promoting.”

Different International locations Compelled To Contemplate Legalizing Their Personal Stablecoins

USD-pegged stablecoins have dominated the market up to now, however the signing of the GENIUS Act has compelled different nations to think about legalizing their very own stablecoins to stay aggressive with the US within the digital foreign money race.

As such, South Korea’s Monetary Companies Fee (FSC), a authorities regulator, introduced {that a} complete stablecoin regulatory invoice will probably be submitted to the nation’s legislature in October.

China has additionally pivoted from its lengthy historical past of opposing cryptocurrencies and privately issued cash when it reportedly signaled that it could enable stablecoins backed by the Yuan to start circulating available in the market.

Nonetheless, the rollout of any yuan-backed stablecoins would possible be restricted to particular financial zones, analysts say.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection