The put up Crypto Liquidations Hit $801M At the moment; What’s Subsequent for Altseason 2025? appeared first on Coinpedia Fintech Information

The crypto market has continued to bleed, led by Bitcoin (BTC). The whole crypto market cap slipped 2% to hover round $3.12 trillion on Monday, November 17 through the late North American buying and selling session.

In consequence, greater than 154k merchants had been liquidated, with complete liquidations totaling about $801 million. Out of this, round $500 million concerned lengthy merchants, thus additional strengthening the midterm crypto selloff by means of a long-squeeze.

Crypto Merchants Concern for the Worst

The crypto market has been trapped in a collection of brutal sell-offs up to now 4 weeks. Up to now 41 days, the whole crypto market cap has dropped over $1.1 trillion amid heavy liquidations of lengthy merchants.

Supply: X

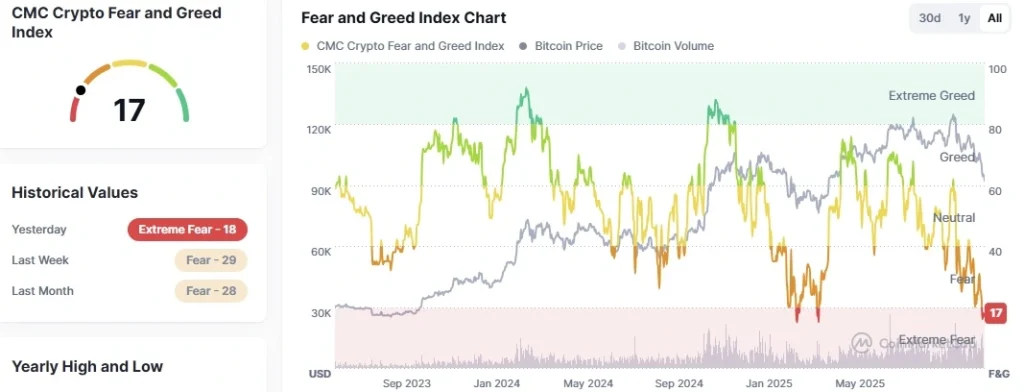

In consequence, the concern of an extra crypto crash is palpable. In keeping with Binance-backed CoinMarketCap (CMC), the Crypto Concern and Greed Index has dropped to 17, virtually the bottom stage year-to-date.

Supply: CoinMarketCap

What’s Subsequent for Altseason?

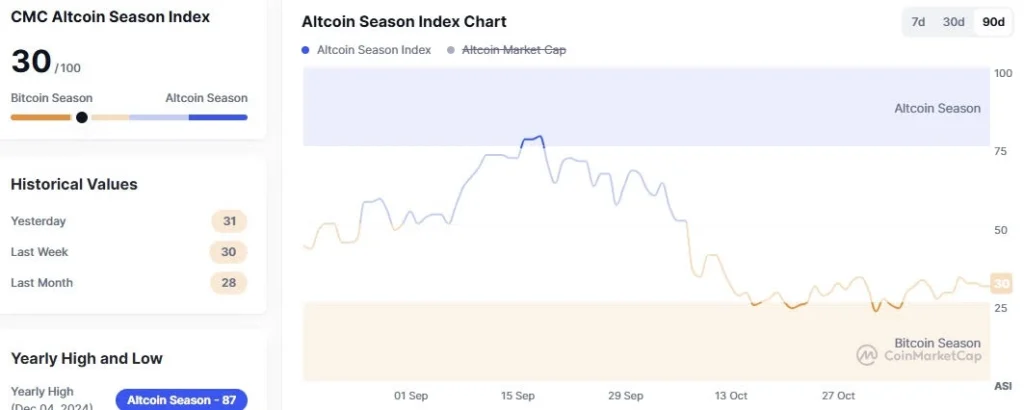

In keeping with market information evaluation from CMC, crypto merchants have been favoring a Bitcoin season up to now few days. The CMC’s Altcoin Season Index hovered round 30/100 as nearly all of the crypto tasks bleeds amid low recent liquidity.

Supply: CoinMarketCap

Nonetheless, a number of key macroeconomic occasions are anticipated to set off a recent wave of world liquidity injection. Traditionally, a spike in international cash provide has favored bullish sentiment for the broader crypto market. A number of the wider macroeconomic occasions to contemplate for bullish altseason 2025 embody:

The US is making ready $2,000 stimulus checks.

Japan is making ready a $110 billion stimulus bundle.

China has authorised a $1.4 trillion stimulus bundle.

The Fed is formally ending Quantitative Tightening (QT) on December 1st.

Canada is restarting its Quantitative Easing program.

International M2 cash provide is at a document $137 trillion.

International fee cuts are at greater than 320 over the past 24 months.